Report Overview

Automated Sample Storage Systems Highlights

Automated Sample Storage Systems Market Size:

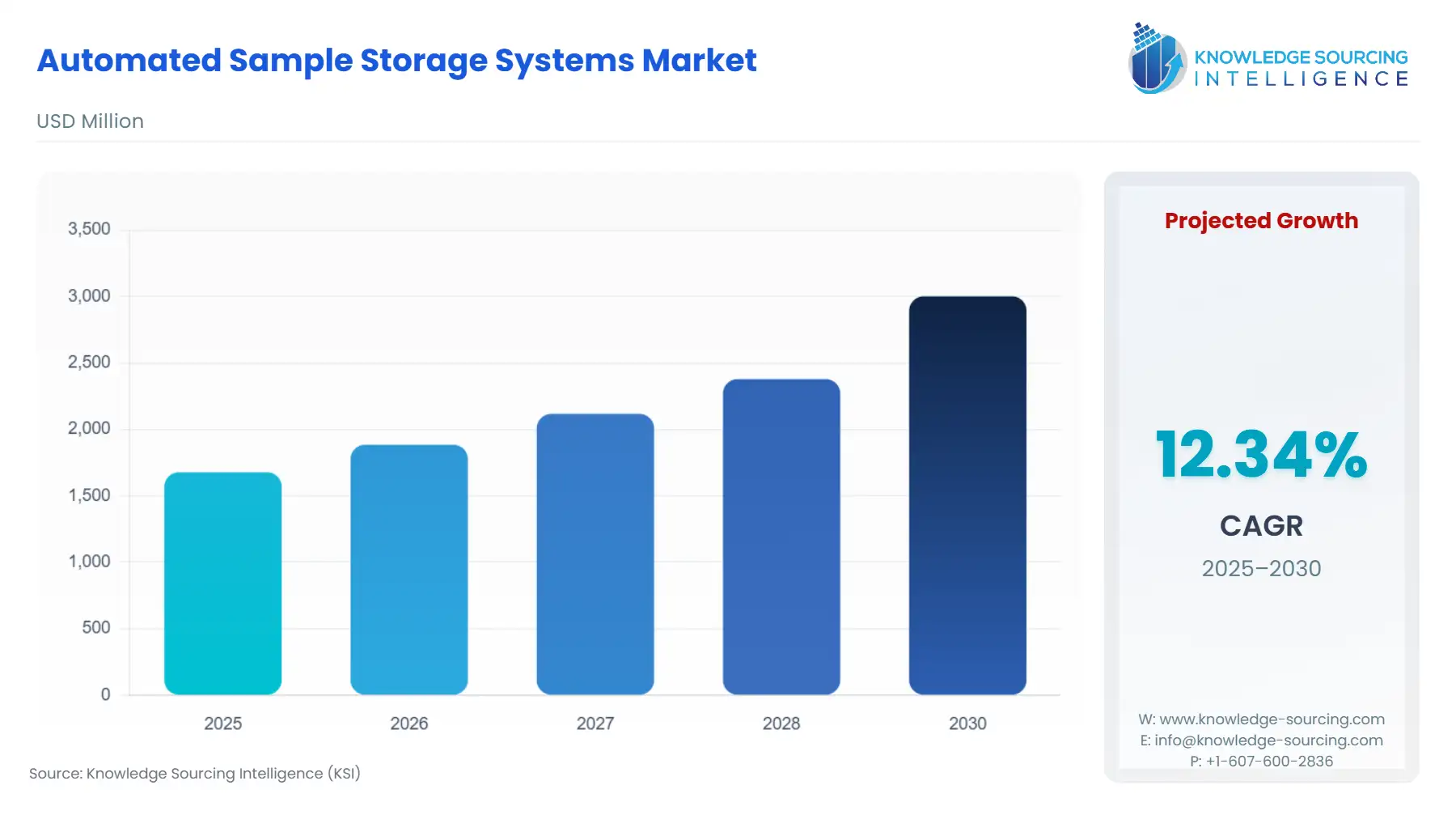

The Automated Sample Storage Systems Market is expected to grow from USD 1.678 billion in 2025 to USD 3.002 billion in 2030, fueled by a 12.34% CAGR.

