Fresh Food Packaging Market Size, Share, Opportunities, COVID-19 Impact, And Trends By Type (Plastic, Paper And Board, Glass, Metal, Others), By Application (Poultry And Meat Products, Dairy Products, Produce (Vegetables And Fruits), Sea Food, Others) And By Geography - Forecasts From 2021 To 2026

- Published : May 2021

- Report Code : KSI061611073

- Pages : 131

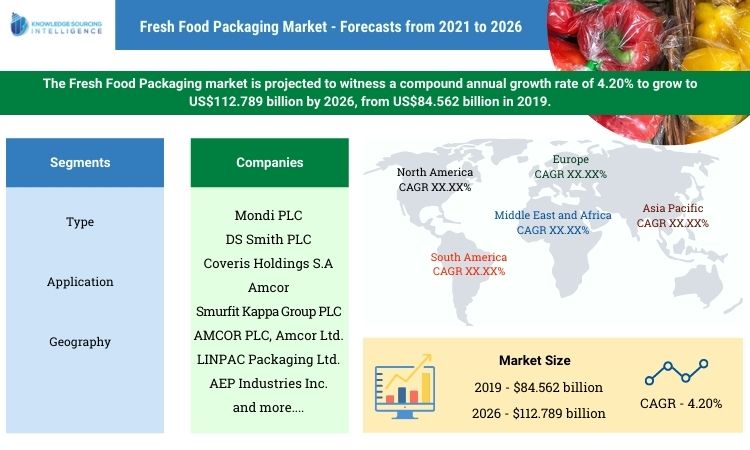

The Fresh Food Packaging market is projected to witness a compound annual growth rate of 4.20% to grow to US$112.789 billion by 2026, from US$84.562 billion in 2019. Food products are packed using several materials to protect them from adverse environmental conditions such as weather adversities, pollution, dust, etc. Packaging of fresh food is also required for the transportation of produce to avoid any physical damage and wastage.

The growing demand for convenience food items and an effort to improve the shelf life of fresh food products using innovative packaging solutions are the major driving factors behind the fresh food packaging solutions. Budding awareness regarding global warming is motivating companies to introduce cost-effective and biodegradable packaging solutions. However, disposal of food waste while packaging remains a major concern for the companies and this might restrict the demand for fresh food packaging solutions. The Asia Pacific region is projected to grow at an impressive rate owing to rising disposable income and increasing population during the forecast period.

The primary reason for the increase in the demand for fresh food packaging materials is the burgeoning demand for fruits and vegetables, poultry and meat products across the globe. Another reason behind the surge in the demand for fresh food packaging solutions is the rising consumer preference for convenience food products.

The key reasons for the rise in demand are the shift of consumers towards a healthy lifestyle and a high purchasing power. Examples of convenience food in this segment are salad bags, fresh herbs packs, chopped vegetable bags, vegetable trays, single-serve salad packaging, etc. all of which require fresh food packaging products such as paper and board, plastic, glass, etc. In the emerging markets of BRICS and MENA, the growing demand for such food items is increasing due to the tendency of consumers to buy off-the-shelf fresh food items. Hence, the increasing demand for convenience food items is driving the market for fresh food packaging. To meet the increasing demand for fresh food items, the FMCG industry is consuming a significant amount of packaging products.

The key players in the fresh food packaging market produce specialized packaging solutions to meet the growing demand. For instance, Bemis Company, Inc. provides flexible packaging solutions. The prominent players in the market are adopting various strategies such as mergers and acquisitions, collaborations, expansion, etc. to maintain their position in the market and to meet the rising demand for fresh food packaging material. For instance, on World Idly Day, iD Fresh Food, one of India’s giant fresh food brands, announced the launch of a Giant Home Kitchen which is a state-of-the-art facility and one of the world’s largest Idly and Dosa batter preparation and packaging plants in Anekal, Karnataka. The investment in this plant is close to INR 40 crores.

The plastic packaging material is largely used in the fresh food packaging market as it is cost-effective, hygienic, versatile, lightweight, and convenient to use. However, despite these advantages, the market for plastic-based packaging material is expected to decline during the forecast period owing to the stringent rules and regulations imposed by the government concerning the use of plastics, globally. Most of the plastic material used for packaging is non-recyclable which is increasingly causing environmental concerns as decomposing them is a major concern. All the countries have their own set of guidelines and regulations, which are imposed on the manufacturers who want to use recyclable plastic as the packaging material for fresh food. In the United States, the Food and Drug Administration (FDA) has mentioned certain points, which are to be considered for the use of recycled plastics in food packaging.

The guidelines state that the use of recycled polymers is permissible if it is of a type previously permitted for food contact, has been kept free of contaminates during the recycling process, and the recycled material has been tested to establish suitable purity for reuse in food packaging Many countries are imposing penalties such as an additional tax on the manufacturers who use non-recyclable or a less percentage of recyclable plastic for packaging fresh food products. For instance, in the United Kingdom, the government has imposed a £200 per tonne tax rate for packaging with less than 30% recycled plastic on the manufacturers.

