Report Overview

Blood Warmer Market - Highlights

Blood Warmer Market Size:

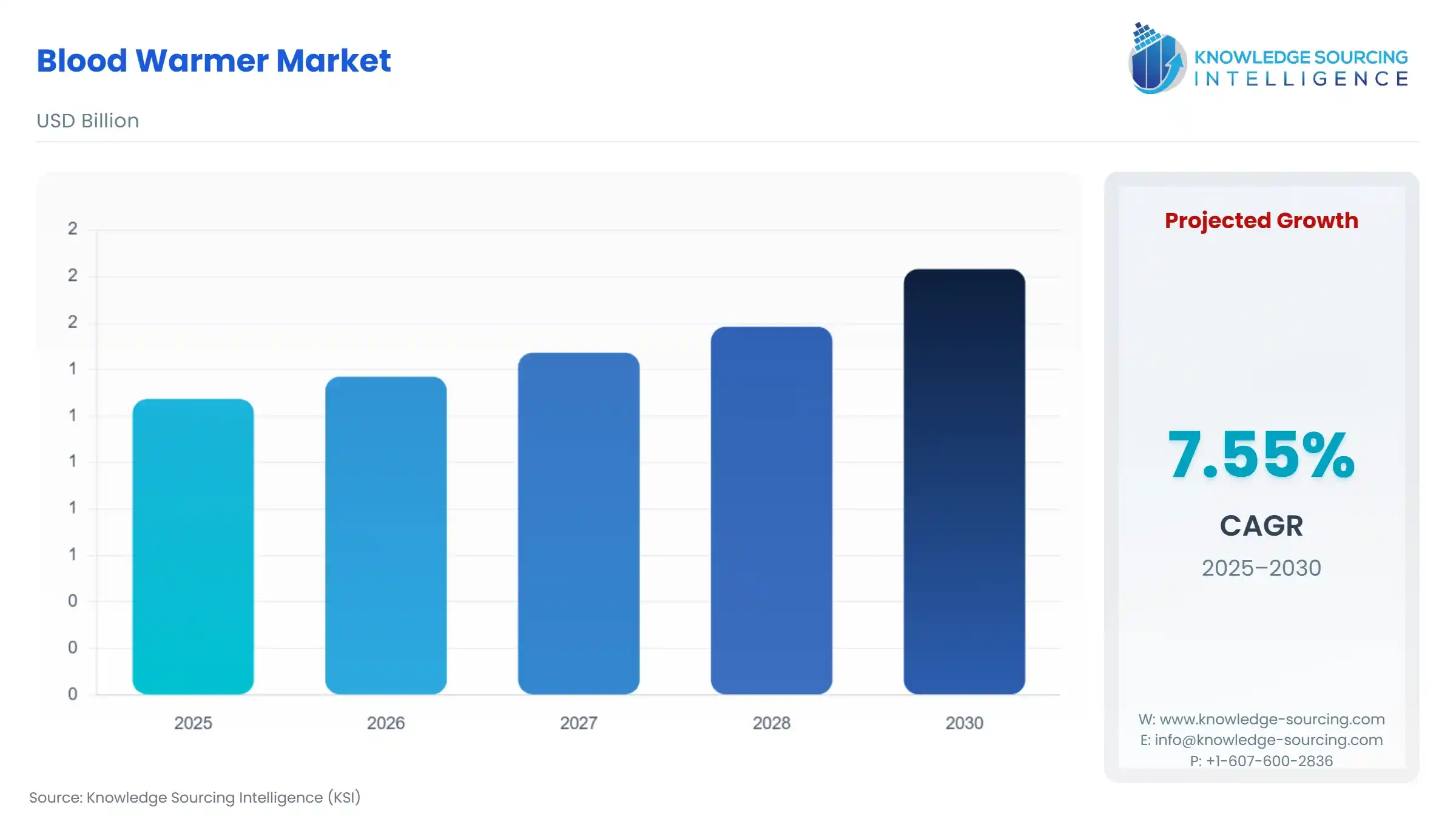

The blood warmer market, with a 7.33% CAGR, is expected to grow to USD 1.946 billion in 2031 from USD 1.273 billion in 2025.

Blood warmers are medical devices designed to raise the temperature of blood either during or before it is administered. The applications of blood warmers encompass various areas, including surgery, acute care settings, newborn care, home care, and other relevant medical scenarios. The blood warmer market size is significantly expanding owing to the growing surgical procedures, and ambulance services making them prominent drivers for market expansion.

Blood Warmer Market Drivers:

Emerging ambulance services bolsters the blood warmer market growth.

Blood warmers play a crucial role in ambulance services as they are used to maintain the temperature of donated blood during transport and administration. As ambulance services continue to grow, fuelled by increasing demand for emergency medical care coupled with government initiatives and aim to enhance the quality and efficiency of ambulance services. In March 2023, Crockett County (TN) Ambulance Service launched its first rural blood program, enabling on-site blood administration before hospital arrival. The initiative reflects the state’s dedication to innovative prehospital care, supported by robust quality control systems, and strategic partnerships with Master Medical Equipment and LIFELINE Blood Services, ensuring proper blood storage and utilization.

