Report Overview

India ALD Precursors Market Highlights

India ALD Precursors Market Size:

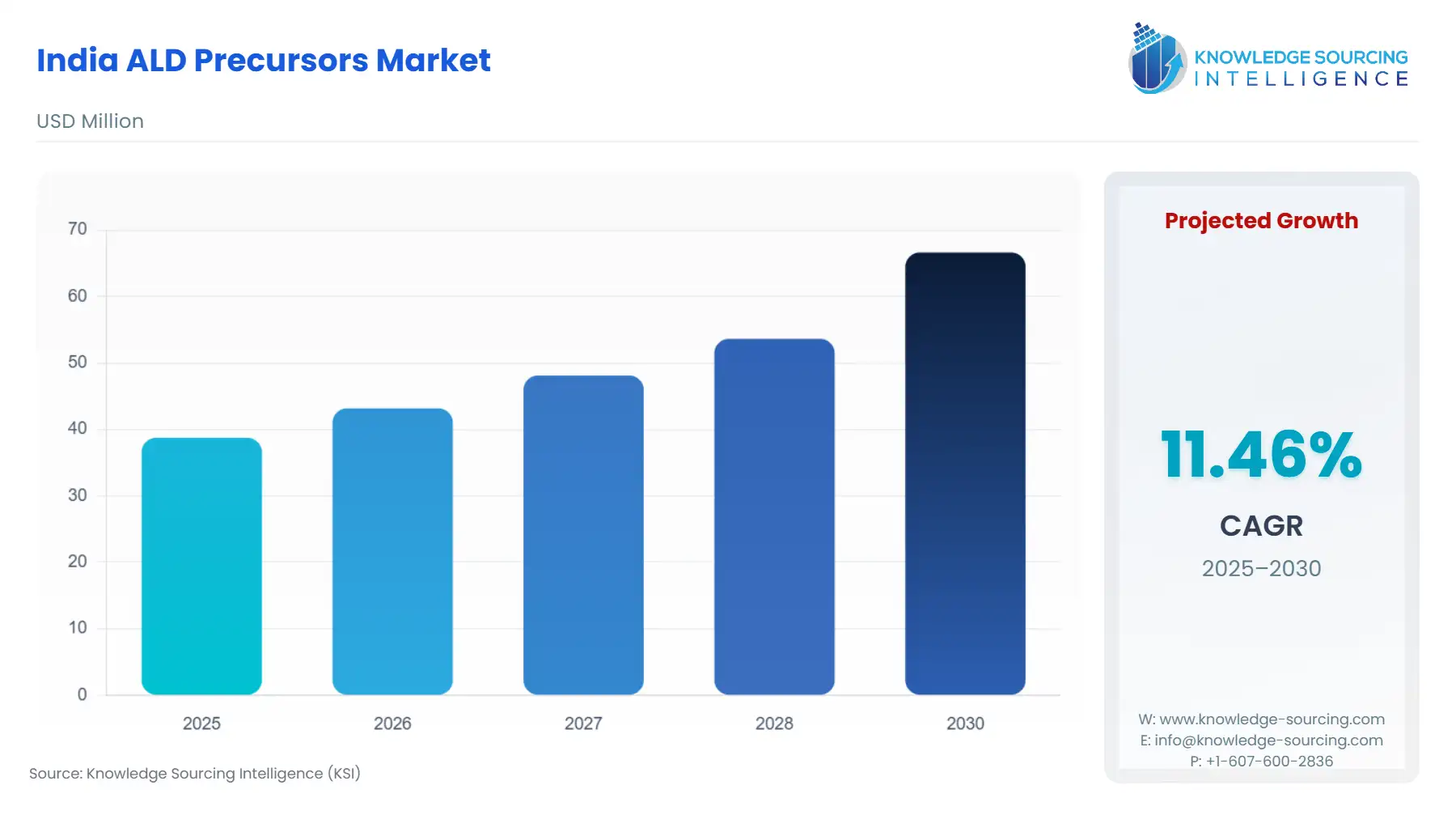

The India ALD Precursors Market is projected to expand at a CAGR of 11.46%, reaching USD 66.642 million in 2030 from USD 38.742 million in 2025.

