Report Overview

Packaging Automation Market - Highlights

Packaging Automation Market Size:

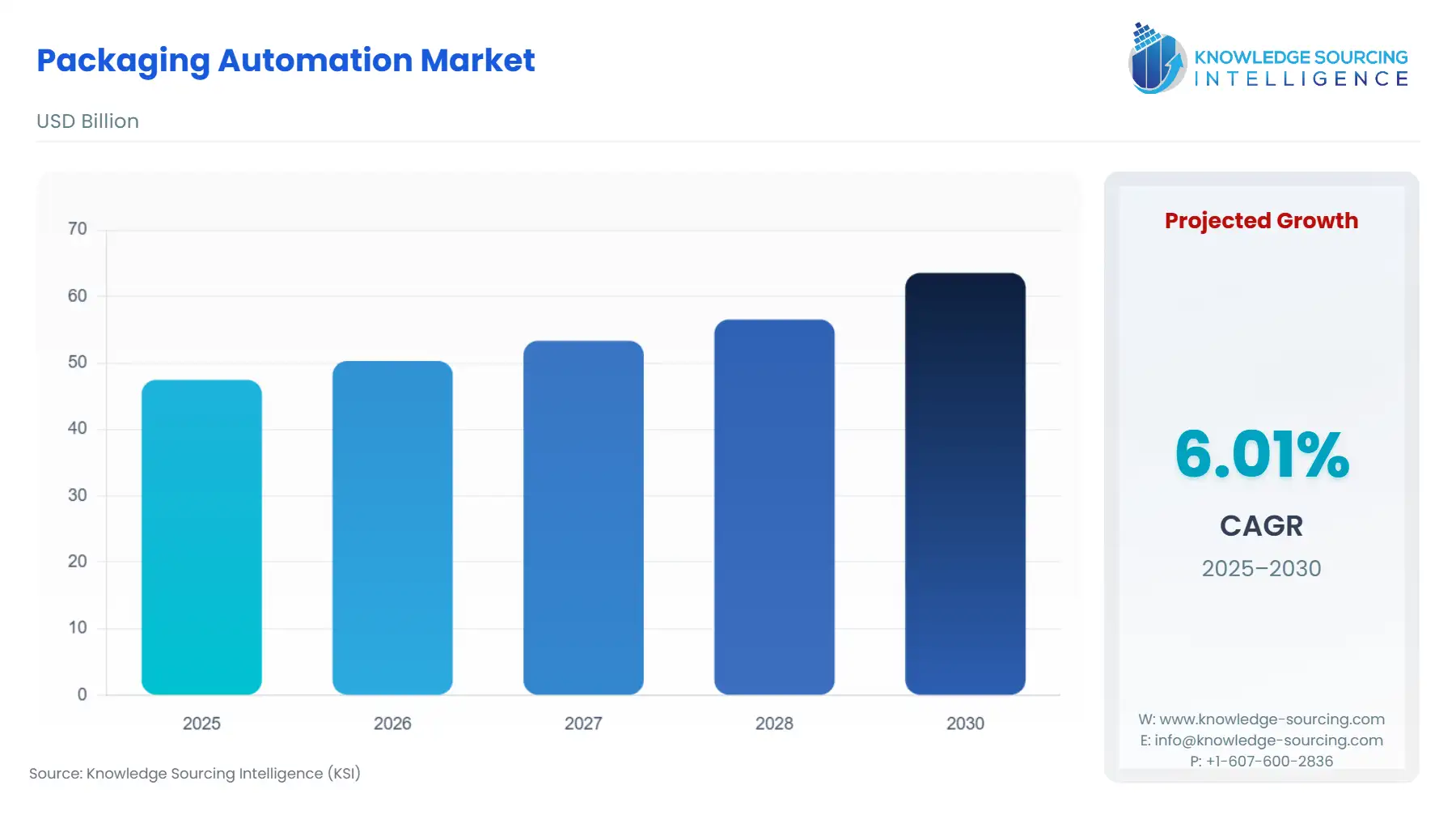

The Packaging Automation Market is expected to grow from US$47.462 billion in 2025 to US$63.555 billion in 2030, at a CAGR of 6.01%.

