Global Consumer DNA (Genetic) Testing Market Size, Share, Opportunities, COVID 19 Impact, And Trends By Gender (Male, Female), By Age Group (0-15 Years, 15-30 Years, 30-60 Years, Above 60 Years), Application (Identity Seeking, Disease Risk, Curiosity Driven), And By Geography - Forecasts From 2021 To 2026

- Published : Jul 2021

- Report Code : KSI061611330

- Pages : 106

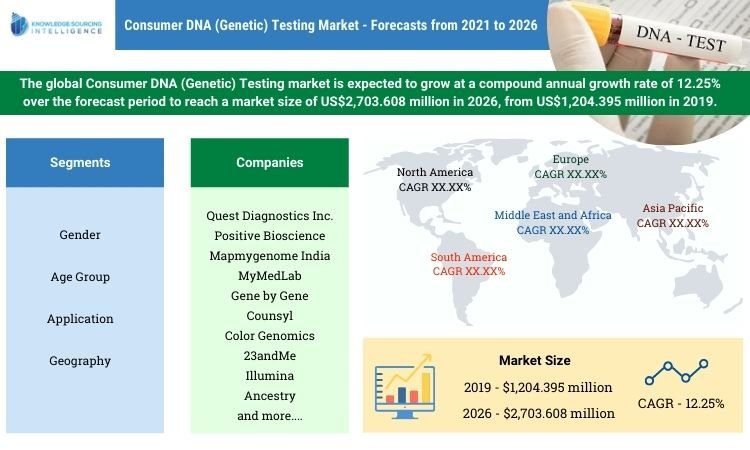

The global Consumer DNA (Genetic) Testing market is expected to grow at a compound annual growth rate of 12.25% over the forecast period to reach a market size of US$2,703.608 million in 2026, from US$1,204.395 million in 2019. Genetic or DNA testing usually refers to medical tests that examine and evaluates the changes in chromosomes, genes, or several types of proteins to help a person’s chance of developing one or rule out a suspected genetic condition. The market is expected to surge in the coming years, due to the rise in the demand for direct-to-consumer genetic testing, identity seeking, and other related factors. Increasing and raising awareness about novel developments and advancements in the DNA testing market is expected to play a major role in the overall market growth. Major companies such as Ancestry and 23andMe have been investing a significant sum of capital to develop advanced and innovative superior and excellent direct-to-consumer genetic testing and other related solutions. Moreover, the growth in genetic ancestry testing is also expected to play a major and imperative role in the market growth, during the forecast period. These trends are expected to have a positive impact on the market, in the coming years.

A rise in Genetic Ancestry Testing

Genetic ancestry testing is defined as a way for an individual to learn more about his family’s genealogy or want to go beyond data collection from historical documentation. There has been a surge in the demand for ancestry testing, with the use of cheek swabs or saliva DNA test kits, especially in the regions like Europe and North America. According to the data given by the MIT Institute and Technology, more than 26 million customers had added their respective DNA to four major health databases and commercial ancestry. Moreover, according to Ancestry and 23andMe, two of the major players in the market, the companies have now a collection of some of the world’s biggest collections of human DNAs. With the affordable pricing of around US$59, these DNA tests offer a plethora of entertainment, a major chance of discovering family and ancestry secrets, such as estranged siblings. Ancestry also claimed that they had registered a record Thanksgiving sale in the month of November 2018 and sold a total number of test kits at around 14 million. Moreover, other companies are also making significant developments in the market. For instance, Gene By Gene, one of the major firms in the market, had stated that its family tree DNA ancestry database contains approx. 2 million people. Another company, known as MyHeritage, a major Israeli firm, had stated that their database has around 2.5 million profiles. Moreover, the growth in direct-to-consumer DNA testing is also expected to have a major impact on the market. According to several official figures, there had been an expectation of sales of around 100 million kits by the year 2021. A plethora of companies has been providing DNA testing services to their customers, in the past few years. For instance, in December 2020, MyHeritage, a major global service for identifying your past and future company, announced the launch of genetic groups. The genetic groups would be able to identify and find ancestral origins with high-resolution data of around 2100 geographic regions. This development is expected to enhance the company’s market share, in the coming years. Other players are also making significant developments in the market. In January 2021, myDNA, a major Australian genomics company, announced a merger with FamilyTreeDNA, a US-based consumer DNA test company, and with Gene By Gene, the parent company of FamilyTreeDNA. The innovative merger of these companies is expected to be a major development for the market, as the companies would aim to focus on the enhancement of a scientific foundation for personalized and actionable insights. Asia Pacific region is expected to have a major share in the market, due to the rise in the number of start-ups and increasing excitement about ancestral DNA testing.

Novel Developments

- In May 2021, GB HealthWatch, a major player in translational genomics, announced the launch of their novel and advanced GBInsight Nutritional Genomics genetic analysis panel and testing as a core and major component of their healthcare platform. The company, with the novel addition, had been planning to expand into the area of genetics-based and precision preventive healthcare. This development is expected to have a positive impact on the market, in the coming years.

- In May 2021, 23andMe, a major player in the market, announced that it had been merging with VG Acquisition Corporation, a special purpose acquisition company. According to 23andMe, their company had been valued at US$3.5 billion and will bet the consumer research and genetics company with approx. US$759 million in extra and additional cash. This development is expected to enhance the market, during the forecast period.