________________________________________

India’s ALD precursors market has been undergoing a transformation driven by key sectors such as semiconductors, solar energy, and electric vehicles (EVs). The country’s growing focus on advanced manufacturing technologies and clean energy solutions is significantly increasing the demand for ALD (Atomic Layer Deposition) precursors. ALD technology is crucial in creating ultra-thin, high-precision coatings for semiconductor devices, photovoltaic cells, and energy storage systems. As India accelerates its industrial growth, the market for ALD precursors is expected to expand, spurred by technological advancements, government support, and evolving industry needs.

________________________________________

India ALD Precursors Market Analysis:

Growth Drivers

- Expansion of Semiconductor Manufacturing: India is actively fostering its semiconductor industry through initiatives like the National Semiconductor Mission, which aims to make India a global hub for semiconductor production. This is driving the need for ALD technology, which is critical in the production of high-performance semiconductors. ALD is used to deposit thin layers of materials like metals, dielectrics, and semiconductors, which are essential for advanced chips, particularly those with smaller node sizes. The increasing complexity and performance requirements of semiconductors in India are directly fueling the demand for ALD precursors.

- Advancements in Solar Energy: India’s commitment to increasing renewable energy capacity, particularly in solar power, has catalyzed the adoption of ALD technology. ALD is used in photovoltaic (PV) technology to improve the efficiency and durability of solar cells by applying thin-film coatings. India’s focus on expanding solar energy generation, through initiatives like the National Solar Mission, is driving demand for high-quality ALD precursors for PV applications. As India aims to meet its ambitious renewable energy targets, the solar industry will continue to be a significant contributor to the ALD precursor market.

- Electrification of the Automotive Sector: India’s automotive sector, especially the electric vehicle (EV) market, is seeing a rapid transformation with increased adoption of EVs. ALD plays a vital role in improving the performance of lithium-ion batteries used in EVs, particularly in enhancing their safety, energy density, and lifespan. Government incentives and growing consumer interest in EVs are contributing to the rise in demand for ALD precursors, which are crucial in the production of advanced batteries and other components used in electric vehicles.

- Technological Advancements in ALD: The development of new ALD technologies, such as Plasma-Enhanced ALD (PE-ALD) and Roll-to-Roll ALD, is driving demand for advanced ALD precursors. PE-ALD enables deposition at lower temperatures, making it suitable for sensitive substrates like flexible electronics, while Roll-to-Roll ALD allows continuous deposition processes, benefiting industries like solar energy and flexible displays. As India adopts these advanced technologies, the demand for specialized precursors is expected to increase.

- Government Support and Policies: The Indian government has introduced various policies and incentives aimed at boosting technological advancements, particularly in the semiconductor and renewable energy sectors. The Atmanirbhar Bharat Abhiyan (Self-Reliant India Mission) and the PLI Scheme for Semiconductors are designed to make India a key player in the global semiconductor market. These initiatives are directly supporting the growth of the ALD precursor market, as ALD plays an essential role in India’s push for semiconductor production and high-tech manufacturing.

Challenges and Opportunities

Challenges:

- Supply Chain and Raw Material Constraints: India’s dependency on imported raw materials for the production of ALD precursors remains a significant challenge. The importation of high-purity chemicals and specialty materials, such as metal-organic precursors, can lead to price volatility and supply disruptions, particularly in the context of global logistical challenges and geopolitical tensions.

- Pricing Volatility: The price of critical materials for ALD precursor production, including metals like hafnium and titanium, is subject to market fluctuations. The rising costs of these raw materials impact the pricing and availability of ALD precursors, creating uncertainties for manufacturers and end-users.

Opportunities:

- Domestic Manufacturing Initiatives: The Indian government's push for self-reliance in manufacturing provides opportunities for local players to establish production capabilities for ALD precursors. By investing in domestic manufacturing, India can reduce its dependency on imports and stabilize the pricing of ALD precursors.

- Expansion of Renewable Energy: As India continues to prioritize renewable energy, particularly solar power, the adoption of ALD technology will likely increase in the solar energy sector. The growth in demand for efficient solar panels presents a significant opportunity for ALD precursor suppliers.

- Electronics and EV Sectors: The rise of electric vehicles and the increasing demand for advanced semiconductor devices present substantial growth opportunities for the ALD precursor market. By aligning with the automotive and electronics sectors, suppliers can capitalize on the demand for more efficient energy storage systems and semiconductor components.