The evolution of modern drug discovery and clinical diagnostics has rendered manual sample management unsustainable, transitioning the field into an era where automation is a non-negotiable prerequisite for scientific integrity. The sheer volume and irreplaceable nature of biological and compound samples—spanning cell lines, nucleic acids, and small molecule libraries—demand storage infrastructure capable of maintaining precise, auditable environmental conditions. This market analysis focuses on the pivotal technologies and market dynamics influencing the procurement and integration of Automated Sample Storage Systems (ASSS), providing a data-centric perspective on the structural shifts compelling industry investment in advanced automation platforms.

Automated Sample Storage Systems Market Analysis

Growth Drivers

The imperative for verifiable sample integrity is the central catalyst for market growth. The escalating scale of High-Throughput Screening (HTS) in early drug discovery and the volume demands of cell and gene therapy (CGT) development directly increase demand for high-density, ultra-low-temperature (ULT) automated freezers. These systems reduce manual intervention, mitigating the risk of temperature excursions and freeze-thaw cycles that compromise expensive, irreplaceable samples. Furthermore, global titles on US tariff impact indicate that duties on specialised robotics and industrial machinery imported from key manufacturing regions have increased the initial capital outlay for ASSS in North America. While this introduces a cost headwind for purchasers, it simultaneously drives system manufacturers to invest in localised final assembly or high-efficiency designs, ultimately reinforcing the long-term strategic value of automation to offset the increased cost of compliance and logistics. This dual pressure of scientific necessity and logistical complexity accelerates the shift away from less efficient manual methods.

Challenges and Opportunities

A principal challenge facing the market is the substantial initial capital investment required for fully automated, large-scale systems, which creates a significant barrier to entry for smaller academic laboratories and Contract Research Organisations (CROs). This cost constraint often pushes procurement toward smaller, modular systems or prolongs the decision-making cycle. Another constraint is the complexity of system integration with existing Laboratory Information Management Systems (LIMS), demanding specialised IT and operational skill sets. Conversely, the market opportunity lies in the burgeoning field of molecular diagnostics and biobanking in developing economies. As these regions establish foundational healthcare infrastructure and centralised research facilities, the opportunity to implement automated, standardised storage from the outset bypasses the legacy system constraints found in established markets. Developing lower-cost, scalable, and more easily validated Medium Capacity systems designed for seamless LIMS integration represents a key avenue for market expansion beyond the top-tier biopharmaceutical sector.

Raw Material and Pricing Analysis

Automated Sample Storage Systems are complex electromechanical devices, classifying them as physical products. Their cost structure is dominated by high-value, specialised raw materials. Stainless steel is critical for both the internal structure of cryogenic freezers and the external robotic components, meaning its global pricing volatility significantly impacts manufacturer costs. Pricing fluctuations are also tied to the cost of specialised refrigeration components, including compressors and eco-friendly refrigerants required for ultra-low temperature (ULT) environments ($ -80^{\circ} \text{C}$ and liquid nitrogen $\text{LN}_2$ at $-196^{\circ} \text{C}$). The highest variable cost, however, stems from precision robotics and electromechanical components (e.g., linear actuators, shuttle mechanisms) necessary for automated sample retrieval and storage. The final price to the end-user reflects a high degree of non-recurring engineering (NRE) costs and the substantial expense of software validation, particularly for systems intended for Good Manufacturing Practice (GMP) or Good Laboratory Practice (GLP) environments, where validation can account for a significant portion of the total cost of ownership (TCO).

Supply Chain Analysis

The global supply chain for ASSS is characterised by a high degree of specialisation and geographical dependency. Core components, such as ULT-capable compressors and precision robotic arms, often originate from a limited number of specialised manufacturers in East Asia (e.g., Japan, South Korea) and Central Europe (e.g., Germany, Switzerland). Final assembly and integration, particularly for large, bespoke systems, typically occur in the US and Europe to be closer to key pharmaceutical and biobanking end-users, facilitating better installation and post-sales service. Logistical complexity is substantial, driven by the size and weight of cryogenic freezers and the need for Just-In-Time delivery of perishable components. The market relies heavily on a two-tier structure: OEMs (Original Equipment Manufacturers) providing the core automation and refrigeration technology, and a network of specialised systems integrators who customise the final installation and ensure seamless interface with the client's existing laboratory ecosystem. Any sustained disruption to global semiconductor and electronics manufacturing directly constrains the production capacity for the electronic control units and robotic components essential to all ASSS platforms.

