Report Overview

China ALD Precursors Market Highlights

China ALD Precursors Market Size:

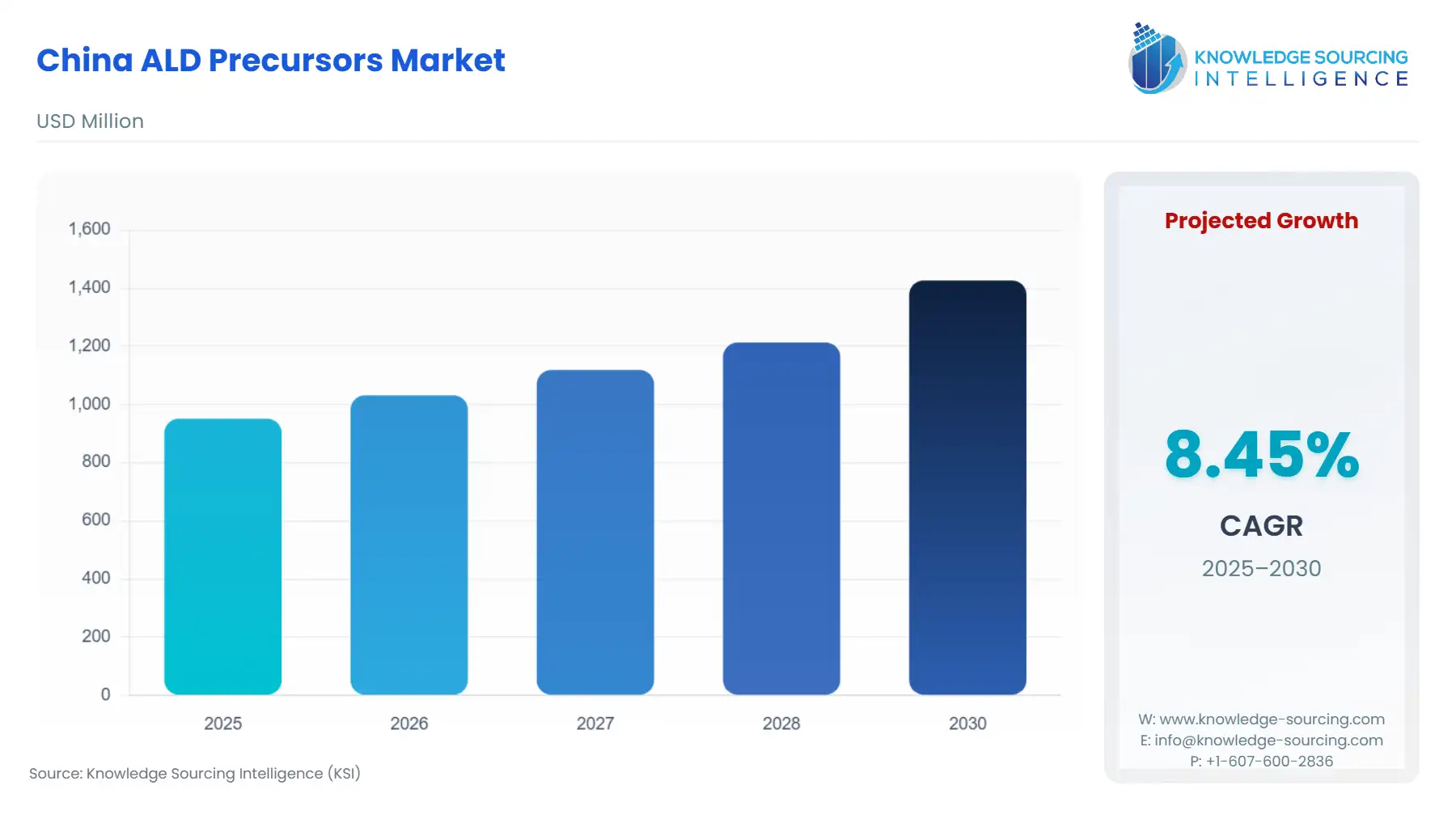

The China ALD Precursors Market is expected to grow at a CAGR of 8.45%, rising from USD 951.421 million in 2025 to USD 1427.131 million by 2030.

The Chinese Atomic Layer Deposition (ALD) Precursors market is at a critical inflection point, fundamentally shaped by the nation's strategic imperative to achieve self-sufficiency across the entire semiconductor value chain. ALD precursors—specialty chemicals used to deposit ultra-thin, highly conformal films in advanced chip manufacturing—are essential materials for nodes at 28 nm and below, enabling the high-k dielectrics and complex 3D structures required for modern logic and memory devices.

The increasing complexity of integrated circuit design, particularly the shift to vertical and gate-all-around architectures, mandates the use of highly specific, high-purity precursors to maintain device performance and yield. Consequently, the Chinese market is defined by a dichotomy: robust, government-fueled end-user demand from major domestic foundries on one side, and a concerted national effort to onshore the technically challenging material supply on the other. This dynamic positions the ALD precursors sector as a strategic, high-growth bottleneck within China's broader technology ambitions.

