Report Overview

Saudi Arabia ALD Precursors Highlights

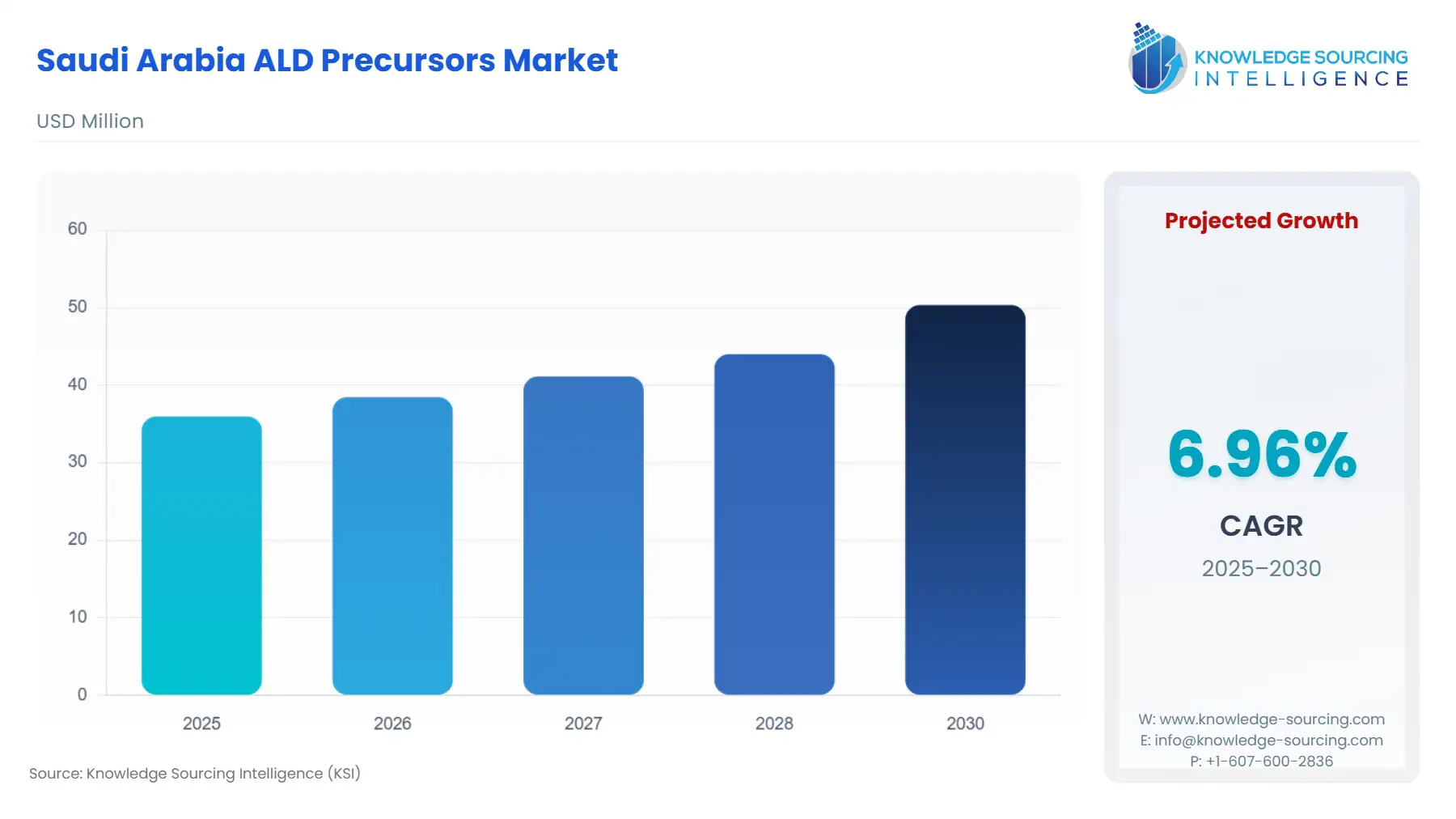

Saudi Arabia ALD Precursors Market Size:

The Saudi Arabia ALD Precursors Market is expected to grow at a CAGR of 6.96%, rising from USD 35.955 million in 2025 to USD 50.337 million by 2030.

