Report Overview

Demineralized Bone Matrix Market Highlights

Demineralized Bone Matrix Market Size:

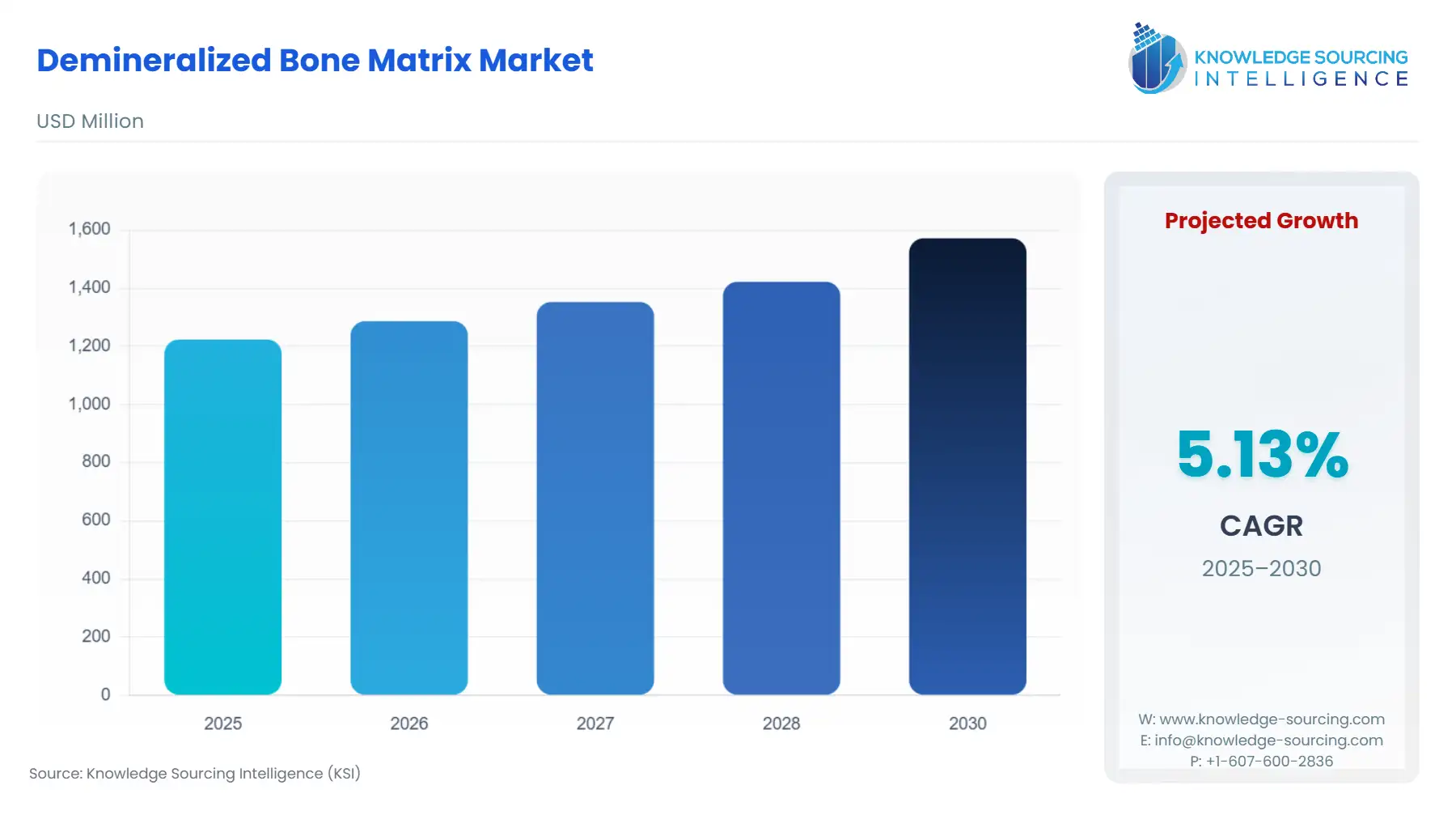

Demineralized Bone Matrix Market is forecasted to grow at a 4.98% CAGR, increasing from USD 1.224 billion in 2025 to USD 1.638 billion in 2031.

Demineralized Bone Matrix Market Trends:

The use of DBM in the spine has been studied in preclinical settings with encouraging outcomes. Clinical research on the impact of DBM on spinal fusion is sparse. For instance, in one research, firmly instrumented circumferential fusions using titanium mesh cages, coralline hydroxyapatite, and DBM were successful in achieving anterior interbody fusion of the lumbar spine.

