Enterprise Manufacturing Intelligence Market Size, Share, Opportunities, COVID 19 Impact, And Trends By Deployment Model (On-Premise, Cloud), By Offering (Software, Services), By Industry Verticals (Chemical, Manufacturing, Food And Beverage, Energy And Power, Pharmaceutical, Oil And Gas, Aerospace And Defence, Others), And By Geography - Forecasts From 2021 To 2026

- Published : May 2021

- Report Code : KSI061610514

- Pages : 124

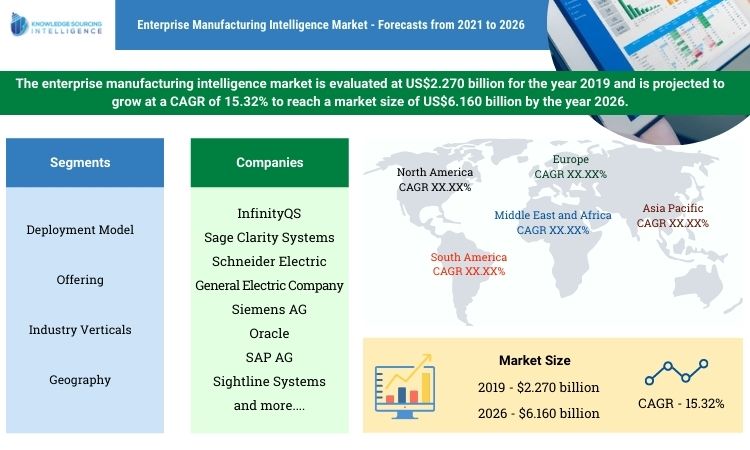

The enterprise manufacturing intelligence market is evaluated at US$2.270 billion for the year 2019 and is projected to grow at a CAGR of 15.32% to reach a market size of US$6.160 billion by the year 2026.

Enterprise Manufacturing Intelligence refers to a system that provides all of the data of the organization related to manufacturing in a single place. The manufacturing data is derived from multiple sources and is then used by the organization for reporting, analysis, and visualization. The growing competition in the manufacturing sector owing to globalization and government support is driving the market growth. The market is also driven by the ability of the EMI to allow users to easily find the information they need, regardless of their source, and easily perform analysis on all the characteristics of manufacturing, whether information related to production costs, quality, capacity, resources available, or any other performance indicator (KPI) that they want to set. These factors are having a positive impact on the enterprise manufacturing intelligence market and are anticipated to propel business growth opportunities for the market players over the forecast period.

The recent outbreak of the novel coronavirus disease has majorly affected the enterprise manufacturing intelligence market negatively as the pandemic led to the fall of the manufacturing sector in which this system is used. According to United Nations Industrial Development Organisation, the manufacturing of electrical equipment in China fell by nearly 32% between December 2019 and January 2020 in just a matter of one month. Other countries across the world also faced such downfalls in manufacturing due to the lockdown, trade restrictions, and Covid-19 guidelines. The manufacturing scenario has since been improved and recovered with the activities resumed and guidelines eased, leading to recovery in the enterprise manufacturing market. But with Covid-19 cases still fluctuating in many parts of the world, the market is not expected to properly recover in 2021 and is expected to recover and surge by 2022 onwards and is expected to continue to gain good momentum from that year.

Increased competition in manufacturing

One of the key factors supplementing the Enterprise Manufacturing Intelligence market growth includes the growing competition in the manufacturing sector owing to the rapid globalization, changing consumer preferences, technological advancements, and government support. According to the Bank of England, trade openness, which is measured as the ratio of imports and exports to national income, increased from 15% to 60% for emerging countries and from 25% to around 40% for industrialized countries, in the past 30 years. The governments of various countries have been supporting manufacturing leading to increased competition. The Make in India program of the Government of India has set a goal of expanding the manufacturing sector of India and making it 25% of the country’s GDP by 2025. The United States government has launched various programs to increase the competitiveness of the country in advanced manufacturing. Some of the initiatives are Advanced Manufacturing Technology Consortia (AMTech), Investing in Manufacturing Communities Partnership (IMCP), Manufacturing USA, Materials Genome Initiative (MGI), and National Robotics Initiative among many others. Germany has launched “Industrie 4.0”, France has launched “Industrie du Futur”, and China has launched “Made in China 2025” to make advancements in the manufacturing sector. The increased competition is leading to a tendency to adopt the use of new systems like Enterprise Manufacturing Intelligence for standing out in the competition and is hence anticipated to be one of the major factors bolstering the market growth during the forecast period.

