Report Overview

Global Pipeline and Process Highlights

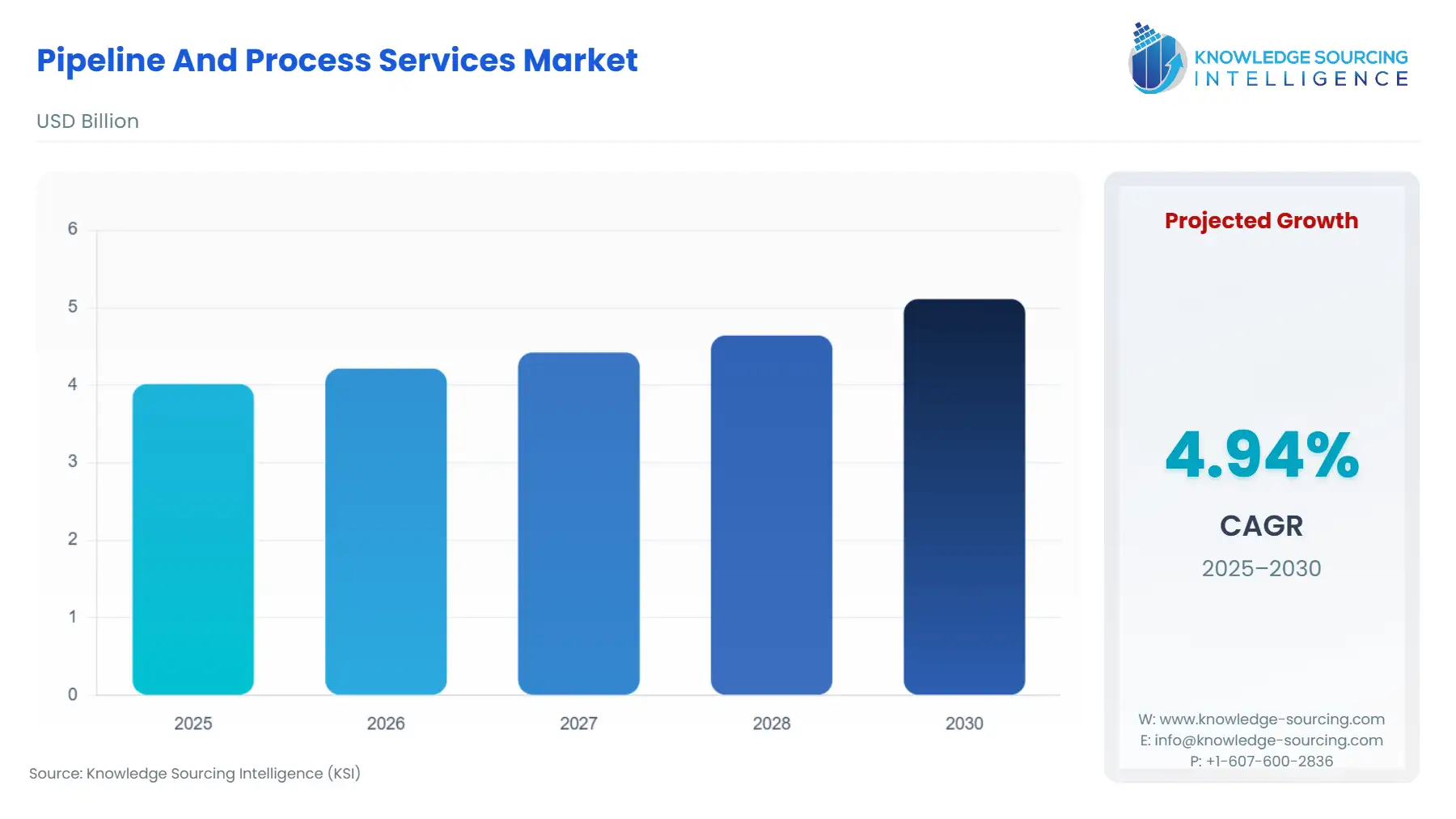

Pipeline and Process Services Market Size:

The Pipeline And Process Services Market will grow from USD 4.016 billion in 2025 to USD 5.111 billion in 2030, fueled by a 4.94% CAGR.

Pipeline and Process Services Market Trends:

The market of pipeline & process services is expected to drive by increasing demand for natural gas & crude oil (mainly, from the Asia Pacific), increasing investments in infrastructural developments, and increasing the need for connectivity drive. The growth of the pipeline and process services market is restrained by the increasing demand and uses of renewable sources of energy, and technical and political instability problems by cross-border projects in the Middle East and the Asia Pacific regions.

