Report Overview

Cloud Music Services Market Highlights

Cloud Music Services Market Size:

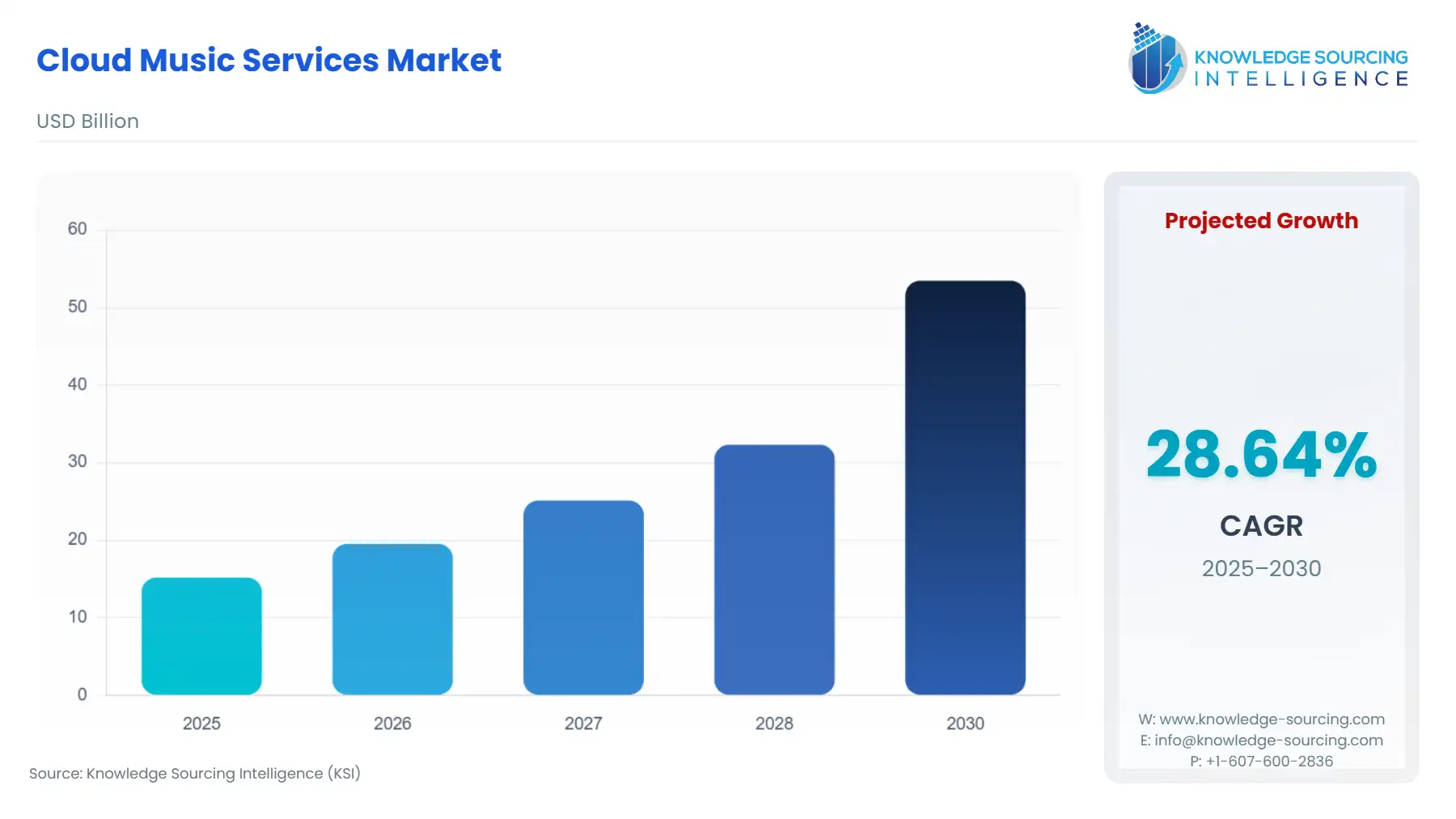

The cloud music services market is projected to grow at a CAGR of 28.61% over the forecast period, from US$15.177 billion in 2025, and is expected to reach US$53.469 billion by 2030.

A music service or music provider is a service or solution that includes 'music-on-demand' features for the users, and it also collects, registers, licenses, and accounts royalties with the producer and writer of the songs or music. Online or cloud-based music services are a type of streaming media that provides users with the music of their choice through the internet, without necessarily requiring downloading or storing the music file. With online music services, the consumer or the subscriber has easy access to the music of their choice, along with offering a cost-efficient method to legally consume the art form without buying it.