The Global Fresh Food Packaging Market is segmented on the basis of Type, Mode of Application, and Geography.

- On the basis of Type, the global fresh food packaging market can be segmented into Plastic, Paper and Board, Glass, Metal, and Others.

- On the basis of Mode of Application, the global fresh food packaging market can be segmented into Poultry and Meat Products, Dairy products, Produce (fruits and vegetables), Seafood, and others.

- On the basis of Geography, the fresh food packaging market can be segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific

Growth Factors

- The rise in demand for an extended shelf life of fresh food products

The major driver of the fresh food packaging market is the rising demand for the extended shelf life of fresh food products. After packaging, it takes a considerable amount of time for freshly packaged food to reach its customers and consumers, globally. There are substantial chances of packaged foods to lose their taste and aroma before it reaches the consumer. This results in the loss of quality of fresh food products and impacts the capital invested in the production of fresh foods. Major food packaging companies have been investing a significant sum of capital to develop intelligent packaging, and other innovative solutions, with the aim to extend the shelf life of the product.

For instance, in April 2021, ProAmpac, a flexible packaging leader, announced that it would expand its presence in North America, and had introduced its major fresh food-to-go packaging portfolio, with its extended shelf-life freshness and quality and widely recyclable paper sustainability. This development is expected to have a positive impact on the fresh food packaging market. Other players are also making significant developments in the market. For instance, in April 2021, The Guacapack Project announced that it had been developing a biodegradable packaging system, which includes antioxidant additives and barrier labels from avocado waste and would extend the food’s shelf life by approx. 15%. With the number of investments increase in the enhancement of fresh food packaging, the market is expected to surge at an exponential rate, during the forecast period.

- Increase in consumption of fresh food products

Over the last few years, there has been a significant increase in the consumption of fresh food products. The key drivers of demand for fresh food products in these regions are increasing population, rapid urbanization, high disposable income of the people, and increasing health awareness amongst the consumers, which in turn will increase the demand for fresh food packaging materials like plastic, glass, paperboard, etc. The demand for fresh food products in developing countries like India and China is expected to grow further during the forecast period.

Restraints

- Packaging disposal

The major factor which can hinder the growth of the fresh food packaging industry is the problems faced while disposing of the packaging material such as glass, plastic, etc. this problem is being faced by all the countries, globally. The governments of various countries have been imposing regulations and restrictions concerning the disposal of packaging material which could halt the growth of the fresh food packaging industry. For instance, In Europe, the regulations for plastic landfills are extremely stringent. The European Union intends to achieve ‘zero plastics to landfill’ by 2025. Due to the growing concerns related to environmental pollution, packaging companies are focusing on shifting towards eco-friendly solutions for environmental sustainability. To adhere to the three ‘R’s of eco-friendly packaging: renew, reuse, and recycle green packaging products are being designed.

The governments of emerging economies are encouraging packaging solution providers to provide eco-friendly products. The reason behind this because eco-friendly packaging products are made of natural bio-polymer, which is more flexible than traditional plastic. Fresh food packaging can be made using eco-friendly packaging materials, such as bioplastics, recycled papers, forest wood, and palm leaf.

Competitive Insights

Prominent/major key market players in the Global Fresh Food Packaging Market include Mondi PLC, DS Smith PLC, Coveris Holdings S.A, Amcor, Smurfit Kappa Group PLC, Sealed Air Corporation Ltd., AMCOR PLC, Amcor Ltd., LINPAC Packaging Ltd., Sonoco Products Company, and AEP Industries Inc. The players in the Global Fresh Food Packaging Market are implementing various growth strategies to gain a competitive advantage over their competitors in this market.

Major market players in the market have been covered along with their relative competitive strategies and the report mentions recent deals and investments of different market players over the last few years. The company profiles section details the business overview, financial performance (public companies) for the past few years, key products and services being offered along with the recent deals and investments of these important players in the Global Fresh Food Packaging Market.

Fresh Food Packaging Market Scope:

| Report Metric | Details |

| The market size value in 2019 | US$84.562 billion |

| The market size value in 2026 | US$112.789 billion |

| Growth Rate | CAGR of 4.20% from 2019 to 2026 |

| Base year | 2019 |

| Forecast period | 2021–2026 |

| Forecast Unit (Value) | USD Billion |

| Segments covered | Type, Application, And Geography |

| Regions covered | North America, South America, Europe, Middle East, and Africa, MEA, Asia Pacific |

| Companies covered | Mondi PLC, DS Smith PLC, Coveris Holdings S.A., Bemis Company, Inc., Smurfit Kappa, Sealed Air Corporation, Amcor Limited, LINPAC Packaging, Sonoco Products, AEP Industries |

| Customization scope | Free report customization with purchase |

Segmentation:

- By Type

- Plastic

- Paper and Board

- Glass

- Metal

- Others

- By Application

- Poultry and Meat Products

- Dairy Products

- Produce (Vegetables and Fruits)

- Sea Food

- Others

- By geography

- North America

- USA

- Canadá

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- Indonesia

- Others

- North America

Frequently Asked Questions (FAQs)

Q1. What will be the fresh food packaging market size by 2026?

