Biosimulation Market Size, Share, Opportunities, COVID-19 Impact, And Trends By Type (Software, Services), By Application (Drug Development, Drug Discovery, Others), By End-User Industry (Pharmaceutical Companies, Academic Institutions, Research Organizations, Others), And By Geography - Forecasts From 2021 To 2026

- Published : Aug 2021

- Report Code : KSI061610570

- Pages : 122

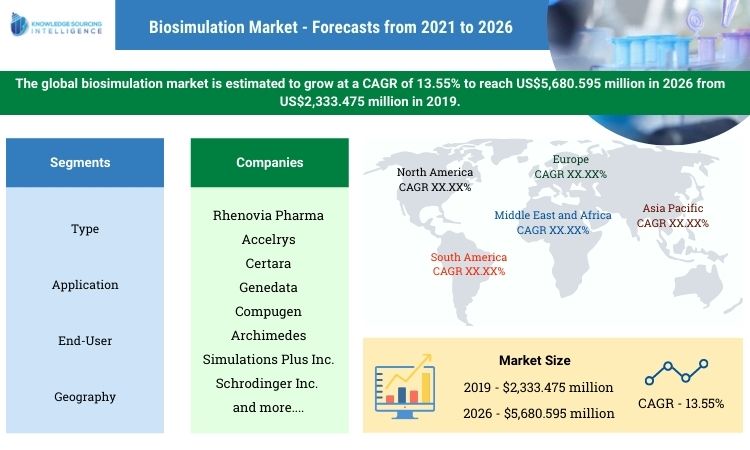

The global biosimulation market is estimated to grow at a CAGR of 13.55% to reach US$5,680.595 million in 2026 from US$2,333.475 million in 2019.

Biosimulation refers to a computer-aided program that simulates biological processes and systems. It is being used extensively for pharmaceutical drug development to mimic the flow of diseases and then running the designed medicine through the simulation to observe its impact on the disease and the body. The increase in the investment in R&D has been a major reason for the growth in the biosimulation market.

According to WHO, the 2020 report analyses the global health spending by countries around the world from the year 2000 to 2018. According to the report, the global spending on health has increased drastically between 2000 and 2018 and it has reached US$ 8.3 trillion i.e., 10% of the global GDP. The out-of-pocket spending has also increased especially in the low- and middle-income countries, thereby representing a share greater than 40% of the total health spending in 2018.

The pharmaceutical companies segment will account for a significant market share and is anticipated to grow at a substantial rate in the coming years. This is due to the increasing adoption of in silico models for developing new drugs in the areas such as cancer, diabetes, and central nervous system diseases. Companies are investing heavily in R&D activities to prolong the lifecycles of patent-expiring drugs by incorporating a biosimulation approach to develop drug variants. For instance, Rhenovia Pharma Ltd., a biotech company, utilized in silico models to identify better treatment approaches related to bipolar disorders, depression, schizophrenia, and Alzheimer’s disease.

Market Restraints.

- There is a lack of standardization in biosimulation. Biosimulation uses a variety of models, tools, and languages for processing and capturing many different aspects of biological processes. The bodies governing it are yet to standardize the use of biosimulation technologies in the process of drug development and discovery.

- The shortage of skilled labor in developed countries is another reason hampering the growth in the region.

North America to witness significant growth.

The North American region will witness significant growth in the market of biosimulation. The growth in the biotechnology and pharmaceutical industry, increase in the R&D investment by these pharmaceutical and biotechnology companies, and increase in the use of personalized medicines are some of the major factors driving growth in the market. Moreover, the U.S. Food and Drug Administration (FDA) firmly recommends simulation processes in drug development and discovery, thereby boosting growth in the region.

Market Developments:

- In March 2021 Certara announced the acquisition of AUTHOR!. This company has regulatory and biostatistical expertise in a huge range of therapeutic areas, including cardiovascular diseases, oncology, and rare diseases.

- In February 2021, SimulationPlus announced its distribution agreement with Mosim, China’s leading biopharmaceutical services company. It will distribute MonolixSuite, the Lixoft division’s pharmacodynamic (PK/PD) modeling platform, in China.

- In February 2021, Schrodinger announced that it had expanded its collaboration agreement with Google Cloud. This collaboration will help accelerate the speed and capacity of its physics-based computational platform for the discovery of drugs and materials science.

