Report Overview

Global Bioburden Testing Market Highlights

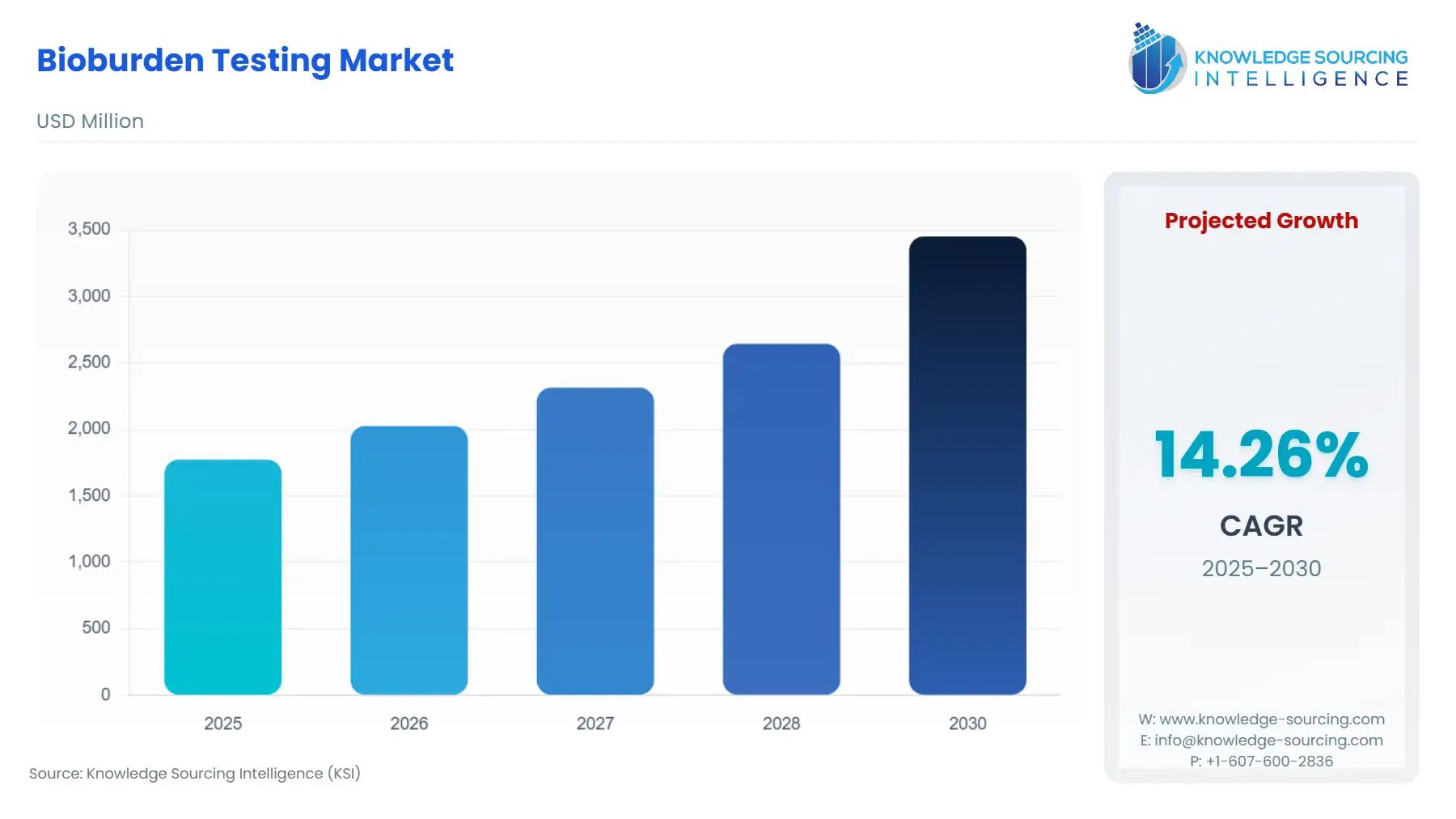

Bioburden Testing Market Size:

The Bioburden Testing Market is expected to soar from USD 1.773 billion in 2025 to USD 3.453 billion in 2030, at a CAGR of 14.27%.

The Global Bioburden Testing Market is an indispensable segment of the broader microbial quality control landscape, centered on measuring the total viable microbial load on raw materials, in-process products, and finished goods prior to sterilization. This testing is a fundamental requirement under current Good Manufacturing Practice (cGMP) guidelines across the pharmaceutical, biotechnology, and medical device sectors.

The market's operational foundation is inextricably linked to the global imperative for patient safety and product efficacy, positioning bioburden testing not merely as a quality step but as a critical gateway for regulatory compliance and final product market release. The prevailing market trend shows a decisive pivot toward integrating rapid and automated testing platforms to mitigate the risk of contamination and accelerate manufacturing timelines, a direct response to increasing global production complexity and volume.

