Gallium Nitride (GaN) Substrates Market Size, Share, Opportunities, COVID-19 Impact, And Trends By Type (GaN On Silicon, GaN On Sapphire, GaN On Silicon Carbide, Others), By Production Process (Hybrid Vapor Phase Epitaxy, Metal-Organic Chemical Vapor Deposition), By Product (LED, Lasers, Power Switching De-vice), By End-User (Military & Defense, Automotive, Healthcare, Consumer Electronics, Others), And By Geography - Forecasts From 2021 To 2026

- Published : Jun 2021

- Report Code : KSI061611138

- Pages : 140

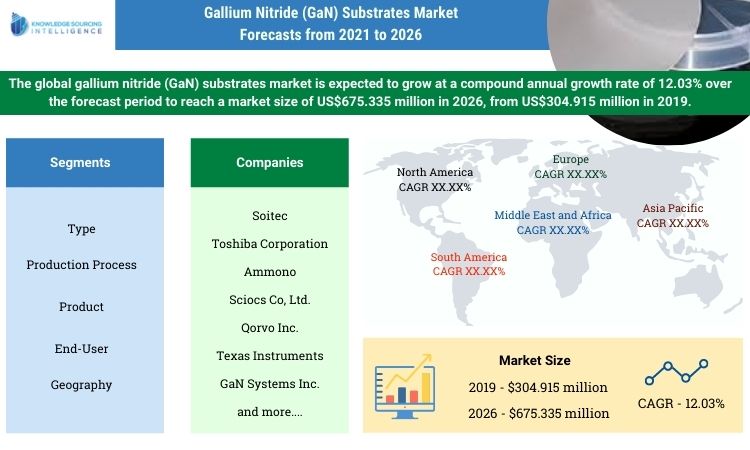

The global gallium nitride (GaN) substrates market is expected to grow at a compound annual growth rate of 12.03% over the forecast period to reach a market size of US$675.335 million in 2026, from US$304.915 million in 2019. GaN or Gallium Nitride Substrate is known as a wide bandgap or banding material that provides excellent advantages over other types of semiconductor materials such as silicon carbide, silicon, aluminum, and others.

The market is expected to surge in the coming years, because of the increasing usage of gallium nitride substrates in healthcare, automotive, consumer electronics, general lighting, military and defense, and other industries. Some of the major end-users of gallium nitride substrates are laser, LED, radiofrequency, and power electronic devices. Major companies have been making significant developments in the market in the past few years. The rise in innovation and investment is expected to play a major role in the overall market growth, in the coming years. In April 2021, researchers and scientists at Osaka University announced the development of a non-destructive method for the characterization of the crystalline quality of gallium nitride substrates. The researchers in the university had used multiphoton excitation photoluminescence to analyze and evaluate gallium nitride substrate. This development is expected to have a positive impact on the market, in the coming years. Other players have also been making substantial developments in the market, in the past few years. For instance, in April 2021, researchers at the Imec lab in Belgium had announced a novel breakthrough in the gallium nitride process on a respective 200mm wafer, that would also be able to take on silicon carbide material, in the bigger and higher power of around 1200V designs for the novel and first time. Imec lab had been working with Aixtron, a German semiconductor equipment maker and developer, and had grown thicker and wider epitaxial gallium nitride buffer layers for lateral transistors for around 1200V applications on the novel and respective 200mm QST substrates. This development is also projected to have a significant and positive impact on the market, during the forecast period. The rise in manufacturing and production in the Asia Pacific region is expected to play a crucial role in the overall market growth, in the coming years.

The rise in the automotive industry.