The Saudi Arabian ALD (Atomic Layer Deposition) Precursors market is transitioning from a nascent, import-dependent structure to a strategic supply chain component, directly tethered to the nation’s high-technology localization agenda. Atomic Layer Deposition is a crucial thin-film technology utilizing high-purity chemical compounds—the precursors—to deposit ultra-thin, conformal films required for advanced device fabrication.

This market’s current trajectory is fundamentally shaped by the Kingdom's economic diversification mandate, which necessitates the development of a resilient domestic electronics and clean energy ecosystem. The consequent rise in sophisticated manufacturing within Saudi Arabia is now an irreversible structural driver demanding localized, high-specification precursor supply.

Saudi Arabia ALD Precursors Market Analysis:

Growth Drivers

The market sees significant propulsion from two strategic, government-backed sectors. The commitment to establish a localized semiconductor industry, involving incentives to complete at least 50 semiconductor design companies by 2030, necessitates the importation and eventual localized synthesis of advanced ALD precursors. This initiative directly creates demand for specialized materials like hafnium and aluminum precursors essential for High-kappa dielectrics in advanced logic and memory devices. Concurrently, the National Renewable Energy Program (NREP) mandates the construction of vast solar photovoltaic (PV) capacity. Thin-film solar cells, alongside advanced passivation layers on conventional silicon cells, rely heavily on ALD-deposited films like aluminum oxide Al2O3), directly increasing the consumption volume of their respective precursors. This dual-sector focus establishes a diverse and stable demand base for market growth.

Challenges and Opportunities

A significant challenge is the critical reliance on complex global supply chains for ultra-high-purity chemical synthesis, as domestic precursor manufacturing infrastructure remains in its developmental phase. The extreme purity and specialized handling requirements of volatile metal-organic precursors introduce logistical friction and high initial capital expenditure. However, this constraint simultaneously presents a major opportunity for global chemical players and domestic petrochemical giants like SABIC and Saudi Aramco to vertically integrate their operations. Developing a local synthesis and purification hub, leveraging existing feedstock availability, would mitigate geopolitical supply risk and secure local market share, thereby stabilizing and increasing local precursor demand by ensuring immediate, high-quality material availability for incoming electronics fabricators.

Raw Material and Pricing Analysis

ALD precursors, as physical products, are predominantly synthesized from specialized, high-purity organometallic compounds or metal halides. The supply chain for these raw materials is highly consolidated and globalized, with sourcing often linked to specialized metal processing facilities in East Asia and Europe. The pricing dynamics are a function of two variables: the global commodity price of the core element (e.g., hafnium, tantalum, aluminum) and the specialized, energy-intensive purification and synthesis cost to achieve a semiconductor-grade purity (99.9999% or higher). Price volatility in the base metal market is therefore amplified by the high-cost barrier of ultra-purification, transferring cost pressure directly to Saudi Arabia's emerging end-users and making long-term supply contracts with fixed pricing a strategic imperative for local fabricators.

Supply Chain Analysis

The ALD precursors supply chain feeding the Saudi market is characterized by a high degree of global segmentation. Production hubs for advanced precursors are concentrated in North America, Europe, and East Asia, reflecting decades of foundational R&D and manufacturing expertise in semiconductor materials. This necessitates a complex logistical process involving intercontinental shipment under highly controlled conditions, including temperature, pressure, and inert atmosphere packaging to maintain precursor integrity and prevent decomposition. The key logistical complexity in the Saudi context is the "last mile" delivery: maintaining the ultra-high-purity chain of custody from port to the end-user fabrication facility, a dependency that necessitates reliable local partnerships with industrial gas and chemical distributors already operating robust high-purity delivery networks within the Kingdom.

Government Regulations

The regulatory framework in Saudi Arabia fundamentally influences the precursor market by dictating the chemical inputs and logistical integrity.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Saudi Arabia | SASO RoHS Technical Regulation | Mandates the exclusion of six hazardous substances (e.g., Lead, Mercury) in finished electrical and electronic equipment (EEE). This directly compels precursor suppliers to certify and guarantee their materials do not introduce non-compliant residues, restricting the palette of viable precursor chemistries and favoring Pb-free and Cd-free formulations for ALD layers. |

| Saudi Arabia | General Directorate of Customs/E-Commerce Law | Governs the import of sensitive chemicals and high-purity materials. The requirement for stringent product certification and documentation via the SABER platform impacts the speed and cost of precursor importation, emphasizing the need for local stocking and swift customs clearance to maintain just-in-time inventory for high-volume manufacturing. |