Raw Material and Pricing Analysis

The primary raw materials for ALD precursor production are high-purity chemicals, including metal-organic compounds and halide-based chemicals. These materials, particularly titanium, hafnium, and aluminum, are sourced from a limited number of global suppliers, which can lead to supply chain risks and price volatility. For India, which relies on imports for most of its ALD precursor raw materials, fluctuations in global prices can significantly affect the cost structure of manufacturers. Moreover, the production of these chemicals requires strict quality control to meet the high standards demanded by industries such as semiconductors, solar energy, and automotive, further complicating the supply chain.

Supply Chain Analysis

The global supply chain for ALD precursors is complex and involves several critical stages: raw material extraction, chemical synthesis, precursor production, and distribution. Key production hubs are located in North America, Europe, and parts of Asia, including China and Japan. India’s supply chain for ALD precursors is heavily dependent on imports, primarily from these regions, which exposes the market to risks arising from trade disruptions, logistical delays, and raw material shortages. Efforts to establish local manufacturing capabilities for ALD precursors are underway, with companies exploring partnerships with international players to improve the resilience of the supply chain.

India ALD Precursors Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

India |

Ministry of Electronics & Information Technology (MeitY) |

The government’s push for semiconductor manufacturing through the National Semiconductor Mission is driving demand for ALD technology in the semiconductor sector. This regulation is supporting both domestic production and innovation in ALD precursor technology. |

|

India |

Ministry of New and Renewable Energy (MNRE) |

The National Solar Mission encourages the use of ALD technology in the manufacturing of high-efficiency solar panels, driving demand for ALD precursors in the renewable energy sector. |

|

India |

Department of Heavy Industry (DHI) |

The PLI Scheme for Automotive and EV promotes the development of electric vehicles, increasing the demand for ALD precursors used in energy storage systems and battery technologies. |

India ALD Precursors Market Segment Analysis:

- By Application: High-k Dielectric

High-k dielectric materials are essential in semiconductor manufacturing, particularly for advanced microprocessors and memory devices. These materials are used to create thin insulating layers in transistors, enabling smaller devices with better performance and energy efficiency. As the semiconductor industry in India grows, particularly with initiatives to boost domestic chip manufacturing, the demand for high-k dielectric materials is expected to increase. ALD is the preferred method for depositing these materials, as it offers precise control over layer thickness and uniformity, crucial for the performance of modern semiconductor devices. As India positions itself as a hub for semiconductor manufacturing, the high-k dielectric segment will be one of the primary growth drivers for ALD precursors.

- By End-User: Electronics & Semiconductors

India's electronics and semiconductor sector is undergoing rapid expansion, driven by government initiatives and increasing demand for consumer electronics, smartphones, and advanced computing devices. The use of ALD in semiconductor manufacturing, particularly for the deposition of metal, dielectric, and insulating layers, is becoming more critical as the industry moves toward smaller node sizes. Semiconductor manufacturers in India, such as SemIndia, are investing in ALD technology to meet the requirements of next-generation electronic devices. This sector’s growth will significantly boost the demand for ALD precursors, particularly as India seeks to become more self-reliant in semiconductor production.

________________________________________

India ALD Precursors Market Competitive Analysis:

The ALD precursor market in India is highly competitive, with several global players dominating the supply of high-quality chemicals. Key players include Merck KGaA, Linde plc, and Air Liquide, which provide ALD precursors to a variety of industries, including semiconductors, solar energy, and automotive. These companies are leveraging their global supply networks and technical expertise to support India’s growing demand for ALD technology.

- Merck KGaA: Merck KGaA offers a comprehensive portfolio of ALD precursors, particularly for semiconductor and renewable energy applications. The company is actively expanding its production capabilities in India to cater to the country’s increasing demand for advanced materials.

- Linde plc: A major player in the global gas and chemical supply sector, Linde provides high-purity gases and chemical precursors for ALD processes in electronics and energy storage applications.

________________________________________

India ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 38.742 million |

| Total Market Size in 2031 | USD 66.642 million |

| Growth Rate | 11.46% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

India ALD Precursors Market Segmentation:

- BY APPLICATION

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- BY TECHNOLOGY

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- BY END-USER

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others