Report Overview

Global Yttrium Market Report, Highlights

Yttrium Market Size:

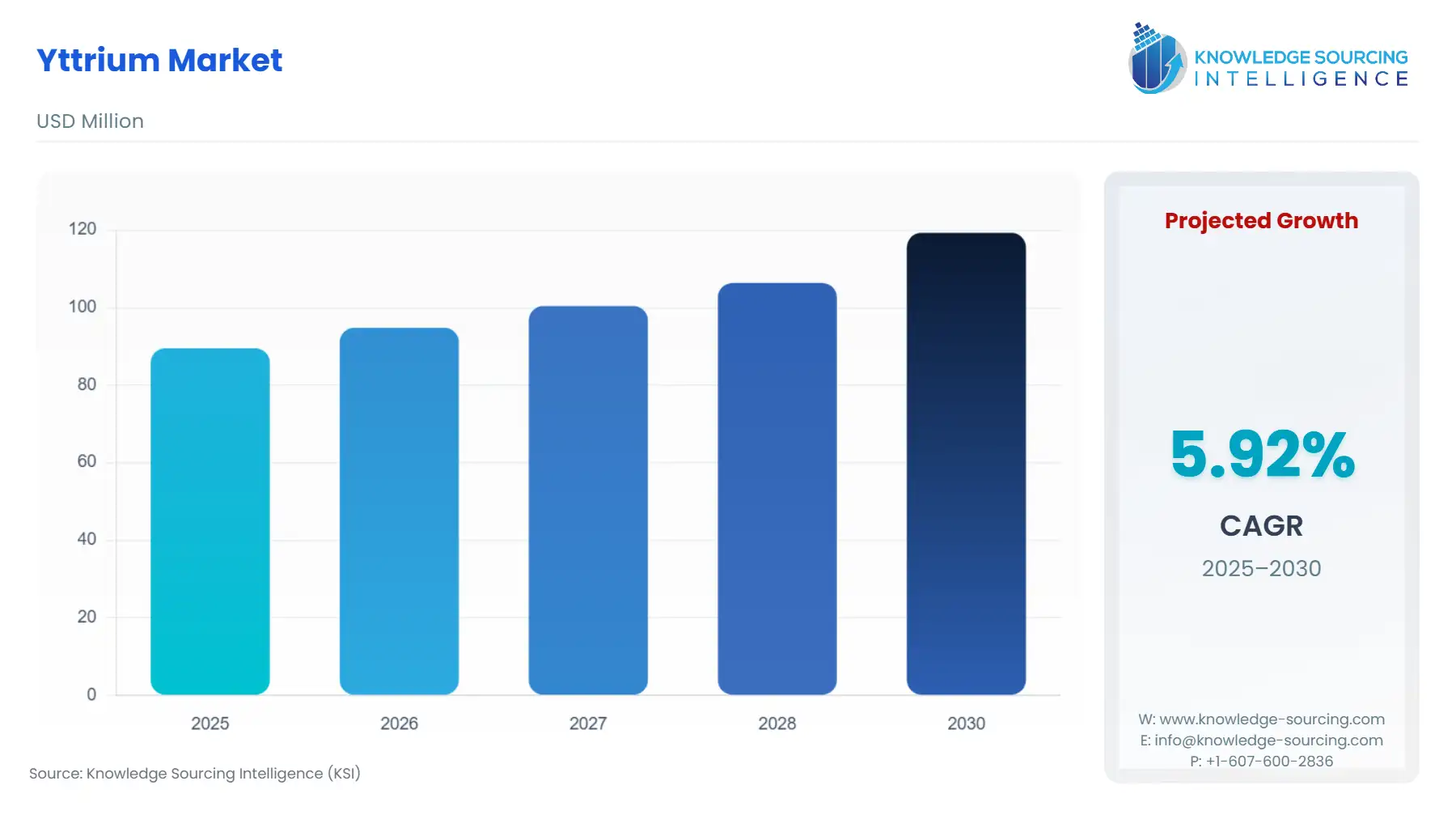

The global yttrium market is expected to grow at a CAGR of 5.92%, reaching a market size of US$119.317 million in 2030 from US$89.517 million in 2025.

Yttrium is a rare-earth metal, a highly crystalline, iron-gray, widely used as an additive in alloys. It increases the strength of aluminum and magnesium alloys. The use of yttrium is highly diversified, and it is a chief driver of the market, from pharmaceuticals to construction. The industry is investing in yttrium-based technology and is slowly moving towards experimenting and piloting with the application.

