Report Overview

Blockchain Enabled Sustainability Reporting Highlights

Blockchain Enabled Sustainability Reporting Market Size:

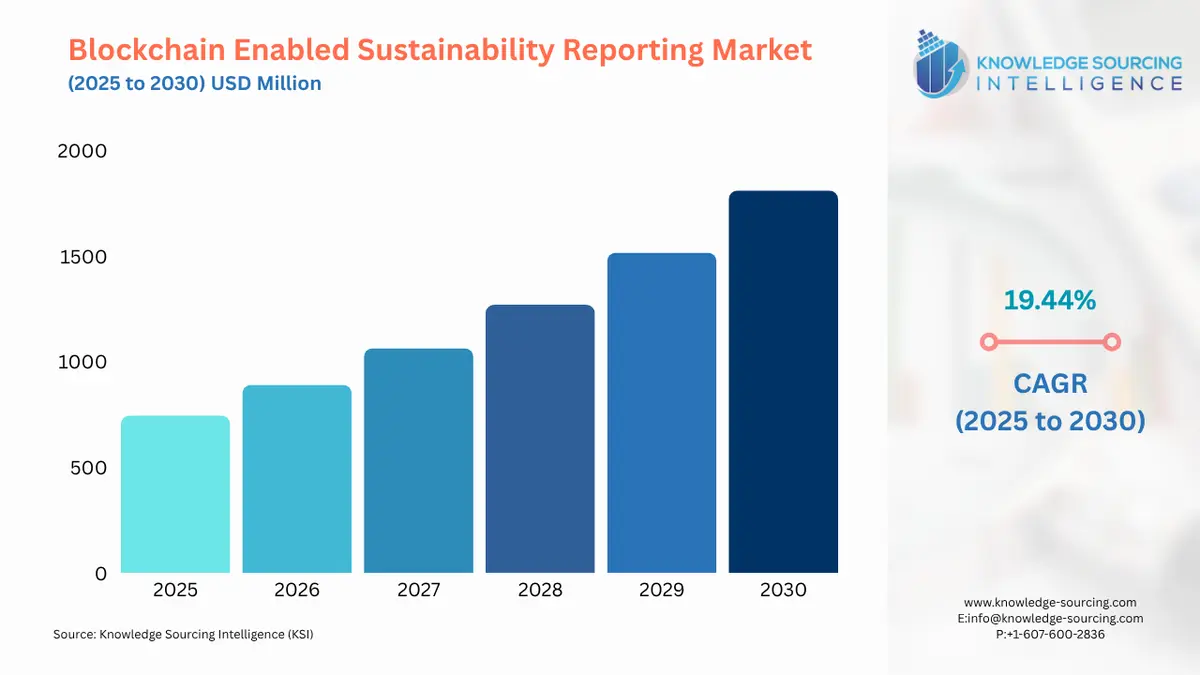

The Blockchain Enabled Sustainability Reporting Market is forecast to surge at a CAGR of 19.44%, reaching USD 1,811.151 million in 2030 from USD 745.127 million in 2025.

As the government and regulators are pushing increasing ESG transparency through regulations such as the EU’s CSRD, SEC’s proposed climate disclosures and others, there is increasing demand for technology to track, verify and report sustainability-related data in a tamper-proof and decentralized manner. This is driving companies to use blockchain to enable regulated, assured and real-time data. Also, with growing issues of greenwashing, the market is driving, as consumers, investors, and partners are increasingly demanding more transparent ESG reports. All these factors – regulatory push, increasing greenwashing, and demand from stakeholders for transparent ESG reports- the blockchain-enabled sustainability reporting market is growing.

The coming years are expected to witness increasing integration of IoT, AI and smart contracts with blockchain. In addition, the emergence of interoperable blockchain platforms will allow for industry-wide ESG consortia. Various ESG platforms are partnering with blockchain companies or acquiring startups to integrate traceable sustainability tools. However, lack of ESG data stanadrization, limited technical expertise, and cost concerns are major challenges for the market growth.

Blockchain Enabled Sustainability Reporting Market Overview & Scope:

The Blockchain Enabled Sustainability Reporting Market is segmented by:

- Component: The blockchain enabled sustainability reporting market comprises platforms that offer software solutions facilitating blockchain-based sustainability reporting, and services such as consulting, implementation, integration, and maintenance services to support the deployment and operation of blockchain solutions.

- Technology: public blockchain, private blockchain, and hybrid blockchain are three major types used.

- Application: The blockchain-enabled sustainability reporting market is segmented into carbon footprint management, supply chain transparency, renewable energy certificates, ESG compliance reporting, and waste management and circularity.

- End-Users: The blockchain-enabled sustainability reporting market is segmented into energy and power, agriculture, construction, retail and consumer goods, financial services, and other industries.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. North America holds a key share driven by SEC’s climate disclosure rules, and high corporate adoption of ESG practices, particularly in the U.S. Europe also holds a significant share, driven by stringent EU regulations like the Corporate Sustainability Reporting Directive (CSRD), encouraging blockchain adoption and government support.

Top Trends Shaping the Blockchain Enabled Sustainability Reporting Market:

- Convergence with AI and IoT for Real-Time ESG

The coming years will experience the increasing integration of AI and IoT sensors, transforming how companies track, analyse, and report sustainability data in real time.

