Report Overview

Electronic Paper Display Market Highlights

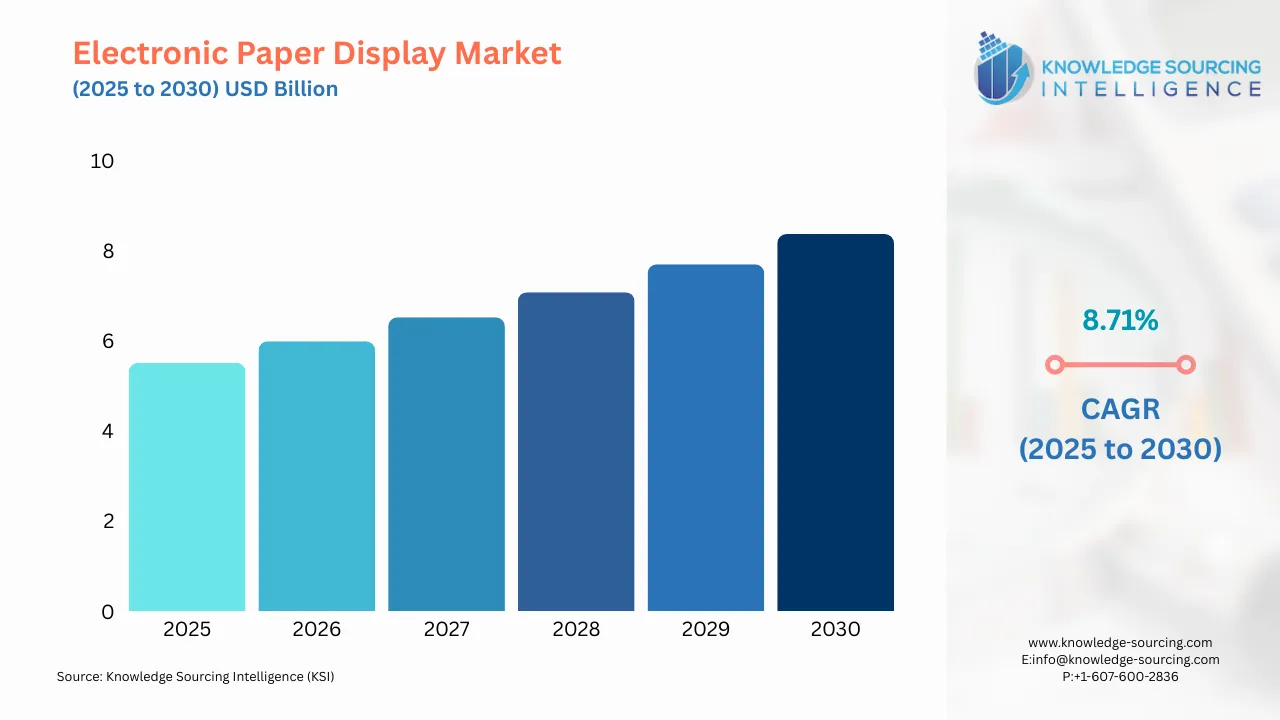

Electronic Paper Display Market Size:

The electronic paper display market is evaluated at US$5.513 billion in 2025 and is projected to grow at a CAGR of 8.71% to reach US$8.369 billion in 2030.

Electronic Paper Display Market Introduction

The electronic paper display (EPD) market, also known as the e-paper or e-ink market, represents a transformative segment within the global display technology industry. Renowned for its paper-like readability, low power consumption, and versatility, e-paper technology mimics the appearance of ink on paper, offering high contrast, wide viewing angles, and excellent visibility in various lighting conditions, including direct sunlight. These attributes make EPDs ideal for applications such as e-readers, electronic shelf labels (ESLs), digital signage, smartwatches, and emerging Internet of Things (IoT) devices. As industries increasingly prioritize energy efficiency, sustainability, and user-friendly interfaces, the EPD market is experiencing robust growth, driven by technological advancements and expanding application areas.

