Report Overview

Data Masking Market Size, Highlights

Data Masking Market Size:

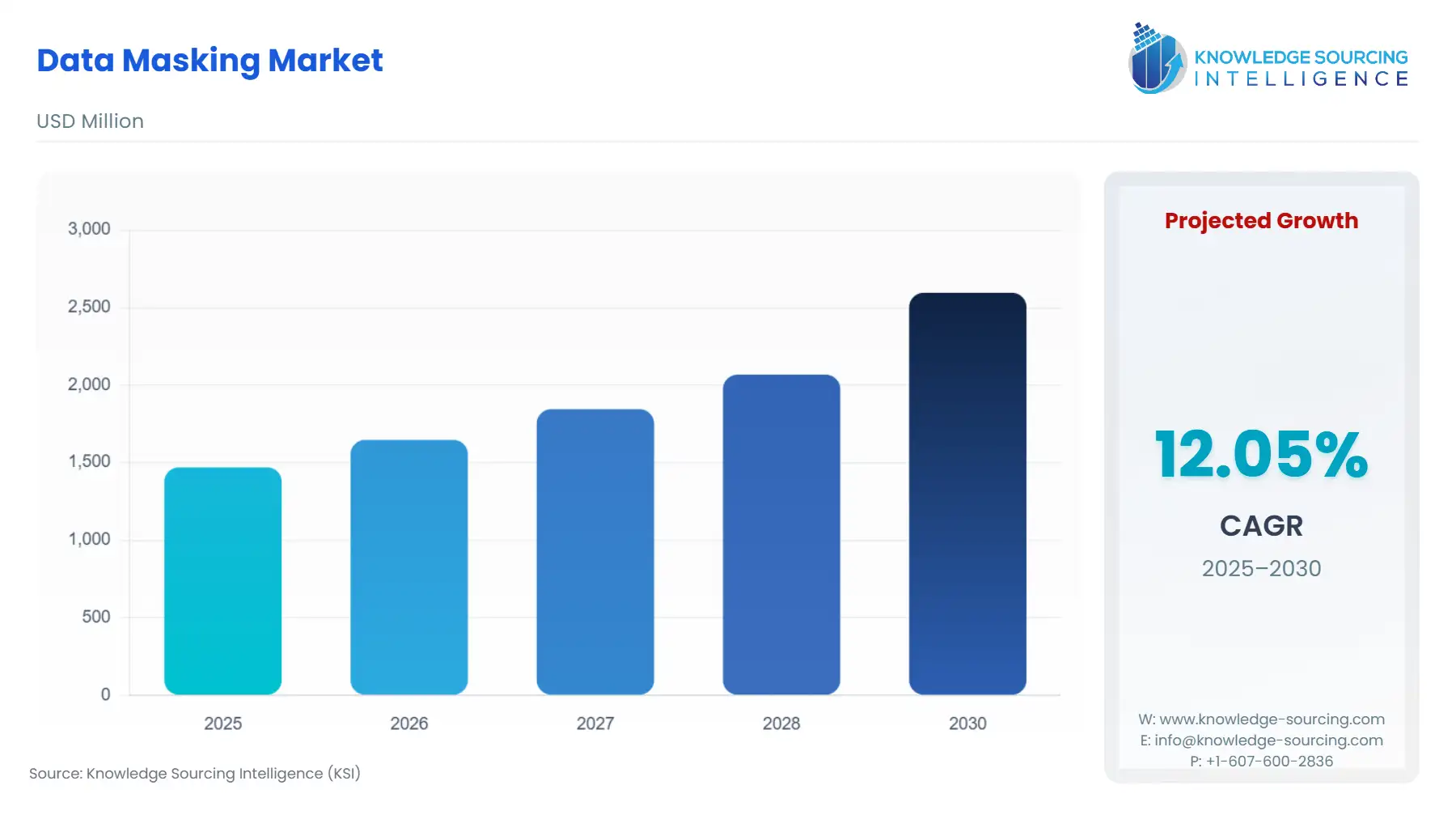

The data masking market is forecasted to achieve a 12.04% CAGR, reaching USD 2.596 billion by 2030 from USD 1.470 billion in 2025.

