Report Overview

Japan ALD Precursors Market Highlights

Japan ALD Precursors Market Size:

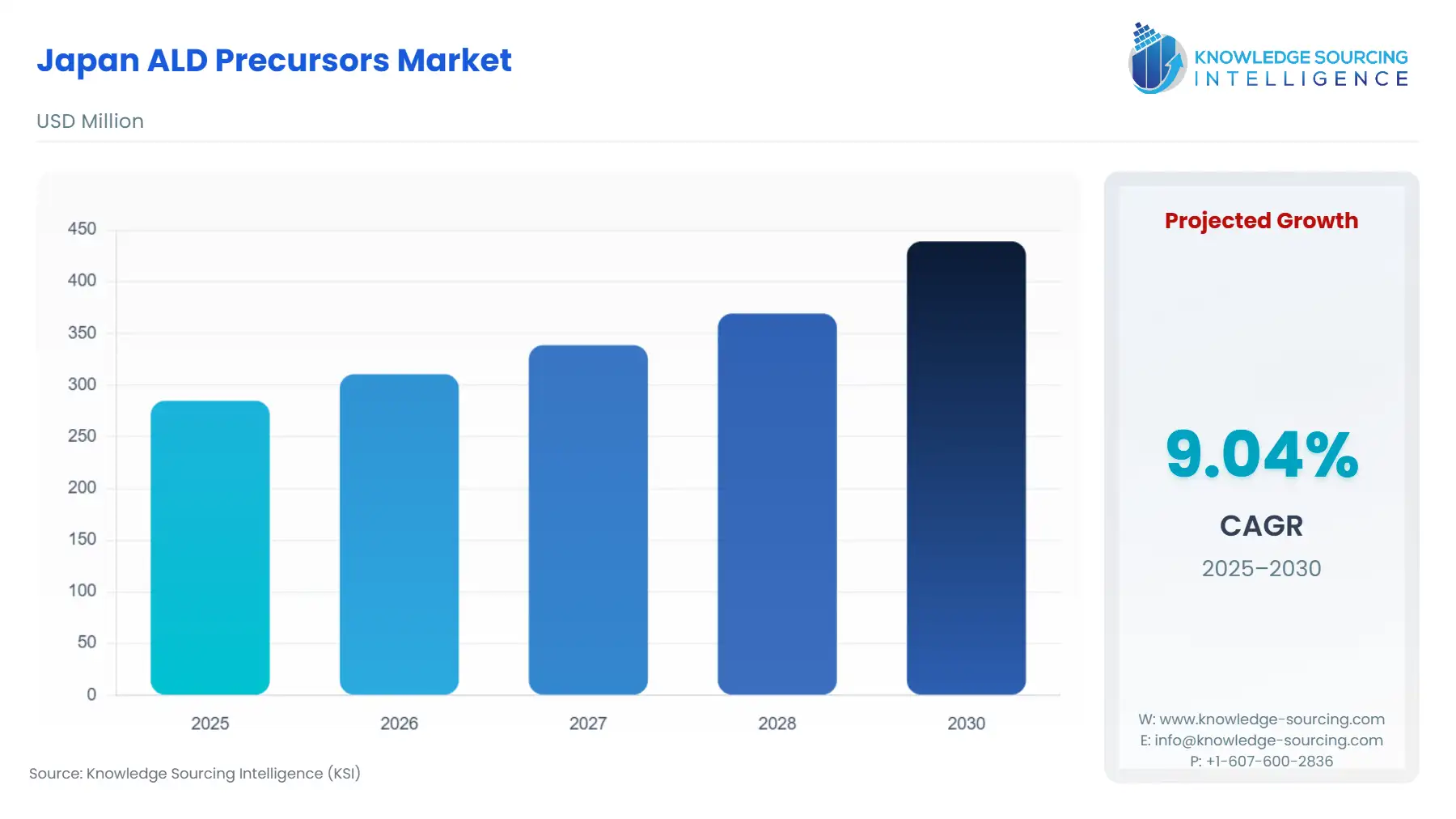

The Japan ALD Precursors Market is projected to increase at a CAGR of 9.04%, climbing to USD 439.118 million in 2030 from USD 284.917 million in 2025.

________________________________________

Japan’s ALD precursors market has been undergoing significant growth, primarily fueled by advancements in semiconductor technologies, the rise of renewable energy applications, and Japan’s push toward electric vehicle adoption. As a leader in high-tech manufacturing, Japan is pivotal in driving demand for ALD precursors, which are essential for creating thin, uniform films used in semiconductor chips, energy storage, and solar energy technologies.