Electronic paper displays operate using technologies such as electrophoretic, electrowetting, and cholesteric displays, with electrophoretic displays (EPDs) being the most prevalent due to their energy efficiency and readability. Unlike traditional LCD or OLED screens, e-paper displays are bistable, meaning they retain content without continuous power, consuming energy only when updating the display. This characteristic, combined with their lightweight and flexible nature, positions EPDs as a sustainable alternative to conventional displays. Key applications include e-readers (e.g., Amazon Kindle), ESLs for retail, digital signage for transportation and advertising, and wearables like smartwatches. Emerging uses in smart cities, such as solar-powered e-paper bus stop displays, highlight the technology’s adaptability to public infrastructure.

The global push for digitalization and eco-friendly solutions has accelerated EPD adoption. In retail, ESLs are transforming pricing and inventory management, with major chains adopting e-paper for its ability to update prices remotely while reducing paper waste. For instance, a recent report noted that large supermarkets in Europe are increasingly transitioning to ESLs to enhance operational efficiency. In transportation, the Jerusalem Transportation Master Plan Team implemented solar-powered e-paper displays at bus stops in 2024, showcasing their role in smart city initiatives. These applications underscore the market’s growing relevance across diverse sectors.

The EPD market is witnessing continuous innovation and strategic investments. Boston-based Modos introduced a paper laptop with a large e-paper display, targeting text-focused applications like word processing and email, offering reduced eye strain and extended battery life. In February 2024, LG Display unveiled a 0.7mm ultra-thin flexible e-paper for wearables and industrial labels, pushing the boundaries of lightweight technology. Additionally, CLEARink Displays developed video-capable e-paper in 2024, reducing energy consumption by 90% compared to LCDs, targeting advertising and education sectors. These developments highlight the industry’s focus on overcoming technical limitations and expanding market reach.

Electronic Paper Display Market Trends

Electronic paper (e-paper) represents an innovative, portable display medium that mimics the appearance of conventional paper while offering the advantage of reusable digital content. This technology is gaining significant traction across various applications, including e-readers, digital signage, and electronic billboards. Currently, North America dominates the e-paper market, while the Asia Pacific region is poised for substantial growth in the coming years, driven by technological advancements and increasing environmental consciousness regarding traditional electronics. However, the market faces challenges, particularly in terms of high production costs.

The integration of e-paper displays into smart cards presents transformative potential, offering benefits such as reduced physical bulk, improved security features, and greater functional flexibility. This application has captured the attention of smart card manufacturers, who are actively exploring ultra-thin e-paper solutions.

Comprehensive market analysis reports on electronic paper displays provide valuable strategic insights, combining executive-level perspectives with data-driven projections. These regularly updated resources examine key market drivers, including technological innovations, regulatory frameworks, and macroeconomic factors. The reports offer detailed assessments of various e-paper technologies - such as electrophoretic and electrowetting displays - along with their regional adoption patterns, competitive landscapes, and emerging market opportunities. This intelligence enables informed decision-making for stakeholders across the industry.

Some of the major players covered in this report include E Ink Holdings Inc., BOE Technology Group Co., Ltd., LG Display Co., Ltd., Pervasive Displays Inc., Plastic Logic GmbH, Visionect, Samsung Display Co., Ltd., Densitron Technologies, and Toppan Printing Co., Ltd., among others.

Electronic Paper Display Market Drivers

Rising Demand for Energy-Efficient and Sustainable Display Solutions

The global push for sustainability and energy efficiency is a primary driver for the EPD market, as e-paper displays consume minimal power, requiring energy only during content updates due to their bistable nature. This characteristic makes them ideal for battery-powered devices like e-readers, electronic shelf labels (ESLs), and wearables, aligning with environmental goals to reduce energy consumption and carbon footprints. The World Economic Forum highlights that energy-efficient technologies are critical for achieving net-zero targets, with displays playing a significant role in reducing electronic waste. In 2024, E Ink Holdings Inc. expanded its Kaleido 3 Color e-paper production, supporting over 10,000 digital signage installations globally, emphasizing its eco-friendly profile for retail and public displays. The ability of EPDs to operate on solar power, as seen in Jerusalem’s solar-powered e-paper bus stop displays implemented in 2024, further enhances their appeal in sustainable urban infrastructure.

