Report Overview

Global Otoscope Market - Highlights

Otoscope Market Size:

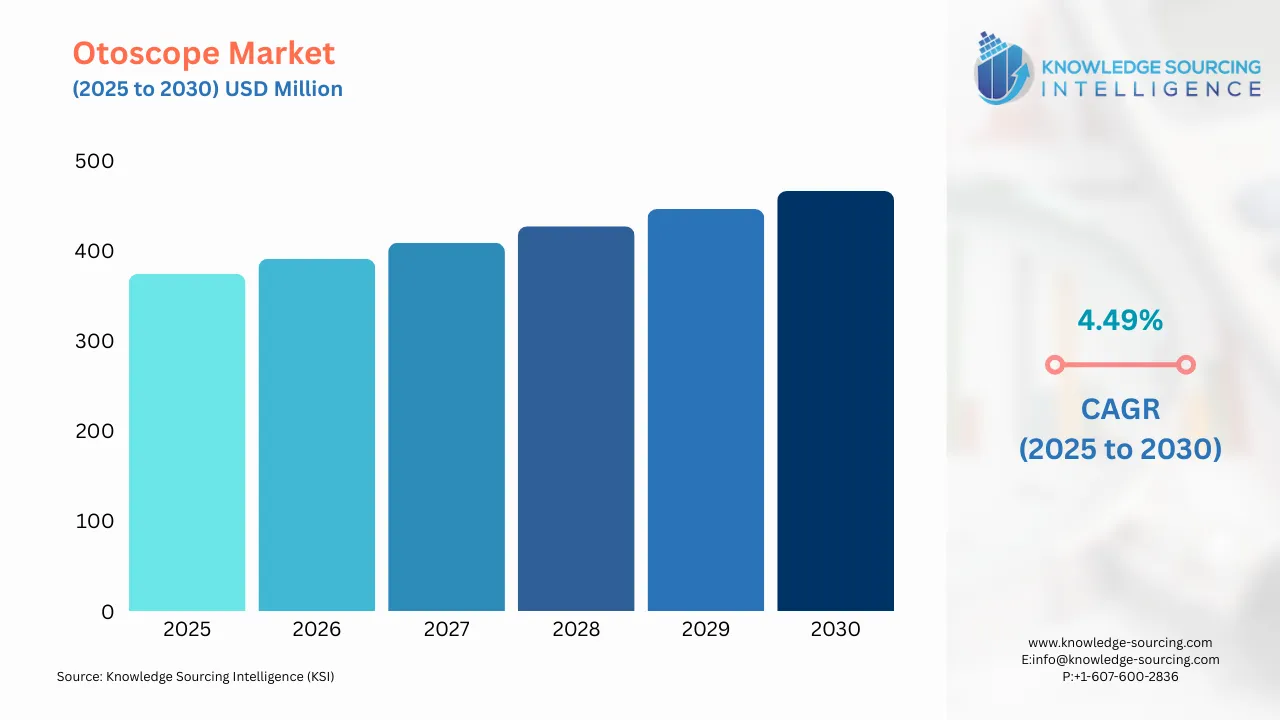

The global otoscope market is projected to grow at a CAGR of 4.49%, from US$374.297 million in 2025 to US$466.245 million in 2030.

There are a growing number of cases of otitis media, which is a disease caused due to inflammation in the middle region of the ear. It is of two types: Acute Otitis Media and Otitis Media with Infusion. On the other hand, Otitis externa, which is a disease also known as the swimmer's ear, affects the outer part of the ear. The most common causes for ear infections are the entry of bacteria or viruses in the middle ear, or most often, it can result from colds, cases of flu, and allergies, which eventually result in congestion and swelling of the nasal passages, throat, and Eustachian tubes.

Acute otitis media is among the most common and accounts for 10% to 15% of all the cases for which younger patients visit the doctor. In addition, there are approximately 60% to around 85% of children suffer from acute otitis media (AOM) during the first year of their lives. Therefore, these increasing cases of ear infections among children and the geriatric population are causing a spike in the demand for otoscopes globally and fuelling market growth over the forecast period.

