Report Overview

Germany ALD Precursors Market Highlights

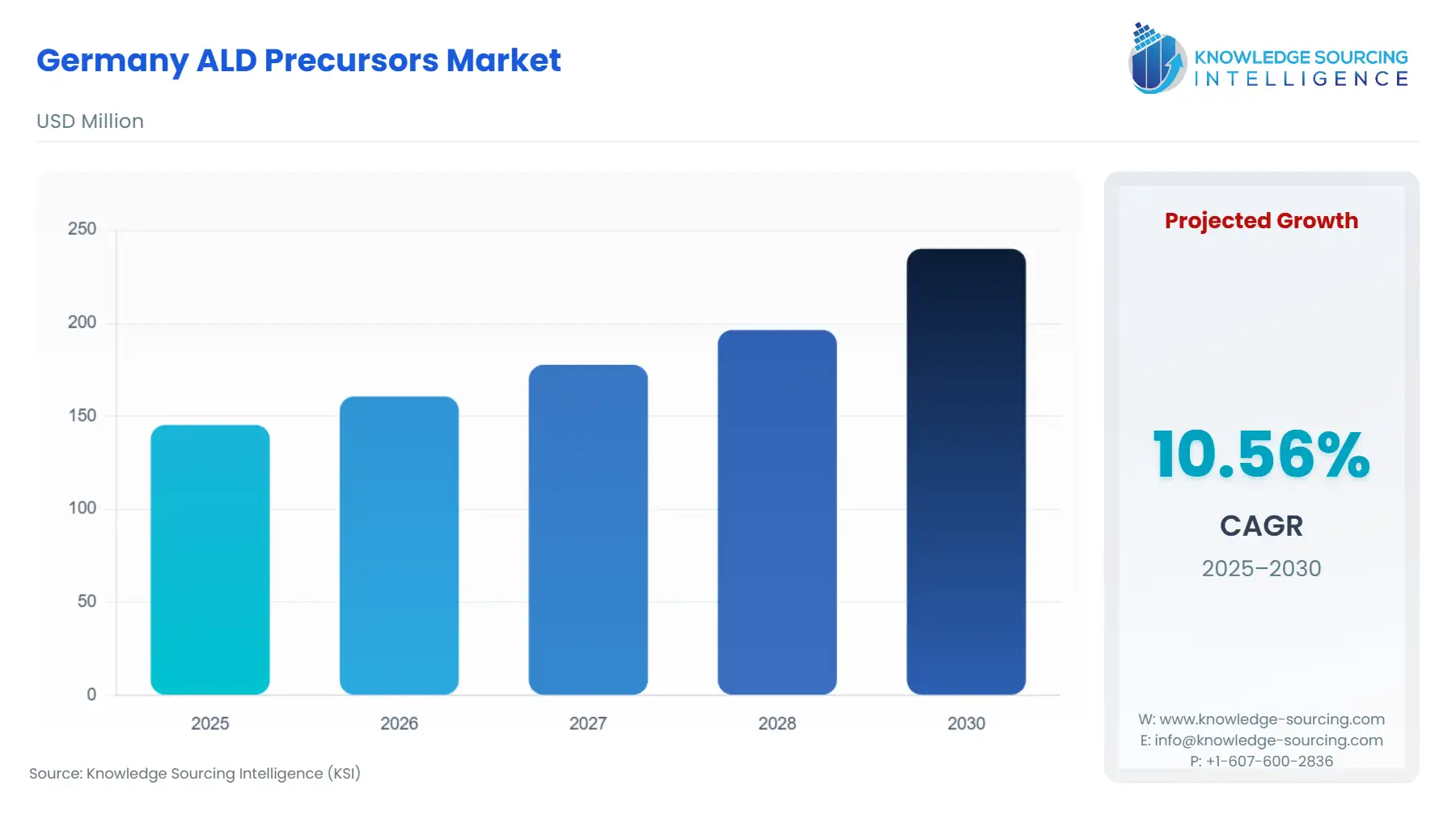

Germany ALD Precursors Market Size:

The Germany ALD Precursors Market is anticipated to grow at a CAGR of 10.52%, reaching USD 240 million in 2030 from USD 145.283 million in 2025.