Increasing blood transfusion drives the blood warmer market expansion.

Blood warmers are utilized during blood transfusion procedures to maintain the temperature of the donated blood. Keeping the blood warm is essential to prevent hypothermia and associated complications in the recipient. The increasing demand for blood transfusions can be attributed to factors such as advancements in medical procedures, the growing implementation of effective donation programs, and the increasing number of voluntary donors. According to the Pan America Health Organization, in 2020, the Latin America and Caribbean region witnessed a significant supply of transfusion blood with a total of 8.2 million donations. Notably, 48% of these donations were contributed by voluntary donors, showcasing a 2% increase compared to the figures recorded in 2017.

Rise in surgical procedures growth drives blood warmer market growth.

Blood warmers are used in surgical procedures to prevent hypothermia and its associated complications and to maintain optimal body temperature during surgery which is crucial for patient safety and successful outcomes. Government investments have contributed to the growth of surgical procedures by improving healthcare infrastructure, providing funding for advanced surgical technologies, and implementing initiatives to enhance access to surgical services. For instance, the Victorian Government's COVID Catch-Up Plan, implemented in April 2022, aims to address deferred care and reduce waiting lists by increasing surgical capacity. With a $1.5 billion investment, the plan aims to facilitate over 240,000 public patient surgeries annually by 2024, surpassing pre-pandemic levels by more than 40,000 procedures per year.

Blood Warmer Market Geographical Outlook:

Asia-Pacific is expected to be the market leader.

The Asia-Pacific is expected to hold significant share of the blood warmer market due to the region's large population, coupled with increasing healthcare expenditure and the rising prevalence of chronic diseases, which has created a significant demand for blood warmers. For instance, according to the Ministry of Health and Family Welfare, in July 2021, the Cabinet approved the implementation of the "India Covid-19 Emergency Response and Health Systems Preparedness Package - Phase-II" with a budget of Rs. 23,123 crores. The initiative aims to effectively address the ongoing COVID-19 threat, enhance national health systems' preparedness, and strengthen preventive, detection, and response measures in India.

Blood Warmer Market Restraints:

High initial costs restrain the blood warmer market growth.

The development, manufacturing, and maintenance of blood warmers entail considerable expenses, which can create a significant barrier for healthcare facilities, especially those operating in resource-constrained settings or with limited budgets. The initial investment required to procure blood-warming equipment, including the costs associated with research and development, manufacturing processes, quality control, and ongoing maintenance, can be substantial. These financial constraints restrict the ability of healthcare facilities to invest in blood warmers, leading to a lower adoption rate and hindering the overall growth of the blood warmer market.

Blood Warmer Market Company Products:

Thermedx FluidSmart: Thermedx FluidSmart, developed by Stryker Corporation, is a comprehensive fluid management system designed for various applications such as irrigation, distention, fluid warming, and deficit measurements. With its user-friendly interface, the system provides step-by-step instructions displayed on the screen, ensuring effortless set-up. One of its notable features is the on-demand fluid warming capability, allowing users to warm fluids to a specified set temperature quickly and efficiently.

Astotherm Plus: Gentherm Medical offers the Astotherm Plus, a comprehensive blood and infusion warming system. This system allows users to select from multiple temperature options, including 39°C, 41°C, and 43°C, to meet specific warming requirements. Additionally, the Astotherm Plus offers an optional heat protection sleeve for enhanced safety during usage. With its advanced features and customizable settings, this system provides healthcare professionals with a reliable and flexible solution for efficiently warming blood and infusions, promoting optimal patient care and comfort.

3M Ranger blood and fluid warming system: 3M offers the Ranger blood and fluid warming system, featuring a compact yet powerful warming unit capable of handling flow rates ranging from KVO to 30,000 mL/hr. The system boasts an intuitive setup process, ensuring ease of use for healthcare professionals. Additionally, cleaning the system is quick and straightforward, requiring only one tool and a few minutes to complete.

List of Top Blood Warmer Companies:

Stryker Corporation

Gentherm Medical

Belmont Medical

3M

ICU Medical

Blood Warmer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Blood Warmer Market Size in 2025 | USD 1.273 billion |

Blood Warmer Market Size in 2030 | USD 1.832 billion |

Growth Rate | CAGR of 7.56% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Blood Warmer Market |

|

Customization Scope | Free report customization with purchase |

Blood Warmer Market Segmentation

By Product

Portable Blood/IV Warmers Device

Non-portable Blood/IV Warmers Device

By Application

Surgery

Acute Care

New Born Care

Homecare

Others

By End-User

Hospitals/Clinics

Ambulatory Services

Defense Forces

Rescue Forces

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others