Report Overview

Global Human Papilloma Virus Highlights

Human Papilloma Virus (HPV) Vaccine Market Size:

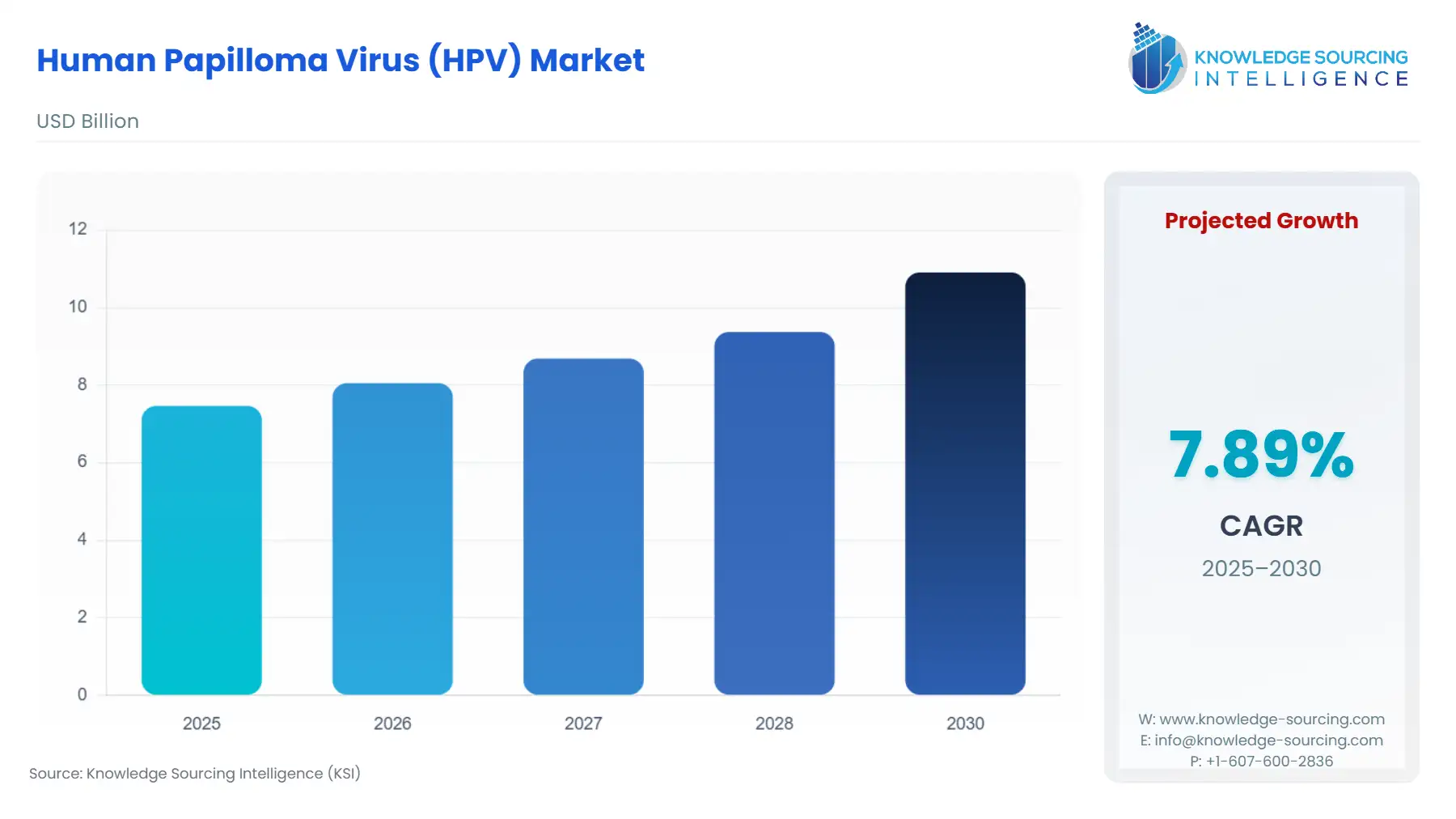

The human papilloma virus (HPV) market is expected to grow from US$7.464 billion in 2025 to US$10.909 billion in 2030, at a CAGR of 7.89%.

Human Papilloma Virus (HPV) Vaccine Market Introduction

Demand for HPV vaccines is shaped primarily by national immunization policies, global public-health targets, and the supply capacity of a concentrated group of manufacturers. Governments, donors, and public health agencies view HPV vaccination as a foundational intervention for reducing cervical cancer incidence, which has resulted in sustained procurement and long-term budget allocation. As more countries adopt single-dose schedules endorsed by leading global health agencies, the structure of vaccine demand is shifting, with ministries evaluating how to expand coverage efficiently under constrained resources.

