Report Overview

Israel AI in Military Highlights

Israel AI in Military Market Size:

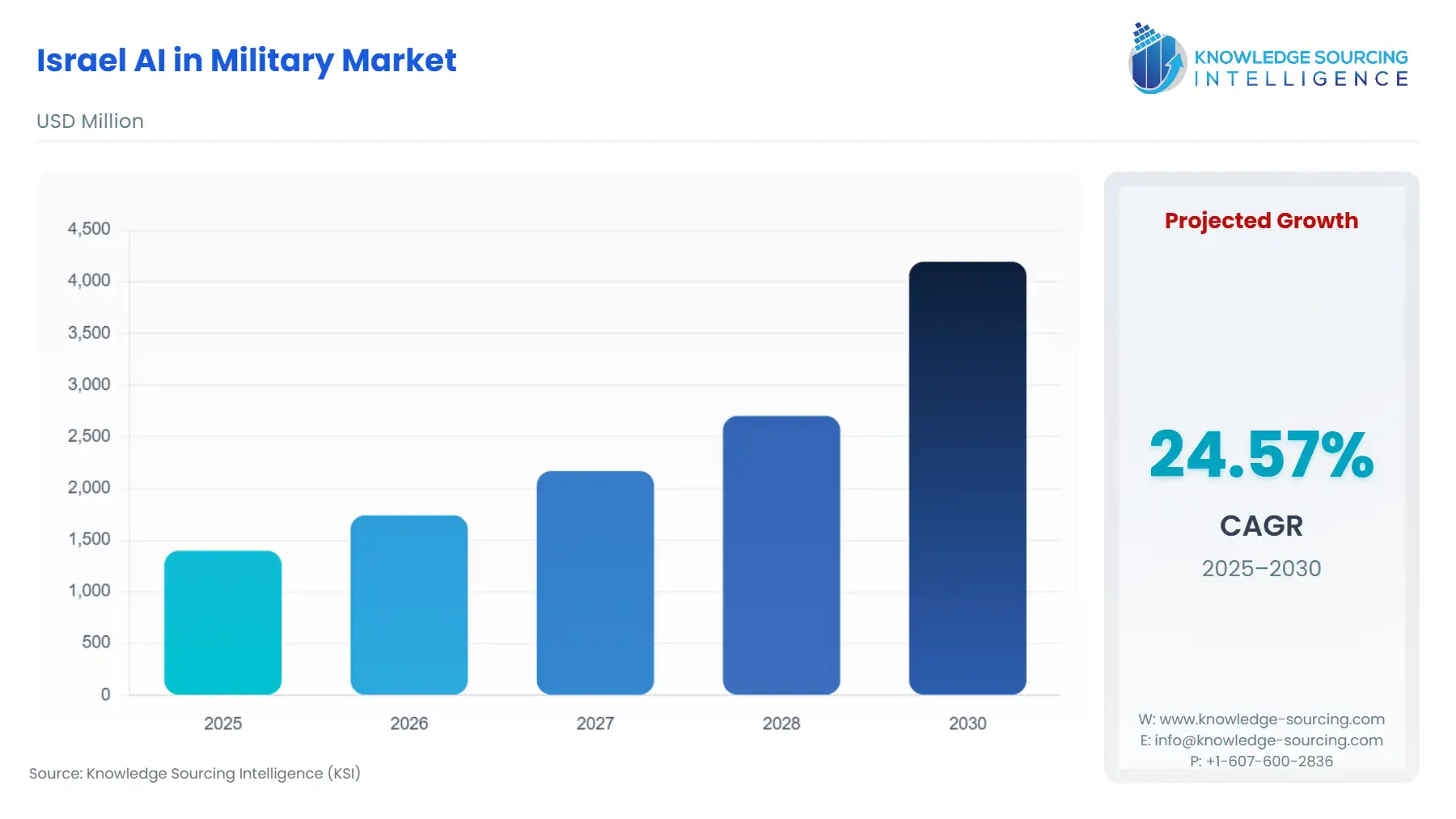

The Israel AI in Military Market is expected to grow at a CAGR of 24.57%, rising from USD 1.398 billion in 2025 to USD 4.194 billion by 2030.

The Israeli AI in the Military Market is defined by an entrenched, high-velocity innovation ecosystem, primarily driven by direct, mission-critical requirements from the Israel Defense Forces (IDF). Unlike markets reliant on commercial technology transfer, this sector's growth is inherently fused with the nation's defense doctrine, which places a high premium on technological superiority and minimizing troop exposure through automation.