Japan ALD Precursors Market Analysis:

Growth Drivers

- Semiconductor Industry Demand: Japan has long been a key player in the semiconductor market, with major companies like Toshiba, Sony, and Renesas Electronics leading the charge in producing high-performance chips. The ongoing shift toward smaller transistors and advanced nodes in semiconductor manufacturing necessitates the use of Atomic Layer Deposition (ALD) for precise thin-film deposition. ALD precursors are used in critical applications such as high-k dielectrics, conductive metals, and insulating layers. As the need for more powerful and energy-efficient devices rises, particularly in 5G networks and IoT applications, Japan’s semiconductor manufacturers are increasingly dependent on ALD technology, thus fueling demand for ALD precursors.

- Advances in ALD Technology: Technological advancements in ALD processes, particularly Plasma-Enhanced ALD (PE-ALD) and Roll-to-Roll ALD, are driving innovation in Japan’s manufacturing landscape. PE-ALD allows for deposition at lower temperatures, which is crucial for the fabrication of thin films in applications such as energy storage and photovoltaics. Roll-to-Roll ALD, which enables continuous deposition processes, is particularly relevant for manufacturing flexible electronics and solar cells. As Japanese companies invest in these next-generation ALD technologies, the demand for advanced precursors designed for these processes continues to grow.

- Renewable Energy Growth: Japan’s commitment to achieving carbon neutrality by 2050 and expanding renewable energy capacity, particularly solar power, is contributing to the increased use of ALD in solar cell production. ALD allows for the precise deposition of thin films that improve the efficiency and durability of photovoltaic systems. Japan’s role as one of the leading solar markets in the Asia-Pacific region has created a strong demand for ALD precursors, particularly for applications in high-efficiency thin-film photovoltaics.

- Automotive and Energy Storage: With the global shift towards electric vehicles (EVs) and energy storage solutions, Japan’s automotive sector is witnessing a rise in demand for ALD technologies. ALD is crucial in enhancing the performance and longevity of lithium-ion batteries used in EVs, as it enables the deposition of highly uniform films that improve energy storage capacity and safety. Japan’s major automotive manufacturers, such as Toyota and Nissan, are investing heavily in these technologies, directly boosting demand for ALD precursors.

- Governmental Push for Sustainability: Japan’s strong regulatory framework, which includes environmental mandates for reducing emissions and improving energy efficiency, continues to drive demand for ALD in clean technologies. These regulations create strong incentives for industries, particularly in the semiconductor, automotive, and energy sectors, to adopt ALD technology for manufacturing more sustainable products. Government incentives for clean energy technologies, alongside Japan’s commitment to sustainability, are crucial demand drivers for ALD precursors.

Challenges and Opportunities

- Supply Chain and Raw Material Constraints: Japan’s reliance on imported raw materials for the production of ALD precursors presents a challenge, especially as the global supply chain becomes increasingly strained. The complexity of producing high-purity chemicals for ALD, which require rigorous quality control, means that Japan’s ALD precursor market is vulnerable to disruptions caused by geopolitical tensions or natural disasters. For example, trade restrictions and raw material shortages, particularly from regions such as Southeast Asia, could lead to fluctuations in precursor availability and pricing.

- Volatility in Raw Material Pricing: The pricing of key ALD precursor materials, such as metal-organic compounds and halide-based chemicals, is subject to volatility driven by fluctuations in the cost of base metals and environmental regulations governing chemical extraction. As these materials are primarily sourced from a limited number of regions, any disruptions in supply or changes in global pricing dynamics can directly impact the cost structure of Japan’s ALD precursor market. Managing this pricing volatility is a key challenge for Japanese manufacturers, who must find ways to mitigate the risks associated with the fluctuating costs of raw materials.

- Opportunities in Energy Storage and Automotive: The growing demand for energy storage solutions, driven by the shift toward electric vehicles and renewable energy, presents a major opportunity for the ALD precursor market. The ability of ALD to improve battery performance, particularly in enhancing the stability and efficiency of electrodes, is a key factor driving adoption in the automotive and energy sectors. As Japan ramps up its production of electric vehicles and integrates more renewable energy solutions, the demand for ALD precursors in energy storage applications is expected to rise.

Raw Material and Pricing Analysis

As ALD precursors are primarily composed of high-purity chemicals, including metal-organic compounds and halides, their pricing and availability are significantly impacted by the cost of raw materials such as aluminum, titanium, hafnium, and other specialty metals. These materials are generally sourced from international markets, with major suppliers located in North America, Europe, and Asia. Any disruption in the supply of these raw materials—whether due to mining constraints, trade policies, or logistical challenges—can directly affect the cost and availability of ALD precursors in Japan.

The rising cost of these materials has been a notable trend, particularly with metals like hafnium and zirconium, which are used in high-k dielectric films. Additionally, the increasing global demand for these materials, driven by the growth of industries like semiconductors, photovoltaics, and energy storage, contributes to price volatility. Japan’s heavy reliance on imported chemicals also exposes its ALD precursor market to currency fluctuations, particularly with the Japanese yen’s volatility against the U.S. dollar, which can increase material costs for manufacturers.