The Data Masking Market occupies a unique position at the intersection of regulatory compliance and data-driven innovation, serving as a critical control point for risk management within the modern enterprise. As organizations leverage massive, distributed datasets for application development, cloud migration, and advanced analytics, the inherent risk of exposing sensitive information, from customer credit card numbers to employee health records, escalates commensurately. Data Masking solutions, spanning Static and Dynamic methods, Tokenization, and Redaction, provide an auditable methodology to secure this sensitive data by replacing it with realistic, non-retraceable equivalents. This capability is no longer optional; it is a fundamental architectural requirement mandated by evolving government regulations and the existential need to prevent devastating, litigation-inducing data breaches.

Data Masking Market Analysis

- Growth Drivers

Market expansion is fundamentally propelled by the Regulatory Imperative, where data privacy laws like GDPR and CCPA explicitly allow consumers to sue if their unencrypted or unredacted information is breached, directly driving demand for data obfuscation as a liability shield. This is reinforced by the Innovation Mandate, particularly the explosion of AI/ML development. These models require massive volumes of production-grade data for effective training, compelling Information Technology (IT) and Operations teams to adopt Static Data Masking to create functionally accurate yet secure sandboxes, allowing development and testing to proceed without violating privacy laws.

- Challenges and Opportunities

A critical challenge facing the market is the technical complexity of maintaining Referential Integrity across highly normalized, distributed databases following masking, which can render masked data unusable for testing. This complexity is amplified by heterogeneous Hybrid and Multi-cloud deployments. The main opportunity lies in the rapid adoption of Dynamic Data Masking (DDM), which solves the referential integrity problem in non-production environments and secures data in high-throughput production systems, such as call centers, without creating physical copies. Furthermore, the complexity fuels demand for high-margin Managed Services to handle initial implementation, data discovery, and ongoing policy management.

- Supply Chain Analysis

The supply chain in the Data Masking Market is largely intangible, centered on the flow of intellectual property and highly specialized talent. The market's stability depends heavily on the pool of software architects and data security engineers proficient in developing and deploying complex algorithms for Tokenization, shuffling, and format-preserving encryption. This talent pool is heavily concentrated in North America (USA, Canada) and the Asia Pacific (India). A secondary dependency is the integration of Solution components with underlying core databases (e.g., Oracle, SQL Server, Snowflake), where vendors must maintain strong, reliable technical partnerships and compatibility to ensure their masking functionality operates efficiently across diverse client platforms.

Data Masking Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

General Data Protection Regulation (GDPR) |

Mandatory De-identification: GDPR mandates data minimization and advocates for de-identification/anonymization techniques to protect Personal Data. This creates a non-negotiable demand for Static Data Masking (SDM) to secure non-production datasets and Dynamic Data Masking (DDM) to enforce role-based access in operations, mitigating severe financial penalties. |

|

United States |

California Consumer Privacy Act (CCPA) |

Litigation Mitigation: CCPA specifically allows consumers to sue if their nonencrypted or nonredacted PII is breached. This regulation translates directly into demand for audited masking methods (Redaction, Tokenization) to eliminate the unredacted data liability, making data masking a crucial legal requirement, especially in the Retail and Information Technology sectors. |

|

Brazil |

General Data Protection Law (LGPD) |

Increased Auditing: The LGPD establishes comprehensive data protection standards for handling Brazilian residents' data, closely mirroring GDPR. This compels local BFSI and Telecommunications firms to adopt auditable Solution platforms to demonstrate compliance and accountability for all stages of data processing, driving demand for Professional Services for policy governance. |

Data Masking Market Segment Analysis

- By Type: Dynamic Data Masking (DDM)

