Report Overview

France AI in Military Highlights

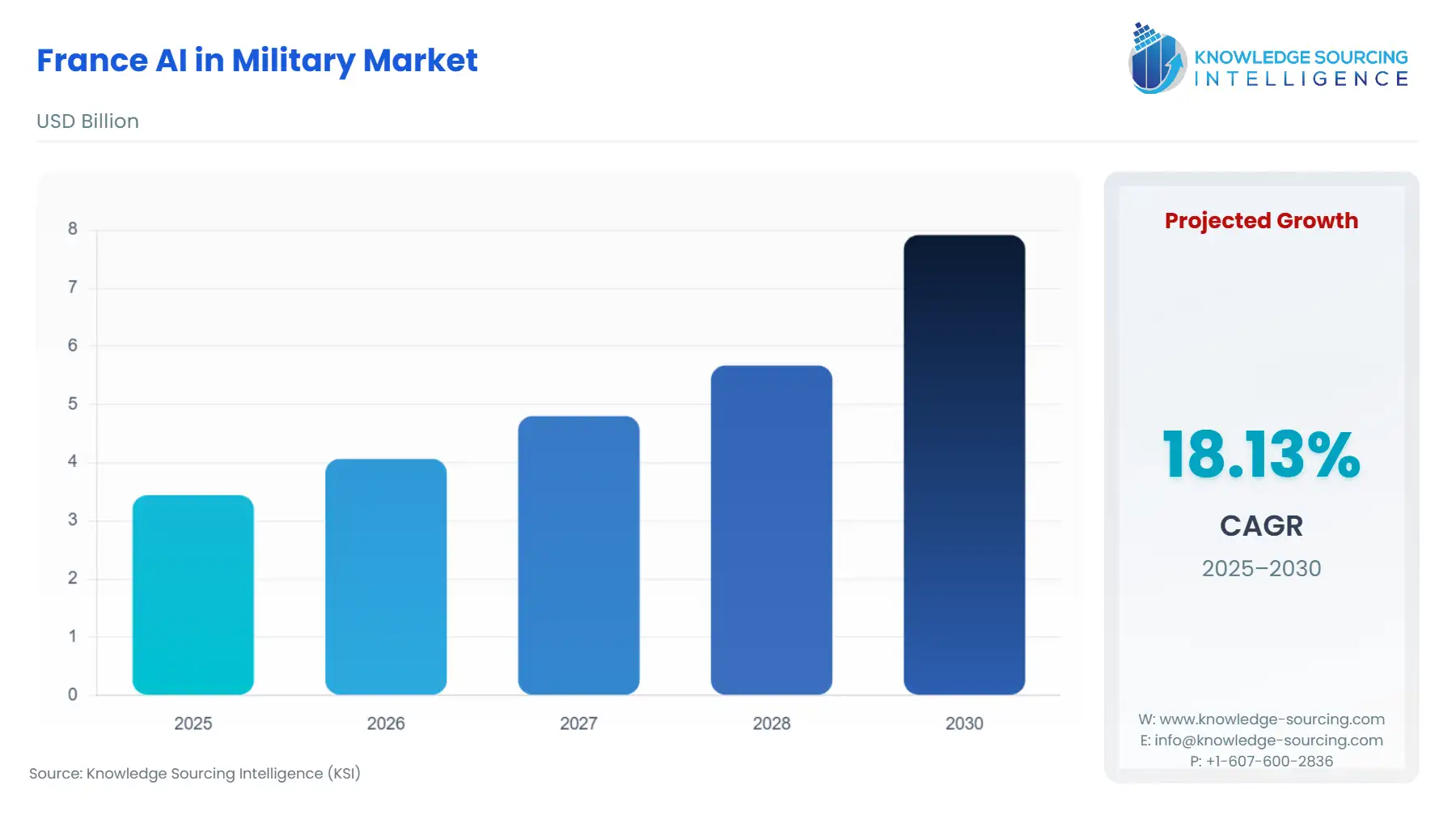

France AI in Military Market Size:

The France AI in Military Market is expected to grow at a CAGR of 18.13%, rising from USD 3.441 billion in 2025 to USD 7.915 billion by 2030.

The French AI in Military Market is entering a critical execution phase, transitioning from strategic planning to concrete program implementation, fundamentally driven by the nation's strategic autonomy imperative.