- In October 2020, Blackstone, a private equity firm, announced that it would acquire a majority stake in a major DNA testing company, called Ancestry. Blackstone had stated that it would invest behind functionality further data and novel product development and advancement across Ancestry’s market-leading platform.

- In August 2020, Ancestry announced that it would step up and advanced its consumer DNA testing using novel and next-generation sequencing programs and technologies developed by a major player in the market, known as Quest Diagnostics. Ancestry had been relaunching its flagship AncestryHealth service with more innovative, safer, and advanced genetic or DNA testing technology to alert customers, which are at the risk of having or developing certain inheritable diseases.

- In December 2020, Genebox, a major Chinese start-up, announced that it had raised a sum of around tens of millions in series A round, which was led by Centurium Capital. The company had already raised more than US$21 million in their angel round, which was led by Dashenlin Pharmaceutical, a major drug retail chain. This development is expected to have a positive impact on China’s DNA testing market, in the coming years.

Global Consumer DNA (Genetic) Testing Market Scope:

| Report Metric | Details |

| The market size value in 2019 | US$1,204.395 million |

| The market size value in 2026 | US$2,703.608 million |

| Growth Rate | CAGR of 12.25% from 2019 to 2026 |

| Base year | 2019 |

| Forecast period | 2021–2026 |

| Forecast Unit (Value) | USD Million |

| Segments covered | Gender, Age Group, Application, And Geography |

| Regions covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies covered | Quest Diagnostics Inc., Positive Bioscience, Mapmygenome India, MyMedLab, Laboratory Corporation of America, Gene by Gene, Counsyl, Color Genomics, 23andMe, Illumina, Ancestry |

| Customization scope | Free report customization with purchase |

Segmentation:

- By Gender

- Male

- Female

- By Age Group

- 0-15 Years

- 15-30 Years

- 30-60 years

- Above 60 Years

- By Application

- Disease Risk

- Identity Seeking

- Curiosity Driven

- By Geography

- North America

- USA

- Canadá

- South America

- Europe

- UK

- Germany

- France

- Others

- Middle East and Africa

- Asia Pacific

- Japan

- China

- Others

- North America

Frequently Asked Questions (FAQs)

Q1. What will be the consumer DNA (Genetic) testing market size by 2026?

A1. The global consumer DNA testing market is expected to reach a market size of US$2,703.608 million by 2026.

Q2. What are the growth prospects for the consumer DNA testing market?

A2. The consumer DNA (Genetic) testing market is expected to grow at a CAGR of 12.25% over the forecast period.

Q3. What is the size of the global consumer DNA (Genetic) testing market?

A3. Consumer DNA (Genetic) Testing Market was valued at US$1,204.395 million in 2019.

Q4. Who are the major players in the consumer DNA testing market?

A4. Major industry players profiled as part of the consumer DNA testing market report are Quest Diagnostics Inc., Positive Bioscience, Mapmygenome India, MyMedLab, Laboratory Corporation of America, Gene by Gene, among others.

Q5. What factors are anticipated to drive the consumer DNA testing market growth?

A5. The consumer DNA testing market is expected to surge in the coming years, due to the rise in the demand for direct-to-consumer genetic testing, identity seeking, and other related factors.

1. Introduction

1.1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Research Data

2.2. Assumptions

3. Executive Summary

3.1. Research Highlights

4. Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. The Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. Global Consumer DNA (Genetic) Testing Market Analysis, By Gender

5.1. Introduction

5.2. Male

5.3. Female

6. Global Consumer DNA (Genetic) Testing Market Analysis, By Age Group

6.1. Introduction

6.2. 0-15 Years

6.3. 15-30 Years

6.4. 30-60 years

6.5. Above 60 Years

7. Global Consumer DNA (Genetic) Testing Market Analysis, By Application

7.1. Introduction

7.2. Disease Risk

7.3. Identity Seeking

7.4. Curiosity Driven

8. Global Consumer DNA (Genetic) Testing Market Analysis, by Geography

8.1. Introduction

8.2. North America

8.2.1. United States

8.2.2. Canada

8.3. South America

8.4. Europe

8.4.1. UK

8.4.2. Germany

8.4.3. France

8.4.4. Others

8.5. The Middle East and Africa

8.6. Asia Pacific

8.6.1. Japan

8.6.2. China

8.6.3. Others

9. Competitive Environment and Analysis

9.1. Major Players and Strategy Analysis

9.2. Emerging Players and Market Lucrativeness

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Vendor Competitiveness Matrix

10. Company Profiles

10.1. Quest Diagnostics Inc.

10.2. Positive Bioscience

10.3. Mapmygenome India

10.4. MyMedLab

10.5. Laboratory Corporation of America

10.6. Gene by Gene

10.7. Counsyl

10.8. Color Genomics

10.9. 23andMe

10.10. Illumina

10.11. Ancestry

Quest Diagnostics Inc.

Positive Bioscience

Mapmygenome India

MyMedLab

Laboratory Corporation of America

Gene by Gene

Counsyl

Color Genomics

23andMe

Illumina

Ancestry

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| Connected Agriculture Market Size & Share: Report, 2021-2026 | Sep 2021 | |

| Pyrometer Market Size, Share & Trends: Industry Report, 2021-2026 | Jun 2021 | |

| Radiotherapy Market Size & Share: Industry Report, 2021-2026 | Jul 2021 | |

| Data Center Colocation Market Size & Share: Report, 2023 - 2028 | Jun 2023 | |

| Industrial Enzymes Market: Size, Share, and Insights, 2029 | Mar 2024 |