The market’s trajectory is therefore influenced by the interplay between epidemiological priorities, manufacturer production capabilities, and policy decisions regarding dosage schedules and age cohorts. This creates a demand environment where programmatic feasibility, affordability, and product availability collectively determine uptake.

Human Papilloma Virus (HPV) Vaccine Market Analysis

- Growth Drivers

Government-backed immunization recommendations remain the strongest demand catalyst, as routine adolescent vaccination is embedded in national schedules across many regions. This ensures predictable annual procurement from public health systems. Global health agencies reinforcing single-dose efficacy have lowered operational complexity and reduced total dose requirements per individual, enabling ministries to vaccinate larger cohorts within existing budgets. Donor commitments, including large multi-year purchase agreements for low-income markets, further translate policy priorities into secured volumes. Clinical evidence demonstrating protection against high-risk HPV strains sustains strong justification for vaccine adoption, particularly in regions with high cervical cancer burdens. Together, these forces anchor stable and expanding public-sector demand.

- Challenges and Opportunities

The tariff environment in the United States exerts only a limited influence on HPV vaccine demand because most HPV vaccine doses supplied domestically—particularly the 9-valent vaccine—are manufactured within the country by established producers. Vaccines imported under Harmonized Tariff Schedule categories for biologics typically face low or zero basic duty rates, which reduces tariff-related cost pressure on public immunization programs. However, any additional trade measures applied to biologics from specific countries can raise landed costs for private-sector importers, creating localized pricing inefficiencies. When such measures occur, private healthcare providers may experience higher acquisition costs, potentially narrowing access in commercial channels where price sensitivity is higher.

Vaccine hesitancy, inconsistent adolescent health infrastructure, and limited national immunization resources in low-income regions impede full conversion of supply into administered doses. Even where procurement is funded, weak delivery systems delay coverage expansion. However, single-dose schedules create an opportunity to address these structural barriers by lowering both delivery costs and drop-out rates. Additional WHO-prequalified suppliers introduce competitive pricing that can make nationwide rollouts more financially achievable. Countries evaluating gender-neutral immunization or expanded age cohorts now face lower marginal costs, opening opportunities to strengthen population-level protection if ministries can improve school outreach, community-based delivery, and social-acceptance initiatives.

- Raw Material and Pricing Analysis

HPV vaccines rely on recombinant antigen production, sterile bioprocessing, specialized adjuvants, and cold-chain compliant packaging. Production yields, adjuvant availability, vial formats, and fill-finish capacity drive cost structures. Single-dose vials reduce contamination risk but increase packaging cost per dose, while multi-dose formats lower packaging costs but require stringent cold-chain handling to reduce wastage. The biopharmaceutical nature of HPV vaccines results in high fixed manufacturing costs, making scale crucial for price competitiveness. As additional suppliers entered the global market with regulatory approvals and prequalification, tender prices for public-sector procurement have experienced downward pressure. Cold-chain transport and last-mile logistics remain substantial components of total delivered cost in emerging markets.

- Supply Chain Analysis

HPV vaccine manufacturing is geographically concentrated, with major facilities in North America, Europe, and Asia. Production requires complex upstream bioprocessing and controlled fill-finish operations, with long cycle times that limit rapid supply expansion. Cold-chain requirements add logistical complexity, particularly for deliveries to remote regions. Recent facility expansions from leading manufacturers increased global output stability and improved supply predictability for multi-year tenders. Supply-chain dependencies include regulatory approvals for batch release, international quality-control protocols, and coordination with global procurement agencies for delivery scheduling. The effectiveness of national immunization programmes ultimately determines how efficiently manufactured doses are converted into administered vaccinations at the population level.

Human Papilloma Virus (HPV) Vaccine Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FDA approval and CDC immunization schedule |

Routine adolescent vaccination recommendations create consistent annual demand and shape commercial and public-sector purchasing. |

|

European Union |

EMA marketing authorisations and national immunization programmes |

Regulatory harmonization allows coordinated approvals, while national programme design determines actual procurement volumes. |

|

China |

National regulatory approvals and health authority guidelines |

Expanded approvals across age groups generate substantial incremental demand in a high-population market. |

Human Papilloma Virus (HPV) Vaccine Market Segment Analysis

- By Indication — Cervical Cancer

Cervical cancer remains the core indication underpinning global HPV vaccine demand. National cancer prevention strategies consistently prioritize early adolescent immunization for females, as evidence links high coverage to long-term declines in cervical cancer incidence. Ministries of health allocate resources toward vaccines that offer protection against HPV types most strongly associated with cervical lesions, making product valency a central procurement consideration. Broader-valent vaccines appeal to programmes targeting maximal oncogenic strain coverage, while lower-cost bivalent options attract countries operating under strict budget ceilings. Single-dose schedules significantly shift programme economics by reducing the number of doses required to achieve population protection, enabling ministries to expand geographic reach and include older catch-up cohorts when funding is constrained. Donor-supported procurement further amplifies cervical-cancer prevention priorities by underwriting volume commitments that reduce per-dose costs. Ultimately, cervical cancer’s public health burden makes this segment the most influential in shaping global demand, determining both procurement scale and programme design.