This transformation sees AI not merely as an enhancement layer but as an integral component of next-generation defense capabilities, explicitly mandated across all operational domains. The focus is shifting the demand away from generalized IT solutions toward specialized, high-integrity AI software and hardware integrated into critical platforms and command systems. This strategic pivot, backed by significant multi-year budgetary commitments, creates a sustained commercial environment for domestic and allied technology providers specializing in trustworthy, explainable, and ethically compliant artificial intelligence.

________________________________________

France AI in Military Market Analysis:

Growth Drivers:

The establishment of the Ministerial Agency for Artificial Intelligence in Defense (MAAID), with an announced annual budget and a mandate for sovereign technology, acts as a profound market catalyst. This agency directly increases the government's demand for domestically developed, high-TRL (Technology Readiness Level) AI solutions by providing dedicated funding and a centralized procurement channel. Concurrently, the increasing complexity of the multi-domain battlespace necessitates real-time data fusion and predictive analytics for commanders, which directly creates demand for AI-driven Command & Control (C2) software that can process vast streams of sensor data faster than human operators, shifting investment priorities from legacy systems to high-speed AI analytics platforms.

Challenges and Opportunities:

A critical challenge constraining market expansion is the scarcity of high-quality, labeled military datasets required to train robust, domain-specific AI models. This data dependency creates an immediate demand bottleneck and necessitates investment in data management and synthetic data generation platforms. Conversely, the opportunity lies in the rapid technological advancement of edge AI and decentralized processing, enabling real-time inference at the sensor or platform level. This trend directly drives demand for specialized, low-power AI hardware and embedded software, particularly for autonomous systems and remote platforms that must operate in disconnected, contested environments without relying on centralized cloud infrastructure.

Supply Chain Analysis:

The supply chain for the French military AI market is characterized by a reliance on global suppliers for high-performance semiconductors and specialized hardware accelerators, representing a key dependency and logistical complexity. Critical production and integration hubs are primarily concentrated within France's defense-industrial base, centered around prime contractors in regions like Île-de-France (for high-level systems integration and software) and Nouvelle-Aquitaine (aeronautics). The intellectual component—AI algorithms and foundational models—is predominantly sovereign, with key research emanating from French public-private partnerships (e.g., Hi! Paris). This dual structure means that while the software core is domestically controlled, the underlying computational power remains a global-market dependent element, influencing lead times for new AI-enabled hardware platforms.

Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| France / EU | Ministerial Agency for Artificial Intelligence in Defense (MAAID) | Centralizes R&D and procurement for sovereign AI, creating a direct, funded demand for domestic industry while establishing strict criteria for national control and ethical oversight. |

| France | Military Programming Law (LPM) 2019-2025 | Allocates substantial, multi-year funding to defense modernization, providing financial certainty that sustains demand for long-cycle AI integration programs, such as for the Rafale F5 and future systems. |

| International/France | Responsible AI in the Military Domain (REAIM) Principles / National Ethics Frameworks | Imposes a non-negotiable requirement for "trusted," "explainable," and "ethical" AI systems, shifting demand towards certified software and development methodologies that demonstrably minimize bias and maintain human control. |

France AI in Military Market Segment Analysis:

By Application: Command & Control (C2)

The Command & Control segment is overwhelmingly propelled by the operational imperative to accelerate the OODA loop (Observe, Orient, Decide, Act) in high-intensity conflict scenarios. AI systems are increasingly critical for achieving this speed by fusing heterogeneous sensor data from disparate sources—satellite, airborne, ground, and cyber—into a single, coherent, and predictive operational picture. The sheer volume and velocity of data generated by modern digitized forces necessitate machine learning and deep learning models to automatically classify, prioritize, and correlate events, bypassing human cognitive overload. This creates a direct and immediate demand for AI-enabled C2 platforms capable of real-time multi-source data processing, threat prediction, and automated course-of-action generation, effectively transforming the role of the commander from a data processor to a decision validator. The integration of collaborative combat concepts, such as those planned for the future air systems, hinges on robust, AI-orchestrated C2 links, solidifying this segment as a top investment priority.

