Report Overview

Global Non-Optical Magnetometer Market Highlights

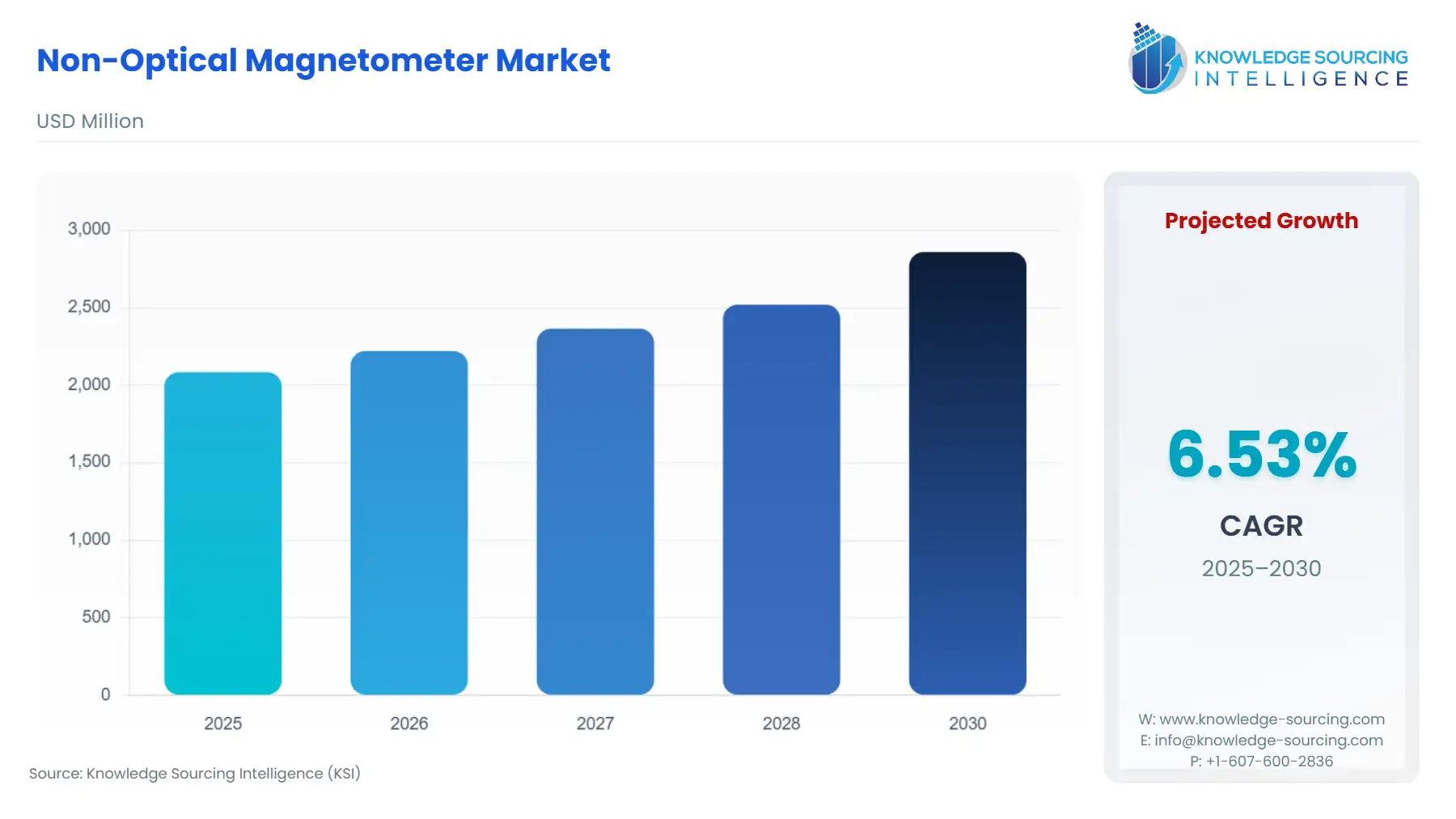

Non-Optical Magnetometer Market Size:

The Global Non-Optical Magnetometer Market is expected to grow from US$2.084 billion in 2025 to US$2.859 billion in 2030, at a CAGR of 6.53%.

