Global Ureteroscope Market Size, Share, Opportunities, COVID-19 Impact, And Trends By Type (Flexible Ureteroscope, Rigid Ureteroscope, Semi-Rigid Ureteroscope), By Application (Urolithiasis, Kidney Cancer, Urinary Stricture, Others), By End User (Hospitals And Clinics, Ambulatory Surgical Centers, Diagnostic Centers), And Geography - Forecasts From 2021 To 2026

- Published : Jul 2021

- Report Code : KSI061611831

- Pages : 116

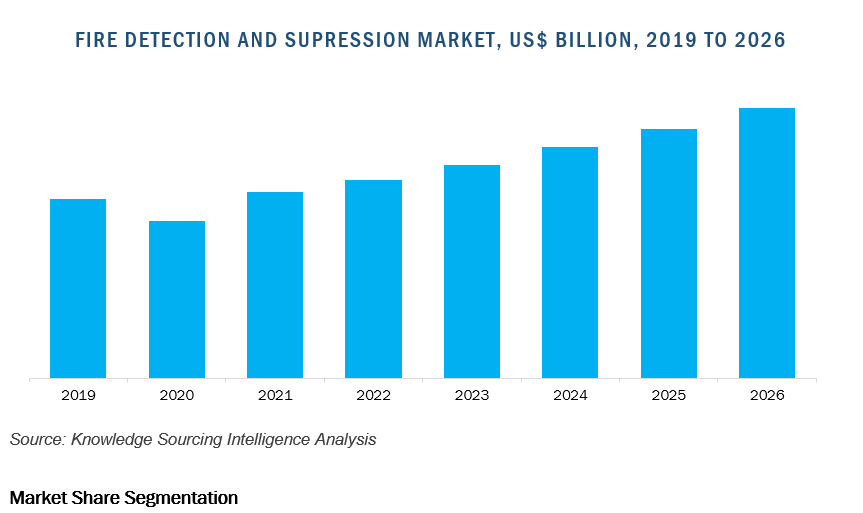

The global ureteroscope market is evaluated at US$360.178 million for the year 2019 and is projected to grow at a CAGR of 4.33% to reach the market size of US$484.713 million by the year 2026.

A ureteroscope is a small size instrument inserted into the bladder and ureter to diagnose and treat a variety of problems in the urinary tract. The purview of ureteroscopy has broadened from diagnostic endoscopy to various minimally invasive procedures. Growth in the ureteroscope market is significantly driven by the rising incidence of urolithiasis coupled with the increasing prevalence of urologic cancers. Also, the growing adoption and demand for minimally invasive procedures are anticipated to play a crucial role in augmenting the market growth during the forecast period. Moreover, the rise in research and development activities in ureteroscopes is expected to boost the growth of the global ureteroscope market. However, the high cost of ureteroscope is expected to hinder the market growth. Furthermore, the rising prevalence of obesity, diabetes, and a growing geriatric population are expected to surge the incidences of diseases of the urinary tract, which in turn is anticipated to propel the global ureteroscope market growth during the assessment period.

The recent outbreak of the novel coronavirus disease had a negative impact on the global ureteroscope market. The pandemic shifted the major focus of the healthcare system towards COVID-19 and as part of the COVID-19 restrictions, a large number of surgeries had to be cancelled in many parts of the world, which led to a decline in the global ureteroscope market in 2020. However, as the restrictions are being eased in most parts of the world, the market is anticipated to recover and continue at its normal pace from the year 2022 onwards.

Rising prevalence of urolithiasis.

One of the major factors anticipated to drive the growth of the global ureteroscope market during the forecast period is the growing number of cases of urolithiasis, which is expected to surge the demand for ureteroscope. According to an article published in the Journal of Family Medicine and Primary Care in December 2020, the prevalence of urolithiasis has been increasing around the world with a prevalence of 7–13% in North America, 5-9% in Europe 5–9%, and 1-5% in Asia. It also states that the United States will have an expected additional expenditure of $1.24 billion/year by 2030 due to a rise in the number of cases of urolithiasis. An article published by Advanced Biomedical Research in the US National Library of Medicine, National Institutes of Health showed that diabetes increases the risk of urolithiasis. As per International Diabetes Federation, 9.3% of the global population i.e. 463 million people had diabetes in 2019, which is projected to increase to 10.2% i.e. 578 million by 2030 and 10.9% i.e. 700 million by 2045. This is leading to an increased prevalence of urolithiasis, which is anticipated to propel the growth of the global ureteroscope market during the assessment period.

Growing demand for minimally invasive surgeries.

The rise in the adoption and demand for minimally invasive surgeries, due to its various advantages over traditional surgeries, is prompting increased use of ureteroscope which is anticipated to propel the growth of the global ureteroscope market during the forecast period. The minimally invasive surgery requires smaller incisions and consequently less scarring which are some of the reasons for its rising preference. Minimally invasive surgeries reduce the hospital stay time for the patient and have shorter recovery periods, along with providing increased accuracy, which is prompting the demand for minimally invasive surgeries. Another article published in February 2020 in US NLM, NIH, showed that open surgical procedures declined by nearly 35% from 2000 to 2018 and are being replaced by minimally invasive surgeries. This rising demand is expected to grow further in the coming years and is anticipated to boost the global ureteroscope market growth during the forecast period.