Global Bioburden Testing Market Analysis

- Growth Drivers

Stringent global regulatory compliance is the primary catalyst driving absolute demand for the Global Bioburden Testing Market. Agencies like the FDA and EMA enforce rigorous microbial limits testing across all phases of pharmaceutical and medical device manufacturing. This mandatory oversight directly increases demand for testing kits, culture media, and services to perform the required raw material and in-process testing for every production batch. Furthermore, the rising complexity and volume of high-value biologics and cell therapy products intensify the need for sensitive, in-process microbial monitoring. This specific need accelerates the adoption of advanced techniques like PCR and automated detection systems, which directly drives demand for high-end instrument sales and specialized reagents.

- Challenges and Opportunities

A critical challenge constraining market expansion is the high capital expenditure required for advanced instruments, such as automated microbial identification systems and PCR equipment. This high cost acts as a barrier to entry, particularly for smaller manufacturing facilities or those in emerging economies, consequently dampening the overall instrument demand. Conversely, the market is presented with a significant opportunity through the rapid growth of the Contract Manufacturing Organization (CMO) and Contract Research Organization (CRO) sector. The increasing trend of outsourcing specialized quality control functions, including bioburden testing, allows CMOs to leverage their high-cost, specialized expertise and instrumentation, thereby creating sustained, high-volume demand for outsourced testing services.

- Raw Material and Pricing Analysis

The Bioburden Testing Market primarily utilizes physical products, including consumables. Culture media, the foundational raw material for many tests, relies on biological components like peptones and extracts, subjecting pricing to volatility based on the supply chain stability of these agricultural or animal-derived ingredients. The reagents and kits, frequently containing proprietary enzymes or fluorophores for rapid methods, face pricing pressure influenced by complex chemical synthesis costs and intellectual property barriers. Supply chain complexities in sourcing and purifying these specialty biochemicals contribute to the high per-test cost of consumables. Companies strategically position their high-margin consumable sales, offsetting the lower margins or high initial investment of the instrument hardware.

- Supply Chain Analysis

The global supply chain for bioburden testing is highly concentrated at the top tier, dominated by a few multinational life science and diagnostics companies. Key production hubs are primarily located in North America and Europe, which specialize in the high-quality, sterile manufacturing of culture media, complex reagents, and precision analytical instruments. Logistical complexity centers on the cold-chain requirements for transporting temperature-sensitive biological media and kits, introducing a critical dependency on reliable, validated global freight networks. The dependence on specialized, high-purity raw material suppliers for proprietary reagents constitutes a key vulnerability, as disruptions in these niche supply streams can immediately impact the production and availability of high-demand consumables.

Bioburden Testing Market Government Regulations

Government regulations are the foundational pillars of market demand, compelling continuous and rigorous bioburden testing.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FDA (21 CFR Part 211 - cGMP) |

Mandates bioburden testing for components, drug product containers, and closures with potential for microbiological contamination (211.84). This regulation creates an indispensable, routine demand for raw material and in-process testing products. |

|

European Union |

EMA (EU GMP Annex 1) |

Explicitly requires bioburden monitoring prior to sterilization and mandates the definition of workplace-specific limits. This drives continuous investment in environmental monitoring and pre-sterilization testing solutions for every manufactured batch. |

|

Global/Medical Devices |

ISO 11737-1:2018 |

Serves as the consensus standard for determining the population of microorganisms on medical devices, recognized by the FDA and EU MDR. This directly forces medical device manufacturers to purchase validated test kits and services to ensure compliance and support sterilization dose validation. |

Bioburden Testing Market Segment Analysis

- Raw Material Testing (By Application)

The Raw Material Testing segment commanded the largest share of the bioburden market, driven by the critical imperative to vet contamination at the initial stage of production. Regulatory mandates, particularly FDA's cGMP rules, require testing components for microbiological contamination liability before use, translating into consistent, high-volume demand for culture media and basic counting kits. The increasing frequency of pharmaceutical product recalls stemming from microbial contamination linked to raw materials forces manufacturers to implement tighter incoming quality control protocols. This proactively drives the demand for rapid, high-throughput technologies, such as automated plate readers, to screen bulk quantities of non-sterile active pharmaceutical ingredients (APIs), excipients, and water systems before they enter the manufacturing process, thereby mitigating costly downstream losses.

- Pharmaceutical and Biotechnology Manufacturers (By End-User)

Pharmaceutical and Biotechnology Manufacturers constitute the largest end-user segment, fueled by the accelerating pace of drug development and production, especially for complex biologics. The inherent risk of microbial contamination in biologic production lines, which often utilize complex nutrient-rich culture broths, necessitates comprehensive and continuous bioburden monitoring. This sector's adherence to pharmacopoeial standards, such as those set by the United States Pharmacopeia (USP), directly creates a massive, recurring demand for validated testing methodologies. The significant investment in sterile manufacturing facilities and the high cost associated with batch failure compels these companies to invest in the most advanced, often automated, bioburden testing instruments and platforms to ensure the earliest possible detection of microbial excursions.