The market is expected to surge in the coming years, because of the growth in the automotive industry, globally. According to the International Organization of Motor Vehicle Manufacturers, around 92.17 million motor vehicles were manufactured in the year 2019. There has been a rise in the demand for electric vehicles, which is expected to propel market growth, in the coming years. The rise of LED, and other related applications and features in electric and other automotive vehicles are expected to propel GaN market growth. According to the data given by the International Energy Agency, sales of electric vehicles rose to 2.1 million, worldwide, in 2019. The electric car and vehicle sales registered an approx. 40% on year-on-year growth, between 2018 and 2019. Europe is a leading and major producer of automotive vehicles, worldwide. The region is one of the world’s largest producers of motor vehicles. The industry also represents the biggest private investment in R&D. According to the European Automobile Manufacturers Association, 18.5 million motor vehicles were produced in the region, and it represented approx. 20% of the total motor vehicle production, in 2019. In India, according to the data given by the Indian government, the country manufactured approx. 26 million vehicles, which includes commercial vehicles, passenger vehicles, two-wheelers, three-wheelers, and quadricycles in April 2019 to March 2020. The United States is also making substantial developments in the market. According to the data given by the US government, the country is the world’s second-biggest market for vehicle sales and production. Since 1982, major Korean, Japanese, and European automakers had invested over US$75 billion in the country. In the year 2018, total foreign direct investment in the country reached approx. US$114.6 billion. Tesla and General Motors are some of the major players in the production of electric vehicles in the region. General Electric announced that it would spend over USD 20 billion through 2025, on the development and production of the next-generation and novel, advanced autonomous, and EV vehicles. Tesla announced that the company delivered 499,550 vehicles in the year 2020. The company produced 509,737 vehicles in the year 2020. These trends are expected to have a positive impact on the market, in the coming years.

Growth in the consumer electronics and semiconductor industry.

The market is expected to surge in the coming years, due to the growth in the consumer electronics market, worldwide. Gallium nitride is making significant developments in the applications for high-power transistors in high temperatures. The growth in the semiconductor industry is expected to play a major role in the overall market growth. According to the data given by the Semiconductor Industry Association, the worldwide semiconductor sales had surged from US$125.6 billion, in the year 1998 to approx. US$412.2 billion in the year 2019, with a CAGR of around 6.5%. Countries like Taiwan, the USA, and China are expected to make significant developments in the market, in the coming years. In 2020, China had announced that it would invest over US$1.4 trillion, over the coming six years, to develop and enhance and grow its semiconductor industry. The United States-based companies have the biggest market of approx. 45%., according to the data given by their country’s semiconductor association. The United States companies have been maintaining a strong and powerful position in design, process technology, and research and development. Growth in gallium nitride applications in consumer electronics is likely to surge in the coming years. In India, according to the IBEF, the country’s consumer electronics market had reached aroundUS$10.93 billion in the year 2019, and according to the government estimations, the market is likely to reach US$21.18 billion in the year 2025. These developments are expected to enhance the gallium nitride substrate market growth, in the next few years.

Gallium Nitride (GaN) Substrates Market Scope:

| Report Metric | Details |

| Market size value in 2019 | US$304.915 million |

| Market size value in 2026 | US$675.335 million |

| Growth Rate | CAGR of 12.03% from 2019 to 2026 |

| Base year | 2019 |

| Forecast period | 2021–2026 |

| Forecast Unit (Value) | USD Million |

| Segments covered | Type, Production Process, Product, End-User, And Geography |

| Regions covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies covered | Sumitomo Electric Industries Ltd., Mitsubishi Chemical Corporation, Soitec, Xiamen Powerway Advanced Material, Toshiba Corporation, Ammono, Sciocs Co, Ltd., Qorvo Inc., Texas Instruments, GaN Systems Inc. |

| Customization scope | Free report customization with purchase |

Segmentation:

- By Type

- GaN on Silicon

- GaN on Sapphire

- GaN on Silicon Carbide

- Others

- By Production Process

- Hybrid Vapor Phase Epitaxy

- Metal-Organic Chemical Vapor Deposition

- By Product

- LED

- Lasers

- Power Switching Device

- By End-User

- Military & Defense

- Automotive

- Healthcare

- Consumer Electronics

- General Lightning

- Communication and Technology

- By Geography

- North America

- USA

- Canadá

- South America

- Europe

- UK

- Germany

- France

- Others

- Middle East and Africa

- Asia Pacific

- Japan

- China

- Taiwan

- Others

- North America

Frequently Asked Questions (FAQs)

Q1. What are the growth prospects for the gallium nitride substrates market?