Dynamic Data Masking (DDM) represents the fastest-growing segment by technology, driven by the critical need to secure sensitive data within live Production Environments without physically altering the original data. Unlike SDM, DDM applies masking policies in real-time, at the moment of access, based strictly on the user's role or privilege. For instance, in BFSI customer support centers, a representative can view a customer's account details for transaction purposes but will only see the masked version of their full credit card number (e.g., **** **** **** 1234). This capability is essential for compliance with regulations like PCI DSS and HIPAA, where only the minimally necessary data must be exposed to an authorized user. The low implementation disruption—as DDM operates without requiring changes to underlying application code—makes it the preferred solution for rapidly deployed Cloud and Hybrid architectures, accelerating its adoption among large-scale Operations teams.

- By End-User Industry: Banking, Financial Services, and Insurance (BFSI)

The BFSI segment is the highest-value consumer of Data Masking solutions, driven by an unparalleled combination of regulatory scrutiny, high-value sensitive data, and constant application development velocity. The sector handles massive volumes of PII, financial transaction records, and cardholder data, making it subject to stringent global regulations (GDPR, LGPD) and industry standards (PCI DSS). This requires the consistent application of Tokenization and Deterministic Static Data Masking to ensure masked test data maintains referential consistency across complex core banking systems for tasks like anti-money laundering (AML) model training. The rapid pace of digital transformation and mobile banking application development necessitates continuous deployment and testing. Therefore, BFSI organizations demand high-performance, On-premise and Hybrid masking solutions that integrate directly with enterprise-grade databases, facilitating secure, agile release cycles.

Data Masking Market Geographical Analysis

- US Market Analysis

The US market for Data Masking is characterized by a fragmented, compliance-driven landscape, with federal, state, and sector-specific laws driving demand. State-level regulations like the CCPA (California) and the burgeoning momentum for similar laws across other states create a patchwork of PII protection requirements, forcing large Retail and IT & Telecommunication companies to adopt versatile masking platforms. Furthermore, the healthcare sector's strict adherence to HIPAA mandates the de-identification of Protected Health Information (PHI), ensuring a constant demand for Professional Services and specialized SDM for research and analytics in government and private Healthcare entities.

- Brazil Market Analysis

The Brazilian market is primarily shaped by the LGPD, which has rapidly increased the need for corporate data governance and accountability. This has catalyzed the adoption of data masking among major BFSI institutions and Telecommunications providers who handle vast consumer datasets. Due to a preference for controlling core data, the market exhibits strong demand for robust, On-premise and Hybrid masking solutions, supported by local Services firms who can tailor masking rules to meet the specific requirements of the LGPD's accountability principles and data security mandates.

- Germany Market Analysis

The German Data Masking Market is highly influenced by the stringent enforcement posture of the GDPR by EU supervisory authorities. This creates a zero-tolerance environment for non-compliance, driving demand for auditable and irreversible masking techniques, such as Tokenization and SDM, particularly within the highly regulated Finance and Manufacturing sectors. Organizations prioritize masking solutions that offer detailed audit trails and transparent reporting to demonstrate full adherence to the strict requirements for data minimization and privacy-by-design, with a noticeable uptake in solutions deployed via secure, sovereign cloud models.

- Saudi Arabia Market Analysis

The growth catalyst in Saudi Arabia is the government-led digital transformation agenda, coupled with emerging local data sovereignty and privacy frameworks. Major state-backed entities in Government and Defence and Energy and Utilities are the key adopters, requiring masking to secure citizen and proprietary data during large-scale system modernization and migration projects. The market favors comprehensive, enterprise-grade Solution packages and intensive Professional Services from major international vendors to establish best-in-class data security governance frameworks from the inception of new cloud environments.

