Report Overview

Medical Tape Market - Highlights

Medical Tape Market Size:

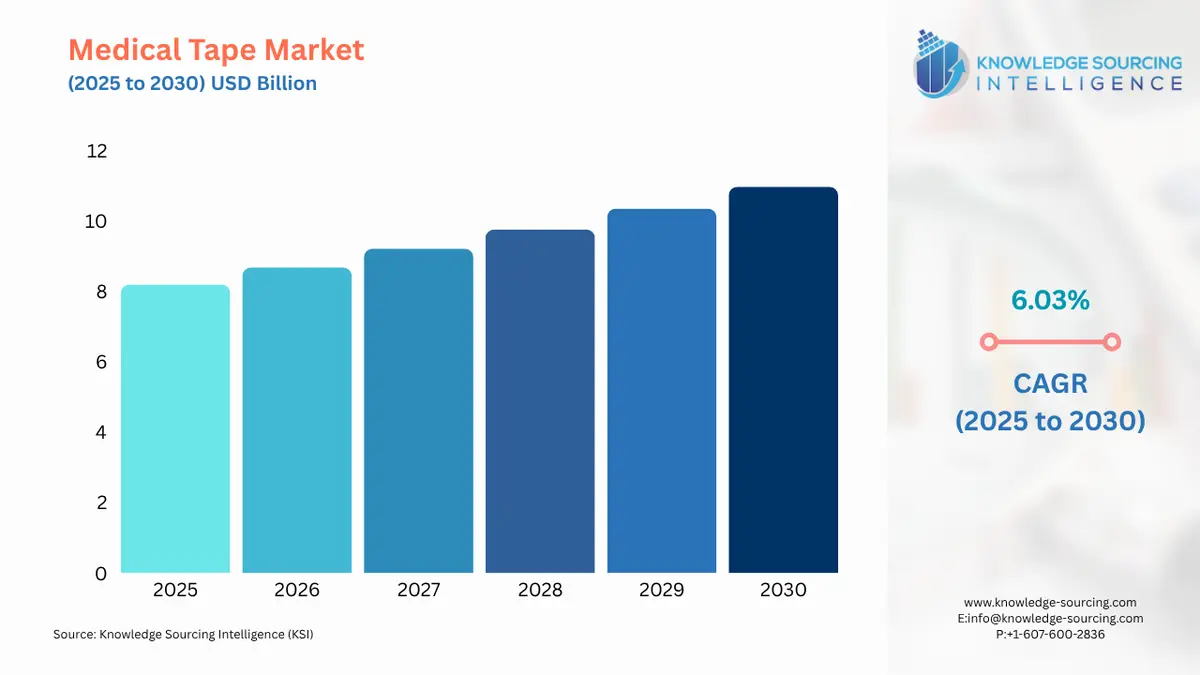

The medical tape market, at a 5.85% CAGR, is anticipated to reach USD 11.519 billion in 2031 from USD 8.190 billion in 2025.

Medical Tape Market Trends:

Medical tape is a type of pressure-sensitive adhesive tape used in medicine and first aid. The wider application of medical tapes in wound closure and other treatments is a major growth factor in the medical tape market. Moreover, the rising chronic diseases and road injuries indicate the need for wound treatment and pain management in illnesses such as arthritis which is also contemplated to bolster the medical tape market. Furthermore, the technological innovation followed by product launches by the market players is also positively impacting the medical tape market size.

Medical Tape Market Growth Drivers:

Wider Application in Healthcare

The diverse application range of medical tape for numerous health issues is a major growth driver in the market growth. These uses can include keeping a wearable device in place (such as a continuous glucose monitor, or CGM), holding IVs on the skin before, during, or after a medical operation, and securing wounds. It's difficult to envision a world without practical medical patches for things like nicotine, hormones, and pain management, and there is a huge need for non-irritating medical adhesives that are safe to use on the skin. Both surgical tape and medical tape are examples of personal protective equipment (PPE) that are used to shield the skin from contact with dangerous substances.

