Report Overview

Global Blood Transfusion Diagnostics Highlights

Blood Transfusion Diagnostics Market Size:

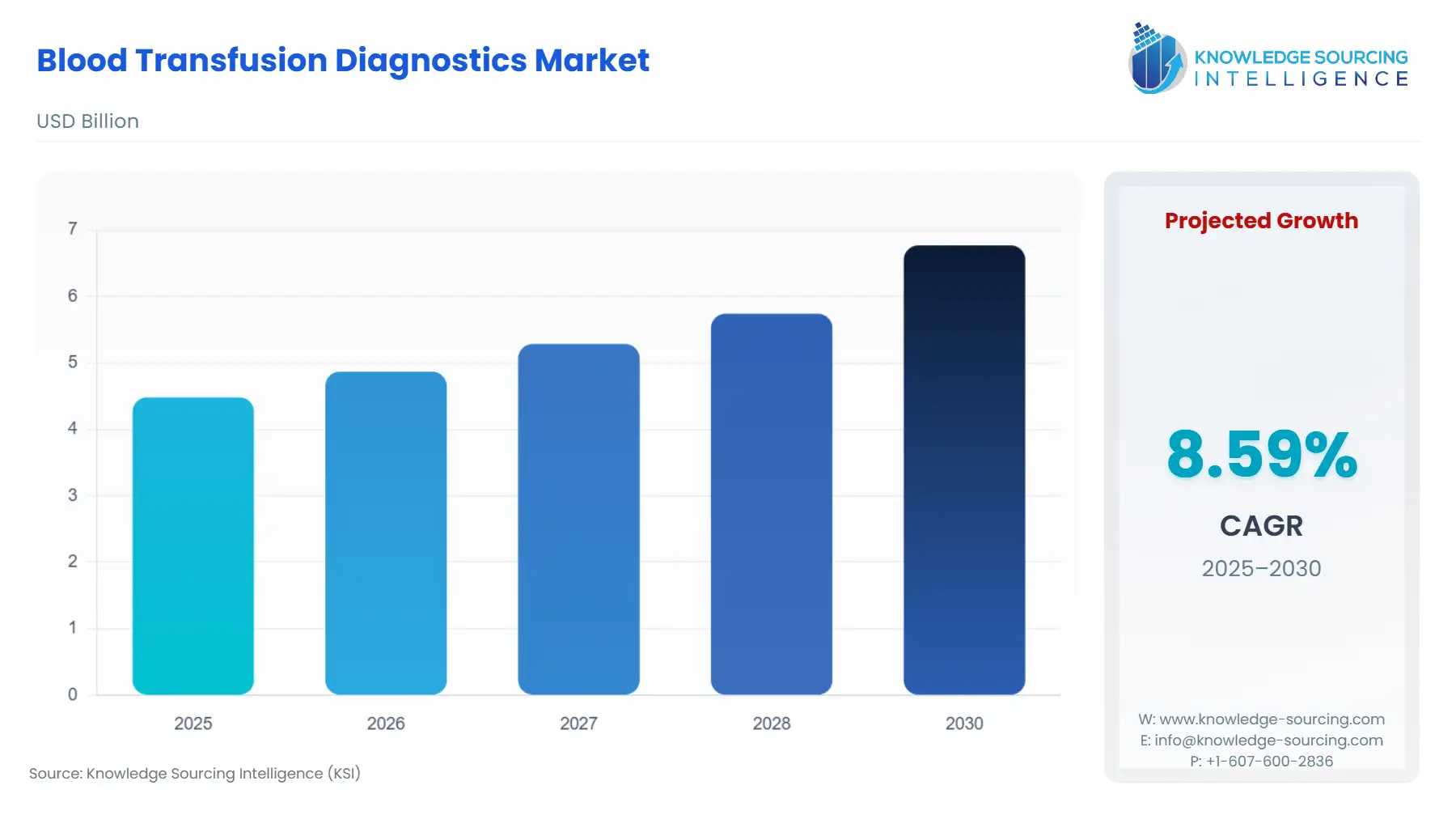

The Blood Transfusion Diagnostics market will grow at a CAGR of 8.59% from USD 4.484 billion in 2025 to USD 6.771 billion in 2030.

Blood transfusion diagnostics refers to testing conducted on blood and blood components before transfusion to patients. To avoid adverse reactions or infection transmission, each blood unit must be checked for blood group type and disease screening. It is an essential component of transfusion treatment since it offers vital information to healthcare practitioners and validates the compatibility of donor and recipient blood samples. Red blood cells are the most frequently transfused blood products. Molecular blood group diagnosis is one of the transfusion diagnostics. For patients with antibodies against clinically relevant, uncommon, or weak antigens, molecular blood group diagnosis allows for safer blood storage and on-demand supplies.