Pipeline and Process Services Market Segment Analysis:

By asset type, the pipeline and process services market is segmented by process and pipeline, where the process segment is expected to have significant growth in the forecast period majorly for pre-commissioning operations in the Middle East, North Africa, and the Asia Pacific regions, while the pipeline segment accounts for the significant market share and is also projected to have a potential growth in the forecast period. The pipeline segment is more demanding in the coming future due to the convenient transportation of the products, such as oil & gas, and so on. Pipelines are generally made of carbon steel, steel, and plastic cylinders. In short term, North America is expected to have the highest growth in pipeline and process services, whereas, the Middle East and Africa is having the potential to grow in the forecast period due to increasing demand for LNG vessels. The pipeline sector is further segmented into transmission and distribution, where distribution is having the largest market share. The process sector is segmented into FPS, Refinery & Petrochemical, and Gas Storage & Processing. The market by operations is segmented by pre-commissioning, commissioning, decommissioning, Maintenance, and others. Among them, a significant share of the market is accounted for by pre-commissioning and commissioning segments. The driving force for the growth of this segment is the higher volume of activities of gas processing and pre-commissioning in the Middle East and North Africa region, and that of refinery activities in the Asia Pacific region.

Pipeline and Process Services Market Key Developments:

The Middle East and African countries (mainly, Saudi Arabia and Iran) have been attracting companies to invest in there due to the new developmental projects and expansions of the refineries and storage & processing activities. EnerMech has invested in a new process, pipeline, and umbilical services division of $20 million and has been appointed as one of the industries leading pipeline experts to head up the unit. In 2019, Marathon Petroleum Corporation and Andeavor Logistics have merged with the former one for $23 billion, in order to expand the midstream company in the Marcellus shale and Permian Basin.

Refinery and Petrochemical Integrated Development project has been started to increase the production of refined petrochemical products, where Petronas and Saudi Aramco have invested $7 billion to expand the capacity in Malaysia. Turkmenistan – Afghanistan – Pakistan – India (TAPI) natural gas pipeline construction will begin in 2021 in Turkmenistan of 1125 miles, $33 billion cum/year. The pipeline runs 133 miles in Turkmenistan, 480 miles in Afghanistan, 512 in Pakistan, and the Indian border.

The Ajaokuta-Kaduna-kano pipeline (614 km long) project has been commissioned in 2020 by the NNPC (Nigerian National Petroleum Corporation) with an estimated cost of $2.8 billion. The aim of building the pipelines is to connect the regions of Nigeria to strengthen the industrial sector. Also, to boost the electricity sector, increase the domestic gas use, and increase the revenue of Nigeria by increasing the exports.

Pipeline and Process Services Market Regional Analysis:

- APAC to witness lucrative growth

The Asia Pacific is the region with the huge potential to grow in the pipeline and process services market. The market’s growth in this region is driven by the increasing demand for crude oil and natural gas, by increasing investments in the infrastructures of pipelines and transportation facilities. India and China are the potential regions in the Asia Pacific, due to the increase in the demand for natural gas and oil, and industrialization. In India, the world’s largest refinery project has been initiated to promote the growth of the energy sector with an investment of INR 3 Lacs crore. This project has been started by Indian Oil Corporation Ltd, Bharat Petroleum Corporation Ltd, and Hindustan Petroleum Corporation Ltd to fulfill domestic demand. This project is expected to add further investments in the future by at least 20% more. The refinery has been planned to commission by 2025 and will produce Euro-VI and high-quality automotive fuels along with providing convenient exports and imports.

List of Top Pipeline and Process Services Companies:

- Halliburton

- BHGE

- Enermech

- IKM

- Hydratight

Pipeline and Process Services Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.016 billion |

| Total Market Size in 2031 | USD 5.111 billion |

| Growth Rate | 4.94% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Asset Type, Operations, Location of Deployment, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Pipeline and Process Services Market Segmentation:

- By Asset Type

- Pipeline

- Process

- By Operations

- Commissioning

- Decommissioning/Troubleshooting

- Maintenance

- Others

- By Location of Deployment

- Offshore

- Onshore

- By End-users

- Power generation

- Chemicals & Refined products

- Water & wastewater

- Oil & Gas

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America