Supply Chain Analysis

The global ALD precursor supply chain is complex and heavily reliant on specialized suppliers for high-purity chemicals. Major precursor production hubs are located in North America, Europe, and Asia, with key players such as Air Liquide, Merck KGaA, and Linde plc controlling significant market share. For Japan, supply chains are heavily dependent on the import of high-purity chemicals from countries like China, Taiwan, and the United States.

In recent years, Japan has been focused on securing more stable supply chains by fostering relationships with international suppliers and exploring localized production capabilities. However, disruptions in global logistics, such as the COVID-19 pandemic and geopolitical tensions, have highlighted vulnerabilities in Japan’s ALD precursor supply chains. These risks are exacerbated by the need for precise quality control measures when producing ALD precursors, which require specialized facilities and handling.

Japan ALD Precursors Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Japan |

Ministry of Economy, Trade, and Industry (METI) |

METI has enacted various initiatives to encourage semiconductor innovation and sustainability, including incentives for clean energy technologies, which directly increase demand for ALD precursors in the semiconductor and energy sectors. |

|

Japan |

Ministry of the Environment |

The Japanese government’s emphasis on reducing carbon emissions has led to a push for more energy-efficient manufacturing processes. This regulation accelerates the demand for ALD in energy storage systems and automotive sectors. |

|

Japan |

Japan External Trade Organization (JETRO) |

JETRO's policies to support high-tech industries and exports encourage the adoption of ALD technology in advanced manufacturing sectors, further expanding the domestic market for ALD precursors. |

Japan ALD Precursors Market Segment Analysis

- By Application: High-k Dielectric

High-k dielectric materials, such as hafnium oxide (HfO?), are essential in semiconductor manufacturing. These materials are crucial for creating thin insulating layers in advanced transistors, which are fundamental for high-performance chips. As semiconductor manufacturing in Japan advances toward smaller node sizes, the need for high-k dielectric films has increased. ALD precursors are pivotal for achieving the precision and uniformity required in these films, making high-k dielectric one of the leading applications in the ALD precursor market. The surge in demand for semiconductors, driven by industries such as consumer electronics, automotive, and telecommunications, will continue to drive growth in the high-k dielectric segment.

- By End-User: Electronics & Semiconductors

The electronics and semiconductor industries are the primary end-users of ALD precursors in Japan. As one of the largest semiconductor manufacturers in the world, Japan is witnessing an increased demand for ALD as the need for smaller, faster, and more efficient chips rises. ALD is essential in producing highly uniform thin films for transistors, capacitors, and interconnects in semiconductor devices. With continued advancements in 5G technologies, artificial intelligence (AI), and the Internet of Things (IoT), the demand for ALD in semiconductor manufacturing is expected to remain strong, with Japan playing a central role in fulfilling global requirements.

________________________________________

Japan ALD Precursors Market Geographical Analysis:

Japan Market Analysis: Japan’s ALD precursor market is one of the largest in the Asia-Pacific region, driven by the country’s dominant semiconductor industry, a growing focus on renewable energy, and a commitment to electric vehicle development. Local production capabilities, coupled with a robust regulatory framework, are shaping a favorable environment for ALD technology adoption. However, challenges related to raw material imports and supply chain volatility need to be closely monitored.

________________________________________

Japan ALD Precursors Market Competitive Environment and Analysis:

Major Companies:

- Tokyo Electron Limited: Tokyo Electron, a leader in semiconductor equipment, plays a significant role in the Japanese ALD precursor market. Its advanced ALD technologies cater to the needs of semiconductor manufacturing, with a focus on high-performance materials for cutting-edge applications.

- Merck KGaA: A global leader in chemical and life sciences, Merck KGaA offers a wide range of ALD precursors for semiconductor, solar, and energy storage applications. The company’s ongoing research and development efforts ensure its products meet the growing demands of Japan’s high-tech industries.

________________________________________

Japan ALD Precursors Market Developments:

- August 2024: JSR Corporation, a leading Japanese materials supplier, completed its acquisition of Yamanaka Hutech Corporation, making it a wholly-owned subsidiary. This move strengthens JSR's portfolio in high-purity chemicals for semiconductor fabrication, including ALD precursors for advanced thin-film deposition in logic and memory devices. The integration enhances supply chain resilience for Japan's chip ecosystem, targeting sub-3nm nodes with improved precursor purity.

________________________________________

Japan ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 284.917 million |

| Total Market Size in 2031 | USD 439.118 million |

| Growth Rate | 9.04% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

Japan ALD Precursors Market Segmentation:

- BY APPLICATION

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- BY TECHNOLOGY

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- BY END-USER

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others