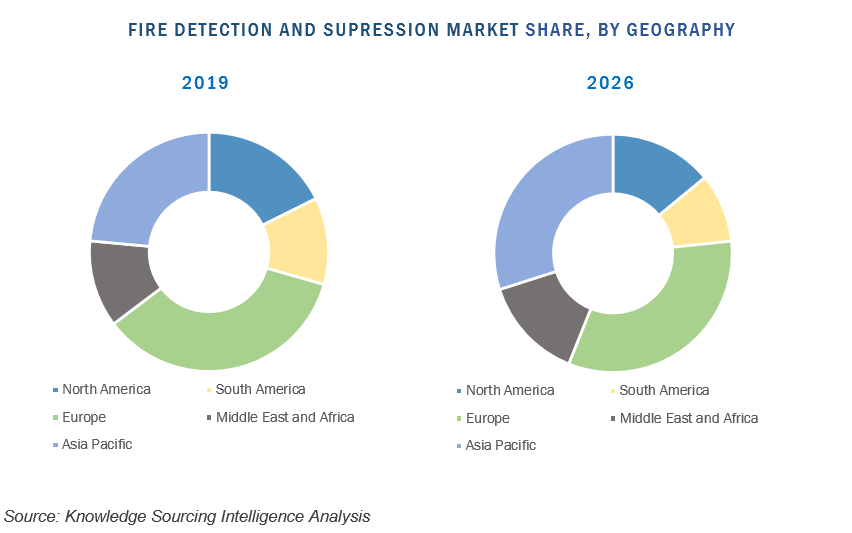

North America to hold a significant market share.

Geographically, the North American region is anticipated to hold a significant market share owing to a large presence of conditions that lead to urolithiasis and other complications requiring the use of a ureteroscope. The United States has a high prevalence of diabetes that increases the risk of urolithiasis, which is one of the reasons for the high market share of North America. Also, the presence of an advanced healthcare system contributed to the domination of North America in the global ureteroscope market. The Asia Pacific region is anticipated to witness substantial growth due to rising cases of urolithiasis in the region and the increasing number of people with obesity. Also, the increased expenditure in the healthcare industry is further anticipated to propel the market growth in the Asia Pacific during the forecast period.

Segmentation

- By Type

- Flexible Ureteroscope

- Rigid Ureteroscope

- Semi-Rigid Ureteroscope

- By Application

- Urolithiasis

- Kidney Cancer

- Urinary Stricture

- Others

- By End-User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Frequently Asked Questions (FAQs)

1.1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Research Data

2.2. Assumptions

3. Executive Summary

3.1. Research Highlights

4. Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of End-Users

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. Global Ureteroscope Market Analysis, by Type

5.1. Introduction

5.2. Flexible Ureteroscope

5.3. Rigid Ureteroscope

5.4. Semi-Rigid Ureteroscope

6. Global Ureteroscope Market Analysis, by Application

6.1. Introduction

6.2. Urolithiasis

6.3. Kidney Cancer

6.4. Urinary Stricture

6.5. Others

7. Global Ureteroscope Market Analysis, by End-User

7.1. Introduction

7.2. Hospitals and Clinics

7.3. Ambulatory Surgical Centers

7.4. Diagnostic Centers

8. Global Ureteroscope Market Analysis, by Geography

8.1. Introduction

8.2. North America

8.2.1. USA

8.2.2. Canada

8.2.3. Mexico

8.3. South America

8.3.1. Brazil

8.3.2. Argentina

8.3.3. Others

8.4. Europe

8.4.1. Germany

8.4.2. France

8.4.3. UK

8.4.4. Others

8.5. Middle East and Africa

8.5.1. Saudi Arabia

8.5.2. UAE

8.5.3. Others

8.6. Asia Pacific

8.6.1. China

8.6.2. India

8.6.3. Japan

8.6.4. South Korea

8.6.5. Taiwan

8.6.6. Thailand

8.6.7. Indonesia

8.6.8. Others

9. Competitive Environment and Analysis

9.1. Major Players and Strategy Analysis

9.2. Emerging Players and Market Lucrativeness

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Vendor Competitiveness Matrix

10. Company Profiles

10.1. Boston Scientific Corporation

10.2. Olympus Corporation

10.3. Richard Wolf GmbH

10.4. PENTAX Medical

10.5. Clarion Medical Technologies

10.6. NeoScope Inc.

10.7. Maxiflex LLC

10.8. Stryker

10.9. ELMED Medical Systems

10.10. Dornier MedTech

Boston Scientific Corporation

Olympus Corporation

Richard Wolf GmbH

PENTAX Medical

Clarion Medical Technologies

NeoScope Inc.

Maxiflex LLC

Stryker

Dornier MedTech

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| Syringe Market Size, Share & Growth: Industry Report, 2023-2028 | Dec 2023 | |

| Cystoscope Market Size, Share & Growth: Industry Report: 2021-2026 | Oct 2021 | |

| Bronchoscope Market Report, Industry Share & Growth: 2021 - 2026 | Jul 2021 | |

| Smart Medical Device Market Size: Industry Report, 2023-2028 | Dec 2023 | |

| Stethoscope Market Size, Share & Trends: Industry Report, 2022–2027 | Sep 2022 |