- China Market Analysis

China's market is overwhelmingly dictated by the Personal Information Protection Law (PIPL) and government-mandated data localization requirements, which impose severe restrictions on the collection and transfer of personal information. This regulatory environment forces domestic and multinational Telecommunications and Information Technology firms to deploy robust, local SDM solutions to secure test and development environments while strictly controlling cross-border data flows. The large volume of data used in development and the need for consistent policy application across numerous regional datasets drives demand for highly scalable, centrally managed masking platforms.

Data Masking Market Competitive Environment and Analysis

The Data Masking Market is highly competitive, consisting of major enterprise software vendors and specialized pure-play data security providers. The competitive edge is determined by the completeness of the Solution portfolio (covering SDM, DDM, and Tokenization), the ability to support diverse data environments (multi-cloud, mainframes, NoSQL), and integration with existing data governance and data catalog tools. Strategic positioning is shifting toward embedding masking capabilities directly into broader data management platforms to offer customers a unified data security layer.

- IBM

IBM strategically positions its data masking capabilities, primarily within its Data Privacy and Security portfolios, to cater to large enterprises with complex, heterogeneous data environments, including mainframes and various cloud deployments. Its strategic focus in 2024-2025 has been on expanding its expertise and services around core enterprise applications. For example, the acquisition of consulting firms specializing in Oracle cloud applications, such as Applications Software Technology LLC in 2025, directly enhances IBM's ability to implement and manage sophisticated data masking policies in the critical BFSI and Government sectors that rely heavily on these core systems.

- Oracle

Oracle holds a foundational competitive advantage by integrating its Dynamic Data Masking (DDM) and Redaction capabilities directly into its database products (e.g., Oracle Database, Oracle Exadata). This eliminates integration complexity and ensures high performance for customers utilizing the Oracle ecosystem, predominantly in the BFSI and Telecommunications sectors. Its strategic development focuses on extending these security features to the cloud layer and partnering to integrate with cutting-edge technologies, as seen by its 2025 collaboration with IBM to advance Agentic AI on its cloud infrastructure, where securing the underlying AI training data with masking is a prerequisite.

- Informatica

Informatica maintains a significant position by offering masking capabilities as a core component of its broader Intelligent Data Management Cloud (IDMC) platform. This strategy targets customers seeking an end-to-end data governance and compliance solution, encompassing data discovery, data classification, and automated masking policy enforcement. Its strength lies in providing consistent, high-fidelity Deterministic Static Data Masking across large, complex, and distributed enterprise data landscapes, making it a preferred vendor for Information Technology and Retail companies managing multi-terabyte test environments across various vendors.

Data Masking Market Developments

- May 2025: IBM and Oracle announced an expanded partnership focusing on bringing IBM watsonx AI to Oracle Cloud Infrastructure (OCI). This strategic development underscores the critical need for robust data security solutions, like masking, to secure the enterprise-grade data required for training and deployment of multi-agentic AI applications.

- January 2025: IBM announced its intent to acquire Applications Software Technology LLC, a global Oracle consultancy. This merger and acquisition activity strengthens IBM Consulting’s ability to deliver secure cloud transformation services and integrate data masking and security solutions into core Oracle Cloud Applications for public sector and large enterprise clients.

Data Masking Market Segmentation

BY TYPE

- Static Data Masking (SDM)

- Dynamic Data Masking (DDM)

- Tokenization

- Redaction

BY BUSINESS FUNCTION

- Finance

- Operations

- Marketing and Sales

- Human Resources

- Legal

- Information Technology (IT)

- Customer Support

- Other

BY COMPONENT

- Solution

- Services

- Professional Services

- Managed Services

BY DEPLOYMENT MODEL

- On-premise

- Cloud

- Hybrid

BY ENTEPRISE SIZE

- Micro

- Small

- Medium

- Large

BY END-USER INDUSTRY

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Telecommunications

- Information Technology

- Government and Defence

- Media and Entertainment

- Healthcare

- Manufacturing

- Energy and Utilities

- Education

- Others

BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others