This strategic necessity has cultivated a world-class concentration of defense R&D, centered around the rapid algorithmic integration into existing and future platforms. The market environment is characterized by a unique feedback loop wherein operational needs from one of the world's most active combat theaters immediately inform the R&D cycle, accelerating the deployment of AI-enabled solutions across air, land, naval, and cyber domains. The demand is not for abstract AI research but for combat-proven solutions that deliver a decisive edge in intelligence gathering, precision strike, and decision-making superiority.

________________________________________

Israel AI in Military Market Analysis:

Growth Drivers

The IDF's commitment to network-centric warfare directly propels demand for AI-driven platforms. The imperative to link thousands of distributed sensors and effectors across the battlespace necessitates autonomous data fusion and filtering, increasing demand for Deep Learning and Machine Learning solutions that can process petabytes of real-time intelligence for the human operator. Furthermore, the rising need for high-end, precision-guided munitions (PGMs) in contested environments creates a direct demand for embedded Computer Vision and Automatic Target Recognition (ATR) algorithms, enabling platforms like missiles and loitering munitions to execute missions effectively in GPS-denied or heavily jammed scenarios. This technological imperative ensures consistent procurement.

Challenges and Opportunities

A major challenge facing the market is the severe regulatory and ethical headwind concerning the export of advanced autonomous systems. International debate over the Lethal Autonomous Weapon Systems (LAWS) and the public scrutiny of AI systems used in conflict directly constrain the critical foreign military sales (FMS) channel, thus limiting market growth potential. Conversely, a significant opportunity lies in the burgeoning demand for certified, AI-enabled simulation and training systems. As AI-based operational systems become more complex, the IDF requires highly realistic, data-driven synthetic environments for soldier training, creating a growth avenue for companies specializing in AI-enhanced Simulation & Training applications. This provides an ethical and regulatory-compliant diversification path.

Supply Chain Analysis

The military AI supply chain in Israel is structurally decentralized but strategically concentrated. The nation's major defense primes maintain significant internal R&D capabilities, acting as the primary system integrators. Production hubs for advanced microchips and processing units, crucial for edge AI computing in drones and guided munitions, are globally diversified, creating a dependency on secure foreign sources (e.g., US and Asian semiconductor fabs). Logistical complexity centers on securing and maintaining the supply of high-caliber software engineering and data science talent. A primary dependency is the constant rotation of skilled personnel from military intelligence units (a key talent pipeline) to the defense industry, which requires aggressive retention strategies to stabilize the intellectual capital supply chain.

Government Regulations

Key regulatory frameworks fundamentally shape the AI defense market by controlling technology transfer and ensuring ethical deployment.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Israel | Ministry of Defense (IMOD) / AI and Autonomy Administration (MAFAT) | Centralizes strategic R&D budgets and procurement, creating massive, focused domestic demand. Enforces security and doctrinal compliance, acting as the single largest demand aggregator and certification body. |

| Israel | Defense Export Control Agency (DECA) | Imposes stringent, politically sensitive export controls on AI-enabled dual-use technologies, particularly those with Autonomous/LAWS potential, which directly restricts the major defense contractors' access to international FMS markets. |

| International | International Humanitarian Law (IHL) / Domestic Ethical Guidelines | Mandates the inclusion of verifiable 'Human-on-the-Loop' control mechanisms in high-lethality systems. This directly drives demand for system transparency and AI-driven decision support systems, not fully autonomous strike capabilities. |

________________________________________

Israel AI in Military Market Segment Analysis:

By Application: Surveillance & Reconnaissance

The operational necessity for persistent, multi-domain situational awareness drives the segment's growth. The confluence of asymmetric threats, requiring covert monitoring, and sophisticated conventional threats, demanding wide-area tracking, creates an acute need for AI-enabled Surveillance & Reconnaissance solutions. AI, specifically Computer Vision and Deep Learning, is mandated to filter the "data deluge" generated by high-resolution sensors (e.g., airborne radar, electro-optical payloads, and space-based platforms) into actionable intelligence. This dramatically increases demand for intelligent payloads and AI-at-the-edge processing units that can perform on-board classification and tracking. Elbit Systems' Frontier system, which uses AI-based adaptive learning to autonomously detect and classify threats in real-time, exemplifies this demand. The market directly rejects systems that cannot demonstrate a superior reduction in false-positive alerts, prioritizing AI solutions that enhance operator effectiveness in time-critical ISR missions.

