Report Overview

Global Crypto ATM Market Highlights

Crypto ATM Market Size:

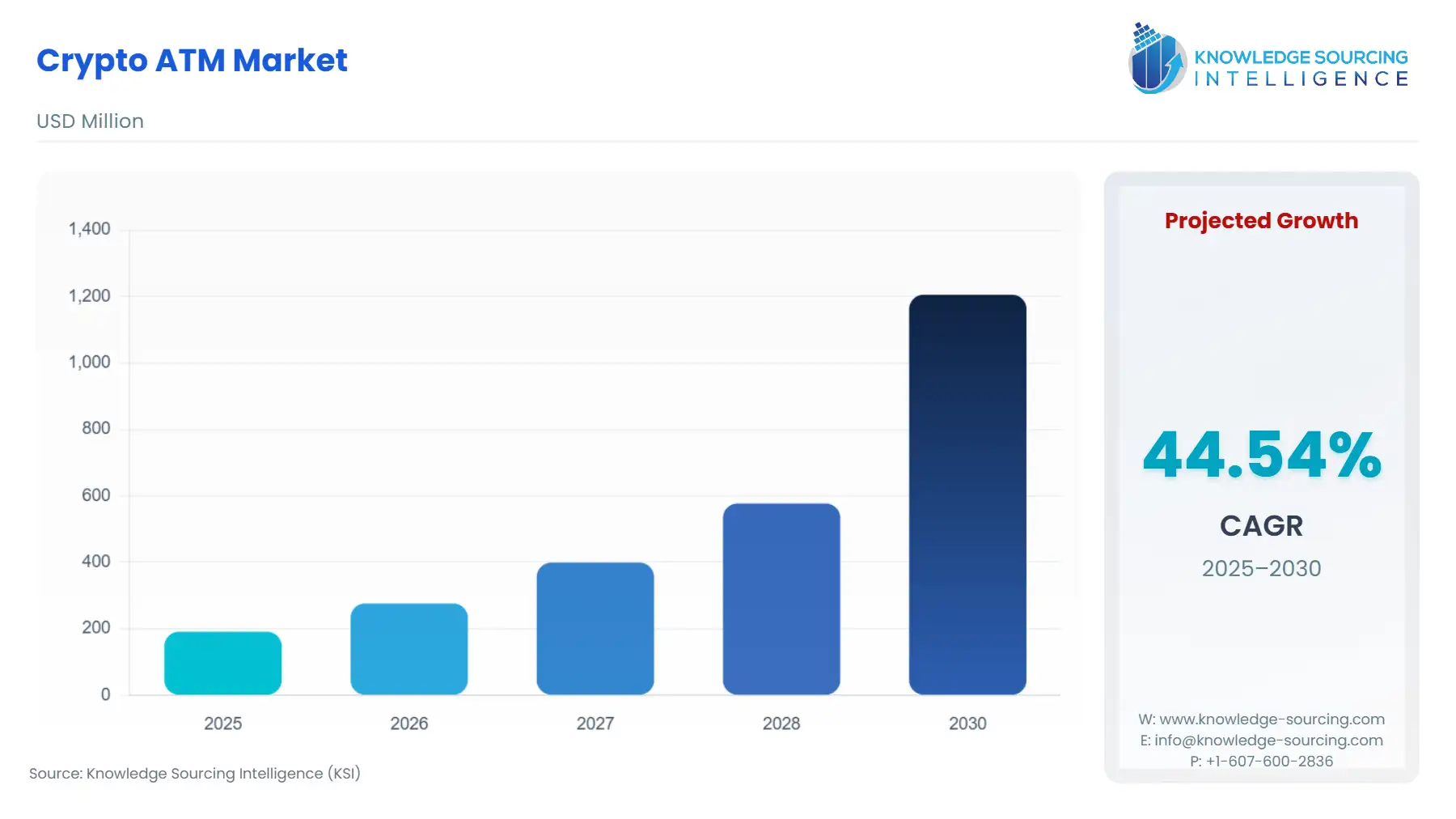

The Global Crypto ATM Market is projected to soar from USD 191.130 million in 2025 to USD 1,205.783 million in 2030, with a 44.54% CAGR.

The global crypto ATM market has experienced significant growth in recent years, driven by the increasing adoption of cryptocurrencies and the need for accessible financial services. This report delves into the key factors influencing the market, including demand drivers, challenges, regulatory impacts, and technological advancements, providing a comprehensive analysis for industry experts.

Crypto ATM Market Analysis:

Growth Drivers:

- Cryptocurrency Adoption: The rising popularity of cryptocurrencies, particularly among unbanked and underbanked populations, has led to an increased demand for accessible financial services. Crypto ATMs provide a convenient means for users to buy and sell digital currencies without the need for traditional banking infrastructure.

- Financial Inclusion: In regions with limited access to banking services, crypto ATMs offer an alternative for individuals to participate in the digital economy, facilitating remittances and microtransactions.

- Technological Advancements: Innovations in ATM technology have led to the development of more secure and user-friendly machines, enhancing customer experience and trust in crypto transactions.

Challenges and Opportunities:

Challenges:

- Regulatory Uncertainty: The lack of consistent regulations across jurisdictions poses challenges for operators, leading to compliance complexities and potential legal risks.