Automated Sample Storage Systems Market Government Regulations

Key global regulations have fundamentally redefined the necessity of automated sample management by codifying the requirements for data integrity and sample traceability.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | FDA 21 CFR Part 11 (Electronic Records; Electronic Signatures) | This regulation mandates secure, computer-generated, time-stamped audit trails for electronic records, including those generated by ASSS. This requirement directly invalidates manual, paper-based tracking, thereby making automated systems an imperative for GMP/GLP compliance in the pharmaceutical and diagnostics sectors. |

European Union | EU GMP Annex 11 (Computerised Systems) | Analogous to 21 CFR Part 11, Annex 11 enforces stringent data integrity, security, and validation standards for computerized systems in pharmaceutical manufacturing. This necessitates automated sample storage platforms to operate with validated software and robust access controls, acting as a mandatory demand driver for fully compliant systems. |

Global | ISO 20387:2018 (Biobanking — Requirements for Quality and Competence) | While voluntary, this international standard defines best practices for biobanks, including the need for robust quality management systems and detailed traceability of samples. ASSS platforms are uniquely positioned to deliver this level of traceable automation and environmental control, promoting their adoption as the standard for certified biobanks globally. |

Automated Sample Storage Systems Market Segment Analysis

Fully Automated Systems (FAS) Segment Analysis

The Fully Automated Systems (FAS) segment, encompassing platforms capable of 'walk-away' storage, retrieval, and inventory management without human intervention, represents the most significant growth vector in the market. Demand is overwhelmingly propelled by the operational scaling imperatives of the Pharmaceutical & Biotechnology sector, specifically in areas requiring ultra-high throughput and maximum sample integrity. The shift toward personalised medicine and complex genetic screening programs has dramatically increased the number of individual aliquots managed per project. An HTS laboratory, for instance, requires the rapid and precise selection of thousands of compound vials daily. Manual retrieval in such a setting introduces unacceptable risks of error, frost accumulation, and prolonged sample exposure to ambient temperatures. The core demand driver for FAS is the minimisation of the coefficient of variation (CV) in assay results and the elimination of sample integrity breaches. FAS provides an electronically verifiable, closed-system environment where the temperature log and chain of custody are immutable, directly supporting the stringent validation requirements for IND (Investigational New Drug) submissions to regulatory bodies. This capability transforms the ASSS from a capital expense into a risk mitigation and regulatory compliance tool.

Pharmaceutical & Biotechnology End-User Segment Analysis

The Pharmaceutical & Biotechnology end-user segment is the anchor tenant of the ASSS market, characterised by significant R&D budgets and a non-negotiable requirement for regulatory compliance. Demand is intrinsically linked to the acceleration of pipeline development, particularly within the high-value sectors of cell, gene, and oligonucleotide therapies. These advanced therapeutic modalities rely on highly sensitive biological samples (e.g., patient-derived cells, viral vectors) that require storage at $-80^{\circ} \text{C}$ or $\text{LN}_2$ temperatures. The economic value of a single vial in a late-stage clinical trial is immense, making the consequences of sample loss catastrophic. Consequently, the industry prioritises systems that offer redundant cooling, real-time monitoring, and a high-resolution audit trail. The demand curve for this segment is also shaped by M&A activity and the subsequent need for biobank consolidation. When a large pharmaceutical company acquires a biotech firm, the physical relocation and integration of hundreds of thousands of legacy samples into a standardised, automated storage system becomes an immediate operational imperative to ensure the newly acquired IP is preserved and traceable under the parent company's compliance framework. This creates cyclical, high-value demand for new, large-capacity ASSS installations.

Automated Sample Storage Systems Market Geographical Analysis

The demand profile for Automated Sample Storage Systems exhibits distinct characteristics across major global regions, influenced by localised R&D spending, regulatory maturity, and the presence of mega-biobanks.