Key developments

In June 2020, Hexagon’s manufacturing intelligence division launched a new range of smart factory technologies which is aimed at improving the productivity of the companies and supporting the companies with digital transformation.

In April 2019, Siemens launched manufacturing intelligence solutions for the next level of digital transformation in the manufacturing industry. The launch includes industrial software and automation technology to connect the virtual and real worlds in manufacturing.

North America to hold a prominent share in the market

Geographically, the North American region is anticipated to hold a significant market share owing to the presence of technologically advanced manufacturing sectors in the United States and Canada. Also, the government support in the region for enterprise manufacturing intelligence systems is anticipated to propel market growth. The Asia Pacific region is anticipated to witness substantial growth due to a rapid increase in BI and analytics in countries such as China, India, Malaysia, and Indonesia.

Competitive Insights

Prominent/major key market players in the Enterprise Manufacturing Intelligence market include InfinityQS, Sage Clarity Systems, Schneider Electric, and General Electric Company, among others. The players are executing various growth strategies to gain a competitive advantage.

The company profiles section details the business overview, financial performance (public companies) for the past few years, key products and services being offered along with the recent deals and investments of these important players in the Enterprise Manufacturing Intelligence market.

Enterprise Manufacturing Intelligence Market Scope

|

Report Metric |

Details |

|

Market size value in 2019 |

US$2.270 billion |

|

Market size value in 2026 |

US$6.160 billion |

|

Growth Rate |

CAGR of 15.32% from 2019 to 2026 |

|

Base year |

2019 |

|

Forecast period |

2021–2026 |

|

Forecast Unit (Value) |

USD Billion |

|

Segments covered |

Deployment Model, Offering, Industry Verticals, And Geography |

|

Regions covered |

North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

Companies covered |

InfinityQS, Sage Clarity Systems, Schneider Electric, General Electric Company, Rockwell Automation, Inc., Siemens AG, Oracle, SAP AG, Epicor Software Corporation, Sightline Systems |

|

Customization scope |

Free report customization with purchase. |

Segmentation

- By Deployment Model

- On-premise

- Cloud

- By Offering

- Software

- Services

- By Industry Verticals

- Chemical

- Manufacturing

- Food and Beverage

- Energy and Power

- Pharmaceutical

- Oil and Gas

- Aerospace and Defense

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

- North America

Frequently Asked Questions (FAQs)

Q1. What will be the enterprise manufacturing intelligence market size by 2026?

A1. The enterprise manufacturing intelligence market is projected to reach a market size of US$6.160 billion in 2026.

Q2. What are the growth prospects for the enterprise manufacturing intelligence market?

A2. The global enterprise manufacturing intelligence market is projected to grow at a CAGR of 15.32% over the forecast period.

Q3. What is the size of the global enterprise manufacturing intelligence market?

A3. Enterprise Manufacturing Intelligence Market was valued at US$2.270 billion in 2019.

Q4. What factors are anticipated to drive the enterprise manufacturing intelligence market growth?

A4. The growing competition in the manufacturing sector owing to globalization and government support is driving the enterprise manufacturing intelligence market growth.

Q5. Which region holds the largest market share in the enterprise manufacturing intelligence market?

A5. Geographically, the North American region is anticipated to hold a significant share in the enterprise manufacturing intelligence market owing to the presence of countries having technologically advanced manufacturing sectors like the United States.