The ALD (Atomic Layer Deposition) precursors market in Germany is a critical component of the country's high-tech manufacturing ecosystem, providing essential materials for a range of advanced industries, including semiconductors, solar energy, and aerospace. The necessity for ALD precursors in Germany is closely tied to the country's leading role in both industrial manufacturing and its commitment to sustainability. As technology evolves, the importance of ALD in creating precision coatings and thin films continues to grow, with applications across numerous high-performance industries.

Germany ALD Precursors Market Analysis:

Growth Drivers

- Expansion of the Semiconductor Industry: Germany is home to some of the world’s most advanced semiconductor manufacturers, such as Infineon Technologies and GlobalFoundries. The need for ALD precursors is primarily driven by the need for precision thin films in semiconductor devices, particularly in applications like high-k dielectrics, gate oxides, and interlayer dielectrics. As the push for miniaturization in semiconductor components intensifies, the requirement for ALD technology to deposit ultra-thin, uniform layers becomes even more critical.

- Solar Energy Growth: With Germany’s aggressive renewable energy policies and the EU’s ambitious Green Deal, there is an increasing demand for ALD precursors in the solar energy sector. ALD technology is used to fabricate high-efficiency thin films for photovoltaic cells, improving their energy conversion rates. Germany’s status as a leader in the global solar energy market, along with its commitment to achieving carbon neutrality by 2050, bolsters this demand.

- Technological Advancements in ALD: The development of new ALD technologies, such as Plasma-Enhanced ALD (PE-ALD) and Roll-to-Roll ALD, has expanded the range of applications and boosted demand for ALD precursors. These advanced technologies offer higher precision, faster deposition rates, and the ability to scale up production, making them attractive for industries requiring high-performance coatings, such as electronics and energy storage.

- Regulatory Push for Sustainability: Germany’s commitment to environmental sustainability and energy efficiency is creating new opportunities for ALD precursors, especially in the automotive sector. ALD technology is increasingly being used for surface passivation and coating applications in electric vehicle (EV) batteries and fuel cells, providing a high degree of reliability and performance. This is in line with the EU’s regulatory environment, which mandates stricter emissions standards and promotes clean energy technologies.

Challenges and Opportunities

- Supply Chain Volatility: While Germany's ALD precursor market benefits from strong local demand, the global nature of the precursor supply chain presents challenges. Much of the supply comes from international markets, particularly from manufacturers in Asia and North America. Geopolitical uncertainties, such as trade disruptions and supply chain bottlenecks, can lead to pricing volatility and potential shortages. However, as demand continues to grow, German manufacturers may invest in local production facilities, reducing reliance on international suppliers and mitigating some of these risks.

- High Costs of ALD Technology: The initial costs of ALD equipment and precursors can be high, particularly for industries that are just beginning to adopt the technology. While ALD offers significant benefits in terms of film quality and precision, the cost of transitioning to this technology can be a barrier for smaller firms or those with limited budgets. Nonetheless, technological advancements and economies of scale are expected to gradually reduce these costs, offering long-term opportunities for growth, especially in sectors like automotive and energy storage.

- Opportunities in Emerging Industries: As new applications for ALD continue to emerge, Germany stands to benefit from its strong industrial base and innovation-driven environment. For instance, ALD’s potential in the fields of nanotechnology and quantum computing is likely to drive significant future demand for precursors. Additionally, the growing adoption of ALD in the aerospace and defense sectors, where precise and durable coatings are essential, presents another area of opportunity.

Raw Material and Pricing Analysis

Germany’s ALD precursor market relies on key raw materials such as metalorganic compounds (e.g., trimethylaluminum, tungsten hexafluoride) and halide-based chemicals. These materials are sourced from both local and international suppliers, but due to the specialized nature of ALD precursors, Germany’s market is particularly reliant on imports from major suppliers in the United States and Asia. As these raw materials are subject to price fluctuations based on global supply and demand dynamics, companies operating in Germany may experience significant price volatility. However, the growing adoption of ALD technologies and the expansion of renewable energy applications are expected to stabilize demand over time, fostering long-term growth in local precursor manufacturing.