The Packaging Automation Market, a critical enabler of modern global logistics and manufacturing efficiency, is defined by its responsiveness to macroeconomic shifts and technological imperatives. As consumer packaged goods (CPG) companies and third-party logistics (3PL) providers navigate the dual pressures of accelerated demand volatility and the need for operational resilience, investments in automated solutions have shifted from a capital expenditure strategy to an operational necessity. This environment underscores the market's pivotal role in achieving labor independence and precision quality control across high-volume sectors such as Food & Beverage and Electronics.

Packaging Automation Market Analysis

- Growth Drivers

The imperative for high-speed throughput and precision quality control accelerates the demand for advanced automated systems. Traceability mandates, particularly within the pharmaceutical and food sectors, necessitate high-accuracy labeling and inspection systems, thereby driving direct demand for sophisticated automated robot and smart camera-enabled labeling equipment. The complexity introduced by SKU proliferation—driven by customized product variants and regional packaging requirements—forces manufacturers to abandon fixed automation lines in favor of modular, quick-changeover automated packers, directly creating demand for highly flexible systems. Finally, the ongoing digital transformation across global factories, which emphasizes real-time data integration, increases the demand for automated conveyors and sort systems equipped with advanced sensors and connectivity for seamless integration into manufacturing execution systems.

- Challenges and Opportunities

A primary challenge lies in the high initial capital outlay for advanced robotic systems, which acts as a constraint on adoption for small-to-midsize enterprises (SMEs), particularly in emerging economies, thereby dampening immediate demand in this segment. Furthermore, the skill gap in maintenance and programming personnel for sophisticated automated systems poses an operational risk, indirectly slowing the pace of implementation and uptake. Conversely, a significant opportunity emerges from the Industry 5.0 paradigm, which emphasizes human-centricity and sustainable resilience. This trend increases the demand for collaborative robots (cobots) that work alongside human operators, offering a pathway to automation adoption without displacing the entire workforce, and simultaneously improving physical ergonomics in manufacturing. The push for predictive maintenance also presents an opportunity, driving demand for smart components with integrated diagnostics.

- Raw Material and Pricing Analysis

The Packaging Automation Market predominantly comprises physical hardware, including sophisticated mechanical, electronic, and robotic systems. Key raw materials for this hardware are industrial-grade steel and aluminum for structural frames and arms, and semiconductor components and rare earth magnets for electric motors and control systems. Pricing for the underlying steel and aluminum components has been subject to global commodity price volatility, directly impacting the manufacturing cost of automated conveyors and structural chassis. Critically, the ongoing strain on the global semiconductor supply chain has elevated the cost and lead times for high-performance controllers and smart sensors, imposing a direct constraint on the final pricing and delivery schedules of automated packers and robotic arms. This dynamic forces Original Equipment Manufacturers (OEMs) to focus on supply chain resilience and strategic component stockpiling.

- Supply Chain Analysis

The global supply chain for packaging automation is characterized by a high level of geographic specialization and complex logistical dependencies. Key production hubs for high-precision components, such as servo motors and advanced controllers, are concentrated in regions like Germany, Japan, and the United States, which act as the primary sources for firms like Mitsubishi Electric and Siemens AG. The supply chain for mechanical systems and large-format automated conveyors often originates in these same regions, requiring sophisticated, high-value, and complex global logistics. Logistical complexities arise from the sheer size and custom nature of the equipment, which necessitates specialized freight and installation teams. The market is highly dependent on a global network of specialist system integrators who customize and deploy the automation solutions, linking the core manufacturing base to the diverse end-user sites across different industry verticals.