US Market Analysis (North America)

The US market, driven by the presence of the world's largest pharmaceutical companies and a substantial network of government-funded research institutions (e.g., NIH, CDC), represents the single largest source of capital expenditure for ASSS. The primary demand driver is the scale and velocity of clinical trials and the mandated adherence to FDA 21 CFR Part 11 and cGMP (current Good Manufacturing Practice). The market is also heavily influenced by large-scale, long-term national health initiatives, such as the All of Us Research Program, which necessitate massive, long-term, ultra-low-temperature automated biobanking infrastructure. This concentration of high-value, high-risk biological samples accelerates the adoption of FAS, particularly the Large Capacity category. Localised demand for systems is also rising in specialised fields like biodefense and pandemic preparedness, requiring automated, secure inventories of pathogen and antibody samples.

Brazil Market Analysis (South America)

Demand for ASSS in Brazil is nascent but gaining momentum, primarily confined to centralised government and state-level research institutes, and the limited but growing domestic pharmaceutical manufacturing base. The key local factor impacting demand is the creation of a few large, centralised human genetics and population biobanks, often linked to national health programs investigating locally prevalent diseases. The relatively higher cost of importing sophisticated electro-mechanical systems and a more fragmented distribution network often steer procurement towards Medium Capacity and Fully Automated Systems from a smaller range of trusted international vendors. Investment decisions are highly sensitive to government R&D funding cycles and foreign exchange fluctuations, creating a procurement landscape focused on proven reliability and lower operational costs rather than cutting-edge features.

Germany Market Analysis (Europe)

Germany is a European anchor market for ASSS, characterised by a highly regulated environment, a strong tradition in industrial automation, and the presence of major academic and governmental research centres (e.g., the Helmholtz Association). The demand is fundamentally driven by EU GMP Annexe 11 requirements and the imperative of maintaining the stringent quality standards of the domestic biotechnology sector. Local manufacturers benefit from an established supply chain for precision engineering and robotics. A unique local demand factor is the high prioritisation of standardisation and interoperability, compelling ASSS vendors to offer systems that integrate seamlessly with various existing vendor-agnostic LIMS platforms used across multi-site academic collaborations. The strong focus on energy efficiency in European regulations also creates demand for next-generation, environmentally friendlier ULT freezer technologies.

South Africa Market Analysis (Middle East & Africa)

The ASSS market in South Africa is concentrated in a few highly sophisticated research institutes and specialised diagnostic centres located primarily around Johannesburg and Cape Town. The critical demand driver is the need for secure long-term storage of infectious disease samples (e.g., HIV, Tuberculosis) and indigenous genetics cohorts with potential global significance. Procurement is challenging, often reliant on grant funding from international organisations (e.g., WHO, Gates Foundation, NIH), which sets the technical and regulatory specification. The local constraint is a historically volatile power supply, which mandates the procurement of systems with robust, liquid nitrogen-based backup power redundancy and enhanced remote monitoring capabilities to protect irreplaceable, temperature-sensitive samples from utility failures. This constraint elevates the technical specification and cost for reliable installation.

China Market Analysis (Asia-Pacific)

China represents the fastest-growing geographical market, fueled by massive, state-backed investment in biotechnology R&D and the rapid expansion of domestic pharmaceutical manufacturing. Demand for ASSS is explosive, driven by the country's unparalleled scale in population genetics research and the creation of mega-biobanks to support precision medicine initiatives. Unlike other markets, demand is often for ultra-Large Capacity, customised solutions to handle tens of millions of samples, positioning this region as a key revenue driver for FAS manufacturers. A local factor is the government's push for domestic manufacturing self-sufficiency, leading to intense competition from emerging local ASSS providers, forcing international vendors to establish local R&D centres and manufacturing/assembly facilities to remain competitive in large government tenders.

Automated Sample Storage Systems Market Competitive Environment and Analysis

The competitive landscape of the Automated Sample Storage Systems market is consolidated, dominated by a few large multinational corporations that leverage their established positions in broader laboratory equipment and automation. Competition centres on system throughput, thermal stability, software validation and LIMS integration capability, and global service footprints.