The global music and audio industry has greatly increased in recent years. The increase in the music industry globally has shown a positive impact of cloud music services. The report published by UK Music stated that in 2022, the music export of the UK was valued at about US$4.3 billion (Euro 4 billion). Similarly, the Recording Industry Association of America (RIAA) in 2023 stated that in 2023 the streaming revenue of US music was estimated at US$14.4 billion, which increased from US$13.3 billion in 2022 and US$12.4 billion in 2021.

In addition, cloud music services for mobile devices are generally apps that offer music accessibility to the user. In contrast, web-based services offer streaming through the internet on the provider’s website. The cloud music services market is projected to rise at an exorbitant growth rate, owing to the vast availability of music and podcasts with one click.

Moreover, the music industry is growing rapidly with the introduction of cloud services, which is one of the major reasons boosting the market growth. The increasing penetration of 5G, which enables people to download music faster and with low latency, is anticipated to propel the market growth in the coming years. North America is poised to hold a prominent position in the cloud music services market, particularly due to its increasing accessibility to the internet and the technological developments in the music industry.

Cloud Music Services Market Drivers:

- The increase in the accessibility of the internet is anticipated to propel the demand for cloud music services globally.

One of the major drivers for the increase in the global demand for cloud music services can be traced to the increase in global Internet accessibility. With the increase in the accessibility of smartphones and the Internet in the global market, the demand for Internet-based services has increased massively. Various new internet-based platforms, such as online video streaming, movie streaming, music streaming, and e-commerce, among others, have witnessed a rise in their market.

The individual using the internet data published by the International Telecommunication Union (ITU)[1] stated that in 2023, about 5.4 billion, or 67% of the global population, had access to the internet. This figure has increased massively in the past few years, from 5.1 billion in 2022 to 4.9 billion in 2021. This increase is further estimated to expand in the coming years, boosting the global cloud music services market.

Cloud Music Services Market Geographical Outlook

- The United States region is predicted to contribute significantly to market growth.

The United States market for cloud services music is expected to grow in the projected period, owing to the presence of many players such as Spotify, Apple Inc., Amazon, and Pandora, among others. Additionally, the increasing presence of many electronic devices in the country is a major reason propelling the market growth. According to the World Bank, the penetration of mobile phones is 110 mobile phones per 100 people.

Strategic collaboration and partnership in the United States cloud music service market is anticipated to fuel the market in the projected period. For instance, in August 2022, Spotify partnered with Samsung to give users more ways to listen. The partnership will allow Samsung users to seamlessly connect their devices with Spotify so that music never stops. Seamless music will be available on all Galaxy devices, watches, and buds.

According to the Cellular Telecommunications Industry Association (CTIA), 5G connections in America are increasing rapidly, which is one of the major factors fueling market growth in the coming years. In 2020, the active 5G devices were 14 million, which grew to 86 million in 2021. In 2022, the number of 5G active users in the country grew to 162 million. Hence, in the coming years, the growing 5G market is anticipated to boost market growth.

Cloud Music Services Market Key Developments:

- November 2025: Spotify rolled out Lossless audio quality and mixing tools, enhancing the premium experience. It also expanded its personalized AI-powered DJ feature.

- September 2025: YouTube Music launched new features for music artists, allowing fans to pre-save forthcoming albums and view countdowns to new releases.

- June 2025: Apple Music celebrated its 10th anniversary by opening a new global creative hub and state-of-the-art studio in Los Angeles for artists.

- June 2025: Apple Music introduced AutoMix, an AI feature that creates DJ-like transitions between songs, and added Lyrics Translation for global tracks.

Cloud Music Services Market Key Players:

- Spotify- Spotify helps the customer to find the right music or podcast every time. The company was launched in 2008 and, at present, has more than 100 million tracks, 6 million podcast titles, and 3,50,000 audiobooks a la carte. It is among the world’s most popular audio streaming platforms, with more than 615 million users, including 239 million subscribers in more than 180 markets.

- YouTube- YouTube, established in 2005, is one of the major companies in the cloud music service market. The company’s mission is to give everyone a voice and show them to the world.

- SoundCloud- SoundCloud, founded in 2007, is an artist-first platform powered by a global community of artists and listeners. The company powers individual artists with tools, services, and platforms to build and grow their careers in music.

- Amazon- Amazon is guided by four major principles, which include customer obsession, long-term thinking, commitment to operational excellence, and passion for innovation. The company also has 16 leadership principles, which include ownership, invention, simplification, frugality, thinking big, and hiring and developing the best, among others.

Cloud Music Services Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cloud Music Services Market Size in 2025 | US$15.177 billion |

| Cloud Music Services Market Size in 2030 | US$53.469 billion |

| Growth Rate | CAGR of 28.61% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Cloud Music Services Market |

|

| Customization Scope | Free report customization with purchase |

Cloud Music Services Market Segmentation:

- By Type

- Downloadable

- Subscription

- Streaming

- By Platform

- Mobile Device

- Web-Based

- By End-User

- Individual

- Business

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- Italy

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America