Otoscope Market Growth Drivers:

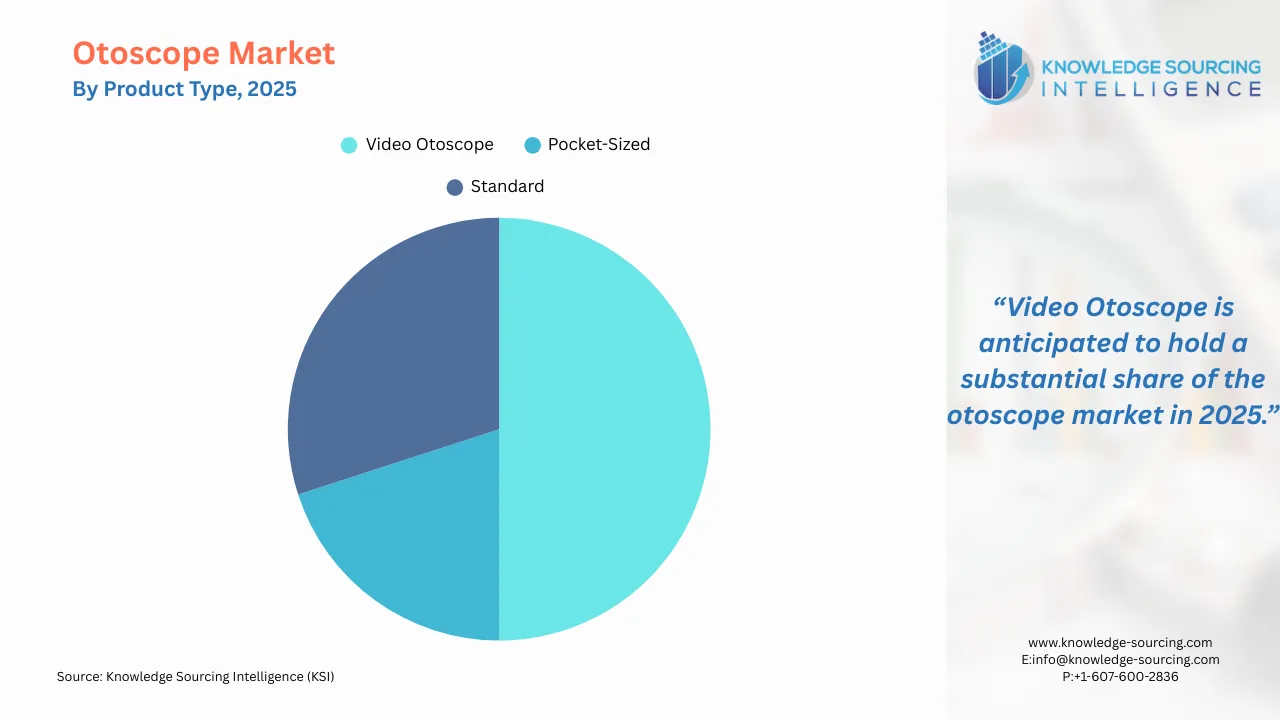

- Increasing demand for video otoscopes by medical physicians

Medical physicians' increasing demand for video otoscopes is driven by their ability to provide enhanced visualization of the ear canal and tympanic membrane, enabling more accurate diagnoses and better patient outcomes. These devices offer high-resolution imaging, which improves the detection of conditions such as infections, blockages, and structural abnormalities. Video otoscopes also aid in educating patients because the patient can view the actual image of his condition, thus creating a better understanding and adherence to the treatment plan. The increasing adoption of telemedicine and remote healthcare services has increased the demand for video otoscopes because they can provide virtual consultations and increase the efficiency of diagnosis.

In addition, they are preferred more by ENT specialists and physicians as they can provide a clearer picture of the underlying problems, and thus, the patients can receive much better treatment and advice.

