Report Overview

Global Biocides Market - Highlights

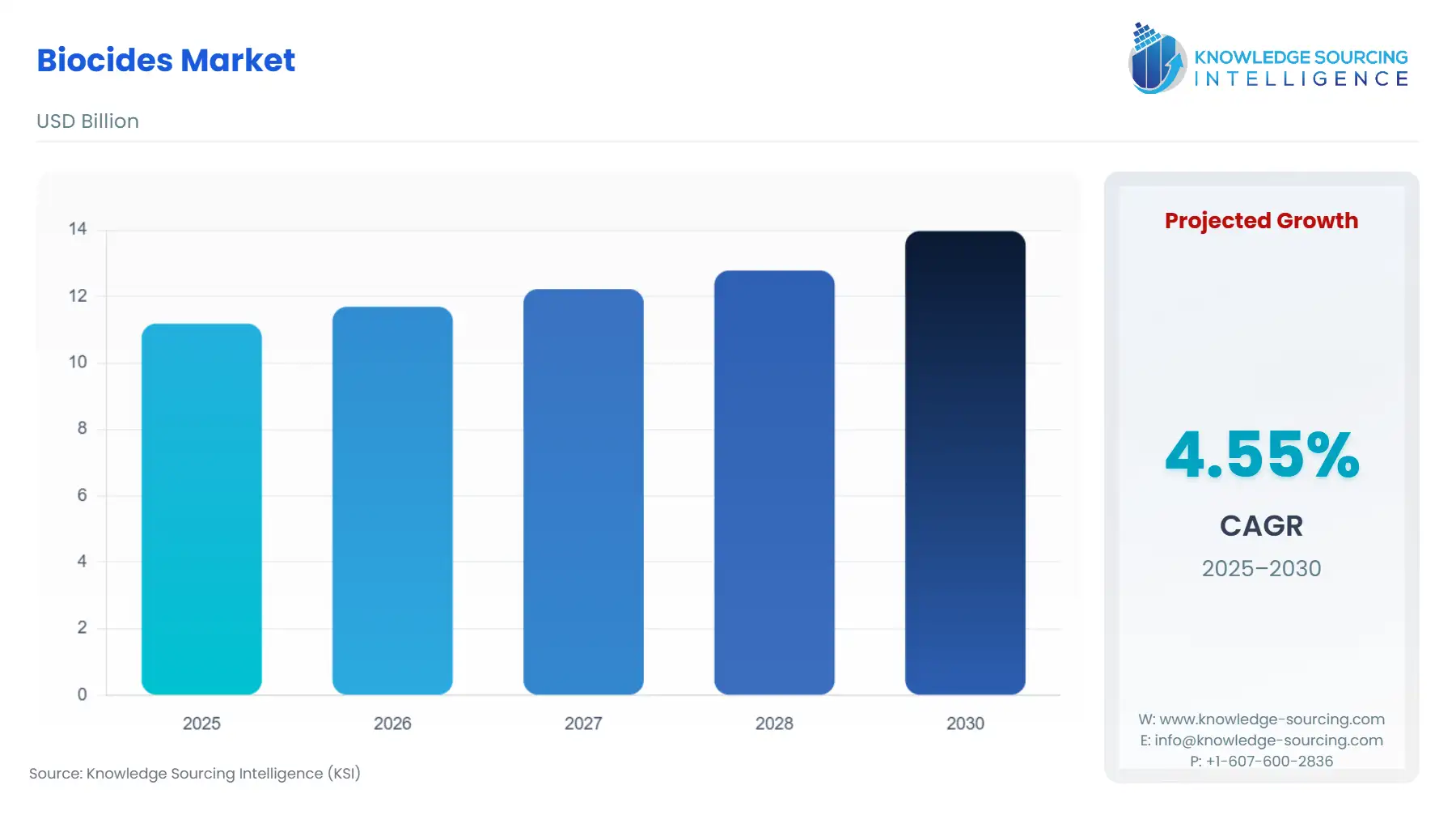

Biocides Market Size:

The global biocides market is expected to grow from USD 11.186 billion in 2025 to USD 13.973 billion in 2030, at a CAGR of 4.55%.

