Fortified Wine Market Size, Share, Opportunities, And Trends By Type (Port, Sherry, Madeira, Vermouth, Muscat, Marsala), And By Geography - Forecasts From 2024 To 2029

- Published : Feb 2024

- Report Code : KSI061611789

- Pages : 144

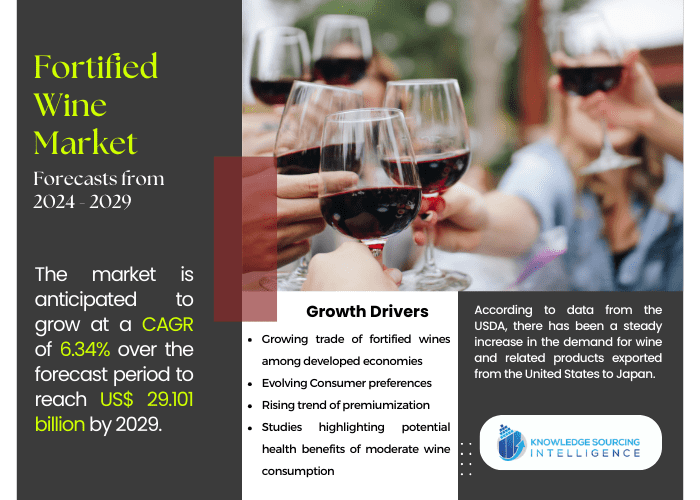

Fortified Wine Market is expected to grow at a CAGR of 6.34% from US$18.921 billion in 2022 to US$29.101 billion in 2029.

In recent years, a new category of fortified wines has emerged, featuring higher alcohol content and distinct flavors, thanks to industry players infusing cannabis into wine. This innovation is a direct response to the legalization of marijuana in various North American states, attracting a younger customer base eager to explore novel and cutting-edge alcoholic beverages.

The demand for fortified wines is significantly influenced by the trend of premiumization. With a rise in disposable income and an expanding working population, consumers are increasingly opting for luxurious fortified wines over local brands. This inclination towards premium options is expected to persist in emerging nations in the coming years.

Additionally, the interest in fortified wines has been fueled by studies highlighting potential health benefits associated with moderate wine consumption. Factors such as antioxidants and potential cardiovascular advantages contribute to the growing appeal of fortified wines as part of a balanced lifestyle. A noteworthy study conducted by S. Renaud and M. De Lorgeril in The Lancet, known as the Lyon Diet Heart Study, explored the impact of a Mediterranean diet supplemented with red wine on cardiovascular health. This research, along with similar studies, supports the enthusiasm for moderate wine consumption, including fortified wines, for potential cardiovascular benefits.

Market Drivers

- Premiumization to boost the market expansion-

Premium fortified wines are increasingly gaining favor among consumers due to their perceived higher quality, distinctive flavors, and association with a more sophisticated drinking experience. This positive perception has led to a growing market, with more individuals willing to invest in these premium products. The influence of social media influencers, particularly in younger demographics, is also contributing to the rising interest in fortified wines.

Furthermore, the trade of fortified wines is expanding, especially among developed economies, contributing to the overall market growth. According to data from the USDA, there has been a steady increase in the demand for wine and related products exported from the United States to Japan. In 2020, the export value was reported at US$ 79.64 million, and by 2022, it had surged to US$ 108.92 million, marking an impressive 28.3% gain in the previous year. This upward trend indicates a promising outlook for the fortified wine segment in the global market.

- Evolving Consumer preferences-

An increase in consumer demand for product innovations, such as additional flavor options, is driving the demand for fortified wine. Wine manufacturers produce novel and exotic flavors of fortified wine to meet changing customer tastes and preferences. This pattern is anticipated to persist as manufacturers try to distinguish their goods and gain market share.

The desire for fortified wines with various flavors and forms of alcohol is also being driven by young customers drawn to the diversity and distinctive taste. Due to client demand, winemakers have innovated the market by developing new products that blend various wine varieties, flavors, and alcoholic beverages.

Restraint-

- Limited availability and distribution-

Fortified wines face challenges related to their limited availability and distribution, which may result in them not being easily found at all retail outlets or dining establishments, particularly outside of specialty stores or regions with established fortified wine cultures. Moreover, consumers may encounter inconsistency in quality and pricing, as well as significant variations in these aspects across different brands and types of fortified wines, leading to confusion and reluctance to make purchases.

The fortified wine market is segmented based on type into port, sherry, Madeira, vermouth, muscat, and marsala.

