Report Overview

Plant Asset Management Market Highlights

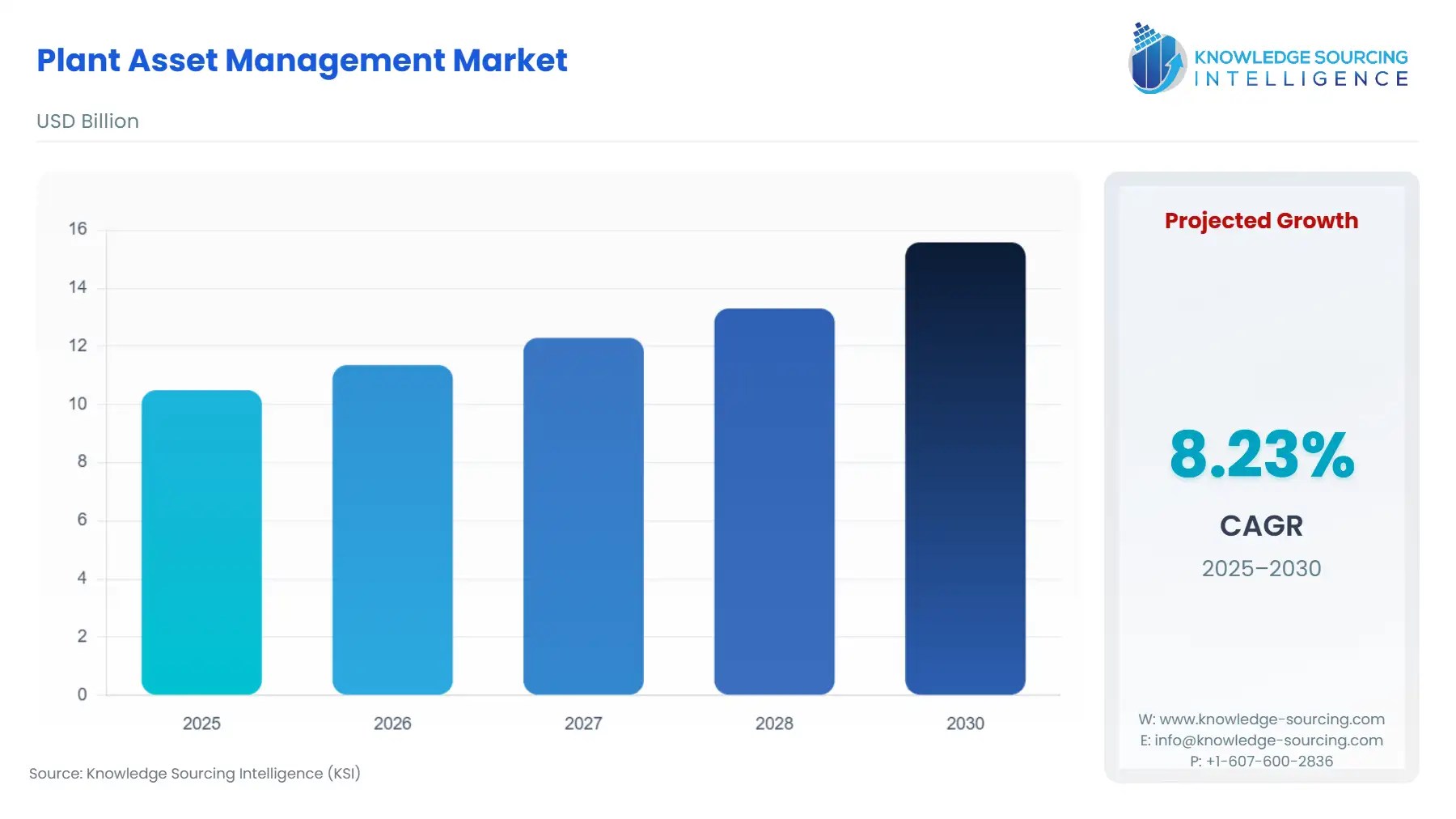

Plant Asset Management Market Size:

The Plant Asset Management Market will grow from USD 10.495 billion in 2025 to USD 15.585 billion by 2030, rising at a CAGR of 8.23%.