Bioburden Testing Market Geographical Analysis

- US Market Analysis

The US market dominates the global bioburden testing landscape due to the U.S. Food and Drug Administration's (FDA) rigorous oversight and a mature, expansive biopharmaceutical sector. The consistent enforcement of 21 CFR Part 211 for finished pharmaceuticals and the acceptance of standards like ISO 11737 for medical devices create a non-negotiable demand floor for testing. High R&D expenditure and a cultural mandate for rapid technological adoption push US-based manufacturers to be early adopters of sophisticated, high-cost automation and rapid microbial methods, disproportionately driving demand for premium instruments and specialized assay kits.

- Brazil Market Analysis

Market dynamics in Brazil are primarily influenced by the rapidly expanding domestic pharmaceutical manufacturing base and the regulatory standards set by ANVISA (Agência Nacional de Vigilância Sanitária). While cost sensitivity remains a factor, the pressure to harmonize with international GMP standards to participate in the global drug supply chain drives demand for validated bioburden testing protocols and traditional culture media-based methods. Local factors, including challenges in cold-chain logistics for sensitive reagents, are creating opportunities for vendors offering robust, less temperature-sensitive consumables and localized support services.

- Germany Market Analysis

Germany's market strength stems from its position as a major European pharmaceutical and medical device manufacturing hub. The market is driven by strict compliance with European Medicines Agency (EMA) and national regulations, which prioritize advanced sterility assurance, particularly the detailed requirements outlined in EU GMP Annex 1. This regulatory environment stimulates high demand for validated and highly automated testing solutions, as manufacturers seek to integrate RMMs into their quality control workflows to enhance data integrity and achieve faster product release.

- South Africa Market Analysis

The South African market experiences demand growth tied to increasing domestic production and the expansion of multinational pharmaceutical companies establishing a local presence. Regulatory compliance, governed by the South African Health Products Regulatory Authority (SAHPRA), increasingly aligns with global standards, which is a key factor pushing local manufacturers toward professional bioburden testing. The demand profile favors a mix of cost-effective, culture media-based consumables for routine testing alongside the specialized services offered by accredited contract testing laboratories.

- China Market Analysis

China's market is characterized by explosive growth, driven by massive state-led investment in biotechnology and a pharmaceutical sector undergoing rigorous regulatory reform under the National Medical Products Administration (NMPA). The country’s immense manufacturing volume for both domestic consumption and export necessitates high-throughput, scalable testing solutions. This volume-based demand creates a catalyst for both the establishment of large-scale contract testing facilities and a significant surge in demand for all classes of bioburden testing consumables and instruments.

Bioburden Testing Market Competitive Environment and Analysis

The competitive landscape of the Global Bioburden Testing Market is moderately consolidated, led by major life science conglomerates that leverage extensive product portfolios and global distribution networks. Competition centers on the development and regulatory acceptance of rapid microbial methods (RMMs) that can significantly reduce the traditional 5-7 day testing window. Companies compete aggressively on the integration of instruments, consumables, and software into comprehensive, compliant workflow solutions. The significant barrier to entry is not only the capital required for instrument R&D but also the lengthy and expensive process of validating new testing methods to meet pharmacopoeial standards for customer adoption.

- Thermo Fisher Scientific

Thermo Fisher Scientific holds a commanding strategic position by offering one of the most comprehensive product ecosystems spanning the entire bioburden testing workflow. Its strategy involves integrating instruments and consumables through proprietary platforms. The company leverages its scale to serve both large pharmaceutical manufacturers and contract testing organizations globally.

- Merck KGaA

Merck KGaA, through its Life Science business, MilliporeSigma, is strategically focused on advanced membrane filtration and rapid detection technologies essential for bioburden testing. Their key positioning is centered on providing validated, user-friendly systems that improve data integrity and workflow efficiency. A core product is the Milliflex® family of products, notably the Milliflex® Quantum system, a fluorescence-based rapid microbial detection system. Merck also provides a wide range of compliant Steritest™ devices and specialized culture media, solidifying their dominant position in the crucial consumable and water-testing segments of the market.

Global Bioburden Testing Market Segmentation

By Products

- Consumables

- Culture Media

- Kits and Reagents

- Others

- Instruments

- PCR Equipment

- Microscopes

- Flow cytometers

- Automated microbial identification systems

- Software & Services

By Application

- Raw Material Testing

- Medical Devices Testing

- In-Process Testing

- Environmental Monitoring

By End-User

- Pharmaceuticals and Biotechnology Manufacturers

- CMOs

- Medical Device Manufacturers

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- The Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others