The global biocides market is an essential, specialized chemicals sector driven by the continuous, mandatory need for microbial control across a diverse array of industrial and consumer applications. Biocides, defined broadly as substances designed to destroy, deter, render harmless, or exert a controlling effect on harmful organisms, are critical inputs for maintaining product integrity, process efficiency, and public health safety. The market operates under a unique tension: while underlying demand is inelastic, rooted in non-discretionary requirements like water sanitation and materials preservation, the supply side is highly constrained by rigorous, multi-year regulatory approval processes. Consequently, the competitive landscape is shaped less by price and more by intellectual property protection, regulatory dossier ownership, and the ability to navigate complex, region-specific authorization procedures.

Global Biocides Market Analysis

- Growth Drivers

The escalating global population necessitates substantial expansion in water infrastructure and sanitation protocols, creating direct, non-negotiable demand for biocides to manage microbial contamination, biofouling, and corrosion in cooling towers and municipal water systems. Furthermore, heightened public awareness and institutional focus on hygiene, catalyzed by recent public health crises, has driven a structural increase in the required use of surface disinfectants and preservatives in healthcare and food & beverage processing sectors. Finally, the need to extend the shelf life and preserve the integrity of materials like paints, coatings, and personal care products directly mandates the continuous integration of antimicrobial preservatives, thus fueling consistent underlying market growth.

- Challenges and Opportunities

The primary challenge facing the biocides market is the significant regulatory burden, notably the high cost and protracted time-to-market associated with obtaining active substance approval under frameworks like the BPR and FIFRA. This acts as a severe barrier to entry for smaller firms and slows the introduction of innovative chemistries. The core opportunity resides in the development and successful commercialization of novel "green biocide" formulations, such as those derived from natural sources, or targeted, non-persistent chemistries. These new products directly address the mounting pressure from environmental agencies and downstream customers seeking alternatives to legacy chemistries associated with toxicity or ecological concerns, offering a crucial pathway for premium product development and market differentiation.

- Raw Material and Pricing Analysis

The Global Biocides Market, a physical chemicals sector, is fundamentally dependent on key petrochemical-derived raw materials, making it susceptible to commodity price volatility. Active ingredients, such as glutaraldehyde and various halogen compounds like chlorine, originate from basic chemical precursors. Glutaraldehyde, for instance, relies on acrolein, a downstream product of propylene. Price fluctuations in crude oil and natural gas directly influence propylene costs, subsequently impacting the cost structure of glutaraldehyde-based biocides. Similarly, the energy-intensive production of chlorine for oxidizing biocides ties its pricing to electricity markets. This raw material cost volatility forces biocide manufacturers to adopt sophisticated hedging strategies and often translates into variable pricing for end-users, affecting profit margins and procurement planning across industries like water treatment and oil & gas.

- Supply Chain Analysis

The biocide supply chain is characterized by a high level of vertical integration among key manufacturers and a primary concentration of production capacity in Asia-Pacific, specifically China and India, for many foundational active ingredients. The chain progresses from the upstream synthesis of active substance precursors (e.g., glutaraldehyde, isothiazolinones) to intermediate formulation, and finally to regional distribution centers near high-demand end-users (e.g., water treatment facilities, coating manufacturers). Logistical complexity arises from the classification of many biocide concentrates as hazardous materials, requiring specialized transport, storage, and handling protocols that significantly elevate supply chain costs and introduce bottlenecks during regulatory or trade disruptions across major shipping lanes. The reliance on Chinese production for intermediate chemicals constitutes a single-source dependency risk.

Biocides Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Biocidal Products Regulation (BPR) (Regulation (EU) No 528/2012) |

BPR mandates a two-step authorization process (active substance approval, then product authorization), drastically increasing R&D and compliance costs. This forces market consolidation, channels demand towards a restricted list of approved actives, and reduces market entry for new, unproven chemistries. |

|

United States |

Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) / Environmental Protection Agency (EPA) |

FIFRA registration requires extensive efficacy and safety data submission, creating high R&D costs that protect patent-holders. It directly affects the speed of market entry and encourages competition once patents expire, driving demand for innovative, protectable formulations. |

|

China |

The 14th Five-Year Plan (2021-2025) / Environmental Protection Law |

The plan sets ambitious targets for energy consumption reduction (13.5% reduction per unit of GDP) and pollution control, driving industrial end-users (e.g., pulp and paper, water treatment) to demand more efficient, lower-emission, and environmentally compliant biocide systems and chemistries. |

