Wearable Display Market Size, Share, Opportunities, COVID-19 Impact, And Trends BY Product Type (Smart Watches, Smart Bands, Head-Mounted Display), By Technology (OLED, LED), By Panel Type (Flexible, Micro-Display, Rigid), BY Industry Vertical (Consumer Electronics, Healthcare, Military And Defense, Others), And By Geography - Forecasts From 2021 To 2026

- Published : Jul 2021

- Report Code : KSI061612398

- Pages : 131

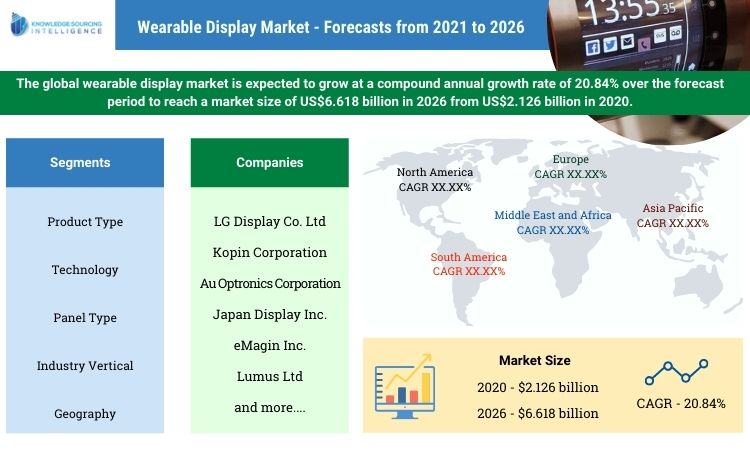

The global wearable display market is expected to grow at a compound annual growth rate of 20.84% over the forecast period to reach a market size of US$6.618 billion in 2026 from US$2.126 billion in 2020. The rising disposable income is pushing the demand for wearable products such as smartwatches and head-mounted display devices.

The shipment of fitness bands and other health tracking wearables has been witnessing a steady increase, on account of the demand from a growing proportion of the population that is becoming health conscious. Furthermore, the growing adoption of AR/VR devices along with the incorporation of small LED displays in wearable devices such as smartwatches and fitness bands is projected to boost the wearable display market. While technological advancements in wearable technologies are also anticipated to widen the growth opportunities and drive the wearable display market over the forecast period. Also, the increasing popularity of wearable devices is estimated to boost their demand around the globe, thus augmenting the demand for wearable displays. In addition to this, the growing demand for connected devices is estimated to shoot up in the coming years reaching 85.933 billion units in 2023, from 19.236 billion units in 2017, i.e., at a CAGR of 18.73% (Source: Knowledge Sourcing Intelligence Analysis), thus further augmenting the demand for wearable displays in the coming years.

By Industry vertical, the wearable display market is segmented as consumer electronics, healthcare, military and defence, and others. Consumer electronics are expected to hold a significant share in the market owing to a significant number of products in the market coupled with increasing investment in research and development by market players. The market for the healthcare sector is anticipated to grow at a substantial rate on account of growing health awareness and rising healthcare expenditure on smart wearable devices around the globe. Furthermore, due to rising government expenditure on the military and defence, the market for wearable displays is anticipated to witness substantial growth in the coming years. Besides, companies are investing heavily in research and development and coming up with new health features in their smartwatch segment in collaboration with health institutions resulting in an increasing demand for wearable displays. In fact, in September 2019, Apple announces three groundbreaking studies in collaboration with leading medical institutions like Harvard T.H. Chan School of Public Health, the NIH’s National Institute of Environmental Health Sciences (NIEHS), and the University of Michigan, and Brigham and Women’s Hospital among others. One of the studies named Apple Hearing Study contributed towards making the listening safe initiative that is used in its latest smartwatch segment.

