Report Overview

Browser Isolation Market Size, Highlights

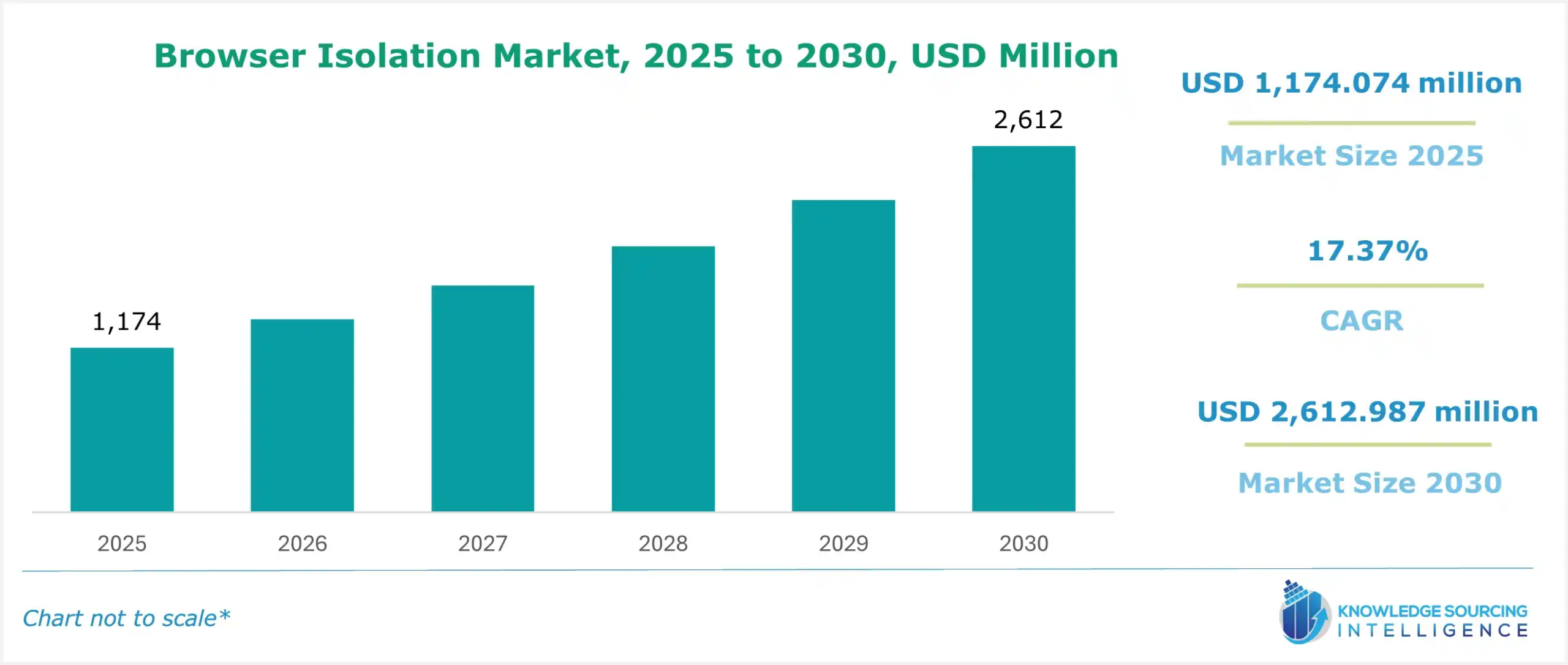

The browser isolation market is expected to grow at a CAGR of 17.37%, reaching a market size of US$2,612.987 million in 2030 from US$1,174.074 million in 2025.

Browser isolation stands as a cybersecurity approach designed to physically separate an internet user's browsing activity from their local networks and infrastructure. This method, such as employing a virtual machine or sandbox, segregates web browsing activities to shield computers from malware and cyber-attacks. The browser isolation industry has witnessed significant growth, propelled by escalating cyber threats and advancements in technology integration.