Biocides Market Segment Analysis

- By Type: Disinfectants

The Disinfectants segment, which includes products for surface, air, and water disinfection, exhibits demand volatility linked directly to public health events and evolving institutional cleaning protocols. This segment is driven by non-cyclical and primarily rooted in mandatory public health compliance and infection control. For instance, the verification of pathogens like SARS-CoV-2 and persistent hospital-acquired infections (HAIs) forces healthcare end-users to mandate high-efficacy, broad-spectrum disinfectants in operating rooms, patient care areas, and surface cleaning protocols. This creates demand for advanced chemistries like quaternary ammonium compounds and stabilized hydrogen peroxide formulations, moving beyond basic hypochlorite solutions. Furthermore, the commercial food & beverage sector drives constant, high-volume demand for food-grade sanitizers to meet Hazard Analysis and Critical Control Point (HACCP) standards, where the specific growth driver is a verifiable kill-rate against target microorganisms without leaving toxic residues. The need for rapid, non-residual action drives preference for oxidizers and non-aldehyde disinfectants.

- By End-User: Water Treatment

The Water Treatment end-user segment is defined by a consistent, high-volume demand driven by the continuous necessity of controlling microbial growth, a process known as biofouling, across industrial and municipal systems. Biofouling, the uncontrolled accumulation of microorganisms, reduces the efficiency of cooling towers by impeding heat transfer and increases corrosion risk in pipelines and heat exchangers, leading to costly plant downtime and infrastructure failure. The key growth driver is operational continuity and asset protection. Industrial users (e.g., power generation, refining) mandate the use of oxidizing biocides (e.g., chlorine, bromine) for broad-spectrum kill and non-oxidizing biocides (e.g., glutaraldehyde, isothiazolinones) for persistence and resistance control. The regulatory imperative to produce potable water that meets defined microbial safety standards further underpins high-volume demand in municipal water treatment, where chlorination and chloramination remain the low-cost, high-efficacy standard solution for disinfection and residual protection within distribution networks. The inelastic nature of this demand anchors a substantial portion of the global biocide market.

Biocides Market Geographical Analysis

- US Market Analysis

The US market is distinguished by its high degree of regulatory maturity under the EPA's FIFRA, which dictates product registration and market access. Local demand is heavily influenced by the high operational requirements of the country's large and sophisticated industrial base, particularly in the oil and gas sector (e.g., hydraulic fracturing water management) and chemical processing. Consumer demand is driven by high-efficacy claims for disinfectants, bolstered by active marketing and a strong presence of professional cleaning services. The market generally tolerates higher price points for formulations that demonstrate superior performance, reduced environmental risk, or offer patent protection, channeling demand toward specialized, non-generic products.

- Brazil Market Analysis

The Brazilian biocide market exhibits robust demand, largely propelled by the extensive need for sanitation in its rapidly expanding urban centers and its vast industrial and agricultural sectors. The primary local demand factor is the essential use of biocides in sugar and ethanol production for process water treatment, and in agricultural chemicals for crop protection. The need for municipal water treatment biocides is consistently high to maintain safety across wide distribution networks, particularly in tropical climates conducive to microbial proliferation. The market is moderately price-sensitive, balancing the need for effective microbial control with the imperative of maintaining low operational costs within competitive industries.

- German Market Analysis

Germany operates under the strict EU BPR regime, which heavily influences market dynamics by limiting the number of available active substances. The market exhibits sophisticated, quality-driven demand, particularly in the healthcare and industrial preservation sectors (paints and coatings). Growth drivers are focused on long-term preservative efficacy and environmental compatibility, favoring high-performance products that ensure regulatory compliance and meet stringent ecological standards. German manufacturers and end-users increasingly seek documented, risk-assessed, and often higher-priced solutions that minimize environmental impact while guaranteeing product integrity.

- UAE Market Analysis

The UAE biocide market is driven intensely by the need for high-efficacy microbial control in challenging climate conditions, specifically in Heating, Ventilation, and Air Conditioning (HVAC) systems and cooling water networks. Due to high ambient temperatures and the dependence on constant air conditioning for commercial and residential comfort, demand is anchored by the necessity of preventing Legionella and other bacterial growth in HVAC condensers and cooling towers. Furthermore, the region's heavy reliance on desalination for potable water necessitates specialized biocide treatments to prevent biofouling in energy-intensive reverse osmosis membranes, making high performance in water treatment a key, non-discretionary local demand factor.