The fortified wine market is segmented based on type into port, sherry, Madeira, vermouth, muscat, and marsala. The port segment of the fortified wine market is expected to grow due to the premiumization of port wine goods, together with new flavor developments and highly developed global distribution networks and the rising popularity of port wine among customers in developing nations like China and India, who are drawn to its sweet and opulent flavor.

North America is anticipated to hold a significant share of the fortified wine market.

Fortified wines have increased in popularity across the US due to the introduction of single-spirit bars. The love of vintage fortified wines like sherry and port is especially evident in these pubs. Businesses have started aggressive branding initiatives and social media advertising to increase brand recognition. In the United States, the consumption of wine per resident in 2021 was 3.18 gallons per person. The main reason behind the increase in per capita consumption of wine was the legalization of marijuana.

Canada is another country that holds a significant share of this market after the United States, supported by factors such as the growing interest in wine culture, the expanding craft beverage industry, the emergence of local wineries and vineyards, and the rising popularity of wine tourism.

Market Developments

- March 2023- As per the press release by Mazurans, a fortified wine producer with a New Zealand base, announced the launch of its New Yellow Label Sparkling Chardonnay. According to its description, the barrel-fermented beverage is "delightfully dry, with fruity overtones of creamy peach and perfumed nectarine. It costs $19 for each single or double gift package.

- September 2022- Taylor's announced the launch of its Very Very Old Tawny Port (VVOP). This is the most recent in a series of limited rolls out of extremely rare and high-quality Ports. As described in Taylor's new release, it is a "rare privilege" It can also draw in new clients searching for a distinctive and private wine experience.

- January 2022- The Rose Vermouth, produced by Maison Mirabeau, was introduced in the UK. It is an 'aromatic' aperitif that honors southern French botanicals called rosé vermouth.

Company Products

- Cabral White Port - The Cabral White Port by Liberty Wines Limited, priced at $18.99, is from Portugal. Produced by Cabral, it originates from the Duoro Valley region.

- GOLD MEDAL PORT 1970- Mazuran's Vineyards Limited offers the GOLD MEDAL PORT 1970 in a 750ml bottle, priced at NZ$495.00.

Fortified Wine Market Scope:

| Report Metric | Details |

| Market Size Value in 2022 | US$18.921 billion |

| Market Size Value in 2029 | US$29.101 billion |

| Growth Rate | CAGR of 6.34% from 2022 to 2029 |

| Base Year | 2022 |

| Forecast Period | 2024 – 2029 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered |

|

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

Market Segmentation

- By Type

- Port

- Sherry

- Madeira

- Vermouth

- Muscat

- Marsala

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others

- North America

Frequently Asked Questions (FAQs)