A1. The global fresh food packaging market is expected to reach a total market size of US$112.789 billion by 2026.

Q2. What is the size of the global fresh food packaging market?

A2. The global fresh food packaging market was valued at US$84.562 billion in 2019.

Q3. What are the growth prospects for the fresh food packaging market?

A3. The fresh Food Packaging market is expected to grow at a CAGR of 4.20% during the forecast period.

Q4. What factors are anticipated to drive the crop protection chemicals market growth?

A4. The growing demand for convenience food items and an effort to improve the shelf life of fresh food products using innovative packaging solutions are the major driving factors behind the fresh food packaging solutions.

Q5. Which region holds the largest market share in the fresh food packaging market?

A5. The Asia Pacific region is projected to hold a significant share in the fresh food packaging market owing to rising disposable income and increasing population during the forecast period.

1. Introduction

1.1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Research Data

2.2. Assumptions

3. Executive Summary

3.1. Research Highlights

4. Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. The Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. Global Fresh Food Packaging Market Analysis, By Type

5.1. Introduction

5.2. Plastic

5.3. Paper and Board

5.4. Glass

5.5. Metal

5.6. Others

6. Global Fresh Food Packaging Market Analysis, By Application

6.1. Introduction

6.2. Poultry and Meat Products

6.3. Dairy Products

6.4. Produce (Vegetables and Fruits)

6.5. Sea Food

6.6. Others

7. Global Fresh Food Packaging Market Analysis, by Geography

7.1. Introduction

7.2. North America

7.2.1. North America Fresh Food Packaging Market Analysis, By Type, 2020 to 2026

7.2.2. North America Fresh Food Packaging Market Analysis, By Application, 2020 to 2026

7.2.3. By Country

7.2.3.1. United States

7.2.3.2. Canada

7.2.3.3. Mexico

7.3. South America

7.3.1. South America Fresh Food Packaging Market Analysis, By Type, 2020 to 2026

7.3.2. South America Fresh Food Packaging Market Analysis, By Application, 2020 to 2026

7.3.3. By Country

7.3.3.1. Brazil

7.3.3.2. Argentina

7.3.3.3. Others

7.4. Europe

7.4.1. Europe Fresh Food Packaging Market Analysis, By Type, 2020 to 2026

7.4.2. Europe Fresh Food Packaging Market Analysis, By Application, 2020 to 2026

7.4.3. By Country

7.4.3.1. UK

7.4.3.2. Germany

7.4.3.3. France

7.4.3.4. Spain

7.4.3.5. Others

7.5. The Middle East and Africa

7.5.1. Middle East and Africa Fresh Food Packaging Market Analysis, By Type, 2020 to 2026

7.5.2. Middle East and Africa Fresh Food Packaging Market Analysis, By Application, 2020 to 2026

7.5.3. By Country

7.5.3.1. Saudi Arabia

7.5.3.2. Israel

7.5.3.3. Others

7.6. Asia Pacific

7.6.1. Asia Pacific Fresh Food Packaging Market Analysis, By Type, 2020 to 2026

7.6.2. Asia Pacific Fresh Food Packaging Market Analysis, By Application, 2020 to 2026

7.6.3. By Country

7.6.3.1. Japan

7.6.3.2. China

7.6.3.3. India

7.6.3.4. Indonesia

7.6.3.5. Others

8. Competitive Environment and Analysis

8.1. Major Players and Strategy Analysis

8.2. Emerging Players and Market Lucrativeness

8.3. Mergers, Acquisitions, Agreements, and Collaborations

8.4. Vendor Competitiveness Matrix

9. Company Profiles

9.1. Mondi PLC

9.2. DS Smith PLC

9.3. Coveris Holdings S.A

9.4. Amcor

9.5. Smurfit Kappa Group PLC

9.6. Sealed Air Corporation Ltd.

9.7. AMCOR PLC, Amcor Limited

9.8. LINPAC Packaging, Ltd.

9.9. Sonoco Products Company

9.10. AEP Industries, Inc.

Mondi PLC

DS Smith PLC

Coveris Holdings S.A

Amcor

Smurfit Kappa Group PLC

Sealed Air Corporation Ltd.

AMCOR PLC, Amcor Ltd.

LINPAC Packaging Ltd.

Sonoco Products Company

AEP Industries Inc.

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| Middle East and Africa Fresh Food Packaging Market: 2022 – 2027 | Sep 2022 | |

| North America Fresh Food Packaging Market Size: 2024 – 2029 | Feb 2024 | |

| South America Fresh Food Packaging Market Size: 2022 – 2027 | Sep 2022 | |

| Asia Pacific Fresh Food Packaging Market Size: Report, 2023-2028 | Dec 2023 | |

| Europe Fresh Food Packaging Market Size & Share: 2022 – 2027 | Sep 2022 |