- China Market Analysis

China represents the world’s largest producer and consumer of chemical products, including biocides. The market trend is undergoing a systemic shift, driven by two key factors: massive industrial output and rapidly tightening environmental policy. The government's 14th Five-Year Plan targets for pollutant emission reductions directly increase demand for high-efficiency, environmentally friendly biocide formulations in water treatment, paper and pulp, and manufacturing. This regulatory push forces a transition away from traditional, pollution-intensive biocides toward higher-quality, compliant products, simultaneously consolidating the market among companies capable of meeting stringent new national manufacturing and environmental standards.

Biocides Market Competitive Environment and Analysis

The Global Biocides Market is characterized by intense competition among large, integrated chemical companies that possess extensive regulatory expertise and proprietary active ingredient portfolios. The competitive advantage is rooted in vertical integration, intellectual property (patents for novel molecules and protected formulations), and the costly, proprietary regulatory dossiers required for BPR and FIFRA compliance. The ability to supply a global customer base while managing varying regional regulations and a complex supply chain dictates market leadership.

- BASF SE

BASF SE maintains a strategic position as a diversified, global chemicals leader, leveraging its extensive research capabilities to offer a broad portfolio of performance chemicals, including a comprehensive range of biocides. Its competitive strength lies in its intellectual property over key active ingredients and its ability to offer customized biocide solutions integrated with its broader chemicals offerings across multiple end-user markets, such as paints and coatings, water treatment, and energy. BASF focuses on developing sustainable solutions, such as its Preventol® and Protectol® product lines, which include technologies aimed at low VOC formulations and enhanced preservation against microbiological and fungal deterioration. The company's large scale allows it to absorb the high costs of maintaining and updating regulatory dossiers globally.

- Lonza

Lonza operates with a strategic focus on the microbial control sector, positioning itself as a specialist with a deep portfolio of high-value active ingredients and formulations. The company’s competitive edge is derived from its expertise in complex regulatory management and its proprietary chemistries in areas like wood protection, hygiene, and coatings. Lonza's biocidal product families, such as Vantocil™ and Omnicide®, target specific, high-specification applications, allowing it to command premium pricing. Lonza's strategy often involves providing customers with not just the product, but also the extensive efficacy data and regulatory support required for end-product claims, a critical value-add in highly regulated sectors like disinfectants and materials preservation.

- Kemira

Kemira is strategically focused on water-intensive industries, positioning its biocide offering as a component of comprehensive water treatment and process efficiency solutions, particularly in the Pulp & Paper and Water Solutions end-user segments. Its competitive advantage is derived from its application expertise in managing the complex microbiological challenges unique to large-scale industrial water loops and papermaking processes, such as preventing slime formation and bio-corrosion. Kemira's Water Solutions business unit provides technologies like FLOCARE™ to ensure efficient microbial control, which is directly tied to improving production yield, asset protection, and compliance with effluent discharge regulations, thus selling a solution rather than just a commodity chemical.

Biocides Market Developments

- October 2025: Kemira finalized the acquisition of Water Engineering, Inc., a US-based industrial water treatment service company. This strategic move strengthens Kemira's service model and market penetration in North America, complementing its existing biocide product portfolio with enhanced application expertise.

- May 2024: Dow announced a capacity expansion through its investment in SAS Chemicals GmbH. This extension increases the supply of high-performance sealants and adhesives used in structural glazing, indirectly impacting demand for preservatives and biocides used in these construction materials to ensure durability and mold resistance.

- February 2024: Kemira completed the divestment of its Oil & Gas related portfolio. This strategic action streamlines the company's focus and capital allocation toward its core, high-growth, water-intensive industries, including the biocide applications within water treatment and pulp & paper.

Biocides Market Segmentation:

- By Type

- Disinfectants

- Preservatives

- Pest Control

- Others

- By Source

- Synthetic

- Natural

- By Form

- Solid

- Liquid

- By End-User

- Food & Beverage

- Personal Care & Cosmetics

- Healthcare

- Water Treatment

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America