- In January 2021, Insilico Biotechnology AG launched a new software product, the Insilico Selector. With the help of Insilico Selector, using micro-scale data accurate selection of high-performing cell clones can be made. It will significantly reduce the process development timelines for biologics and biosimilars.

- In September 2020, INSILICO announced the launch of a new product, INSILICO Designer for Digital-Twin-based Design of Experiments. The use of Insilico designer reduces the experimental burden and provides quality predictions using machine learning applications.

- In August 2020, Certara a global leader in biosimulation announced its plan for the development of a new biosimulation platform for COVID-19 vaccines and major enhancements in its Immunogenicity and Immuno-oncology QRS platforms. Certara’s mechanistic model helped the researchers to examine how a drug or a biologic is handled by the human body in computer-generated, virtual patients.

The rise in the demand for the biosimulation market has compelled major players such as Certara and Simulation Plus to focus on enhancing their global presence by adopting inorganic growth strategies.

Impact of COVID-19 on the Biosimulation Market

The market for biosimulation has been growing during the pandemic. Due to an emergency, the market has been driving towards developing drugs to cure this disease that has killed millions of people worldwide. The healthcare industry has therefore continued to grow during these adverse conditions.

Key Players

The major players in the market of biosimulation are using various strategies to stay ahead of each other, such as new product launches, mergers, and acquisitions. The major companies in the market are Rhenovia Pharma, Accelrys, Certara, Genedata, Leadscope, Compugen, Archimedes, Simulations Plus Inc., Schrodinger Inc., and Insilico Biotechnology. Artificial Intelligence and Machine Learning are extensively being used by these major players to gain better results. Therefore, technological advancements will help grow the biosimulation market further over the forecast period.

Biosimulation Market Scope:

| Report Metric | Details |

| The market size value in 2019 | US$2,333.475 million |

| The market size value in 2026 | US$5,680.595 million |

| Growth Rate | CAGR of 13.55% from 2019 to 2026 |

| Base year | 2019 |

| Forecast period | 2021–2026 |

| Forecast Unit (Value) | USD Million |

| Segments covered | Type, Application, End-User, And Geography |

| Regions covered | North America, South America, Europe, Middle East, and Africa, Asia Pacific |

| Companies covered | Renova Pharma, Accelrys, Certara, Genedata, Leadscope, Compugen, Archimedes, Simulations Plus Inc., Schrodinger Inc., and Insilico Biotechnology. |

| Customization scope | Free report customization with purchase. |

Segmentation

- By Type

- Software

- Services

- By Application

- Drug Development

- Drug Discovery

- Others

- By End-User

- Pharmaceutical Companies

- Academic Institutions

- Research Organizations

- Others

- By Geography

- North America

- U.S.

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Others

- Europe

- U.K

- Germany

- Italy

- France

- Netherlands

- Spain

- Others

- Middle East and Africa

- Israel

- South Africa

- Saudi Arabia

- Others

- Asia-Pacific

- China

- Japan

- Australia

- South Korea

- India

- Others

- North America

Frequently Asked Questions (FAQs)

Q1. What are the growth prospects for the biosimulation market?

A1. The biosimulation market is estimated to grow at a CAGR of 13.55% during the forecast period.

Q2. What will be the biosimulation market size by 2026?

A2. The global biosimulation market is estimated to reach a market size of US$5,680.595 million by 2026.

Q3. What is the size of the global biosimulation market?

A3. The biosimulation market was valued at US$2,333.475 million in 2019.

Q4. Which region holds the maximum market share in the biosimulation market?

A4. The North American region will witness significant growth in the biosimulation market.

Q5. What factors are anticipated to drive the biosimulation market growth?

A5. The increase in the investment in R&D has been a major reason for the growth in the biosimulation market.