Moreover, the increasing incorporation of yttrium into the defense sector is a growing opportunity for the market. Yttrium oxide is added to the glass used to make camera lenses to make them heat—and shock-resistant. It is also used to make superconductors. The radioactive isotope yttrium-90 has medical uses, such as treating some cancers, including liver cancer. These manifold uses across several end-user industries are propelling the market ahead.

Geographically, the Asia-Pacific region is foreseen to dominate the market. China produces and consumes the largest amount of yttrium products. By product, alloys of yttrium have extensive uses in construction. By end-user industry, the consumer electronics division uses yttrium in many devices like televisions, cameras, etc., which are widely in demand.

Yttrium Market Growth Drivers:

- Increase usage of electronics

Due to its physical properties, like electrical conductivity, heat stabilizing and resistant properties, and lightweight, yttrium is becoming integral to various applications in major commercial and industrial sectors. It is used in light bulbs, panels, and television sets. Plasma and flat panel displays are some other applications of yttrium. Producers worldwide are engaging in improving the technology and efficiency of their electronic devices, which is anticipated to augment the global yttrium market’s growth in the coming years.

- Application in the defense sector

Because of their physical and chemical properties, earth metals like yttrium have a wide variety of applications in defense operations. They are used in making electronics and lighting, lasers, phosphors, and the strong permanent magnets contained primarily in computer hard drives, as well as electric motors and actuators.

They are also used in fin actuators in missile guidance and control systems, disk drive motors installed in aircraft and tanks, satellite communications, and radar and sonar systems. The United States Military is one of the flag bearers using yttrium in its defense mechanisms.

- Growing use in the semiconductor sector

Yttrium oxide's role in optical coatings and semiconductor production technology equipment has been explored; thus, the functionalities of these critical components provide diverse applications. Products are produced from Yttrium Oxide for semiconductor wafer processing applications. The demand for semiconductors has been growing due to their applications in automotive, industrial, and consumer markets.

According to the Semiconductor Industry Association (SIA), the market growth signifies changes in demand trends in the chip industry. Companies committed billions in new investments throughout the decade to meet the increasing demand for chips. Further, the innovation and application changes in the automotive, industrial, and consumer electronics industries could reach $1 trillion in sales by 2030.

Yttrium Market Geographical Outlook:

- The Asia Pacific region will dominate the global yttrium market during the forecast period.

By geography, the market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as the ASEAN countries.

In 2023, China's yttrium compounds and metals exports were about 2,900 tons of yttrium oxide. Regarding export volume, the main exporting countries are Japan, Italy, the United States, and South Korea. In 2022, China exported yttrium compounds and metals up to 3,400 tons of yttrium oxide. The global production of yttrium in rare earth mineral concentrates is approximately 10,000 to 15,000 tons, mostly produced in China and Myanmar. These figures justify the region’s importance in the market.

Yttrium Market Restraints:

- Over-dependence and concentration on the production and manufacturing of yttrium in one country is causing challenges related to the supply chain and price volatility.

Yttrium Market Key Developments:

- In February 2024, Namibia Critical Metals Inc. announced that it received all laboratory assays of the RC drilling campaign for its PFS (A pre-feasibility study) study on the largescale “Lofdal 2B-4” heavy rare earth project. It is a Tier-1 Heavy Rare Earth Project, a globally significant deposit of the heavy rare earth metals dysprosium, yttrium oxide, and terbium. Demand for these critical metals used in permanent magnets for electric vehicles, wind turbines, and other electronics is driven by innovations linked to energy and technology transformations.

The Lofdal Project is fully permitted with a 25-year Mining License and is under a joint venture agreement with the Japan Organization for Metals and Energy Security (JOGMEC). JOGMEC is a Japanese government's independent administrative agency seeking to secure stable resources for Japan.

Yttrium Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Yttrium Market Size in 2025 | US$89.517 million |

| Yttrium Market Size in 2030 | US$119.317 million |

| Growth Rate | CAGR of 5.92% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Yttrium Market |

|

| Customization Scope | Free report customization with purchase |

Yttrium Market Segmentation:

- By-Products

- Compounds

- Alloys

- Metal

- By End-user Industry

- Ceramics

- Consumer Electronics

- Manufacturing

- Metallurgy

- Automotive

- Healthcare

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America