Growing Adoption in Retail and Smart City Applications

The retail sector’s digital transformation and the rise of smart city initiatives are significantly boosting EPD demand. ESLs leverage e-paper’s low power consumption and readability to enable real-time pricing and inventory updates, reducing labor costs and paper waste. In 2025, European retailer Opticon launched advanced ESLs with colored e-paper signage, enhancing retail efficiency and customer experience. In smart cities, e-paper’s energy efficiency and sunlight readability make it ideal for public information systems. For example, Japan’s smart bus stop project, developed by E Ink Holdings and Papercast in 2024, utilized solar-powered e-paper displays to provide real-time transit information, supporting sustainable urban mobility. These applications highlight EPDs’ role in streamlining operations and advancing digital infrastructure.

Advancements in Color and Flexible E-Paper Technologies

Technological innovations in color and flexible e-paper displays are expanding their application scope, driving market growth. Recent advancements have improved color vibrancy and flexibility, making e-paper viable for consumer electronics, wearables, and innovative form factors. In April 2024, E Ink Holdings Inc. introduced E Ink Gallery 3 Color, a quad-particle ink system offering vibrant colors for e-readers and signage, enhancing user engagement. Additionally, LG Display’s February 2024 launch of a 0.7mm ultra-thin flexible e-paper for wearables and industrial labels demonstrates the technology’s potential in lightweight, durable applications. These developments address consumer demand for visually appealing, versatile displays, positioning e-paper as a competitive alternative to traditional screens.

Electronic Paper Display Market Restraints

Limited Color Capabilities and Low Refresh Rates

Despite advancements, e-paper displays face limitations in color range and refresh rates compared to LCD and OLED screens, restricting their use in visually intensive applications like advertising or video playback. Current color e-paper, such as E Ink’s Kaleido 3, supports thousands of colors but lacks the vibrancy and speed of conventional displays. A 2025 industry report noted that the limited color palette and slow refresh rates hinder e-paper adoption in dynamic media applications, where rapid updates are essential. This constraint limits market penetration in sectors requiring high-resolution, full-color displays or real-time video capabilities, posing a challenge to broader adoption.

High Production Costs for Advanced E-Paper Displays

The development and manufacturing of advanced e-paper displays, particularly those with color and flexible features, involve complex processes and specialized materials, leading to high production costs. These costs can make e-paper less competitive in price-sensitive markets compared to established technologies like LCDs. A 2025 technology analysis highlighted that the production of vibrant, flexible e-paper requires significant investment in R&D and manufacturing infrastructure, impacting affordability. For instance, the intricate electrophoretic ink systems and flexible substrates increase costs, which may deter adoption in budget-conscious applications like low-cost consumer electronics.

Electronic Paper Display Market Segmentation Analysis

Electrophoretic Displays (EPD) are expected to grow significantly

Electrophoretic Displays (EPDs) dominate the e-paper market due to their widespread adoption, energy efficiency, and superior readability in various lighting conditions, including direct sunlight. EPDs function by manipulating charged pigment particles within microcapsules to create high-contrast, paper-like displays that require power only during content updates, making them ideal for battery-powered devices. This technology underpins most e-readers, electronic shelf labels (ESLs), and digital signage, offering durability and low maintenance. Its dominance is driven by continuous improvements in resolution and color capabilities, such as E Ink Holdings Inc.’s April 2024 launch of E Ink Gallery 3 Color, which introduced a quad-particle ink system to deliver vibrant colors for e-readers and signage, enhancing visual appeal. Additionally, EPDs are favored in sustainable applications, such as Jerusalem’s solar-powered e-paper bus stop displays implemented in 2024, which leverage their low power consumption for public infrastructure. The segment’s leadership is further reinforced by its scalability, enabling applications from small wearables to large-scale signage, positioning EPDs as the cornerstone of the e-paper market.