Based on technology, the wearable display market has been segmented into OLED and LED. The demand for OLED displays is estimated to shoot up in the coming years on account of rising demand for higher quality image output, combined with rapid technological advancements and increasing investment by key players in the development of OLEDs. Additionally, OLED (Organic Light-Emitting Diodes) is a display technology that utilizes a flat light emitting technology, produced by placing a series of thin films between two conductors. This results in a thinner, more vibrant, and brighter display in comparison to other technologies. Additionally, since it individually illuminates every pixel, it can also shut them down individually, resulting in a more battery-efficient performance. These benefits offed by OLED displays have enabled smartwatches and other wearable device manufacturers to offer additional functionality such as always-on displays, thus resulting in the rapid adoption of this technology. For example, in December 2019, Garmin, one of the leading players in the smartwatch industry, launched Garmin Venu, the company’s first smartwatch with an AMOLED display. This increasing adoption of this display technology, combined with the rising production and sales of premium smartwatches is estimated to be some of the prominent drivers of the OLED wearable display market, While, LED wearable displays are anticipated to hold a significant share in the market owing to their early adoption and lower costs compared to OLED displays.

Geographically, Asia Pacific is estimated to hold a major share in the wearable display market owing to the region being a manufacturing hub for connected and wearable devices. Furthermore, budding investments in the manufacturing sector in developing countries such as South Korea, India, and China are also anticipated to further promote the demand for wearable displays in the years to come. North America and the European region are also anticipated to show decent growth in the coming years owing to rapid technological advancements and increasing focus on domestic manufacturing.

The major players profiled in the global wearable display market include Samsung Electronics Co. Ltd., BOE Technology Group Co. Ltd, LG Display Co. Ltd, Kopin Corporation, Au Optronics Corporation, Japan Display Inc., Tianma Microelectronics Co. Ltd., eMagin Inc., HannStar Display Corporation, and Lumus Ltd among others.

Wearable Display Market Scope:

| Report Metric | Details |

| Market size value in 2020 | US$2.126 billion |

| Market size value in 2026 | US$6.618 billion |

| Growth Rate | CAGR of 20.84% from 2020 to 2026 |

| Base year | 2020 |

| Forecast period | 2021–2026 |

| Forecast Unit (Value) | USD Billion |

| Segments covered | Product Type, Technology, Panel Type, Industry Vertical, And Geography |

| Regions covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies covered | Samsung Electronics Co. Ltd., BOE Technology Group Co. Ltd, LG Display Co. Ltd, Kopin Corporation, Au Optronics Corporation, Japan Display Inc., Tianma Microelectronics Co. Ltd., eMagin Inc., HannStar Display Corporation, Lumus Ltd |

| Customization scope | Free report customization with purchase. |

Segmentation:

- By Product Type

- Smart Watches

- Smart Bands

- Head-mounted Display

- By Technology

- OLED

- LED

- By Panel Type

- Flexible

- Micro-display

- Rigid

- By Industry Vertical

- Consumer Electronics

- Healthcare

- Military and Defense

- Others

- By geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- United Kingdom

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

- North America

Frequently Asked Questions (FAQs)

Q1. What will be the wearable display market size by 2026?

A1. The global wearable display market is expected to reach a total market size of US$6.618 billion by 2026.

Q2. What is the size of the global wearable display market?

A2. Wearable Display Market was valued at US$2.126 billion in 2020.

Q3. What are the growth prospects for the wearable display market?

A3. The wearable display market is expected to grow at a CAGR of 20.84% during the forecast period.

Q4. What factors are anticipated to drive the wearable display market growth?

A4. The rising disposable income is pushing the demand for wearable products such as smartwatches and head-mounted display devices.

Q5. Which region holds the largest market share in the wearable display market?

A5. Geographically, Asia Pacific is estimated to hold a major share in the wearable display market owing to the region being a manufacturing hub for connected and wearable devices.

Samsung Electronics Co. Ltd.

BOE Technology Group Co. Ltd

LG Display Co. Ltd

Kopin Corporation

Au Optronics Corporation

Japan Display Inc.

Tianma Microelectronics Co. Ltd.

eMagin Inc.

HannStar Display Corporation

Lumus Ltd

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| Microdisplays Market Size, Share & Growth: Report, 2023 - 2028 | Oct 2023 | |

| Flexible Display Market Size & Share: Industry Report, 2022-2027 | Nov 2022 | |

| AMOLED Display Market Size & Share: Industry Report, 2021 - 2026 | Aug 2021 | |

| Embedded Display Market Size & Share: Report, 2023 - 2028 | Feb 2023 | |

| Foldable Display Market Size & Share: Industry Report, 2022–2027 | Aug 2022 |