China ALD Precursors Market Analysis:

Growth Drivers

The relentless push by Chinese foundries to move to advanced process nodes, specifically for memory (NAND and DRAM) and advanced logic (e.g., 14 nm and 7 nm, acts as a primary catalyst for precursor demand. Miniaturization, which mandates the use of ALD over traditional Chemical Vapor Deposition (CVD) to achieve near-perfect film conformality and thickness control, directly increases the consumption rate of high-purity ALD chemistries. Furthermore, the rising adoption of Plasma-Enhanced ALD (PEALD) for its lower-temperature processing of sensitive films, such as tungsten and cobalt barriers, creates a specific demand for thermally stable, high-reactivity precursors optimized for plasma environments.

Challenges and Opportunities

The primary challenge stems from the oligopolistic nature of the global precursor supply, where a few multinational chemical companies control the intellectual property and complex manufacturing expertise for ultra-high-purity compounds. This creates a critical supply chain vulnerability for domestic Chinese fabs, limiting precursor availability and increasing material costs. The core opportunity, therefore, lies in domestic substitution. Government-directed investment funds actively support local manufacturers in the rigorous, multi-year process of developing, scaling, and qualifying proprietary precursor chemistries with domestic foundries. Success in this area directly translates to new, localized demand for indigenously developed precursors across the entire Chinese semiconductor ecosystem.

Raw Material and Pricing Analysis

ALD precursors are a class of physical products, primarily metal-organic compounds (e.g., hafnium, zirconium, aluminum, ruthenium) that require exceptional purity. Raw material pricing dynamics are dictated less by bulk commodity costs and more by the cost of purification and synthesis. The high-purity metal sources, such as HfCl4 or ZrCl4, must be refined to 99.9999% (6N) or higher purity to meet stringent semiconductor specifications. This specialized purification process represents a significant portion of the material cost, leading to high capital expenditure requirements for precursor manufacturers. Since key specialty ligands and high-purity metals are often sourced globally, the pricing of finished precursors remains highly sensitive to international supply logistics and the specialized, non-standardized nature of ultra-high-purity chemical synthesis.

Supply Chain Analysis

The supply chain for ALD precursors is global, concentrated, and highly rigid, necessitating complex logistical arrangements. Key production hubs for global players are primarily located in the United States, Europe, South Korea, and Japan, with China serving predominantly as a critical end-consumption and nascent production region. Logistical complexity arises from the toxic, volatile, or pyrophoric nature of many precursors, requiring specialized, often sub-atmospheric, stainless-steel canisters and advanced, traceable cold-chain logistics for transport. China is dependent on imports for the most advanced, commercially proven precursors, especially for cutting-edge logic and 3D NAND applications, creating a dependency that the domestic policy drive for self-sufficiency is specifically designed to mitigate.

Government Regulations

The Chinese government leverages industrial policy to fundamentally reshape the ALD precursor market by focusing on localization and technological leapfrogging.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| China (Central Government) | National Guideline for the Development and Promotion of the IC Industry (2014) and Subsequent Five-Year Plans / CICIIF ("Big Fund") | Provides substantial capital injections, tax exemptions (e.g., 10-year CIT exemptions for 28 nm and below IC production lines), and subsidized credit to domestic semiconductor manufacturers and material suppliers. This aggressively drives local capacity expansion, creating an immediate, guaranteed domestic demand base for qualifying ALD precursors from Chinese suppliers. |

| China (Ministry of Industry and Information Technology, MIIT) | Standards and Certification for High-Purity Chemical Materials | Implements stringent domestic standards for purity, packaging, and handling of semiconductor materials. This directly elevates the barrier to entry but simultaneously acts as a quality assurance mechanism, thereby forcing domestic precursor manufacturers to invest in advanced analytics and purification techniques necessary to meet foundry-level demand. |

| International (US Department of Commerce, BIS) | Export Control Regulations on Advanced Semiconductors and Manufacturing Equipment | While primarily targeting manufacturing equipment, the associated geopolitical tensions and export restrictions underscore the strategic importance of domestic material supply. This regulatory environment intensifies the demand for secure, non-trade-restricted indigenous ALD precursors to safeguard China's long-term technology roadmaps. |

China ALD Precursors Market Segment Analysis:

By Application: High-k Dielectric

The High-k Dielectric segment drives disproportionately high demand for ALD precursors, constituting a cornerstone of modern semiconductor technology. The historical shift from silicon dioxide (SiO2) to High-k materials like HfO2 (Hafnium Oxide) and ZrO2 (Zirconium Oxide) was an absolute requirement for managing gate leakage current and improving drive current in transistors at 45 nm nodes and smaller. For current advanced nodes (e.g., 14 nm and below), the deployment of FinFET architectures, and the subsequent move to Gate-All-Around (GAA) structures, makes ALD deposition of the high-k film over the complex 3D topography an imperative. Precursors such as Tetrakis (ethylmethylamino) hafnium (TEMAH) and Tetrakis (dimethylamino) zirconium (TDMAZ) are non-negotiable for these processes. Chinese foundries' commitment to catching up in advanced logic and their massive investments in 3D NAND fabrication—which uses high-k films in the peripheral circuitry and potentially in the memory cell itself—directly translates to an accelerating, high-volume demand curve for these specialized metal-based precursors.