For instance, IoT devices are getting installed in factories, trucks, farms and buildings to collect continuous data on carbon emissions, water and energy usage and others, helping blockchain to record all these ESG data to offer tamper-proof sustainability records and verifiable compliance data. - Tokenization of ESG Assets

There is an emerging trend of tokenization of ESG assets as blockchain enables the creation and trading of digitized carbon credits, biodiversity tokens, and water usage certificates.

Various platforms like Toucan Protocol and KlimaDAO are facilitating tokenization for the carbon market. For instance, Toucan Protocol provide infrastructure for tokenizing carbon credits as Base Carbon Tonnes and Nature Carbon Tonnes which are then traded within Toucan’s ecosystem and on major crypto trading platforms.

Blockchain Enabled Sustainability Reporting Market Growth Drivers vs. Challenges:

Drivers:

- Regulatory Mandates for Transparent ESG Reporting: One of the major factors driving the market is the growing regulatory pressure for more transparency in ESG disclosures. For instance, the EU’s CSRD mandates large and listed companies to disclose ESG data in a standardized verifiable format, effective from 2024. As blockchain helps in offering real-time, tamper-proof and auditable ESG data, there is growth in the blockchain-enabled sustainability reporting.

- Rising Green Washing and ESG Investment Demand: One other factor is greenwashing with ESG data cases by major companies. They often show high claims and do greenwashing of their reports. This poses a serious problem with the sustainability report, driving demand for more transparent and verifiable sustainability disclosures. Various stakeholders are demanding verifiable, traceable sustainability disclosures, and with growing investment in ESG assets, blockchain technology is growing, making it a preferred tool among stakeholders.

Challenges:

- Lack of Data Standarization across ESG Frameworks: The sustainability marks lack standardisation. There are no single global standards requiring companies to follow different mandates as per the country or region they are operating in. As blockchain platforms have to interoperate across these standards, it makes it difficult for one blockchain system to support multi-framework reporting without costly customization or middleware layers. Enterprises hesitate to adopt blockchain platforms as the underlying ESG data definitions are not harmonized, leading to fear of non-compliance.

Blockchain Enabled Sustainability Reporting Market Regional Analysis:

- Europe: Europe leads in the blockchain-enabled sustainability reporting market. As the region is a key region in the ESG and sustainability market, it directly drives the adoption of blockchain as well. The stronger push for transparent sustainability mandates through CSRD, EU Green Deal and SFDR, requiring clarity and comparability of sustainability disclosures in financial market participants' investment policies and products, and adoption of green technology, fuelled by robust green tech startups ecosystems, is giving a boost to the market. The region has high demand, particularly in supply chain traceability and carbon credit verification. In addition, the government support for digital innovation, such as European Blockchain Services Infrastructure blockchain pilot projects, propels the market.

- Germany: Germany is a major region under the EU, having a key share in this market. The market here is driven by industrial integration by Germany’s industrial giants such as Siemens, Bosch and others. They are also increasingly integrating AI and IoT sensors with blockchain technology for ESG reporting. Additionally, Germany’s Blockchain Strategy 2019 and emphasis on blockchain use in energy, environment, and Industry 4.0. is boosting the market growth. Germany’s Supply Chain Due Diligence Act (LkSG) also drives the adoption.

- France: The early adoption of mandatory climate-related financial disclosures through Article 173 of the Energy Transition Law, government support for blockchain technology for ESG reporting and adoption across various industries for ESG transparency, especially food export and luxury, is giving a boost to the market demand. Blockchains are increasingly being used for green bonds, carbon credit validation, and product-level sustainability tracking, fuelled by public-private pilot projects, and startups are driving the regional growth. For instance, France has invested in blockchain innovation through Bpifrance and La French Tech, supporting companies like EcoVadis working on ESG traceability, driving the market growth.

Blockchain Enabled Sustainability Reporting Market Competitive Landscape:

The market is currently fragmented with many players experimenting in niche areas. Some of the major players are IBM Corporation, Everledger, Kaleido, AirCarbon Exchange, Toucan Protocol, KlimaDAO, PwC, EY, TraceX Technologies and Regen Network.

- Collaboration:In May 2025, Verra announced a long-term collaboration with the Hedera foundation for development of digital tools to enhance the transparency, auditability, and integrity of methodologies and monitoring systems in the carbon markets. It will lead the Hedera Guardian to integrate directly with the Verra Project Hub.

- Product Innovation: In July 2024, Deloitte and Hedera Hashgraph partnered to introduce and ESI platform that leverages Hedera’s blockchain technology for ensuring the ESI platform to ensure data integrity and transparency in sustainability reporting.

Blockchain Enabled Sustainability Reporting Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 745.127 million |

| Total Market Size in 2031 | USD 1,811.151 million |

| Growth Rate | 19.44% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Technology, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Blockchain Enabled Sustainability Reporting Market Segmentation:

- By Component

- Platforms

- Services

- By Technology

- Public Blockchain

- Private Blockchain

- Hybrid Blockchain

- By Application

- Carbon Footprint Management

- Supply Chain Transparency:

- Renewable Energy Certificates (RECs

- ESG Compliance Reporting

- Waste Management and Circularity

- By End-User

- Energy and Power

- Agriculture

- Construction

- Retail and Consumer Goods

- Financial Services

- Others

- By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

- North America