Developing and underdeveloped countries lack proper blood banks, medical equipment required for blood transfusion, adequate conditions for blood storage, and a limited supply of blood in response to high demand. Hospitals lack the necessary amenities to deliver hygienic and safe transfusions. Thus, the escalating burden of chronic disorders and the rising need for donor screening are boosting the market’s growth. Furthermore, the rising need for transfusions because of trauma, car accidents, and surgical procedures is favorably influencing the market.

The emergence of advanced molecular platforms by market leaders accelerates the transition from manual testing and equipment to semi-automated and fully automated devices. These automated systems have been critical in detecting transfusion transmissible infections (TTIs) in blood samples and can accurately remove human error throughout the transfusion procedure.

During the forecast period, North America is expected to be the largest regional market for the global blood transfusion diagnostics market. This dominance can be attributed to increased acceptance of the blood transfusion procedure, increased public awareness regarding blood donations, and developed healthcare infrastructure. According to data released by the National Center for Biotechnology Information, over 15 million blood units are transfused in the United States each year, with an estimated 85 million units transfused globally.

Blood Transfusion Diagnostics Market Growth Drivers:

- Blood and blood components are in high demand is anticipate in the market growth

The rising prevalence of blood-related conditions such as hemophilia, cancer, thrombocytopenia, and others, as well as chronic kidney disease (CKD), has increased the demand for blood transfusions. According to World Kidney Day estimates, about 850 million individuals worldwide will be suffering from kidney diseases in 2020. In addition, one out of every ten individuals has chronic kidney disease (CKD), which is predicted to become the sixth leading cause of death by the end of 2040. Furthermore, the growing number of patients suffering from anemia necessitates red blood cell transfusion for treatment, which is further driving up the demand for blood transfusion diagnostics. The World Health Organization (WHO) estimates that anaemia affects around 1.62 billion people worldwide. This, together with increased awareness regarding blood safety from infectious diseases through various initiatives in developed and developing nations, is driving up demand for blood screening tests and other diagnostic instruments.

Blood Transfusion Diagnostics Market Restraints:

- The high cost of instruments and a lack of infrastructure

Despite the rising prevalence of chronic blood disorders and increased demand for blood transfusions, several issues are impeding the market’s growth. One of the causes is a lack of investment in healthcare infrastructure and strict government policies, particularly in developing nations when compared to developed countries. Furthermore, the high cost of tests, instruments, and reagents, along with a shortage of qualified professionals to handle automated diagnostic solutions, is one of the factors restraining the growth of the blood transfusion diagnostics market during the forecast period.

Blood Transfusion Diagnostics Market Competitive Insights:

Officials from the State Blood Transfusion Council (SBTC) reported in September 2021 that supplies in Maharashtra blood banks would barely last a week. This drop was attributed to a decrease in blood donation camps, reduced donor footfall owing to the pandemic, and the closure of offices and institutions in the state.

The American Red Cross started a new nationwide initiative in September 2021 to reach out to more black blood donors to aid patients with sickle cell disease and improve health outcomes. Blood donations from individuals of the same race or ethnicity as well as blood type are the most reliable option to treat sickle cell patients.

Blood Transfusion Diagnostics Market Key Developments:

- March 2023- MedGenome Labs has introduced the FSHD1 genetic screening test, the Optical Genome Mapping Test (OGM), to assess early-stage genetic changes in patients with Facioscapulohumeral Muscular Dystrophy Type 1 (FSHD1). This advanced diagnostic tool uses advanced technology to provide a comprehensive and accurate assessment of genetic changes, detecting both large-scale insertions and duplications, as well as subtle DNA changes.

- May 2021- F. Hoffmann-La Roche Ltd and Bio-Rad Laboratories, Inc. have partnered to offer customers access to Bio-Rad's InteliQ products and Unity QC data management solutions. The partnership aims to enhance workflow efficiency and improve analytical performance in laboratories. Bio-Rad's InteliQ products, including barcoded quality control tubes, are part of the alliance.

List of Top Blood Transfusion Diagnostics Companies:

- Quotient Ltd.

- BAG Healthcare

- Abbott

- Immucor

- Diasorin SPA

Blood Transfusion Diagnostics Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.484 billion |

| Total Market Size in 2031 | USD 6.771 billion |

| Growth Rate | 8.59% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Technology, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Blood Transfusion Diagnostics Market Segmentation:

- By Type

- Instruments

- Kits & Reagents

- By Technology

- ELISA

- Western Blotting

- Nucleic Acid Amplification

- Others

- By End-User

- Hospitals & Clinics

- Diagnostic Labs

- Blood Banks

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- France

- Germany

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- Thailand

- Taiwan

- Indonesia

- Others

- North America