The introduction of advanced otoscopes featuring enhanced technologies, such as ultrasonic transducers and improved magnification, along with qualities like durability and overall performance, is expected to boost adoption rates. This trend is likely to drive significant market growth in the coming years as both established and new companies enter various markets.

Olympus, among the leading companies involved in providing products and solutions catering to different applications in a range of industries, also offers a portfolio of products in the medical systems category, which is otoscopes. They offer two products: "TRUEVIEW II Otoscope 1.9mm” and” TRUEVIEW II Otoscope 2.7mm”. The former product is based on advanced fiber technology, which can facilitate the display of images with superior quality and has a small insertion diameter of 1.9mm. The otoscope product is also fully autoclavable to decontaminate and sanitize it effectively. The latter product offers features such as high durability and boasts of an ergonomic design. In addition, it can facilitate easy handling in every otoscopic application and is easy to set up and reprocess.

Moreover, Welch Allyn, which is one of the leading companies involved in the provision of different products and solutions relating to the ophthalmic and otoscopy applications, among other products, offers their product called the “MacroView Octoscope”. This product is advanced in handheld otoscopy. It has enhanced features such as doubling the field of view and a much better and higher amplification rate. The enlarged view, thus obtained, can provide an easier view of the middle ear. In addition, it has features such as adjustable focus for variable earways or farsighted eyes. It can support fiber optics without interference and offers secure tip fastening of the ear specula.

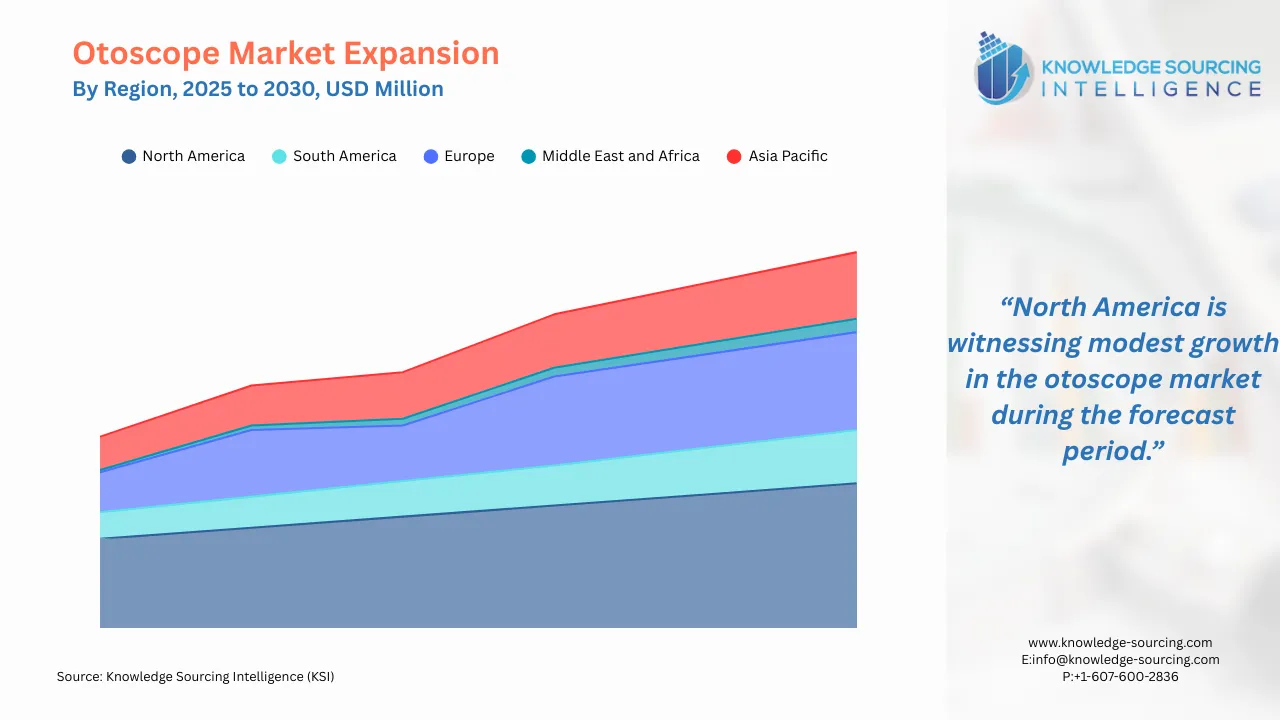

Otoscope Market Geographical Outlook:

- The global otoscope market is segmented into five regions worldwide

Geography-wise, the global otoscope market is divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The European otoscope market is driven by several factors, reflecting improvements in healthcare technology, increasing awareness of ear-related health issues, and growing demand for diagnostic tools. The rise in the aging population with diseases such as otitis media and hearing loss further increases the prevalence of ear disorders, which require advanced otoscopes for proper diagnosis and treatment. For instance, in terms of the proportion of the population that is 65 years of age or older, the highest shares were found in Italy (24.0%), Portugal (24.0%), Finland (23.3%), Bulgaria (23.5%), Croatia (22.7%), and Greece (23.0%), while the lowest shares were found in Luxembourg (14.9%) and Ireland (15.2%). As people age, deafness becomes more common. More than 25% of adults over 60 suffer from debilitating hearing loss.

Deafness is also one of the reasons propelling the otoscope market in the projected period. For instance, according to the Consortium for Research in Deaf Education, approximately 45,671 children will be deaf in the United Kingdom in 2023. London has the highest number of deaf people in the country, standing at 7,654, followed by North West, where 6,308 children have deafness. Hence, the increasing prevalence of deafness in the country is anticipated to fuel the market growth in the projected period.

Technological advancements, like digital and video otoscopes, are offering more advanced images and are embraced by healthcare practitioners for enhanced diagnosis. There has also been an increase in telemedicine services across Europe, increasing demand for the otoscope since it allows consultation and diagnosis to be made from a distance. Increasing healthcare spending and further government policies to increase access to primary care also contribute to market growth. The increased acceptance of portable and user-friendly otoscope devices among general practitioners and ENT specialists is also supporting the market expansion. Growing emphasis on early diagnosis and preventive care further drives the regional demand for otoscopes.

Otoscope Market Recent Developments:

- In March 2024, Inventis, a leader in audiology and balance solutions, introduced Harmonica's first digital video otoscope for general ear examination. This makes comprehensive ear examination revolutionary, bringing greater clarity, efficiency, and user-friendliness, making the diagnostic advantage exceptional for healthcare professionals.

- In September 2024, Remmie built an otoscope with a camera instead of a lens that lets parents and caregivers take pictures of a child's ears, nose, and throat, which helps the doctor diagnose conditions further off.

List of Top Otoscope Companies:

- Hill-Rom Services, Inc

- Rudolf Riester GmbH

- American Diagnostic Corporation

- Gurin Products LLC

- Prestige Medical

Otoscope Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Otoscope Market Size in 2025 | US$374.297 million |

| Otoscope Market Size in 2030 | US$466.245 million |

| Growth Rate | CAGR of 4.49% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Otoscope Market |

|

| Customization Scope | Free report customization with purchase |

The otoscope market is analyzed into the following segments:

- By Product Type

- Standard

- Pocket-Sized

- Video Otoscope

- By Power Source

- Battery Operated

- Disposable

- Rechargeable

- Electrically Powered

- By Light Source

- Light Bulb

- Direct Light

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports:

- Blood Pressure Monitoring Devices Market

- Smart Medical Device Market

- Refurbished Medical Equipment Market

Navigation

- Otoscope Market Size:

- Otoscope Market Key Highlights:

- Otoscope Market Growth Drivers:

- Otoscope Market Geographical Outlook:

- Otoscope Market Recent Developments:

- List of Top Otoscope Companies:

- Otoscope Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 11, 2025