The stringent data privacy regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) compel organizations to enforce robust security measures for safeguarding user data. Additionally, the widespread adoption of cloud-based applications and services necessitates secure access methods. Browser isolation provides a secure and isolated environment for accessing cloud resources.

Moreover, the browser isolation market is poised for substantial growth in the forthcoming years, fueled by the shift towards remote and hybrid work models. The Bureau of Labor Statistics reports that full-time employees typically work 8.19 hours a week at their place of employment and 5.37 hours are spent working from home. Browser isolation technology enables organizations to securely grant access to web-based resources while mitigating the risks associated with unmanaged devices, thereby driving market expansion.

What are the Browser Isolation Market drivers?

- Growing cyber security threats are contributing to the browser isolation market expansion

With the escalating complexity and frequency of cyberattacks, organizations are compelled to prioritize data security. According to IBM, there has been a staggering 71% year-over-year increase in cyberattacks utilizing stolen compromised credentials. Ransomware incidents have also seen a notable rise, accounting for 17% of security incidents in 2023 compared to 21% in 2021. Additional cybersecurity statistics reveal an alarming rate of 2,200 cyberattacks occurring daily, equating to cyberattacks transpiring every 39 seconds on average. According to Cybersecurity Ventures, the projected cost of cyberattacks worldwide was estimated to reach 8 trillion USD in 2023, with expectations for this figure to escalate to 9.5 trillion USD in 2024.

Moreover, while digital tools have ushered in new opportunities to enhance health and well-being, they have simultaneously introduced new health security risks, such as cyber-attacks on healthcare systems and the proliferation of disinformation.

In response to these challenges, browser isolation emerges as a crucial solution. By segregating web browsing sessions from the user's device, browser isolation effectively thwarts malware, phishing attempts, and data breaches from compromising the underlying system. This heightened awareness of cyber threats catalyzes the widespread adoption of browser isolation solutions.

- Increasing the use of the cloud is anticipated to increase the market demand

Due to the increasing demand for strong cybersecurity solutions that can stop risks coming from web surfing activities, the cloud browser isolation market is expanding quickly. Browser isolation helps incorporate a per-user control room for web-browsing learners in a secure cloud-hosted environment, detaching the activities of user context from one's workstation. Thus, it lowers the chances of facing cyber threats like malware, phishing, data breaches, or damage to one's device because it disallows harmful content from getting to the user's device. Cloud browser isolation options are anticipated to achieve significant increases since, worldwide, companies are giving increasing priority to the protection of sensitive data, especially against the backdrop of increasing remote work and cloud adoption.