The global Non-Optical Magnetometer Market is transitioning from a reliance on traditional Hall-effect and Anisotropic Magnetoresistance (AMR) technologies toward high-performance, compact solutions based on Tunnel Magnetoresistance (TMR) and Giant Magnetoresistance (GMR) effects. This strategic shift is fundamentally driven by the critical need for enhanced accuracy, lower power consumption, and resilience against electromagnetic interference, particularly in safety-critical and space-constrained applications. As integration density increases and sensor-fusion architectures become standard, the non-optical magnetometer moves from a standalone component to an essential subsystem within complex electronic control units. The market's competitive dynamics reflect this technological pivot, with leading integrated device manufacturers (IDMs) actively investing in 18nm FD-SOI (Fully Depleted Silicon-on-Insulator) and TMR-specific fabrication processes to gain a decisive advantage in the high-volume Automotive and Consumer Electronics segments.

Global Non-Optical Magnetometer Market Analysis

- Growth Drivers

The electrification of the automotive fleet (xEV) acts as the dominant growth catalyst. Electric and hybrid vehicles fundamentally require high-accuracy non-optical magnetometers—specifically Hall-effect or TMR-based current sensors—to monitor battery health, manage power electronics, and enable efficient motor commutation. Similarly, the relentless drive toward miniaturization in consumer electronics propels demand for compact, high-sensitivity TMR sensors that offer superior performance over bulkier Hall devices in compassing, camera optical image stabilization (OIS), and augmented reality applications. These trends mandate higher sensor count per device, directly multiplying the total market volume for non-optical magnetometers.

- Challenges and Opportunities

A primary challenge remains the long-term supply stability and cost volatility of key raw materials, particularly the rare-earth elements used in the permanent magnets that non-optical magnetometers rely on for operation, which can limit demand elasticity. Conversely, a significant opportunity emerges from the integration of artificial intelligence (AI) at the tiny edge. Embedding the sensor and its processing unit (e.g., in a System-in-Package) enables the magnetometer to perform local sensor fusion and pre-processing, minimizing data latency and reducing computational load on the main system controller. This technological convergence creates substantial new demand for advanced, highly integrated sensor systems capable of delivering actionable data rather than raw magnetic field strength readings.

- Raw Material and Pricing Analysis

Non-optical magnetometers are solid-state electronic devices whose cost structure is dictated by two primary components: the semiconductor wafer and specialized magnetic materials. Pricing is highly sensitive to the global semiconductor cycle, as the devices are manufactured in standard or modified CMOS processes. For high-performance GMR and TMR sensors, the price is further influenced by the cost and geopolitical concentration of rare-earth elements (e.g., Neodymium and Dysprosium) utilized in the paired permanent magnets, which are essential for creating the bias field or the external field being measured. The capital expenditure required for advanced cleanroom deposition of the magnetic thin-films (such as Permalloy or specialized metallic multi-layers) enforces high barriers to entry, maintaining unit price stability among established high-volume manufacturers.

- Supply Chain Analysis

The non-optical magnetometer supply chain is structurally analogous to the global semiconductor model, characterized by deep specialization. Design and Intellectual Property (IP) generation largely reside in North America and Europe. Manufacturing concentrates in East Asia (China, Taiwan, South Korea, Japan) due to the presence of high-volume, cost-efficient foundries capable of 8-inch and 12-inch wafer fabrication, often employing specialized processes for magnetic thin-film deposition. Logistical complexity arises from the single-source dependence on key raw material suppliers and the need for rigorous, high-temperature testing protocols (especially for AEC-Q100 certified automotive parts), leading to potential bottlenecks and extended lead times in a high-demand environment.

Non-Optical Magnetometer Market Government Regulations

Regulatory frameworks significantly impact market structure by imposing material standards and controlling technology diffusion, thus creating mandated demand for compliant products.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Export Administration Regulations (EAR) / Commerce Control List (CCL) Category 6 |

Controls the export of high-sensitivity magnetometers, particularly those exceeding specified noise levels, for defense and aerospace applications. This necessitates domestic sourcing or extensive compliance overhead for foreign sales, restricting international market size for defense-grade sensors. |

|

European Union |

Restriction of Hazardous Substances (RoHS) Directive |

Mandates the elimination of hazardous substances, like lead, in electronic equipment. Directly drives a complete redesign of existing sensor packages (e.g., from lead-based solder pastes to lead-free alternatives), creating compulsory, time-bound replacement demand for RoHS-compliant products. |

|

China |

Made in China 2025 / National Standards (GB Standards) |

Supports and incentivizes the domestic development and procurement of high-end sensors, including non-optical magnetometers. This national policy fosters captive demand for local manufacturers while imposing increasingly rigorous quality benchmarks on foreign suppliers seeking to serve the Chinese market. |