A1. The gallium nitride (GaN) substrates market is expected to grow at a CAGR of 12.03% over the forecast period.

Q2. What is the size of global gallium nitride (GaN) substrates market?

A2. Gallium Nitride (GaN) Substrates Market was valued at US$304.915 million in 2019.

Q3. Who are the major players in the gallium nitride (GaN) substrates market?

A3. Prominent key market players in the gallium nitride substrates market include Sumitomo Electric Industries Ltd., Mitsubishi Chemical Corporation, Soitec, Xiamen Powerway Advanced Material, Toshiba Corporation, Ammono, among others.

Q4. What will be the gallium nitride substrates market size by 2026?

A4. The gallium nitride substrates market is expected to reach a total market size of US$675.335 million by 2026.

Q5. What factors are anticipated to drive the gallium nitride substrates market growth?

A5. The market is expected to surge in the coming years, because of the increasing usage of gallium nitride substrates in healthcare, automotive, consumer electronics, general lighting, military and defense, and other industries.

1.1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Research Data

2.2. Assumptions

3. Executive Summary

3.1. Research Highlights

4. Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. The Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. Global Gallium Nitride (GaN) Substrates Market Analysis, By Type

5.1. Introduction

5.2. GaN on Silicon

5.3. GaN on Sapphire

5.4. GaN on Silicon Carbide

5.5. Others

6. Global Gallium Nitride (GaN) Substrates Market Analysis, By Production Process

6.1. Introduction

6.2. Hybrid Vapor Phase Epitaxy

6.3. Metal-Organic Chemical Vapor Deposition

7. Global Gallium Nitride (GaN) Substrates Market Analysis, By Product

7.1. Introduction

7.2. LED

7.3. Lasers

7.4. Power Switching Device

8. Global Gallium Nitride (GaN) Substrates Market Analysis, By End-User

8.1. Introduction

8.2. Military & Defense

8.3. Automotive

8.4. Healthcare

8.6. Consumer Electronics

8.7. Communication and Technology

9. Global Gallium Nitride (GaN) Substrates Market Analysis, by Geography

9.1. Introduction

9.2. North America

9.2.1. United States

9.2.2. Canada

9.3. South America

9.4. Europe

9.4.1. UK

9.4.2. Germany

9.4.3. France

9.4.4. Others

9.5. The Middle East and Africa

9.6. Asia Pacific

9.6.1. Japan

9.6.2. China

9.6.3. Taiwan

9.6.4. Others

10. Competitive Environment and Analysis

10.1. Major Players and Strategy Analysis

10.2. Emerging Players and Market Lucrativeness

10.3. Mergers, Acquisitions, Agreements, and Collaborations

10.4. Vendor Competitiveness Matrix

11. Company Profiles

11.1. Sumitomo Electric Industries Ltd.

11.2. Mitsubishi Chemical Corporation

11.3. Soitec

11.4. Xiamen Powerway Advanced Material

11.5. Toshiba Corporation

11.6. Ammono

11.7. Sciocs Co, Ltd.

11.8. Qorvo Inc.

11.9. Dongguan Sino Nitridesemiconductor Co., Ltd

11.10. GaN Systems Inc.

Sumitomo Electric Industries Ltd.

Mitsubishi Chemical Corporation

Soitec

Xiamen Powerway Advanced Material

Toshiba Corporation

Ammono

Sciocs Co, Ltd.

Qorvo Inc.

Texas Instruments

GaN Systems Inc.

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| Next Generation Transistors Market Size: Report, 2022-2027 | Nov 2022 | |

| Uncooled Infrared Imaging Market Size & Share: Report, 2024-2029 | Mar 2024 | |

| LED Track Light Market Size & Share: Report, 2023-2028 | Feb 2023 | |

| Photonic Integrated Circuit (PIC) Market Size: Report, 2023 - 2028 | Feb 2023 | |

| Gallium Nitride (GaN)-on-Silicon Market Size & Share | 2019 - 2024 | May 2020 |