Report Overview

Optical Imaging Market Report, Highlights

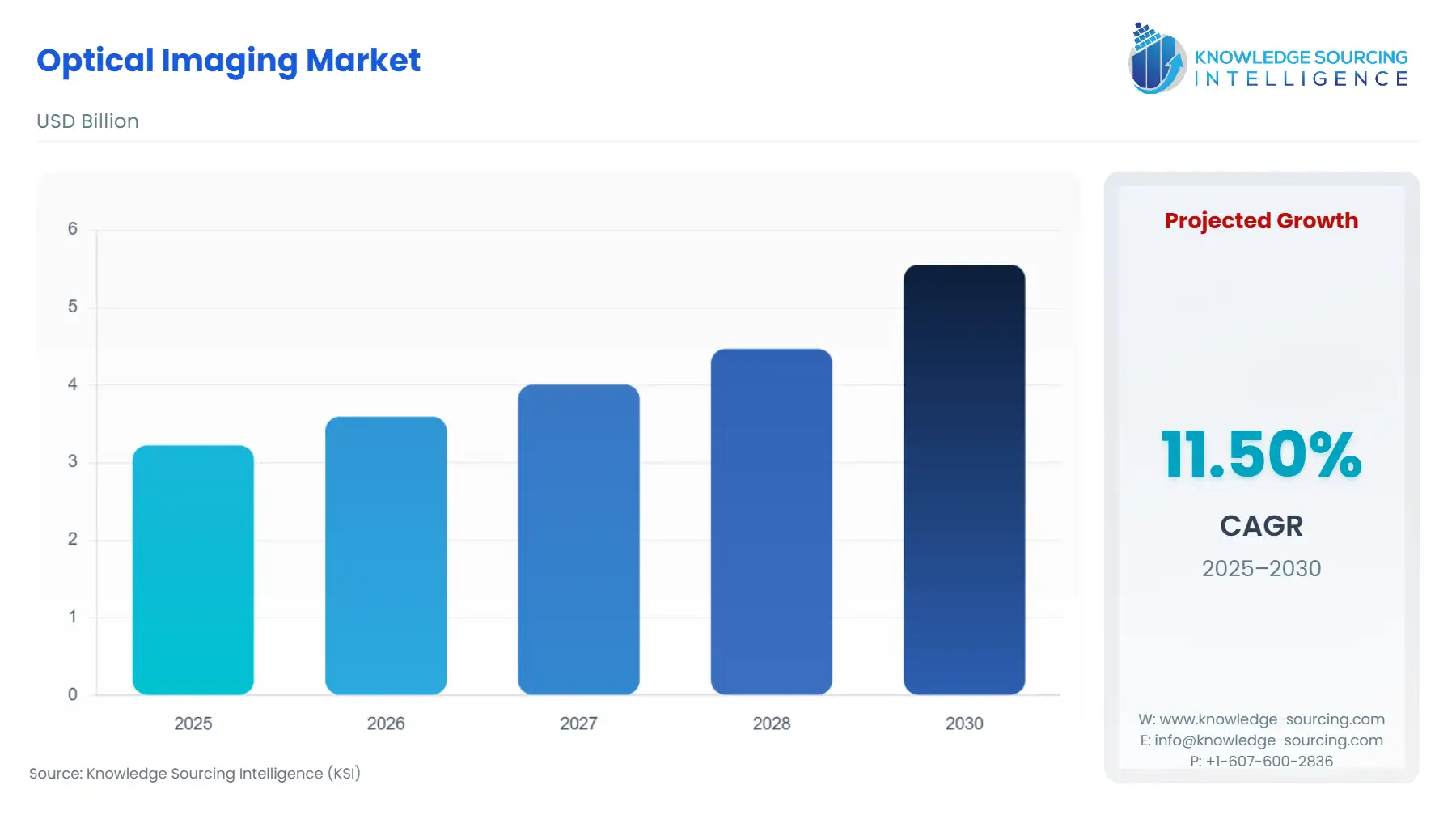

Optical Imaging Market Size:

The optical imaging market is expected to grow at a CAGR of 11.49%, reaching a market size of US$5.555 billion in 2030 from US$3.224 billion in 2025.

Optical imaging uses light to obtain images of body tissue or cells, before which the information is deduced from tissue composition and biomolecular processes. It generates images using photons of light from ultraviolet to near-infrared. Such imaging comprises various types, such as optical coherence tomography (OCT), endoscopy, and photoacoustic imaging, among others.

Optical Imaging is primarily used by researchers, biotechnicians, and pharmacists to study small animal models and clinical applications, such as the detection of cancer and lymphoma, the study of gynaecologic malignancies, in vivo imaging, research on DNA, neonatal and adult brain imaging, and other applications. Optimal Imaging reduces a patient’s exposure to harmful radiation with the help of non-ionizing radiation. It is widely used in biomedical research and medical care.

Optical Imaging Market Growth Drivers:

- Bolstering growth in biomedical and biopharmaceutical research is expected to propel the market expansion.

Optical imaging is an essential technique that provides useful information to researchers, pharmacists, and biotechnicians for studying complex human, animal, and plant models. Research in biomedical, biopharmaceutical, and medical care, especially in eye care, is contributing to the optical imaging market's growth. The National Institute for Occupational Safety and Health (NIOSH) reports that about 2000 US workers suffer from job-related eye injuries daily that require medical treatment.

- Growing chronic disease prevalence has accelerated the market expansion.