Plant Asset Management Market Key Highlights

The Plant Asset Management (PAM) market represents a foundational pillar of the industrial digital transformation agenda, providing essential software and services for monitoring, analyzing, and optimizing the operational performance of physical plant assets. As global industrial operators confront persistent pressures to maximize asset lifespan, reduce unscheduled downtime, and comply with increasingly stringent operational and environmental regulations, the adoption of sophisticated, data-driven PAM frameworks has become a non-negotiable strategic imperative. This shift moves beyond traditional Enterprise Asset Management (EAM) to embrace real-time condition monitoring, predictive analytics, and lifecycle optimization, establishing PAM solutions as a core component of modern, resilient industrial operations across asset-intensive sectors.

Plant Asset Management Market Analysis

- Growth Drivers

The primary catalyst for market expansion is the pervasive implementation of Industry 4.0 frameworks, which directly amplifies the demand for PAM solutions by integrating operational data streams. Real-time sensor data, streamed via IIoT networks from production assets, creates an immediate requirement for PAM software equipped with analytical capabilities to translate raw data into actionable predictive insights, allowing operators to preempt component failures. Concurrently, the rising cost and complexity of maintaining critical, high-value assets across sectors like Oil & Gas necessitates a shift to predictive maintenance models. This specific need generates demand for advanced PAM software licenses that incorporate machine learning and AI, directly replacing lower-value, periodic inspection services with high-value analytical subscription models.

- Challenges and Opportunities

A significant market challenge is the complex integration of new PAM solutions with legacy operational technology (OT) systems. Many industrial facilities operate with decades-old control systems that lack native connectivity protocols, imposing high customization costs and implementation timelines. This constraint can deter demand, especially for smaller or older industrial sites. However, this same complexity creates a substantial Managed Services opportunity, as clients outsource the specialized expertise required for seamless IT-OT convergence and continuous PAM system maintenance. Furthermore, the rising global focus on Environmental, Social, and Governance (ESG) reporting presents an opportunity, driving demand for PAM systems that offer granular data on energy consumption and emissions compliance, directly tying asset efficiency to mandated sustainability metrics.

- Supply Chain Analysis

The Plant Asset Management supply chain is fundamentally an intangible service and software delivery model, focused on intellectual property rather than raw materials. The key production hubs are concentrated in regions with robust software engineering and data science talent pools, primarily North America and Western Europe, which house the R&D centers of major providers. Logistical complexity revolves not around shipping, but around the secure, low-latency deployment of cloud-based infrastructure and the execution of highly specialized integration services. The market exhibits a heavy dependency on cloud service providers (CSPs) for infrastructure and on specialized system integrators for customizing software to unique industrial process control systems. The supply chain risk is thus centered on cybersecurity and the availability of domain-specific industrial control system (ICS) expertise.

Government Regulations

Government and trade association regulations consistently impose operational requirements that directly spur demand for sophisticated PAM systems to ensure auditability and compliance.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Occupational Safety and Health Administration (OSHA) (e.g., Process Safety Management Standard) |

Mandates stringent maintenance and inspection protocols for assets in high-hazard industries. This drives demand for PAM systems to centralize compliance documentation, schedule mandated checks, and provide auditable logs of all asset lifecycle events. |

|

European Union |

EU Industrial Emissions Directive (IED) and Corporate Sustainability Reporting Directive (CSRD) |

The IED requires adherence to Best Available Techniques (BAT) and sets emissions limits. CSRD necessitates transparent reporting of environmental impact. This increases demand for PAM solutions that link asset performance data (e.g., combustion efficiency) directly to emissions monitoring and verifiable ESG reporting metrics. |

|

Global |

ISO 55001: Asset Management Standard |

While non-mandatory, global industries adopt this standard for best-practice risk management and performance optimization. Adherence mandates the structural, informational, and analytical capabilities inherently provided by a modern PAM software suite. |