Browser Isolation Market is analyzed into the following segments

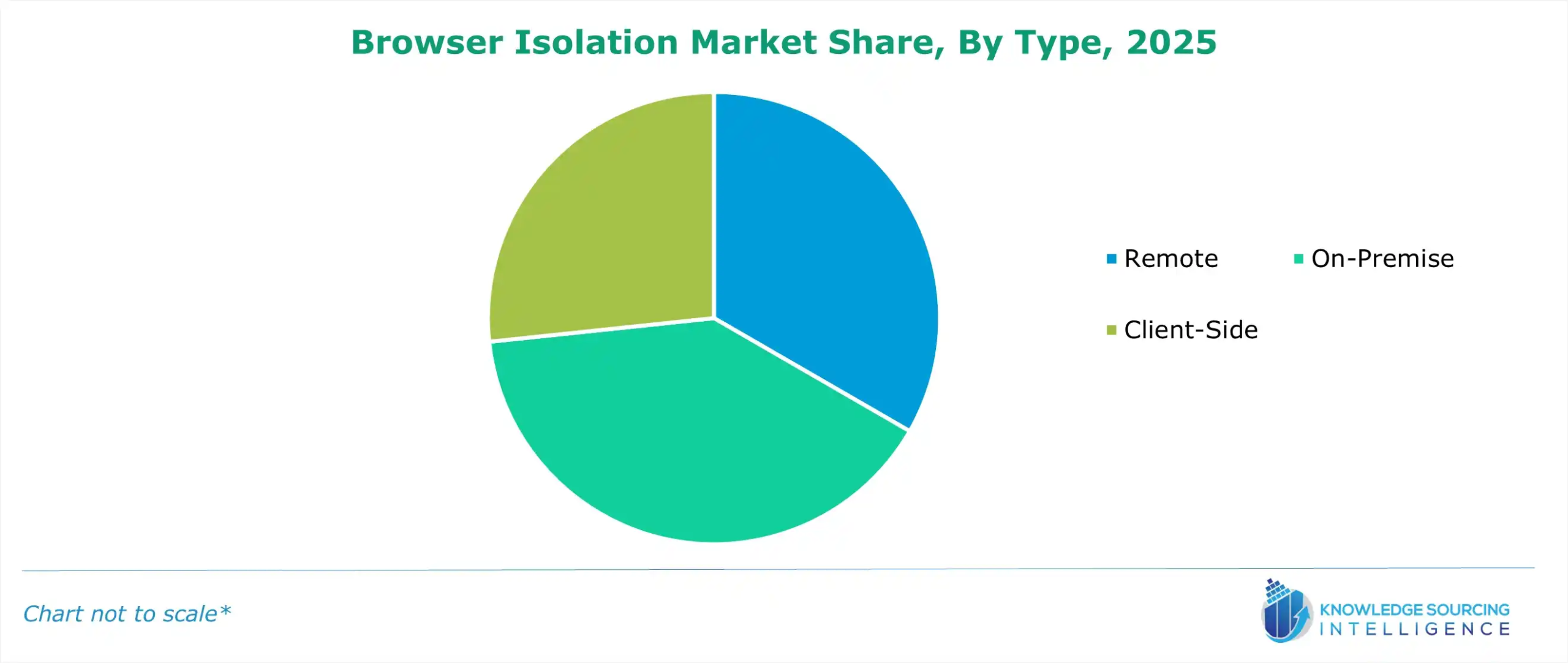

- By type, remote is anticipated to grow during the forecast period

By hosting users' web browsing sessions on a distant server rather than their endpoint device, remote browser isolation (RBI) is a web security technique that eliminates online danger and isolates web content from the user's devices to minimize its attack surface. Instead of the active content, the endpoint receives a pixel-based stream of a webpage or application. Malicious code that is concealed cannot influence the user's experience. To streamline their operations, businesses are embracing new technologies and cloud-based solutions as the digital landscape continues to evolve. Cybercriminals now have more avenues for their attack because of this digital change; thus, cybersecurity is a critical aspect of any digital strategy.

Moreover, RBI helps to isolate browser sessions stopping any possible attacks from reaching the target hosts, thus limiting their discovery and entry points into the organization, making it a host-analysis model. To prevent breaches of sensitive information and threats from unapproved access, governments have strict regulatory rules on cybersecurity. The RBI versions have session isolation and threat filtering through which they boast compliance. In the coming years, the stringency of the requirements is thought to be the driver of RBI solution demand.

Geographical outlook of the Browser Isolation Market:

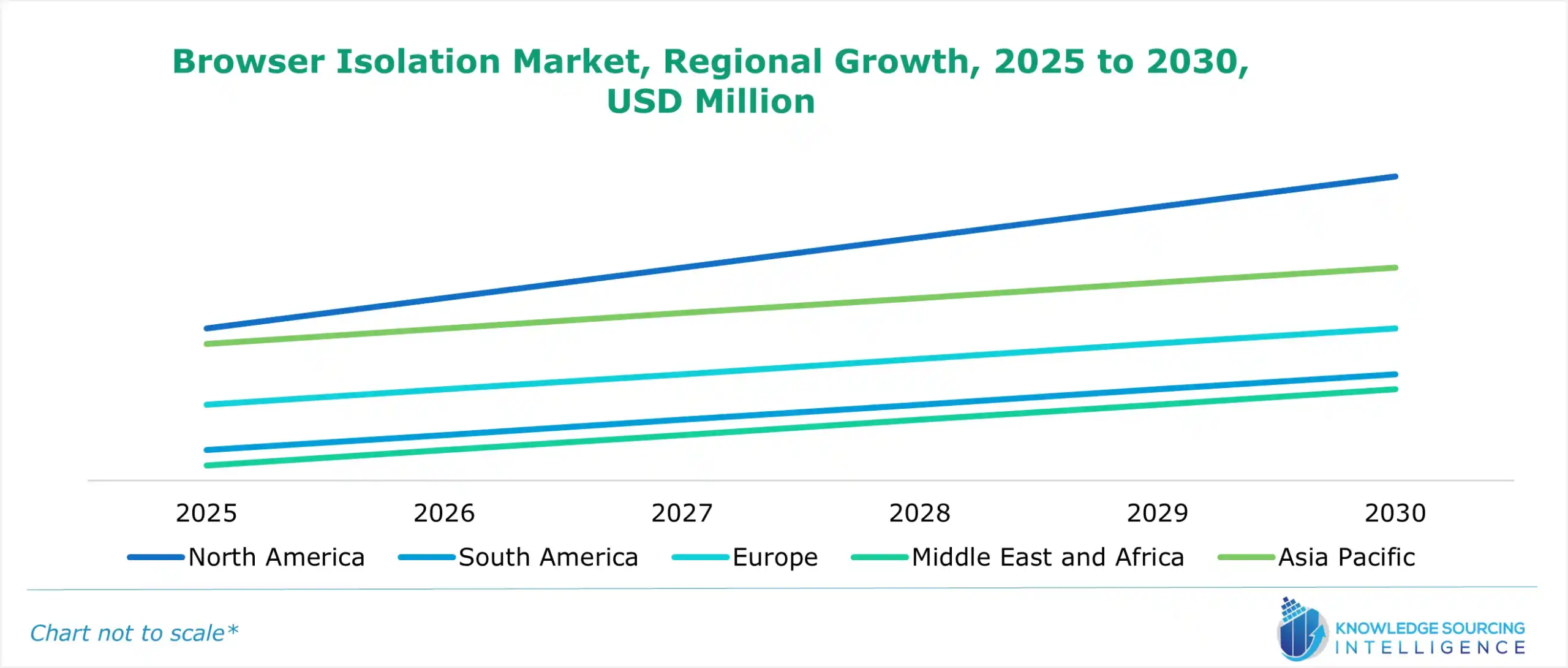

- North America is witnessing exponential growth during the forecast period.

The market is growing with new and robust technologies as the IT industry advances with new solutions and technologies, which is expected to propel the market for browser isolation software.

Further, due to the vast customer base and the accessibility of sensitive financial data, the industries are frequently experiencing data breaches and cyber-attacks. Moreover, there are growing threats to IT systems; specifically, people are becoming more proficient and willing to launch cyberattacks. In addition, the majority of cyberattack types have increased nationwide, and the expense of these attacks is rising as well. For instance, the Cybersecurity and Infrastructure Security Agency (CISA) and the Federal Bureau of Investigation (FBI) jointly released a report on threat actors' use of the Royal ransomware. Many critical infrastructure sectors, including but not limited to manufacturing, communications, healthcare and public healthcare (HPH), and education, have been the target of attacks.

Key launches in the Browser Isolation Market:

- In December 2024. Mandiant has discovered a brand-new way to use QR codes for command-and-control functions while avoiding browser isolation technologies. An increasingly used security technique is browser isolation, which redirects all local web browser requests through distant web browsers housed on virtual machines or cloud environments. Instead of using the local browser, the remote browser runs any scripts or content on the visited webpage. The local browser that performed the initial request then receives the rendered pixel stream of the page, which just shows the page's appearance and shields the local device from any harmful code.

Browser Isolation Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Browser Isolation Market Size in 2025 | US$1,174.074 million |

| Browser Isolation Market Size in 2030 | US$2,612.987 million |

| Growth Rate | CAGR of 17.37% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Browser Isolation Market | |

| Customization Scope | Free report customization with purchase |

The browser isolation market is segmented and analyzed as follows:

- By Type

- Remote

- On-Premise

- Client-Side

- By Enterprise Size

- Small

- Medium

- Large

- By Geography