By End-User: Electronics & Semiconductors

The Electronics & Semiconductors sector is the market's overwhelmingly dominant end-user, driven fundamentally by fabrication capacity and technology node migration. The need for ALD precursors is a direct function of the total silicon wafer start volume in the country's integrated circuit (IC) manufacturing plants. As China expands its 12-inch wafer capacity at an aggressive pace—supported by national policies designed to maximize chip output—the volumetric demand for all associated specialty chemical materials, including ALD precursors, surges. Furthermore, the increasing device complexity, particularly in memory (e.g., 200+ layer 3D NAND and DRAM scaling), drives higher consumption per wafer because advanced processes require more ALD steps for barrier layers, spacers, and encapsulation. The high-purity, consistent nature of ALD precursors is critical to achieving high yields in these multi-billion-dollar fabrication plants, directly linking capital expenditure in new fabs to sustained precursor demand.

China ALD Precursors Market Competitive Environment and Analysis:

The Chinese ALD Precursors market is characterized by a strong presence of multinational leaders in the high-end, advanced node segment and a growing cohort of domestic players aggressively scaling production in the mid-to-low-end and catching up in advanced chemistries. The competitive dynamic is heavily skewed by the aforementioned Chinese government's focus on material localization, creating a strategic advantage for domestic suppliers in securing long-term contracts with state-backed foundries. Global material suppliers compete primarily on proven, qualified technology at the leading-edge nodes, superior quality control, and global supply resilience, while domestic firms compete on lower price points, logistical proximity, and policy preference.

Air Liquide

Air Liquide, a world leader in industrial gases and services, strategically positions itself as a premier supplier of ultra-high-purity electronic materials through its Electronics business line. The company's strategic focus is on delivering materials that enable next-generation semiconductor manufacturing technologies. Its ALD precursor portfolio is anchored by the ALOHA™ and Voltaix™ product lines, which include a wide array of specialized deposition precursors for high-k dielectrics, metals, and barrier films. Air Liquide reinforces its position by collaborating closely with semiconductor customers and Original Equipment Manufacturers (OEMs) for new material development, ensuring its chemistries are qualified for the latest process equipment and nodes in China and globally. The company also offers the enScribe™ line of advanced etching materials, creating a synergistic offering for ALD/ALE processes.

Entegris, Inc.

Entegris operates as a comprehensive specialty materials and contamination control solutions provider. Its strategic positioning in the ALD precursor market focuses on delivering high-purity and consistent chemistries while simultaneously providing the crucial delivery systems and contamination control solutions that ensure material integrity at the point of use. Entegris' portfolio includes a range of Advanced Deposition Materials (ADM) ALD/CVD Precursors and Upstream ALD/CVD Precursors, encompassing metal-ligand complexes for various ALD and CVD applications. A key product differentiator is the ProE-Vap® Delivery System, which specifically addresses the technical challenge of consistently delivering solid precursors with low vapor pressure into the ALD chamber, a critical capability for advanced memory and logic production. This integrated materials-plus-delivery strategy strengthens its competitive position by mitigating critical process risks for Chinese fabs.

Merck KGaA

Merck KGaA, through its Electronics business, is a significant global player providing a comprehensive suite of specialty chemicals and materials for the semiconductor industry. The company utilizes a broad portfolio of deposition precursors under its material science and engineering segment. Its strategy centers on providing high-purity, dependable thin film deposition precursors for advanced applications, including microelectronics, photovoltaics, and optics. Merck's precursor offering covers various metal halides, metal alkyls, and metal Diketonates with purities often reaching 99.9999%. The company leverages its global R&D network and analytical capabilities, particularly through its Sigma-Aldrich brand's offerings, to support material development and customization, positioning it to capture demand for specialized research and high-volume manufacturing precursors in the Chinese market.

China ALD Precursors Market Recent Developments:

- October 2025: Air Liquide's ALIAD Investment in Yuangui Materials Air Liquide's venture fund, ALIAD, completed an investment in Shanghai Yuangui Material Technology Co., Ltd. (Yuangui Materials), a Chinese specialist in CVD/ALD precursors. This strategic minority investment aims to support the development and rapid scaling of Yuangui's high-purity precursors for advanced semiconductor nodes (down to 3nm), strengthening Air Liquide's presence and service capabilities in the vital Chinese electronics market.

China ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 951.421 million |

| Total Market Size in 2031 | USD 1427.131 million |

| Growth Rate | 8.45% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

China ALD Precursors Market Segmentation:

- BY APPLICATION

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- BY TECHNOLOGY

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- BY END-USER

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others