Electronic Shelf Labels (ESL) is expected to be the fastest-growing application

Electronic Shelf Labels (ESLs) represent the largest application segment for e-paper displays, driven by the retail sector’s digital transformation and the need for efficient, sustainable pricing solutions. ESLs utilize e-paper’s low power consumption and high readability to display real-time pricing, product information, and promotions, reducing labor costs and paper waste associated with traditional labels. Retailers benefit from centralized price management and enhanced customer experiences, particularly in large chains. In 2025, European retailer Opticon launched advanced ESLs with colored e-paper signage, improving visual clarity and operational efficiency in stores across Germany and the Netherlands. The segment’s growth is also supported by the global expansion of smart retail, with supermarkets adopting ESLs to streamline inventory and pricing updates. The scalability and eco-friendly nature of ESLs make them a critical driver of e-paper adoption in retail.

Asia-Pacific is anticipated to lead the market expansion

The Asia-Pacific region is the largest and fastest-growing market for electronic paper displays, fueled by robust technological innovation, manufacturing capabilities, and increasing demand for e-paper in consumer electronics, retail, and smart city applications. Countries like China, Japan, Taiwan, and South Korea lead due to their advanced display technology ecosystems and government support for digital infrastructure. Taiwan-based E Ink Holdings Inc., a global leader in e-paper, expanded its Kaleido 3 Color e-paper production in 2024, supporting applications in e-readers and signage across the region. Japan’s smart city initiatives, such as the 2024 collaboration between E Ink and Papercast for solar-powered e-paper bus stop displays, highlight the region’s focus on sustainable urban solutions. Additionally, China’s retail sector is rapidly adopting ESLs, driven by the growth of e-commerce giants and smart retail stores, while South Korea’s advancements in wearables leverage e-paper’s flexibility. The region’s dominance is further supported by its strong supply chain and R&D investments, positioning Asia-Pacific as the epicenter of the global EPD market.

Electronic Paper Display Market Key Developments

July 2025: Samsung Electronics Co., Ltd. launched the Color E-Paper EMDX series, a line of energy-efficient digital signage displays designed for retail and public spaces. These displays leverage e-paper’s low power consumption and high readability to deliver real-time updates for promotions and information, enhancing customer engagement while reducing energy costs. The launch emphasizes e-paper’s role in dynamic, sustainable signage solutions.

June 2024: Boston-based Modos introduced a paper laptop featuring a large electrophoretic e-paper display, replacing traditional LCD or OLED screens. Targeted at text-focused applications like word processing and email, the device offers extended battery life, reduced eye strain, and superior visibility in sunlight, catering to users prioritizing comfort and sustainability.

April 2024: E Ink Holdings Inc. launched E Ink Gallery 3 Color, a quad-particle ink system delivering vibrant colors for e-readers and digital signage. This advancement enhances visual appeal, expanding e-paper’s applications in consumer electronics and retail, with partnerships formed to integrate the technology into various devices.

Electronic Paper Display Market Scope:

| Report Metric | Details |

|---|---|

| Forecast Unit | Billion |

| Growth Rate | CAGR during the forecast period |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Application, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electronic Paper Display Market Segmentations:

Electronic Paper Display Market Segmentation by Type

The Electronic Paper Display Market is segmented by type into the following categories:

Electrophoretic Displays (EPD)

Electrowetting Displays (EWD)

Cholesteric Liquid Crystal Displays (ChLCD)

Others

Electronic Paper Display Market Segmentation by Application

The Electronic Paper Display Market is analyzed by application into the following:

E-Readers

Electronic Shelf Labels (ESL)

Wearables

Signage & Displays

Others

Electronic Paper Display Market Segmentation by End-User Industry

The Electronic Paper Display Market is analyzed by end-user industry into the following:

Consumer Electronics

Retail

Transportation

Healthcare

Others

Electronic Paper Display Market Segmentation by regions:

The study also analysed the Electronic Paper Display market into the following regions, with country level forecasts and analysis as below:

Americas (US)

Europe, Middle East, and Africa (Germany, Netherlands, and Others)

Asia Pacific (China, Japan, Taiwan, South Korea, and Others)