Accurate glaucoma screening requires using novel optical imaging techniques for early diagnosis and treatment that would stop the progression to blindness. Vivo imaging, particularly whole-body Vivo imaging, enables the study of animal models of human diseases, reducing the rate of experimentation on animals and providing essential information in research studies. Other applications of Vivo imaging can be seen in bioluminescence, which is used in microbiology, and fluorescence methods in vivo imaging, which are commonly used in clinical research.

- New technological developments are accelerating the market expansion.

New developments in optical imaging techniques, for instance, CT (Computed Tomography), MRI (Magnetic Resonance Imaging), and PET-CT (Position Emission Tomography – Computed Tomography), are widely applied in medical imaging techniques. Additionally, new software launches to bolster optical imaging are also taking place. For instance, Abbott Laboratories, in October 2023, launched its vascular imaging software “Ultreon 1.0”, which integrates Artificial Intelligence and optical coherence tomography (OCT), which enables physicians to get a comprehensive view of coronary arteries.

Researchers have researched 3D optical imaging and 3D display, with applications in medicine, robotics, security, detection, visualization, and display abilities. For example, 3D medical imaging is a new technology that can improve disease prevention, diagnosis, and treatment in clinics and operating rooms. Optical imaging through imaging probes using bioluminescence, chemiluminescence, afterglow imaging, and NIR-II probes having macro-mesoscopic regimes are new advances in studying deep tissue imaging.

Optical Imaging Market Restraints:

- Lack of clinical expertise is expected to restrain the market growth.

Optical imaging provides a major scope for disease detection and cancer care. However, the low penetration of optimal imaging, absorption, and scattering issues, and the lack of clinical instrumentation and expertise will likely hamper the optical imaging market's growth.

Optical Imaging Market Geographical Outlook:

- During the forecast period, North America is expected to hold a significant share of the optical imaging market.

North America is projected to account for a considerable market share due to increased research and technological advancements, and the surge in eye, brain, cancer, and other diseases, where optical imaging is majorly applied for better diagnosis. Well-established presence of market players, namely Heidelberg Engineering Inc., Carl Zeiss Meditec, Bruker Corporation, Leica Microsystems, and others, has also positively impacted the regional market growth.

Regional economies, namely the USA, are experiencing a high prevalence of vision impairment cases. According to the CDC ( Centres for Disease Control and Prevention), approximately 12 million people 40 years and above suffer from vision impairment in the United States, of which nearly 8 million cases remain untreated. Major eye diseases include Glaucoma, Diabetic Retinopathy, Cataracts, and Refractive Error.

Brain Diseases, mainly Alzheimer's, Brain Tumour, Dementia, and Parkinson’s Disease, are resulting in deaths among people in the United States. Further, MRI Scanning is a technique used to detect images from the brain and deduce results. Breast and brain cancer constitutes one of the major cancer-related deaths in the US.

To better determine the cancer stages and their spread level within the body, imaging techniques such as Computed Tomography (PET-CT) Scans and Emission Tomography are used. Furthermore, emerging technologies such as Artificial Intelligence are also finding their way into medical imaging applications, providing new growth prospects for optical imaging.

Moreover, besides high applicability in the medical sector, optical imaging is also finding its way into space missions, where major space organizations such as NASA are investing in such technology.

Optical Imaging Market Key Developments:

- April 2024: Spectral Instruments Imaging launched the latest version of its vivo optical imaging software, “Aura 4.5”. It is based on precise automation and a proprietary “Kinetics Mode” algorithm for capturing and analyzing real-time dynamic bioluminescent signals.

- February 2024: Bruker Corporation announced the acquisition of Spectral Instruments Imaging LLC, a specialist in developing pre-clinical in-vivo optical imaging systems. The acquisition would enable Bruker to extend its “BioSpin Preclinical Imaging” division for disease research.

- October 2023: Abbott Laboratories announced the launch of its new vascular imaging software, “Ultreon 1.0”, in India. The first-of-its-kind intravascular imaging software combines Artificial Intelligence and Optical Coherence Tomography (OCT) to enable physicians to get a comprehensive view of blockage and blood flow in the coronary arteries.

- September 2023: Revvity Inc. launched the “ IVIS® Spectrum 2”, “IVIS SpectrumCT 2”, and “Quantum GX3 microCT” imaging systems, which aimed to drive innovations across the preclinical research process. The standard products aimed to elevate the sensitivity standard of both in-vivo and ex-vivo optical imaging.

- September 2023: Yole Group’s partner, PISEO, announced the launch of its optical imaging testing services. These services would use cutting-edge equipment that is reliable for the characterization of the entire optical imaging chain in high-value-added medical areas.

Optical Imaging Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | US$3.224 billion |

| Total Market Size in 2031 | US$5.555 billion |

| Growth Rate | 11.49% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technique, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

| Report Metric | Details |

| Optical Imaging Market Size in 2025 | US$3.224 billion |

| Optical Imaging Market Size in 2030 | US$5.555 billion |

| Growth Rate | CAGR of 11.49% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies Covered |

|

| Customization Scope | Free report customization with purchase |

Optical Imaging Market Segmentation:

- By Technique

- Endoscopy

- Optical Coherence Tomography (OCT)

- Photoacoustic Imaging

- Raman Spectroscopy

- Super-Resolution Microscopy

- Diffuse Optical Topography

- By Application

- Ophthalmology

- Oncology

- Dentistry

- Dermatology

- Neurology

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Taiwan

- Others

- North America