In-Depth Segment Analysis

- By Deployment Model: Cloud

The Cloud deployment model is experiencing accelerating demand due to a clear total cost of ownership (TCO) advantage and superior operational flexibility. Industrial operators increasingly reject the high initial capital outlay and dedicated IT maintenance required by on-premise solutions. Cloud-based PAM is a direct response to this, offering a subscription-based (SaaS) model that shifts asset-related costs from CAPEX to OPEX. The cloud's primary growth driver is the requirement for remote, scalable monitoring of geographically distributed assets, such as extensive oil pipelines, utility grids, or fleets of wind turbines. The elastic compute power of the cloud is essential for handling the massive, continuous data streams generated by IIoT sensors, enabling real-time diagnostics and predictive analytics that are infeasible with localized servers. Furthermore, the cloud facilitates the integration of advanced third-party AI/ML tools and allows centralized management of multiple, disparate plant locations under a single, unified view, which is a key necessity for global industrial conglomerates focusing on standardized operational excellence.

- By Industry Vertical: Oil & Gas

The Oil & Gas sector represents a dominant vertical for PAM, driven by the sector's highly aggressive cost-reduction imperative and the catastrophic consequences of asset failure. Asset failure, whether on an offshore platform or in a refinery, results in enormous financial losses from unscheduled downtime and carries significant environmental and safety risks. This environment generates intense demand for high-fidelity predictive maintenance capabilities to ensure maximum uptime of crucial assets like compressors, pumps, and drilling equipment. The aging infrastructure in mature fields, coupled with pressure to maximize output, necessitates detailed PAM software to track asset degradation and predict Remaining Useful Life (RUL). Furthermore, regulatory bodies strictly mandate the integrity of pipelines and pressure vessels. PAM solutions, integrated with sensor technology, directly enable continuous condition monitoring, ensuring compliance with these stringent operational and safety regulations, thereby mitigating operational risk, which is a core purchasing driver for the sector.

Geographical Analysis

- US Market Analysis (North America)

The US market for PAM is characterized by high technological maturity and a robust regulatory environment. The primary growth factor is the intensive adoption of digitalization within the Energy and Manufacturing sectors, driven by the imperative to modernize aging infrastructure across power grids and chemical processing plants. The rapid expansion of massive hyperscale data centers also creates significant demand for PAM to ensure continuous uptime and optimize the power distribution assets critical for these facilities. Furthermore, stringent OSHA and environmental regulations enforce a high standard for asset record-keeping and integrity management, making PAM software a necessary compliance tool.

- Brazil Market Analysis (South America)

The Brazilian market is primarily propelled by the extensive Oil & Gas (Pre-Salt exploration) and Mining sectors. These industries operate large, remote, and complex asset bases that benefit significantly from remote monitoring and centralized management. The emphasis is less on the latest-generation software and more on reliable, robust solutions that can manage asset performance in harsh, geographically isolated environments. Cost management is a central driver, leading to high demand for PAM systems that can minimize inventory and optimize maintenance schedules to reduce operational expenditure.

- Germany Market Analysis (Europe)

Germany's PAM market is fundamentally shaped by its Industry 4.0 leadership and a strong emphasis on industrial automation and efficiency. The market's major growth factor is the drive to establish "smart factories" where production lines are highly optimized. This generates demand for advanced PAM solutions that integrate seamlessly with sophisticated manufacturing execution systems (MES) and utilize digital twin technology to simulate asset performance. Additionally, EU regulations concerning energy efficiency and sustainability compel German manufacturers to adopt PAM for detailed energy consumption tracking at the machine level.