By Technology: Machine Learning

Machine Learning (ML) constitutes the market's technological core, as its adaptive nature directly addresses the military's requirement for systems that can evolve with a dynamic threat landscape. The need for ML is segmented across various operational functions: it is the primary enabler for predictive maintenance (reducing logistics costs), for sophisticated Electronic Warfare (EW) systems that must autonomously identify and counter new jamming techniques, and for real-time sensor fusion. Unlike rule-based software, ML algorithms enable systems to ingest massive amounts of unstructured battlefield data and rapidly synthesize optimal courses of action for commanders. This capacity for accelerated learning and adaptation, which underpins systems like Rafael's IMILITE for imagery intelligence, makes ML a non-negotiable component for all new platform modernization programs, directly increasing procurement cycles across all defense budgets.

________________________________________

Israel AI in Military Market Competitive Environment and Analysis:

The Israeli AI in the Military Market is an oligopoly dominated by the nation's state-owned and publicly traded defense primes, characterized by decades of deep integration with IDF doctrinal requirements and a global export focus.

Israel Aerospace Industries (IAI)

IAI, the largest defense company in Israel, focuses on system-of-systems integration across air, space, land, and cyber domains. The company's strategic positioning revolves around developing fully integrated solutions, where AI acts as the foundational operating layer for autonomous execution. A core offering is the provision of Unmanned Air Vehicles (UAVs), such as the Heron family, and Unmanned Ground Vehicles (UGVs). IAI leverages Machine Learning to power complex mission planning, autonomous navigation in contested airspace, and cooperative swarm tactics for its various unmanned platforms, ensuring its continued relevance in the push toward multi-domain operations.

Elbit Systems

Elbit Systems strategically centers its AI development on C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) and Decision Support Systems (DSS). The company's focus is on translating data superiority into decision superiority. Key products include the AI-Driven Decision Support Systems, which analyze the aerial arena, calculate risk, and provide optimal operational recommendations to pilots and commanders in real-time. By concentrating on C2, Elbit targets the critical juncture where human command meets machine capability, driving demand for intelligent user interfaces and rapid data-to-insight solutions.

Rafael Advanced Defense Systems

Rafael focuses on the application of AI to enhance the lethality and precision of its core missile and protection systems portfolio. Its strategic positioning is to create "smart" weapons and defense layers capable of functioning autonomously in highly complex environments. Key products include the SPIKE LR II missile, which incorporates smart target trackers, and the 'Rocks' air-to-surface missile, which uses Automatic Target Acquisition (ATA) algorithms for high-precision strikes. Rafael's focus on the edge—embedding AI directly into the munition or protection system—creates a high demand for its cutting-edge micro-processing and computer vision integration services.

________________________________________

Israel AI in Military Market Recent Developments:

- September 2025: Elbit Systems launched Frontier, a next-generation wide-area persistent surveillance system designed to address evolving border defense challenges. The system is built to autonomously detect, classify, and assess threats in real-time by leveraging advanced Artificial Intelligence (AI) for optimized intelligence gathering and decision-making in land, air, and maritime domains. This product launch directly addresses the demand for reducing the operational burden on security teams by autonomously filtering massive sensor data and prioritizing actionable insights, thereby reducing costs and enhancing mission success rates.

- September 2024: Rafael Advanced Defense Systems announced an expansion of its collaboration with Oracle to make its multi-domain, combat-proven IMILITE (AI-based Imagery Intelligence) and FIRE WEAVER (shared, real-time situational awareness) systems available on Oracle Cloud Infrastructure (OCI). This move qualifies as a strategic capacity addition, significantly expanding the accessibility and deployment scale of Rafael's core AI-enabled C4I solutions to defense customers globally via a secure cloud environment, enhancing the capability to deliver rapid, actionable intelligence at the tactical edge.

________________________________________

Israel AI in Military Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.398 billion |

| Total Market Size in 2031 | USD 4.194 billion |

| Growth Rate | 24.57% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component Type, Technology, Application, Platform |

| Companies |

|

Israel AI in Military Market Segmentation:

- BY COMPONENT TYPE

- Hardware

- Software

- Services

- BY TECHNOLOGY

- Machine Learning

- Deep learning

- Computer Vision

- Natural Language Processing

- Robotics

- Others

- BY APPLICATION

- Warfare Platforms

- Cybersecurity

- Logistics & Transportation

- Surveillance & Reconnaissance

- Command & Control

- Battlefield Healthcare

- Simulation & Training

- Gathering Intelligence

- Others

- BY PLATFORM

- Land-based Force

- Naval Force

- Air Force

- Space Force