1. Introduction

1.1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Research Data

2.2. Assumptions

3. Executive Summary

3.1. Research Highlights

4. Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of End-Users

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. Enterprise Manufacturing Intelligence Market Analysis, by Deployment Model

5.1. Introduction

5.2. On-premise

5.3. Cloud

6. Enterprise Manufacturing Intelligence Market Analysis, by Offering

6.1. Introduction

6.2. Software

6.3. Services

7. Enterprise Manufacturing Intelligence Market Analysis, by Industry Verticals

7.1. Introduction

7.2. Chemical

7.3. Manufacturing

7.4. Food and Beverage

7.5. Energy and Power

7.6. Pharmaceutical

7.7. Oil and Gas

7.8. Aerospace and Defense

7.9. Others

8. Enterprise Manufacturing Intelligence Market Analysis, by Geography

8.1. Introduction

8.2. North America

8.2.1. North America Enterprise Manufacturing Intelligence Market, By Deployment Model

8.2.2. North America Enterprise Manufacturing Intelligence Market, By Offering

8.2.3. North America Enterprise Manufacturing Intelligence Market, By Industry Verticals

8.2.4. By Country

8.2.4.1. USA

8.2.4.2. Canada

8.2.4.3. Mexico

8.3. South America

8.3.1. South America Enterprise Manufacturing Intelligence Market, By Deployment Models

8.3.2. South America Enterprise Manufacturing Intelligence Market, By Offering

8.3.3. South America Enterprise Manufacturing Intelligence Market, By Industry Verticals

8.3.4. By Country

8.3.4.1. Brazil

8.3.4.2. Argentina

8.3.4.3. Others

8.4. Europe

8.4.1. Europe Enterprise Manufacturing Intelligence Market, By Deployment Models

8.4.2. Europe Enterprise Manufacturing Intelligence Market, By Offering

8.4.3. Europe Enterprise Manufacturing Intelligence Market, By Industry Verticals

8.4.4. By Country

8.4.4.1.1. Germany

8.4.4.1.2. France

8.4.4.1.3. UK

8.4.4.1.4. Others

8.5. Middle East and Africa

8.5.1. Middle East and Africa Enterprise Manufacturing Intelligence Market, By Deployment Models

8.5.2. Middle East and Africa Enterprise Manufacturing Intelligence Market, By Offering

8.5.3. Middle East and Africa Enterprise Manufacturing Intelligence Market, By Industry Verticals

8.5.4. By Country

8.5.4.1. Saudi Arabia

8.5.4.2. UAE

8.5.4.3. Others

8.6. Asia Pacific

8.6.1. Asia Pacific Enterprise Manufacturing Intelligence Market, By Deployment Model

8.6.2. Asia Pacific Enterprise Manufacturing Intelligence Market, By Offering

8.6.3. Asia Pacific Enterprise Manufacturing Intelligence Market, By Industry Verticals

8.6.4. By Country

8.6.4.1. China

8.6.4.2. India

8.6.4.3. Japan

8.6.4.4. South Korea

8.6.4.5. Others

9. Competitive Environment and Analysis

9.1. Major Players and Strategy Analysis

9.2. Emerging Players and Market Lucrativeness

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Vendor Competitiveness Matrix

10. Company Profiles

10.1. InfinityQS

10.2. Sage Clarity Systems

10.3. Schneider Electric

10.4. General Electric Company

10.5. Rockwell Automation, Inc.

10.6. Siemens AG

10.7. Oracle

10.8. SAP AG

10.9. Epicor Software Corporation

10.10. Sightline Systems

InfinityQS

Sage Clarity Systems

Schneider Electric

General Electric Company

Rockwell Automation, Inc.

Siemens AG

Oracle

SAP AG

Epicor Software Corporation

Sightline Systems

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| Enterprise Data Loss Prevention Market Size: Report, 2021-2026 | Nov 2021 | |

| Enterprise Mobility Market Size & Share: Industry Report, 2024-2029 | Feb 2024 | |

| Enterprise Analytics Software Market Size: Report, 2022–2027 | Jul 2022 | |

| ERP Software Market Size & Share: Industry Report, 2022-2027 | Jul 2022 |