- UAE Market Analysis (Middle East & Africa)

The PAM market in the UAE is intrinsically linked to the dominance of the Oil, Gas, and Petrochemicals industries. The colossal scale of sovereign-owned energy assets necessitates a best-in-class approach to asset reliability and integrity management. Large-scale digital transformation initiatives aimed at enhancing predictive maintenance across offshore rigs and expansive refinery complexes drive this demand. The UAE's focus on future-proofing its energy sector ensures strong need for PAM solutions that offer advanced AI-driven diagnostics and cloud deployment capabilities.

- China Market Analysis (Asia-Pacific)

China’s market for PAM is characterized by its scale and its government's push for the "Made in China 2025" strategy, which prioritizes advanced, high-tech manufacturing. The sheer volume of new industrial capacity, especially in sectors like automotive and electronics, drives demand for PAM software as a means of rapidly scaling operational standards and minimizing time-to-market. The need to efficiently manage this vast, rapidly deployed capacity means the market prioritizes cost-effective, scalable, and often localized software solutions.

Competitive Environment and Analysis

The Plant Asset Management competitive landscape is dominated by a few large, diversified industrial automation and software conglomerates that leverage their installed hardware base and deep sector expertise to cross-sell PAM solutions. The market is increasingly shifting from discrete software sales to long-term service contracts and software-as-a-service (SaaS) subscriptions, emphasizing predictive analytics as the core value proposition.

- ABB Ltd.

ABB is strategically positioned to capitalize on the electrification and digitalization trend, utilizing its vast installed base of measurement and control devices. The company's core PAM offering is integrated into the ABB Ability portfolio. A key strategic focus is leveraging its process knowledge to deliver industry-specific applications, particularly in the metals and mining sectors. Its PAM solutions are designed to manage electrical, mechanical, and instrumentation assets across their lifecycle, utilizing connectivity to drive predictive maintenance services that improve uptime and reduce energy consumption.

- Emerson Electric Co.

Emerson maintains a powerful competitive edge through its foundational strength in process control and final control elements (valves, instruments). The company’s PAM strategy centers on its integration with AspenTech (following the combination of its industrial software businesses with AspenTech), creating an end-to-end portfolio that spans from sensor-level diagnostics (hardware) to enterprise-level asset optimization software. Its AMS (Asset Management Solutions) suite, including AMS Device Manager, is positioned to ensure high reliability and compliance for high-pressure/high-temperature assets, making it a critical player in the Oil & Gas and Chemical verticals.

- Siemens AG

Siemens' competitive strategy is anchored in its comprehensive Digital Industries division, which provides seamless integration between hardware (automation and drives) and software (PAM and MES). The company’s MindSphere industrial IoT platform serves as the foundational data ingestion and analytics layer for its PAM offerings. Siemens positions itself as the partner for holistic digital transformation, focusing on leveraging the "Digital Twin" of the plant to simulate, predict, and optimize asset performance throughout its lifecycle, particularly strong in the automotive and discrete manufacturing industries.

Recent Market Developments

- March 2025: Emerson announced the completion of the acquisition of all outstanding shares of common stock of AspenTech not already owned by Emerson. This transaction solidifies Emerson's commitment to industrial software, enhancing its ability to deliver an end-to-end intelligent automation portfolio, which is critical for driving the adoption of high-value PAM optimization services across its customer base.

- January 2025: Siemens released updates for its Teamcenter Service Lifecycle Management (SLM) platform. This iteration included "more efficient physical asset workflows" and "usability updates for managing Service BOMs." These enhancements directly improve the capability for comprehensive digital lifecycle management of plant assets.

Plant Asset Management Market Segmentation

By Offering

- Software

- Services

By Deployment Model

- On-Premise

- Cloud

By Industry Vertical

- Oil & Gas

- Energy & Power

- Food & Beverage

- Automotive

- Healthcare & Pharmaceuticals

- Chemicals

- Metals & Mining

- Pulp & Paper

- Water & Wastewater

- Others

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others