Packaging Automation Market Government Regulations

Key government regulations exert a direct influence on the design and subsequent demand for packaging automation systems.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Machinery Directive (2006/42/EC) & EN ISO 12100 |

Mandates stringent safety standards for packaging machinery, compelling manufacturers to invest in advanced automated robot safety features, sensors, and protective barriers, directly increasing the demand for compliant, safety-integrated systems. |

|

United States |

Food and Drug Administration (FDA) Current Good Manufacturing Practices (cGMP) |

For the Healthcare and Food & Beverage segments, cGMP requires verifiable data logging and precision in processes like filling and labeling. This mandates the adoption of validated, highly automated, and traceable systems with integrated software for electronic batch records, increasing demand for sophisticated automated packers and filling machines. |

|

India |

National Circular Economy Roadmap for Reducing Plastic Waste (e.g., Extended Producer Responsibility) |

Drives a demand shift toward automated packers and wrapping equipment capable of handling new, flexible, and sustainable packaging materials (e.g., biodegradable films) and requires greater throughput for recycling preparation, such as automated sort systems (CSIRO, n.d.). |

Packaging Automation Market Segment Analysis

- By Application: Palletizing

The Palletizing segment is experiencing definitive growth driven by two non-negotiable operational factors: labor efficiency and workplace safety. Manually intensive and ergonomically taxing, the palletizing process is a prime candidate for automation, especially as manufacturers grapple with high employee turnover and rising workers' compensation claims related to repetitive strain injuries. The core growth driver is the direct replacement of human labor with automated robots, which can operate tirelessly at higher speeds and with greater precision, particularly in high-volume, multi-shift environments like the Food & Beverage industry. The push for mixed-load palletizing—the ability to create diverse, store-ready pallets for omnichannel distribution—further accelerates demand for highly intelligent, articulated robots and advanced software, which are necessary to manage the complexity and sequencing of various product sizes and weights onto a single pallet. This complexity cannot be efficiently managed by conventional fixed-function systems, creating a specific market need for advanced robotic palletizing solutions.

- By Industry Vertical: Food & Beverage

The Food & Beverage industry is a major growth catalyst for packaging automation, primarily due to the stringent hygiene requirements and the inherent short shelf-life of its products. The imperative to minimize human contact for contamination control drives demand for automated systems in critical processes such as filling and wrapping. Specifically, sanitary design standards necessitate the adoption of stainless-steel, wash-down-capable automated packers and conveyors. Furthermore, the volatility in consumer preference—ranging from single-serve snacks to bulk family packs—mandates the use of flexible, quick-changeover automated packaging lines to manage short production runs efficiently. This high-mix, high-volume requirement propels the demand for agile automated robot and filling solutions, as human-operated lines cannot achieve the requisite speed or handle the frequent changeovers without significant downtime and risk of error. The necessity is therefore directly linked to the need for food safety compliance and operational agility in a highly dynamic retail environment.

Packaging Automation Market Geographical Analysis

- US Market Analysis (North America)

The US market for packaging automation is characterized by a strong, non-cyclical demand for robot-based systems driven by chronic, severe labor shortages in manufacturing and logistics centers. The primary growth factor is the accelerated adoption of e-commerce, which requires vast, highly automated sort systems and high-speed automated conveyors to process millions of small parcels daily across numerous mega-distribution centers. Favorable capital expenditure incentives and the imperative to reshore manufacturing also compel companies to invest in highly automated packaging lines to offset high domestic labor costs, cementing the demand for sophisticated, high-end automated packers and palletizing solutions.

- Brazil Market Analysis (South America)

The Brazilian market is primarily catalyzed by the need for operational cost reduction and the modernization of aging infrastructure, particularly in the domestic Food & Beverage sector. Local manufacturers increasingly utilize automated packers and filling machines to standardize quality and reduce waste, which had historically been a significant operational challenge. While the high initial cost of imported robotics can be a constraint, competitive pressures from multinational corporations operating in the country are compelling domestic firms to upgrade to automated conveyors and entry-level robotic solutions to compete on price and scale.

- Germany Market Analysis (Europe)

Germany's market is centered on Industry 4.0 integration and precision engineering. The need for automated systems, particularly from major players like Siemens AG and BEUMER Group, is driven by the necessity for seamless data exchange between packaging lines and plant-wide control systems. Manufacturers demand automation that provides high machine intelligence and digital twin capabilities, fueling the need for software-integrated automated robot and sort systems. The focus is less on basic labor replacement and more on total process optimization and achieving near-zero defect production runs.