Non-Optical Magnetometer Market Segment Analysis

- By Application: Consumer Electronics

The consumer electronics segment is an extraordinary volume driver, with demand explicitly focused on miniaturization, low power consumption, and high magnetic immunity—requirements that only advanced GMR and TMR sensors can meet. The primary growth factor is the integration of high-accuracy compassing (e.g., electronic compass for pedestrian navigation and geo-location services), which improves the reliability of location-based applications in magnetically noisy urban environments. Furthermore, the mass proliferation of wearable devices, requiring ultra-low-power non-optical magnetometers to extend battery life while providing motion tracking and contactless payment sensing, drives immense demand. The competition among manufacturers to integrate these advanced functions into ever-slimmer devices forces continuous technological replacement, creating a high-velocity product refresh cycle that sustains market growth independent of new geographic expansion. The cost of the sensor is secondary to its form factor and power profile in this application.

- By Application: Automotive

The automotive segment requires the highest performance and reliability, concentrating demand on Absolute Magnetometers for critical current and position sensing tasks. The transition to electric and hybrid vehicles necessitates highly precise, temperature-stable current sensors (Hall or TMR-based) to accurately monitor the high currents (>100A) flowing to and from the battery pack and motors. This is crucial for both functional safety (ASIL compliance) and maximizing battery range. Additionally, Relative Magnetometers are indispensable for non-contact angle sensing in Electric Power Steering (EPS) and throttle position monitoring, where failure can be catastrophic. The rigorous AEC-Q100 qualification standard acts as a demand filter, restricting the market to a few proven, large-scale manufacturers who can guarantee stability and supply longevity, favoring TMR and robust Hall-effect solutions over less reliable alternatives.

Non-Optical Magnetometer Market Geographical Analysis

- US Market Analysis

The US market for non-optical magnetometers is bifurcated, driven by two high-value segments: defense/aerospace and high-performance automotive. Demand in the defense sector is directly proportional to government investment in GPS-denied navigation and magnetic anomaly detection (MAD) for submarines and airborne systems, creating a stable, high-margin market for highly specialized Fluxgate and advanced TMR sensors subject to strict EAR regulations. In the industrial and automotive sectors, the local factor is the robust presence of electric vehicle startups and established OEMs, which creates localized, high-specification demand for AEC-Q100 qualified current and position sensors. Domestic manufacturers benefit from favorable procurement policies in the defense segment, concentrating a portion of high-end demand domestically.

- Brazil Market Analysis

Market dynamics in Brazil are largely influenced by the size of the domestic industrial automation and heavy machinery sector, which drives demand for durable, robust, and cost-effective magnetic position sensors. The demand centers on low-to-mid-range Hall-effect and AMR-based sensors for non-contact linear and angular position sensing in agricultural equipment and industrial infrastructure. Import tariffs and complex logistics create a price sensitivity that favors magnetometers produced by local integrators or those with established South American distribution networks. Furthermore, the slow but accelerating adoption of advanced automotive safety systems in locally manufactured vehicles gradually opens demand for higher-precision Relative Magnetometers, but the total volume remains limited compared to North America or Europe.

Germany Market Analysis

Germany's market represents the apex of precision engineering and high-value manufacturing, concentrating demand for non-optical magnetometers in the premium automotive and sophisticated industrial automation sectors. The requirement is explicitly for high-linearity TMR and high-resolution GMR sensors used in motor commutation for advanced robotics and precision-guided systems. The strict quality and long-term reliability standards (VDA and AEC-Q100) imposed by major German automotive OEMs, coupled with high environmental compliance mandates (RoHS/REACH), mandate a preference for highly qualified European and select international IDMs. This creates an intense focus on minimizing noise, hysteresis, and temperature drift in the sensor, driving technological development.

- UAE Market Analysis

The UAE's market is overwhelmingly centered on energy sector infrastructure, logistics, and smart city development. The primary growth drivers for non-optical magnetometers are Fluxgate sensors for high-accuracy pipeline monitoring (magnetic signature analysis) and robust Hall-effect sensors for position sensing in automated port and logistics equipment that must withstand harsh desert environments (high heat, dust). Furthermore, the government's investment in advanced defense and surveillance capabilities creates a niche, high-specification demand for sensitive absolute magnetometers. The local factor here is the extreme operating environment, which dictates that sensors must possess superior thermal stability and ingress protection (IP) ratings.

- China Market Analysis

China is the world’s largest volume market, propelled by the rapid scale-up of consumer electronics manufacturing and the domestic electric vehicle industry. The "Made in China 2025" initiative directly fuels mass domestic requirements, specifically targeting self-sufficiency in high-end sensors. This generates immense volume demand for all non-optical magnetometer types (Hall, AMR, TMR, and GMR) for use in smartphones, laptops, and the largest global EV production base. Local manufacturers benefit from favorable policy and are rapidly closing the technological gap in TMR sensors. The sheer scale of domestic assembly lines makes this region a critical driver of overall global volume and a primary source of competitive pricing pressure.

