Report Overview

Germany AI in Military Highlights

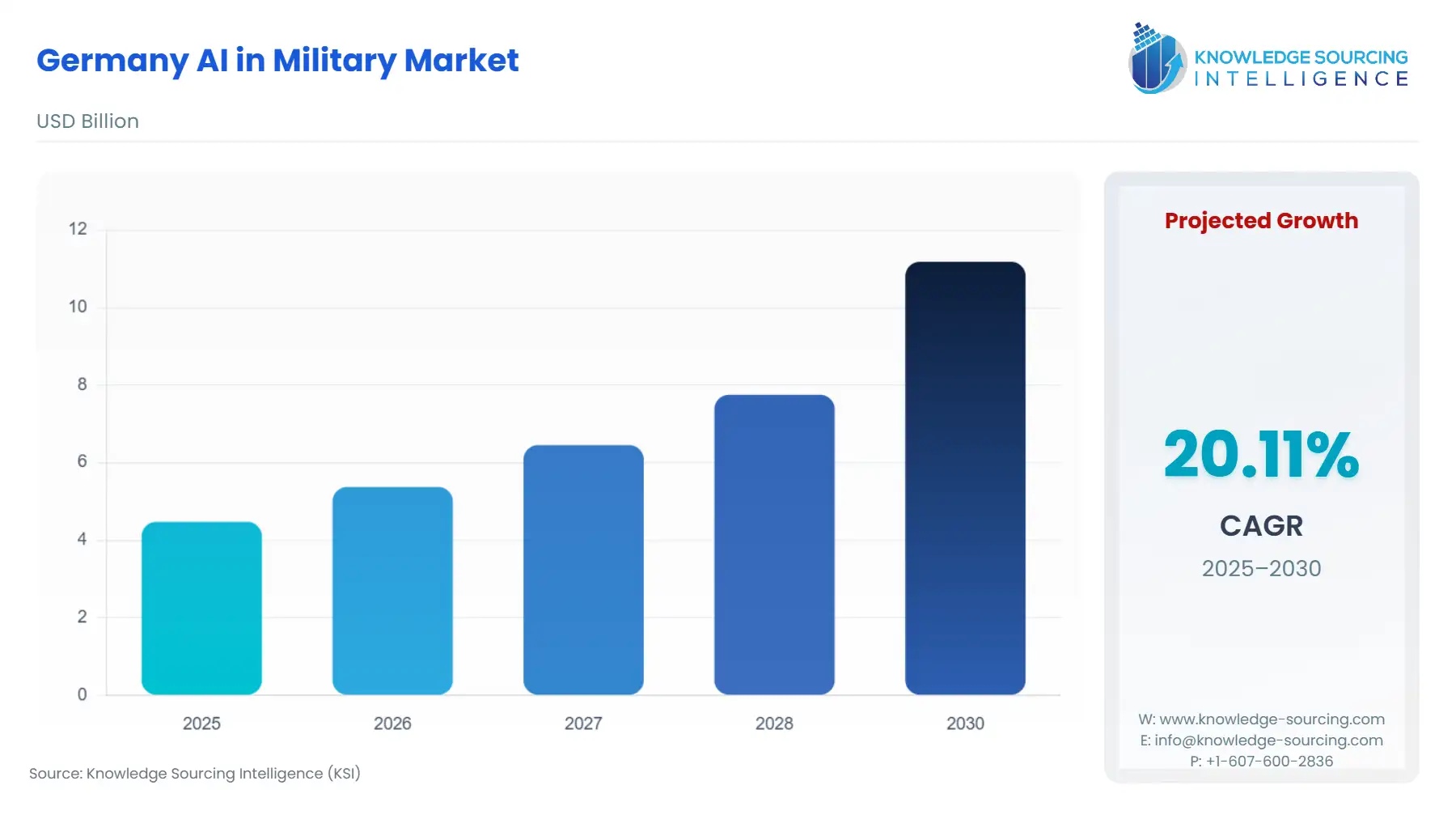

Germany AI in Military Market Size:

The Germany AI in Military Market is expected to grow at a CAGR of 20.11%, rising from USD 4.474 billion in 2025 to USD 11.184 billion by 2030.

The German AI in Military Market is undergoing a rapid, state-mandated transformation, moving from a historically cautious defense posture to one prioritizing advanced technological superiority. This shift is anchored in a recognition of the modern battlefield's digitized, high-speed requirements, where information superiority is directly tied to national security.

The invasion of Ukraine catalyzed an abrupt strategic reassessment across the German political and defense establishment, culminating in significant fiscal and policy commitments. The core imperative driving this market is the need for the Bundeswehr to modernize its operational readiness by integrating smart, data-driven systems capable of accelerating the sensor-to-shooter cycle while strictly adhering to national ethical guidelines on autonomy.