By Platform: Naval Force

The Naval Force segment is experiencing a significant demand uplift for AI-driven solutions, primarily in the areas of underwater warfare, maritime surveillance, and predictive maintenance. France’s commitment to maintaining a robust, sovereign nuclear deterrent and a capable deep-sea intervention force necessitates platforms with advanced autonomy and acoustic signature management. AI’s ability to process complex sonar data for automatic detection, classification, and localization (DCL) of quiet submarines and autonomous underwater vehicles (AUVs) is a major growth driver, replacing legacy, manpower-intensive analysis methods. Furthermore, the operational tempo of naval vessels, especially submarines and aircraft carriers like the Charles de Gaulle, necessitates sophisticated AI-driven predictive maintenance systems to forecast equipment failure. This AI capability reduces costly, disruptive unscheduled downtime and directly enhances operational readiness, driving procurement of specialized AI software services for platform health monitoring.

________________________________________

France AI in Military Market Competitive Environment and Analysis:

The French AI in the Military Market is an oligopsony, dominated by a few national prime contractors with deep-rooted government relationships and a mandate to deliver sovereign capabilities. Competition is less about market share acquisition from new entrants and more about establishing technological leadership and securing large, multi-year state contracts for next-generation platforms. The major players leverage their system integration expertise and access to sensitive defense data to build high-assurance AI components.

Thales Group:

Thales Group positions itself as a global technology leader in defense, leveraging its extensive portfolio across aerospace, space, and ground transport to deliver a comprehensive suite of AI capabilities. Its strategy centers on developing Trusted AI for critical systems, focusing on explainability, safety, and security. A key product integration is its cortAIx AI accelerator, which serves as the hub for integrating AI into systems like radars, sonars, and onboard electronic warfare suites. The firm secured a major role in the European Defence Fund's Artificial Intelligence Deployable Agent (AIDA) project in November 2024, a clear demonstration of its strategic focus on embedding sovereign AI for real-time cyber-defense within combat aircraft systems.

Dassault Aviation:

Dassault Aviation’s competitive edge is anchored in its role as the prime contractor for the Rafale fighter and its involvement in future combat air systems. Its strategy is to integrate AI capabilities directly into the core mission systems of its high-performance platforms to enable collaborative combat and enhanced autonomy. A key development is the announcement in October 2024 by the French Armed Forces Minister for the launch of the development phase for an unmanned combat air system (UCAS) intended for integration with the Rafale F5 standard. This commitment directly positions Dassault as the lead integrator for high-end, mission-critical AI software responsible for coordinating manned-unmanned teaming operations.

________________________________________

France AI in Military Market Recent Developments:

- September 2025: Accenture announced its intent to acquire the French Orlade Group, which provides advisory and project management services for capital projects, including those in the defense systems sector. This move, highlighted in the press release, is intended to expand Accenture's capital projects capabilities and specifically leverage advanced technologies like generative AI to drive large-scale transformation and productivity gains in areas such as technical deliverable production for defense clients.

- November 2024: Thales was selected to lead the Artificial Intelligence Deployable Agent (AIDA) project, funded by the European Defence Fund. The project focuses on designing an AI with autonomous or semi-autonomous response capabilities to provide real-time cybersecurity protection for vulnerable aircraft systems, directly addressing the growing attack surface due to battlespace digitization. This development confirms Thales’s role in embedding sovereign AI for cyber-defense applications in military hardware.

- October 2024: The French Minister of the Armed Forces, Sébastien Lecornu, announced the launch of the development phase for an unmanned combat air system (UCAS) to be integrated into the Rafale F5 standard. This formal program commitment, building on the nEUROn program, establishes a clear, funded technological roadmap for the deployment of AI-enabled collaborative combat capabilities within the French Air Force.

________________________________________

France AI in Military Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.441 billion |

| Total Market Size in 2031 | USD 7.915 billion |

| Growth Rate | 18.13% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component Type, Technology, Application, Platform |

| Companies |

|

France AI in Military Market Segmentation:

- BY COMPONENT TYPE

- Hardware

- Software

- Services

- BY TECHNOLOGY

- Machine Learning

- Deep learning

- Computer Vision

- Natural Language Processing

- Robotics

- Others

- BY APPLICATION

- Warfare Platforms

- Cybersecurity

- Logistics & Transportation

- Surveillance & Reconnaissance

- Command & Control

- Battlefield Healthcare

- Simulation & Training

- Gathering Intelligence

- Others

- BY PLATFORM

- Land-based Force

- Naval Force

- Air Force

- Space Force