- By End-User — Female

Female adolescents constitute the largest and most strategically prioritized end-user segment, driven by cervical cancer prevention policies. National immunization systems design school-based delivery and community outreach initiatives specifically to reach girls aged 9–14, establishing consistent demand for vaccines validated for high-risk HPV types. Programmes with strong school attendance achieve higher uptake, while those with limited adolescent healthcare infrastructure rely on community mobilisation and campaign-style vaccination. Single-dose recommendations have strengthened demand conversion rates by removing the logistical challenge of return visits for a second dose, particularly in rural regions. Cost-effective vaccine options allow ministries to broaden coverage among adolescent girls without substantially increasing expenditure, making product selection closely tied to affordability and coverage objectives. Social acceptance and awareness campaigns play an influential role, as cultural perceptions directly affect willingness to vaccinate. Where public confidence is strong, uptake accelerates rapidly; where hesitancy persists, ministries face slow conversion from procurement to completed vaccination. Female-focused strategies therefore continue to dominate demand channels across all regions.

Human Papilloma Virus (HPV) Vaccine Market Geographical Analysis

- United States

Demand is driven by routine adolescent vaccination schedules endorsed by national public-health authorities. Insurance coverage and established paediatric care infrastructure ensure steady yearly uptake.

- Brazil

The national immunization programme integrates HPV vaccines into school-based delivery, with episodic catch-up campaigns creating spikes in public-sector demand.

- Germany

Country-level recommendations and insurer-supported access maintain stable demand, with regional school-based programmes enhancing coverage in several states.

- South Africa

Budget constraints influence programme pace, but alignment with global guidance on single-dose schedules offers a pathway to expand coverage through school platforms.

- China

Recent regulatory expansions have unlocked substantial new demand, supported by both domestic manufacturers and increased public awareness.

Human Papilloma Virus (HPV) Vaccine Market Competitive Environment and Analysis

The competitive landscape is concentrated among a small group of manufacturers. Merck maintains a dominant global position with its 9-valent product, supported by major supply agreements and recent manufacturing expansions that strengthen its ability to meet multi-year tenders. The company’s global footprint and recognized clinical profile ensure strong alignment with national programme needs.

GSK remains a key competitor with its bivalent vaccine, which continues to be incorporated into several national immunization programmes were cost and targeted oncogenic protection guide procurement decisions. Additional WHO-prequalified manufacturers have introduced greater pricing competition, particularly in low-income markets, although they remain in earlier stages of global scale-up and distribution.

Human Papilloma Virus (HPV) Vaccine Market Developments

- In March 2025, Merck inaugurated a $1 billion vaccine manufacturing facility in Durham, North Carolina, to produce bulk for its HPV vaccines.

- In October 2024, WHO added Cecolin® (a Chinese-produced HPV vaccine) to its list of single-dose-approved vaccines, based on evidence that supports its use in a one-dose schedule.

- In March 2024, Merck announced plans to start clinical development of a novel multi-valent HPV vaccine (beyond its existing types) that would cover additional HPV strains prevalent in African and Asian populations.

Human Papilloma Virus (HPV) Vaccine Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Human Papilloma Virus (HPV) Vaccine Market Size in 2025 | US$7.464 billion |

| Human Papilloma Virus (HPV) Vaccine Market Size in 2030 | US$10.909 billion |

| Growth Rate | CAGR of 7.89% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Human Papilloma Virus (HPV) Vaccine Market |

|

| Customization Scope | Free report customization with purchase |

The human papilloma virus (hpv) vaccine market is analyzed into the following segments:

- By Type

- Quadrivalent HPV Vaccine

- Bivalent HPV Vaccine

- 9-Valent HPV Vaccine

- By Indication

- Cervical Cancer

- Anal Cancer

- Vaginal Cancer

- Vulvar Cancer

- Mouth Cancer

- Genital Warts

- By Gender

- Male

- Female

- By Geography

- North America

- USA

- Mexico

- Canada

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- India

- China

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America