Germany AI in Military Market Analysis:

Growth Drivers: The geopolitical security environment directly propels demand for AI systems by exposing vulnerabilities in conventional defense infrastructure. The German government's commitment to defense modernization, exemplified by its intent to significantly increase its defense budget and the creation of the Sondervermögen, creates a massive pool of capital earmarked for high-end technology procurement. This fiscal certainty accelerates the demand for AI software, hardware, and services tailored for enhanced situational awareness, predictive logistics, and multi-domain command and control. Furthermore, the Bundeswehr's own strategic planning, which explicitly identifies AI as a necessary component for achieving information superiority and "just-in-time effects," translates a strategic concept directly into procurement requirements for specific AI tools, such as advanced sensor data fusion software.

Challenges and Opportunities: The primary challenge is the ethical and legal framework mandating Meaningful Human Control (MHC), which acts as a constraint on demand for fully autonomous offensive systems. This necessitates intensive, costly research and development into Explainable AI (XAI) and robust human-machine interfaces, which slows deployment. However, this challenge simultaneously creates a unique market opportunity: a high-value, defensible demand niche for AI software specializing in decision support systems, data fusion, and automated but non-lethal assistance functions. The market opportunity is further enhanced by the German government's efforts to streamline procurement, which lowers the barrier to entry for domestic, agile defense-tech startups, thereby increasing the supply-side competitive pressure and innovation cycle speed.

________________________________________

Supply Chain Analysis:

The AI in Military supply chain for Germany exhibits a core dependency on non-defense commercial technology for its fundamental components. Key production hubs are centered around the high-tech clusters in Bavaria, including Munich, which hosts major defense integrators and a rapidly growing ecosystem of AI startups like Helsing. Logistical complexity is primarily centered on securing high-end semiconductor chips and specialized AI processing units, often sourced from outside the European Union. Furthermore, the market is subject to dual-use component export control regimes, adding layers of bureaucratic complexity to the procurement of certain high-performance hardware. This global dependency on civilian-grade components and the concentration of high-end software development domestically creates a bifurcated supply chain where critical AI algorithms and systems integration remain sovereign, but underlying hardware relies on international trade flows.

Government Regulations:

The German AI in Military market operates under a strict, human-centric regulatory philosophy, which is a decisive market-shaping factor. The German government is a proactive participant in international forums like the Responsible AI in the Military Domain (REAIM) process and the Political Declaration on responsible military use of AI. Critically, Germany's national contribution to the UN on Lethal Autonomous Weapons Systems (LAWS) emphasizes the non-negotiable requirement for human control in all life-and-death decisions. This regulatory environment does not prohibit the use of AI; rather, it channels market expansion away from fully autonomous weapons and toward advanced human-machine teaming (HMT) and decision-support tools. This distinction is paramount, forcing system designers to focus on explainability, reliability, and human accountability from the earliest design phases.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Germany | Principles of Human Control (as per national contribution to UN LAWS) | Increases Demand for Explainable AI (XAI) and HMT: Prohibits fully autonomous lethal decision-making, shifting defense procurement to AI-enabled C2, surveillance, and logistics applications that provide decision support rather than replacement. |

| European Union | AI Act (Regulation (EU) 2024/1689) | Indirect Normative Influence: While Article 2(3) exempts military systems, the Act's principles of transparency, auditability, and human oversight for 'high-risk' systems establish a normative benchmark. This increases the internal development cost and time for dual-use components by requiring robust documentation. |

| Germany | Sondervermögen Law and Expedited Procurement Legislation | Massive Demand Acceleration: Bypasses traditionally lengthy procurement processes for military goods, enabling faster contract awards to providers of cutting-edge AI software and services, which directly stimulates market growth. |

Germany AI in Military Market Segment Analysis:

By Technology: Deep Learning

The deep learning segment is experiencing a concentrated surge in demand, driven by the sheer volume and complexity of sensor data the Bundeswehr now seeks to exploit across multiple domains. Deep learning models are essential for automating complex perception and cognitive tasks that exceed human capacity, such as Advanced Target Recognition (ATR) in Synthetic Aperture Radar (SAR) and Electro-Optical/Infrared (EO/IR) imagery. This technology directly increases the demand for AI software by providing the analytical engine for the Command & Control and Surveillance & Reconnaissance applications. Specifically, the need for rapid data fusion in platforms like the Eurofighter and future Wingman systems—where milliseconds matter for threat assessment—compels the adoption of deep neural networks capable of processing heterogeneous data streams (radar, SIGINT, video) into a coherent, real-time operational picture. The military's pursuit of pattern-of-life analysis for intelligence gathering also generates explicit demand for deep learning algorithms that can detect subtle anomalies in vast datasets, moving beyond simple object classification to complex behavioral prediction. This application directly drives investment in both highly optimized software architectures and the underlying high-performance hardware.