Non-Optical Magnetometer Market Competitive Environment and Analysis

The competitive landscape is characterized by a mix of large-scale integrated device manufacturers (IDMs) offering a broad portfolio and specialized firms focusing on high-precision niche technologies. Competition centers on achieving the optimal balance between high sensitivity/low noise (TMR/GMR) and cost-efficiency/robustness (Hall-effect). Major players leverage their semiconductor fabrication scale and deep integration with Tier 1 automotive and consumer electronics customers to maintain dominance.

- Honeywell International, Inc.

Honeywell is strategically positioned as a leader in high-reliability, harsh-environment sensing solutions, primarily targeting the aerospace, industrial automation, and high-end transportation markets. Their core strength lies in their patented use of Anisotropic Magnetoresistance (AMR) and proprietary Magnetoresistive (MR) arrays for their SMART Position Sensor product family. This portfolio, including the Linear, Arc, and Rotary SMART Position Sensors, is designed for non-contact, absolute position sensing. Their sensors use a combination of an ASIC and an array of MR sensors to determine a magnet's position with enhanced accuracy, emphasizing durability and reliability in applications such as valve position monitoring and aircraft actuation systems.

- Infineon Technologies AG

Infineon maintains a leading market position through its extensive XENSIV™ magnetic sensor portfolio, which spans basic Hall-effect devices up to advanced TMR-based solutions. The company's strategic focus is heavily weighted toward the automotive sector, where its magnetic sensors are critical components for Advanced Driver Assistance Systems (ADAS), chassis control, and xEV battery current sensing. A key strategic positioning element is the launch of high-precision TMR devices, such as the XENSIV™ TLI5590-A6W magnetic position sensor (announced January 2024), which leverages linear TMR technology to replace traditional Hall sensors and optical encoders in small, high-precision industrial and consumer applications. This TMR push is a direct strategy to capture the high-growth, high-accuracy market segments.

- STMicroelectronics N.V.

STMicroelectronics is a key competitor in the Consumer Electronics and Industrial segments, leveraging its status as a top MEMS manufacturer to integrate non-optical magnetometers (including 3-axis devices) into a broad range of sensor-fusion systems. The company's strategy involves the continuous miniaturization and integration of magnetic sensors with microcontrollers, often utilizing their iNEMO Engine Sensor Fusion software for seamless integration with accelerometers and gyroscopes for 9-degrees-of-freedom (9-DOF) sensing. Their recent strategic efforts, including the acceleration of wafer fab capacity to 300mm Silicon (announced October 2024), aim to reinforce their capability to supply high-volume, cost-competitive, integrated sensor solutions for mass-market applications like wearable devices and mobile phones.

Non-Optical Magnetometer MarketRecent Market Developments

- October 2024: STMicroelectronics N.V. announced a company-wide program to accelerate its manufacturing footprint, focusing on 300mm Silicon wafer capacity and 200mm Silicon Carbide. This strategic capacity addition aims to improve operating efficiency and strengthen the company's long-term capability to supply high-volume semiconductor products, including magnetic sensors, to the Automotive and Industrial markets.

- March 2024: STMicroelectronics disclosed the advancement of a new manufacturing process based on 18nm Fully Depleted Silicon-On-Insulator (FD-SOI) technology with embedded Phase Change Memory (ePCM). This capacity enhancement is set to improve cost competitiveness and power efficiency for their next-generation microcontrollers, which are frequently integrated with the company’s magnetic sensor products.

- January 2024: Infineon Technologies AG introduced the XENSIV™ TLI5590-A6W magnetic position sensor, leveraging linearized Tunnel Magnetoresistance (TMR) technology for linear and angular incremental position detection. Qualified for industrial and consumer use, the small wafer-level package sensor replaces optical encoders and Hall sensors for high-precision motion detection in applications like camera zoom/focus adjustment.

Non-Optical Magnetometer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Non-Optical Magnetometer Market Size in 2025 | US$2.084 billion |

| Non-Optical Magnetometer Market Size in 2030 | US$2.859 billion |

| Growth Rate | CAGR of 6.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Non-Optical Magnetometer Market |

|

| Customization Scope | Free report customization with purchase |

Non-Optical Magnetometer Market Segmentation:

- By Type

- Absolute Magnetometer

- Relative Magnetometer

- By Application

- Automotive

- Manufacturing

- Consumer Electronics

- Communication

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America