Azenta Life Sciences, Inc.

Azenta Life Sciences (formerly Brooks Automation’s Life Sciences segment) holds a dominant strategic position as a pure-play provider focused explicitly on sample management and genomics services. Its positioning centres on offering end-to-end solutions, combining automated storage hardware with specialised laboratory services, including sample processing and bio-logistics. The company’s core product line features the BioStore III and the newer BioArc Ultra automated systems, which are designed for ultra-low temperature storage (down to $-196^{\circ} \text{C}$). Azenta's strength lies in its profound expertise in sample integrity and cryo-preservation, directly appealing to biobanks and high-value cell/gene therapy manufacturers. The strategy is to move beyond hardware sales to providing managed services, integrating the hardware and software for a complete, validated solution that satisfies the complex compliance requirements of its pharmaceutical client base.

Thermo Fisher Scientific, Inc.

Thermo Fisher Scientific is strategically positioned as a comprehensive “full-stack” life science partner. Its ASSS offerings are part of a vast portfolio spanning consumables, instruments, and software (LIMS). This allows Thermo Fisher to offer highly integrated solutions, packaging automated storage (e.g., the ArcticStore series or custom automated systems) alongside complementary equipment such as high-content screening systems and mass spectrometers. Its competitive advantage is derived from its massive, entrenched global footprint and extensive regulatory affairs expertise. For major pharmaceutical clients, procuring ASSS from Thermo Fisher simplifies supply chain management and validation across multiple laboratory functions. The company leverages its scale to ensure its automation software interfaces seamlessly with its proprietary LIMS and other ecosystem products, simplifying the validation burden for end-users seeking FDA 21 CFR Part 11 compliance.

Hamilton Company

Hamilton Company's strategy focuses on precision and modularity, positioning itself as a technology leader in high-precision robotics and liquid handling, which naturally extends into sample storage. Its core ASSS products, the BiOS® and Verso® systems, are designed with a high degree of customisation and scalability, allowing clients to build automated storage that precisely matches their throughput and capacity requirements. Hamilton's strength is its open architecture and LIMS-agnostic approach, making its systems attractive to academic and research institutions that often operate with mixed vendor equipment. The company's press releases frequently highlight its ability to handle extremely high-capacity projects, such as its installations for mega-biobanks, reinforcing its reputation for reliability and engineering excellence in ultra-low temperature environments. Its vertical integration in manufacturing high-quality robotic components minimises its reliance on external robotics suppliers, providing a strategic advantage in quality control and component supply chain resilience.

Automated Sample Storage Systems Market Developments

Significant, verifiable developments in the Automated Sample Storage Systems market reinforce the industry's focus on capacity, efficiency, and integrated data management.

February 2024: Azenta Launches BioArc Ultra

Azenta Life Sciences launched the BioArc™ Ultra, an automated, eco-friendly ultracold storage system. This product launch development is critical as it addresses two key market demands simultaneously: automation for high-value samples and sustainability. The system is designed to provide high-density, ultra-low temperature (ULT) storage while minimising energy consumption and utilising environmentally friendlier refrigerants. This product introduction is a competitive response to the growing global pressure from academic institutions and pharmaceutical firms to reduce their carbon footprint, creating a new purchasing criterion that extends beyond traditional metrics like throughput and cost. This strategic launch positions energy efficiency as a key differentiator in the saturated ULT freezer segment.

Automated Sample Storage Systems Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1.678 billion |

| Total Market Size in 2030 | USD 3.002 billion |

| Forecast Unit | Billion |

| Growth Rate | 12.34% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, Capacity, Sample Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automated Sample Storage Systems Market Segmentation:

By Product Type

Manual Systems

Fully Automated Systems

Accessories & Consumables

By Capacity

Small Capacity

Medium Capacity

Large Capacity

By Sample Type

Biological Samples

Chemical Compounds

Environmental Samples

Others

By End-User

Pharmaceutical & Biotechnology

Academic & Research Institutions

Hospitals and Diagnostics Centres

CROs

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Italy

Others

Middle East & Africa

Saudi Arabia

UAE

Others

Asia Pacific

Japan

China

India

South Korea

Taiwan

Others