Supply Chain Analysis

The global ALD precursor supply chain is marked by high specialization and geographical dependencies. Key production hubs are located in the United States, Japan, and Taiwan, with global players such as Merck KGaA, Air Liquide, and Linde plc contributing to a competitive market. The logistical complexity stems from the need to ensure a continuous, high-quality supply of chemical precursors, with suppliers needing to adhere to rigorous safety, environmental, and regulatory standards. In Germany, logistical challenges such as customs regulations, shipping delays, and raw material sourcing are compounded by the high precision required in ALD applications.

Germany ALD Precursors Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Germany |

Federal Ministry for Economic Affairs and Energy (BMWi) |

BMWi supports innovation in renewable energy, increasing the demand for ALD technology in solar cell production. |

|

European Union |

REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) |

REACH regulations ensure that ALD precursors meet stringent environmental standards, promoting sustainable manufacturing. |

|

Germany |

Federal Environment Agency (UBA) |

UBA’s environmental policies encourage the use of cleaner technologies, boosting demand for ALD in energy storage and automotive sectors. |

Germany ALD Precursors Market Segment Analysis

- By Application: High-k Dielectric

High-k dielectrics are key materials used in semiconductor devices, particularly in transistors and memory chips. These materials have a higher dielectric constant than traditional silicon dioxide, allowing for smaller and faster devices. ALD technology is the preferred method for depositing these materials due to its ability to create extremely thin, uniform films with high precision. In Germany, the semiconductor industry’s rapid growth and the increasing miniaturization of electronic devices are propelling the demand for high-k dielectrics. This trend is particularly significant in light of Europe’s goal to reduce dependence on semiconductor imports, making the local production of these components increasingly important.

- By End-User: Electronics & Semiconductors

The electronics and semiconductor industry is the dominant end-user of ALD precursors in Germany. The country's strong industrial base in semiconductors, coupled with its focus on technological innovation, positions this sector as the largest driver of ALD precursor demand. As the need for high-performance, smaller, and more efficient devices increases, the need for precision thin films and coatings continues to rise. Germany’s investments in advanced manufacturing techniques for semiconductors, including ALD, further enhance its role in global supply chains, making it a critical market for ALD precursor manufacturers.

________________________________________

Germany ALD Precursors Market Competitive Analysis:

- Merck KGaA

Merck KGaA, Darmstadt, Germany, is a global leader in ALD precursor manufacturing, offering a comprehensive portfolio of materials for semiconductor applications. The company’s commitment to sustainability and innovation has strengthened its position in the market, especially with the growing demand for ALD in renewable energy applications. Merck KGaA’s established presence in Germany gives it a strategic advantage in supplying the local market with high-quality precursors.

- Linde plc

Linde plc is another major player in the ALD precursor market, providing a range of high-purity chemicals for industrial applications. Linde’s focus on high-performance materials for semiconductor manufacturing, coupled with its expertise in gas management solutions, has made it a critical partner in the supply chain. The company’s strong global presence, especially in Europe, positions it well to meet the growing need for ALD precursors in Germany’s high-tech sectors.

________________________________________

Germany ALD Precursors Market Developments

- January 2025: U.S.-based Forge Nano opened a 2,000-square-foot cleanroom in January 2025 dedicated to producing TEPHRA™ ALD cluster tools for 200mm semiconductor wafers. This expansion boosts throughput for ALD precursor applications in high-volume manufacturing, targeting conformal coatings for logic and memory devices. While global in scope, it supports European supply chains, including Germany's Infineon and GlobalFoundries fabs, by improving precursor delivery efficiency and reducing defects in nanoscale films. The facility addresses rising demand from AI-driven chip scaling.

- November 2024: Merck KGaA, Darmstadt, Germany, and Intel Corporation initiated a three-year academic research program focused on sustainable semiconductor manufacturing solutions. Announced in 2023, the program officially launched in November 2024 following a successful call for European research proposals. It targets innovations in materials like ALD precursors for eco-friendly chip production, aligning with Merck's commitment to reduce Scope 3 emissions by 52% by 2030. This collaboration enhances precursor development for advanced nodes, fostering sustainability in Germany's semiconductor ecosystem.

________________________________________

Germany ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 145.283 million |

| Total Market Size in 2031 | USD 240 million |

| Growth Rate | 10.52% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

Germany ALD Precursors Market Segmentation:

- By Application

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- By Technology

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- By End-User

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others