Growing Prevalence of Chronic Diseases

The higher prevalence rate of chronic illnesses such as diabetes, heart disease, and arthritis is boosting the demand for medical tapes thereby augmenting the market growth. As per the CDC (Center for Disease Control and Prevention), an estimated 53 million adults in the USA have arthritis. People with other chronic illnesses, such as obesity, diabetes, and heart disease, are more likely to develop arthritis. Kinesiology tape can provide additional support for ailments like patellofemoral stress syndrome, iliotibial band friction syndrome, and shoulder instability. A joint can be supported by the tape while still being somewhat mobile. All these factors contribute to the medical tape market growth.

Rising Road Accidents and Fatalities

The higher prevalence of road accidents causing injury indicates the need for medical tape thereby propelling the medical tape market growth. For instance, according to the Ministry of Road Transport and Highways of India, a total of 4,12,432 road accidents were registered across the nation in 2021, injuring 3,84,448 people. WHO estimates that between 20 and 50 million individuals each year suffer from non-fatal injuries, many of which result in permanent disabilities caused by road accidents. Significant financial harm is caused by road accidents to individuals, their families, and entire nations. These losses result from the expense of medical care as well as missed production for people who suffer fatal or permanent injuries.

Medical Tape Market Challenge:

Not suitable for sensitive skin

Apart from all the growth factors, some factors are expected to limit the medical tape market growth. The biggest disadvantage of clear medical tape is that it can be challenging to remove, particularly if it has been in place for a long time. Additionally, some people may have skin sensitivity from clear medical tape. It is advised against using kinesiology tape on open wounds or surgical incisions that have not fully healed since the tape can trap moisture that encourages the growth of bacteria and so raises the risk of infection. Moreover, it sometimes gets difficult to ensure accurate skin edge apposition and skin edge aversion.

Medical Tape Market Geographical Outlook:

North America is expected to grow significantly

The North American region is expected to hold a significant share of the medical tape market during the forecast period. Various factors attributed to such a share are the strong presence of the healthcare system and rising admission to medical hospitals. For instance, the healthcare industry contributed 17.8% to the national GDP in 2021 according to the Commonwealth Fund Organization. Moreover, with an obesity rate almost twice as high as the OECD average, the U.S. has the largest percentage of people with several chronic illnesses. The presence of major market players such as 3M further augments the medical tape market in the region through the launch of innovative products.

List of Top Medical Tape Companies:

Paul Hartmann AG is a Germany-based multinational company providing solutions such as therapeutic bandages, first aid, wound management, incontinence management, skin care, and others. Omnitape® offered by the company for the sports category. Other adhesives offered by the company are Hydrofilm® Roll, Omnifix® E, and Omnifix® Elastic.

Medtronic is one of the leading companies in medical technology, services, and solutions. The company offers Covidien™ polyester retraction tape for usage in retraction during surgical procedures and sterile cotton umbilical tape.

Medical Tape Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Medical Tape Market Size in 2025 | USD 8.190 billion |

Medical Tape Market Size in 2030 | USD 10.974 billion |

Growth Rate | CAGR of 6.03% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Medical Tape Market |

|

Customization Scope | Free report customization with purchase |

Medical Tape Market Segmentation

By Product Type

Breathable Non-Woven Tape

Breathable PE Tape

Rayon Tape

Easy-Tear Non-Woven Cloth Tape

Zinc Oxide Adhesive Cloth Tape

Elastic Tapes

Silicone Tapes

Paper Tapes

Silk Cloth Tapes

By Sales Channel

Direct Sales

Distributor

By Application

Splints

Wound Dressings

Surgical Wound

Laceration Wound

Secure IV Lines

Ostomy Seals

Surgeries and Surgical Wounds

Traumatic and Laceration Wound

Burns and Ulcers

By End-User

Hospitals

Clinics

Ambulatory Settings

Home Care Settings

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation

Page last updated on: September 29, 2025