By Application: Surveillance & Reconnaissance

Surveillance and Reconnaissance (ISR) stands as the most critical growth segment because it is the foundational requirement for the Bundeswehr's move toward a networked, digitized battlefield. The necessity to operate Unmanned Aerial Systems (UAS) and Unmanned Ground Vehicles (UGV) for persistent, high-risk intelligence gathering creates an inherent and immediate demand for AI. AI-enabled ISR systems decrease the time lag between sensor data capture and human decision-making, a key military effectiveness metric. The necessity is specifically focused on Computer Vision and Machine Learning algorithms that can autonomously detect, classify, and track targets across wide areas in real time, dramatically reducing the cognitive load on human analysts. This application is also a primary beneficiary of the government's investment in Manned-Unmanned Teaming (MUM-T) concepts, where AI software on platforms like the Eurodrone or a Wingman must process and down-select critical information before presenting it to a human pilot for final action. The requirement is not merely for data collection, but for intelligent, automated data pre-processing and fusion.

Germany AI in Military Market Competitive Environment and Analysis:

The German AI in Military market is characterized by a strong presence of established, sovereign defense prime contractors, increasingly challenged and complemented by a burgeoning ecosystem of agile, venture-backed defense-tech startups. This dynamic competitive landscape necessitates a balance between heritage integration expertise and cutting-edge software development speed.

Airbus Defence and Space: As the largest European defense contractor with a significant German presence, Airbus Defence and Space is strategically positioned as a prime integrator for major multinational programs like the Future Combat Air System (FCAS). Its competitive edge stems from its heritage role in platforms like the Eurofighter and A400M. The company’s strategy focuses on developing the Multi-Domain Combat Cloud and Manned-Unmanned Teaming (MUM-T) concepts. A core, verifiable component of its AI strategy is its partnership with defense AI companies like Helsing, focusing on integrating AI software for tasks such as sensor data fusion and autonomous mission planning into its future Wingman platforms, ensuring that its hardware maintains technological relevance in a software-defined defense environment.

Hensoldt: Hensoldt is a European leader in sensor technology, which places it directly at the core of the AI in Military value chain, as AI performance is directly proportional to sensor data quality and availability. The company's strategy is built on software-defined defense (SDD), aiming to separate hardware and software functions to allow for rapid, containerized software updates. Hensoldt's core AI-enabled product is the Ceretron system, designed to combine sensor data streams, evaluate, and process them in seconds to deliver an AI-supported operational picture to the crew, thereby speeding up the decision cycle. The company has publicly emphasized the integration of AI-supported software for detection and tracking in its optronic systems, such as the TAROSS Target Acquisition & Reconnaissance Optronical Sighting System.

Germany AI in Military Market Recent Developments:

- February 2025: Rheinmetall showcased the new Mobile Mission Pod (MMP) at the Enforce Tac exhibition. The MMP is a new product designed for standoff reconnaissance and engagement using small Unmanned Aerial Vehicles (UAVs). The system's official release highlights its high degree of automation and Artificial Intelligence (AI) support in conjunction with its standalone design and long standby time. Developed for special operations, this product launch directly demonstrates the integration of AI for increased operational effectiveness and endurance in unmanned ground systems.

- June 2024: Airbus Defence and Space and the German defense AI company Helsing signed a framework cooperation agreement at the ILA aerospace trade show in Berlin. The collaboration is explicitly focused on developing artificial intelligence technologies for a future Wingman system. This unmanned fighter-type aircraft is designed to operate in a Manned-Unmanned Teaming (MUM-T) capacity alongside current combat jets, utilizing AI software for dangerous tasks including target reconnaissance, destruction, and electronic jamming. This partnership is a verifiable strategic move by a prime contractor to acquire agile AI software capabilities.

Germany AI in Military Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.474 billion |

| Total Market Size in 2031 | USD 11.184 billion |

| Growth Rate | 20.11% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component Type, Technology, Application, Platform |

| Companies |

|

Germany AI in Military Market Segmentation:

- BY COMPONENT TYPE

- Hardware

- Software

- Services

- BY TECHNOLOGY

- Machine Learning

- Deep learning

- Computer Vision

- Natural Language Processing

- Robotics

- Others

- BY APPLICATION

- Warfare Platforms

- Cybersecurity

- Logistics & Transportation

- Surveillance & Reconnaissance

- Command & Control

- Battlefield Healthcare

- Simulation & Training

- Gathering Intelligence

- Others

- BY PLATFORM

- Land-based Force

- Naval Force

- Air Force

- Space Force