- Saudi Arabia Market Analysis (Middle East & Africa)

The need for packaging automation in Saudi Arabia is heavily influenced by large-scale government-backed industrial diversification and infrastructure projects, such as the National Industrial Development and Logistics Program. The local factor driving growth is the rapid establishment of new, world-class Food & Beverage and Logistics facilities built from the ground up with full automation as the baseline. This creates significant demand for comprehensive, large-scale automated conveyor and sort systems from international suppliers, as domestic expertise and supply are still developing.

- India Market Analysis (Asia-Pacific)

India's market expansion is being driven by the confluence of rapid consumer class growth and stringent quality standards in the export-oriented pharmaceutical and logistics sectors. The requirement centers on both high-speed automated packers for mass-market CPG and precision labeling/inspection systems to meet global regulatory compliance for exported goods. Furthermore, the government's "Make in India" initiative encourages domestic manufacturing scale-up, accelerating the demand for automated robots and palletizing solutions to achieve the necessary production volume and speed for international competitiveness.

Packaging Automation Market Competitive Environment and Analysis

The Packaging Automation Market is dominated by a few global conglomerates that leverage their deep expertise in industrial control systems and robotics. The competitive landscape is bifurcated between large, full-suite providers and specialized, application-focused firms. The primary competitive advantage lies in the integration of industrial controls, software, and mechanical systems.

- Siemens AG

Siemens AG's strategic positioning is anchored in its comprehensive Digital Enterprise portfolio, offering an integrated approach from machine control to cloud-based analytics. The company’s core offering, including the SIMATIC line of controllers and the TIA Portal engineering framework, ensures seamless integration of automated packers, conveyors, and sort systems into the overarching plant IT infrastructure. Siemens AG promotes the concept of the Digital Twin, a virtual representation of the packaging line, which increases demand for its components as manufacturers seek to simulate and optimize performance before physical implementation.

- ABB Ltd.

ABB Ltd. is positioned as a robotics and motion control specialist, making it a dominant player in the automated robot and palletizing segments. The company’s key product, the YuMi collaborative robot (cobot), is a significant offering in packaging automation, specifically catering to applications requiring human-robot interaction, such as small parts assembly, kitting, and final packing, directly addressing the modern market trend for human-centric automation in the Industry 5.0 context. Its broader portfolio of articulated arms and high-speed pick-and-place robots reinforces its position as a primary supplier for high-throughput automated lines.

- Mitsubishi Electric Corporation

Mitsubishi Electric Corporation is a key competitor, concentrating its strategy on Factory Automation (FA) products that form the backbone of automated lines. Their core product offerings, such as the MELSERVO-J5 Series of AC servo amplifiers and the iQ-R Series of controllers, emphasize high-speed connectivity and precision motion control. The company's e-F@ctory concept, which integrates IT and FA systems, is its competitive differentiator, directly addressing the demand from end-users for scalable, connected automation platforms.

Packaging Automation Market Developments

- November 2024: Siemens AG released an update to its Totally Integrated Automation (TIA) Portal software, which includes enhanced features for integrating and commissioning automated machines, including automated conveyors and robot controllers. This product launch focuses on simplifying the engineering workflow and reducing the time required to deploy complex packaging automation systems, directly responding to the market's need for faster time-to-market for new production lines.

- February 2024: JASA launches its latest generation of NXXT vertical packaging machines at Fruit Logistica in Berlin. The new line is based on a modular concept, built with autonomous modules designed to offer customers greater efficiency, ease of use, and streamlined serviceability for diverse fresh produce packaging needs.

Packaging Automation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 47.462 billion |

| Total Market Size in 2031 | USD 63.555 billion |

| Growth Rate | 6.01% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Application, Industry Vertical, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Packaging Automation Market Segmentation:

By Product Type

- Automated packers

- Automated conveyors

- Automatic robot

- Sort systems

- Others

By Application

- Filling

- Labeling

- Wrapping

- Palletizing

- Others

By Industry Vertical

- Food & Beverage

- Logistics

- Electronics

- Automotive

- Healthcare

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others