Saudi Arabia ALD Precursors Market Segment Analysis:

By Application: High-k Dielectric

The High-k Dielectric segment represents a disproportionate driver of high-value precursor demand within Saudi Arabia's emerging electronics sector. Advanced CMOS and DRAM structures mandate the use of high-k materials, predominantly Hafnium Oxide (HfO2), to replace traditional silicon dioxide (SiO2) gate oxides. The direct demand creation stems from the critical role HfO2 plays in managing gate leakage and scaling down transistor dimensions. As Saudi Arabia's semiconductor initiatives progress from design to actual fabrication, the requirement for Hf-based precursors (e.g., TEMAH or TDMAH) for depositing these angstrom-thick layers becomes non-negotiable and volume-intensive. The precursor quality for this segment is the most stringent, as impurities lead to device failure, forcing new market entrants to source only from the most certified, high-purity chemical suppliers.

By End-User: Electronics & Semiconductors

The Electronics & Semiconductors end-user segment is the primary demand-pull factor, driven by an overarching national imperative to diversify revenue streams away from hydrocarbons. The development of a domestic semiconductor ecosystem, spearheaded by state-backed investment in fabrication facilities, creates a sustained, compounding need for ALD precursors. This requirement is not merely for volume but for a diverse portfolio of specialized precursors—including metal-organic, organometallic, and halide chemistries—required for complex 3D-stacked architectures (e.g., 3D NAND) and advanced logic nodes. The specific growth driver is the need for highly conformal and uniform thin films—essential for high aspect ratio structures—which only ALD and its corresponding high-quality precursors can reliably deliver at scale, ensuring the performance and yield targets of domestically produced chips.

Saudi Arabia ALD Precursors Market Competitive Environment and Analysis:

The Saudi Arabian ALD precursors market is highly competitive at the global supplier level, characterized by a few major players leveraging their worldwide infrastructure to service the nascent local demand. The competition is centered not on price, but on material purity, logistical reliability, and local technical support.

Company Profiles

Air Liquide

Air Liquide maintains a strong strategic positioning built on its global leadership in industrial and specialty gases, a portfolio that is critically intertwined with the ALD precursor supply chain. The company leverages its extensive NEOSOLUTIONS portfolio, offering a comprehensive suite of ALD and CVD precursors. Their strategic edge in Saudi Arabia lies in their robust local gas supply and distribution infrastructure, which is essential for handling and delivering the high-purity carrier and process gases required for ALD processes alongside the chemical precursors themselves. This co-location of gas and chemical expertise simplifies the logistics for a new fabrication facility in the Kingdom.

Linde plc

Linde plc is positioned as a leading global industrial gases and engineering company with a significant footprint in the Middle East. Its strategy involves utilizing its extensive regional asset base to provide a secure and reliable supply of ultra-high-purity gases and advanced materials, including precursors. Linde's competitive strength is rooted in its integrated supply model, which includes the provision of critical inert gases and the management of gas-handling systems, providing turnkey solutions for customers requiring stringent contamination control—an imperative for the adoption of ALD technology in advanced semiconductor manufacturing.

SABIC

As a global chemical manufacturing giant headquartered in Saudi Arabia, SABIC’s strategic positioning is unique: it represents the highest potential for localized synthesis and supply chain independence. While not a legacy ALD precursor supplier, its immense scale in petrochemical and specialty chemical production, coupled with government support for localization, provides a robust foundation. SABIC's focus is on leveraging its access to local feedstock and established industrial parks to develop a competitive domestic offering, aiming to provide bulk and semi-specialty precursors and reduce the Kingdom's import dependency for the electronics sector.

Saudi Arabia ALD Precursors Market Recent Developments:

- March 2025: Aramco launched Saudi Arabia’s first CO2 Direct Air Capture (DAC) test unit in collaboration with Siemens Energy. This facility will test next-generation CO2 capture materials, highly suggesting the localized evaluation and potential demand for new or specialized ALD precursor chemistries for large-scale application coating development.

Saudi Arabia ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 35.955 million |

| Total Market Size in 2031 | USD 50.337 million |

| Growth Rate | 6.96% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

Saudi Arabia ALD Precursors Market Segmentation:

- BY APPLICATION

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- BY TECHNOLOGY

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- BY END-USER

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others