1.Introduction

1.1.Market Definition

1.2.Market Segmentation

2.Research Methodology

2.1.Research Data

2.2.Assumptions

3.Executive Summary

3.1.Research Highlights

4.Market Dynamics

4.1.Market Drivers

4.2.Market Restraints

4.3.Porters Five Forces Analysis

4.3.1.Bargaining Power of Suppliers

4.3.2.Bargaining Power of Buyers

4.3.3.The threat of New Entrants

4.3.4.Threat of Substitutes

4.3.5.Competitive Rivalry in the Industry

4.4.Industry Value Chain Analysis

5.Biosimulation Market Analysis, By Type

5.1.Introduction

5.2.Software

5.3.Services

6.Biosimulation Market Analysis, By Application

6.1.Introduction

6.2.Drug Development

6.3.Drug Discovery

6.4.Others

7.Biosimulation Market Analysis, By End-User

7.1.Introduction

7.2.Pharmaceutical Companies

7.3.Academic Institutions

7.4.Research Organizations

7.5.Others

8.Biosimulation Market Analysis, by Geography

8.1. Introduction

8.2. North America

8.2.1.North America Biosimulation Market Analysis, By Type, 2021 to 2026

8.2.2.North America Biosimulation Market Analysis, By Application, 2021 to 2026

8.2.3.North America Biosimulation Market Analysis, By End-User, 2021 to 2026

8.2.4.By Country

8.2.4.1. United States

8.2.4.2. Canada

8.2.4.3.Mexico

8.3.South America

8.3.1.South America Biosimulation Market Analysis, By Type, 2021 to 2026

8.3.2.South America Biosimulation Market Analysis, By Application, 2021 to 2026

8.3.3.South America Biosimulation Market Analysis, By End-User, 2021 to 2026

8.3.4.By Country

8.3.4.1.Brazil

8.3.4.2.Argentina

8.3.4.3.Colombia

8.3.4.4.Others

8.4.Europe

8.4.1.Europe Biosimulation Market Analysis, By Type, 2021 to 2026

8.4.2.Europe Biosimulation Market Analysis, By Application, 2021 to 2026

8.4.3.Europe Biosimulation Market Analysis, By End-User, 2021 to 2026

8.4.4.By Country

8.4.4.1.U.K

8.4.4.2.Germany

8.4.4.3.Italy

8.4.4.4.France

8.4.4.5.Netherlands

8.4.4.6.Spain

8.4.4.7.Others

8.5.Middle East and Africa

8.5.1.Middle East and Africa Biosimulation Market Analysis, By Type, 2021 to 2026

8.5.2.Middle East and Africa Biosimulation Market Analysis, By Application, 2021 to 2026

8.5.3.Middle East and Africa Biosimulation Market Analysis, By End-User, 2021 to 2026

8.5.4.By Country

8.5.4.1.Israel

8.5.4.2.South Africa

8.5.4.3.Saudi Arabia

8.5.4.4.Others

8.6.Asia Pacific

8.6.1.Asia Pacific Biosimulation Market Analysis, By Type, 2021 to 2026

8.6.2.Asia Pacific Biosimulation Market Analysis, By Application, 2021 to 2026

8.6.3.Asia Pacific Biosimulation Market Analysis, By End-User, 2021 to 2026

8.6.4.By Country

8.6.4.1.China

8.6.4.2.Japan

8.6.4.3.Australia

8.6.4.4.South Korea

8.6.4.5.India

8.6.4.6.Others

9. Competitive Environment and Analysis

9.1. Major Players and Strategy Analysis

9.2. Emerging Players and Market Lucrativeness

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Vendor Competitiveness Matrix

10. Company Profiles

10.1.Rhenovia Pharma

10.2.Accelrys

10.3.Certara

10.4.Genedata

10.5.Leadscope

10.6.Compugen

10.7.Archimedes

10.8.Simulations Plus Inc.

10.9.Schrodinger Inc.

10.10.Insilico Biotechnology.

Rhenovia Pharma

Accelrys

Certara

Genedata

Leadscope

Compugen

Archimedes

Simulations Plus Inc.

Schrodinger Inc.

Insilico Biotechnology.

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| Bioinformatics Market Size & Share: Industry Report, 2021-2026 | Jan 2022 | |

| Next Generation Sequencing Market Size: Report, 2021-2026 | Feb 2022 | |

| Bioherbicides Market Size, Share & Trend: Industry Report, 2022-2027 | Mar 2022 | |

| Biosimilars Market Size, Share & Trends: Industry Report, 2023 - 2028 | Mar 2023 | |

| Global Biologics Market Size & Share: Industry Report, 2024-2029 | Apr 2024 |