- Security Concerns: Instances of fraud and scams associated with crypto ATMs have raised concerns about user safety and the need for enhanced security measures.

Opportunities:

- Regulatory Developments: The evolving regulatory landscape presents opportunities for operators to engage in dialogue with policymakers to shape favorable regulations that promote industry growth.

- Market Expansion: Emerging markets with growing cryptocurrency adoption represent untapped opportunities for expanding crypto ATM networks, particularly in regions with limited banking infrastructure.

Supply Chain Analysis:

The global supply chain for crypto ATMs involves multiple stakeholders, including hardware manufacturers, software developers, compliance solution providers, and operators. Key production hubs are in North America and Europe, with logistical complexities arising from the need to ensure compliance with varying regulatory standards across regions. Dependencies on technology providers for software updates and security features are critical to maintaining operational efficiency and user trust.

Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

State-level regulations (e.g., Arizona, Vermont) |

Imposes transaction limits, disclosure requirements, and operational moratoriums, affecting deployment strategies. |

|

Australia |

AUSTRAC compliance |

Mandates Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, influencing operational costs and procedures. |

|

United Kingdom |

Financial Conduct Authority (FCA) oversight |

Prohibits unregistered crypto ATMs, leading to enforcement actions against non-compliant operators. |

Crypto ATM Market Segment Analysis:

- By Machine Type – Two-Way ATMs:

Two-way crypto ATMs, which allow both the purchase and sale of cryptocurrencies, are experiencing increased demand due to their versatility and the growing need for liquidity in digital assets. These machines cater to a broader user base, including traders and investors seeking to manage their portfolios conveniently. The ability to convert cryptocurrencies to fiat currencies and vice versa without intermediaries enhances user autonomy and aligns with the decentralized ethos of blockchain technology.

- By End-User – Retail Sector:

The retail sector is increasingly adopting crypto ATMs to cater to the growing number of customers seeking to use digital currencies for everyday transactions. Retailers benefit from attracting tech-savvy consumers and offering an additional payment option, potentially increasing foot traffic and sales. The integration of crypto ATMs into retail environments also positions businesses as forward-thinking and adaptable to emerging financial trends.

Crypto ATM Market Geographical Analysis:

United States:

The U.S. remains a dominant player in the crypto ATM market, with a significant concentration of installations. However, the regulatory landscape is becoming more stringent, with states like Arizona and Vermont implementing transaction limits and operational restrictions. These developments necessitate operators to adapt their strategies to comply with local laws while maintaining service availability.

Brazil:

Brazil's crypto ATM market is expanding, driven by increasing cryptocurrency adoption and a large unbanked population. Regulatory measures by the Central Bank of Brazil aim to standardize operations, ensuring security and compliance. Operators are focusing on strategic placements in urban centers to maximize accessibility and user engagement.

Germany:

Germany's crypto ATM market is characterized by a high level of regulatory compliance, with operators adhering to Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements. The market is mature, with a focus on enhancing user experience through advanced technology and customer support services.

India:

India's crypto ATM market is in its nascent stages, with limited installations primarily in metropolitan areas. The regulatory environment is evolving, and operators are cautiously expanding, focusing on educating users and building trust in digital currencies.

Australia:

Australia's crypto ATM market is experiencing growth, with over 1,200 installations. The Australian Transaction Reports and Analysis Centre (AUSTRAC) have established a task force to ensure compliance with AML and KYC regulations. Operators are investing in secure technologies and transparent operations to align with regulatory expectations.

Crypto ATM Market Competitive Environment and Analysis:

The global crypto ATM market is competitive, with several key players offering a range of products and services. Notable companies include:

- General Bytes: A leading manufacturer of crypto ATMs, offering both one-way and two-way machines with advanced security features and user-friendly interfaces.

- ChainBytes: Known for its customizable crypto ATM solutions, catering to various business needs and regulatory requirements.

- Bitcoin Depot: A prominent operator with a vast network of crypto ATMs, focusing on user experience and compliance with regulatory standards.

These companies are focusing on technological innovation, regulatory compliance, and customer service to maintain a competitive edge in the market.

Crypto ATM Market Recent Developments:

- July 2025: Bitcoin Depot informed approximately 27,000 users of a data breach affecting personal information collected through its crypto ATMs. The company delayed disclosure due to an ongoing federal investigation, highlighting concerns over data security and regulatory compliance.

- June 2025: The Federal Trade Commission (FTC) reported over $65 million in losses from crypto ATM scams in the first half of 2024, prompting increased regulatory scrutiny and the implementation of consumer protection measures across various states.

- December 2024: The Australian Transaction Reports and Analysis Centre (AUSTRAC) established a task force to combat the criminal exploitation of cryptocurrencies, focusing on ensuring compliance among crypto ATM providers and preventing fraudulent activities.

Crypto ATM Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 191.130 million |

| Total Market Size in 2031 | USD 1,205.783 million |

| Growth Rate | 44.54% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Machine Type, Cryptocurrency Supported, Ownership Model, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Crypto ATM Market Segmentation:

By Machine Type:

- One-Way ATMs

- Two-Way ATMs

By Cryptocurrency Supported:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Others

By Ownership Model:

- Public

- Private

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others