1. INTRODUCTION

1.1. Market Overview

1.2. Market Definition

1.3. Scope of the Study

1.4. Market Segmentation

1.5. Currency

1.6. Assumptions

1.7. Base, and Forecast Years Timeline

1.8. Key benefits to the stakeholder

2. RESEARCH METHODOLOGY

2.1. Research Design

2.2. Research Process

3. EXECUTIVE SUMMARY

3.1. Key Findings

3.2. Analyst View

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

4.5. Analyst View

5. FORTIFIED WINE MARKET BY TYPE

5.1. Introduction

5.2. Port

5.2.1. Market opportunities and trends

5.2.2. Growth prospects

5.2.3. Geographic lucrativeness

5.3. Sherry

5.3.1. Market opportunities and trends

5.3.2. Growth prospects

5.3.3. Geographic lucrativeness

5.4. Madeira

5.4.1. Market opportunities and trends

5.4.2. Growth prospects

5.4.3. Geographic lucrativeness

5.5. Vermouth

5.5.1. Market opportunities and trends

5.5.2. Growth prospects

5.5.3. Geographic lucrativeness

5.6. Muscat

5.6.1. Market opportunities and trends

5.6.2. Growth prospects

5.6.3. Geographic lucrativeness

5.7. Marsala

5.7.1. Market opportunities and trends

5.7.2. Growth prospects

5.7.3. Geographic lucrativeness

6. FORTIFIED WINE MARKET BY GEOGRAPHY

6.1. Introduction

6.2. North America

6.2.1. By Type

6.2.2. By Country

6.2.2.1. United States

6.2.2.1.1. Market Trends and Opportunities

6.2.2.1.2. Growth Prospects

6.2.2.2. Canada

6.2.2.2.1. Market Trends and Opportunities

6.2.2.2.2. Growth Prospects

6.2.2.3. Mexico

6.2.2.3.1. Market Trends and Opportunities

6.2.2.3.2. Growth Prospects

6.3. South America

6.3.1. By Type

6.3.2. By Country

6.3.2.1. Brazil

6.3.2.1.1. Market Trends and Opportunities

6.3.2.1.2. Growth Prospects

6.3.2.2. Argentina

6.3.2.2.1. Market Trends and Opportunities

6.3.2.2.2. Growth Prospects

6.3.2.3. Others

6.3.2.3.1. Market Trends and Opportunities

6.3.2.3.2. Growth Prospects

6.4. Europe

6.4.1. By Type

6.4.2. By Country

6.4.2.1. Germany

6.4.2.1.1. Market Trends and Opportunities

6.4.2.1.2. Growth Prospects

6.4.2.2. France

6.4.2.2.1. Market Trends and Opportunities

6.4.2.2.2. Growth Prospects

6.4.2.3. United Kingdom

6.4.2.3.1. Market Trends and Opportunities

6.4.2.3.2. Growth Prospects

6.4.2.4. Spain

6.4.2.4.1. Market Trends and Opportunities

6.4.2.4.2. Growth Prospects

6.4.2.5. Others

6.4.2.5.1. Market Trends and Opportunities

6.4.2.5.2. Growth Prospects

6.5. Middle East and Africa

6.5.1. By Type

6.5.2. By Country

6.5.2.1. Saudi Arabia

6.5.2.1.1. Market Trends and Opportunities

6.5.2.1.2. Growth Prospects

6.5.2.2. UAE

6.5.2.2.1. Market Trends and Opportunities

6.5.2.2.2. Growth Prospects

6.5.2.3. Israel

6.5.2.3.1. Market Trends and Opportunities

6.5.2.3.2. Growth Prospects

6.5.2.4. Others

6.5.2.4.1. Market Trends and Opportunities

6.5.2.4.2. Growth Prospects

6.6. Asia Pacific

6.6.1. By Type

6.6.2. By Country

6.6.2.1. China

6.6.2.1.1. Market Trends and Opportunities

6.6.2.1.2. Growth Prospects

6.6.2.2. India

6.6.2.2.1. Market Trends and Opportunities

6.6.2.2.2. Growth Prospects

6.6.2.3. South Korea

6.6.2.3.1. Market Trends and Opportunities

6.6.2.3.2. Growth Prospects

6.6.2.4. Taiwan

6.6.2.4.1. Market Trends and Opportunities

6.6.2.4.2. Growth Prospects

6.6.2.5. Thailand

6.6.2.5.1. Market Trends and Opportunities

6.6.2.5.2. Growth Prospects

6.6.2.6. Indonesia

6.6.2.6.1. Market Trends and Opportunities

6.6.2.6.2. Growth Prospects

6.6.2.7. Japan

6.6.2.7.1. Market Trends and Opportunities

6.6.2.7.2. Growth Prospects

6.6.2.8. Others

6.6.2.8.1. Market Trends and Opportunities

6.6.2.8.2. Growth Prospects

7. COMPETITIVE ENVIRONMENT AND ANALYSIS

7.1. Major Players and Strategy Analysis

7.2. Market Share Analysis

7.3. Mergers, Acquisition, Agreements, and Collaborations

7.4. Competitive Dashboard

8. COMPANY PROFILES

8.1. Liberty Wines Limited

8.2. Sogevinus Fine Wines SL (Kopke)

8.3. Taylor's Port

8.4. Albina & Hanna

8.5. Backsberg

8.6. Mazuran's Vineyards Limited

8.7. Lombardo winery

8.8. Curatolo Arini

8.9. EMILIO HIDALGO SA

8.10. McWilliam’s Wines Group Ltd

Liberty Wines Limited

Sogevinus Fine Wines SL (Kopke)

Taylor's Port

Albina & Hanna

Mazuran's Vineyards Limited

Lombardo winery

Curatolo Arini

EMILIO HIDALGO SA

McWilliam’s Wines Group Ltd

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| Wine Market Size, Share & Growth: Industry Report, 2023-2028 | Aug 2023 | |

| Fatty Alcohol Market Size & Share: Industry Report, 2022-2027 | Dec 2022 | |

| Alcohol Ingredients Market Size & Share: Industry Report, 2023-2028 | Aug 2023 | |

| France Alcohol Ingredients Market Size: Industry Report, 2022 – 2027 | Jun 2022 | |

| UK Alcohol Ingredients Market Size: Industry Report, 2022 – 2027 | Sep 2022 |