Demineralized Bone Matrix Market Growth Drivers:

Opportunities for the demineralized bone matrix market to increase

The demineralized bone matrix industry is anticipated to grow quickly due to developments in grafting techniques and an increase in aesthetic surgery. Athletes and the younger generation's increased need for surgical treatments and soft tissue allografts will surely propel this industry ahead.

Growing geriatric population

The key reason driving the expansion of the demineralized bone matrix market is the ageing population, which is more prone to fractures and bone degradation. Globally, the number of older individuals is rising quickly. By 2050, the Globe Health Organisation (WHO) projects that there will be 2.1 billion individuals in the globe who are 60 years of age or older. Age increases a person's risk of bone deterioration and fractures, and older people are more likely to have these disorders. Demineralized bone matrix is projected to see increased demand due to the ageing population's increased prevalence of these diseases, which will propel demineralized bone matrix market growth.

Rising prevalence of bone-related disorders

The demineralized bone matrix industry is expected to expand due in large part to the rising frequency of bone-related diseases and injuries as well as the rising number of dental treatments including bone grafting and dental implant surgeries for a variety of tooth ailments. The expansion of the demineralized bone matrix market is attributed to the increasing use and desire for minimally invasive operations. The advantages of minimally invasive surgery include reduced discomfort, fewer problems, and a quicker recovery. Minimally invasive methods employ demineralized bone matrix.

Enhancement in Technology

The recent expansion of the sector has been significantly attributed to technological developments including the development of biomimetic and implantable microcarriers that use a demineralized bone matrix and maintain the crucial biochemical composition, architecture, and surface topography of genuine bone tissue. In addition to improvements in materials, designs and allografting methods, which are employed in several difficult procedures, are regarded as a major development. The high cost of the demineralized bone matrix is a demineralized bone matrix market growth barrier which is being tackled by introducing cheaper alternatives.

Growing popularity in dental application

The dental application is anticipated to expand throughout the projected period. The increased growth rate is attributed to the dental surgeon's predilection for demineralized bone matrix materials during dental procedures. Furthermore, it is anticipated that this demineralized bone matrix market would expand quickly due to the rising number of training sessions for dental professionals offered by reputable organisations to increase awareness of DBM. Additionally, the availability of dentists with advanced training would support the demineralized bone matrix market growth.

High procedural volume at hospitals

The hospitals are anticipated to dominate the demineralized bone matrix market due to the greater number of bone graft treatments performed in hospitals for orthopaedic and dental procedures,. Hospitals in wealthy and developing nations both grant suitable reimbursement schemes. Additionally, hospitals are furnished with cutting-edge surgical tools and equipment. Since more patients are choosing hospitals for bone transplant surgeries, the hospital sector is predicted to grow. The demineralized bone matrix industry is also expected to experience astounding growth due to the rising availability of many medical services in hospitals throughout established and developing nations.

Demineralized Bone Matrix Market Geographical Outlook:

The market for demineralized bone matrices in North America is anticipated to expand quickly.

Demineralized bone matrix sales in North America are anticipated to lead the global demineralized bone matrix market, and it is most probable that this trend will continue during the forecast period. The demineralized bone matrix market growth in the North American region is primarily driven by elements like the presence of sophisticated healthcare infrastructure and technological capabilities, the rising prevalence of bone-related disorders and orthopaedic surgeries, and favourable reimbursement policies for bone grafting procedures.

Asia Pacific is anticipated to hold the second-largest market share

Over the projected period, the Asia Pacific demineralized bone matrix market is predicted to develop the quickest. The Asia Pacific region is expected to see the fastest rate of growth after North America over the projected period due to reasons like its dense population, emerging economies, and rising demand for cutting-edge treatment alternatives. Additionally, the industry has grown as a result of advantageous government policies, including China's healthcare reform and the Indian government's permission for 100% foreign direct investment in the medical devices sector. These two nations are anticipated to drive the expansion of the regional demineralized bone matrix market.

Demineralized Bone Matrix Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Demineralized Bone Matrix Market Size in 2025 | USD 1.224 billion |

Demineralized Bone Matrix Market Size in 2030 | USD 1.572 billion |

Growth Rate | CAGR of 5.13% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Demineralized Bone Matrix Market |

|

Customization Scope | Free report customization with purchase |

Demineralized Bone Matrix Market Segmentation

By Product

Gel

Putty

Paste

Graft

Others

By Material

Human DBM

Animal DBM

Synthetic DBM

By Application

Spinal Fusion

Dental / Maxillofacial Surgery

Trauma Surgery

Joint Reconstruction

Others

By End-User

Hospitals

Orthopedic Clinics

Ambulatory Surgical Centers

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Others