Report Overview

Smart Coatings Market Size, Highlights

Smart Coatings Market Size:

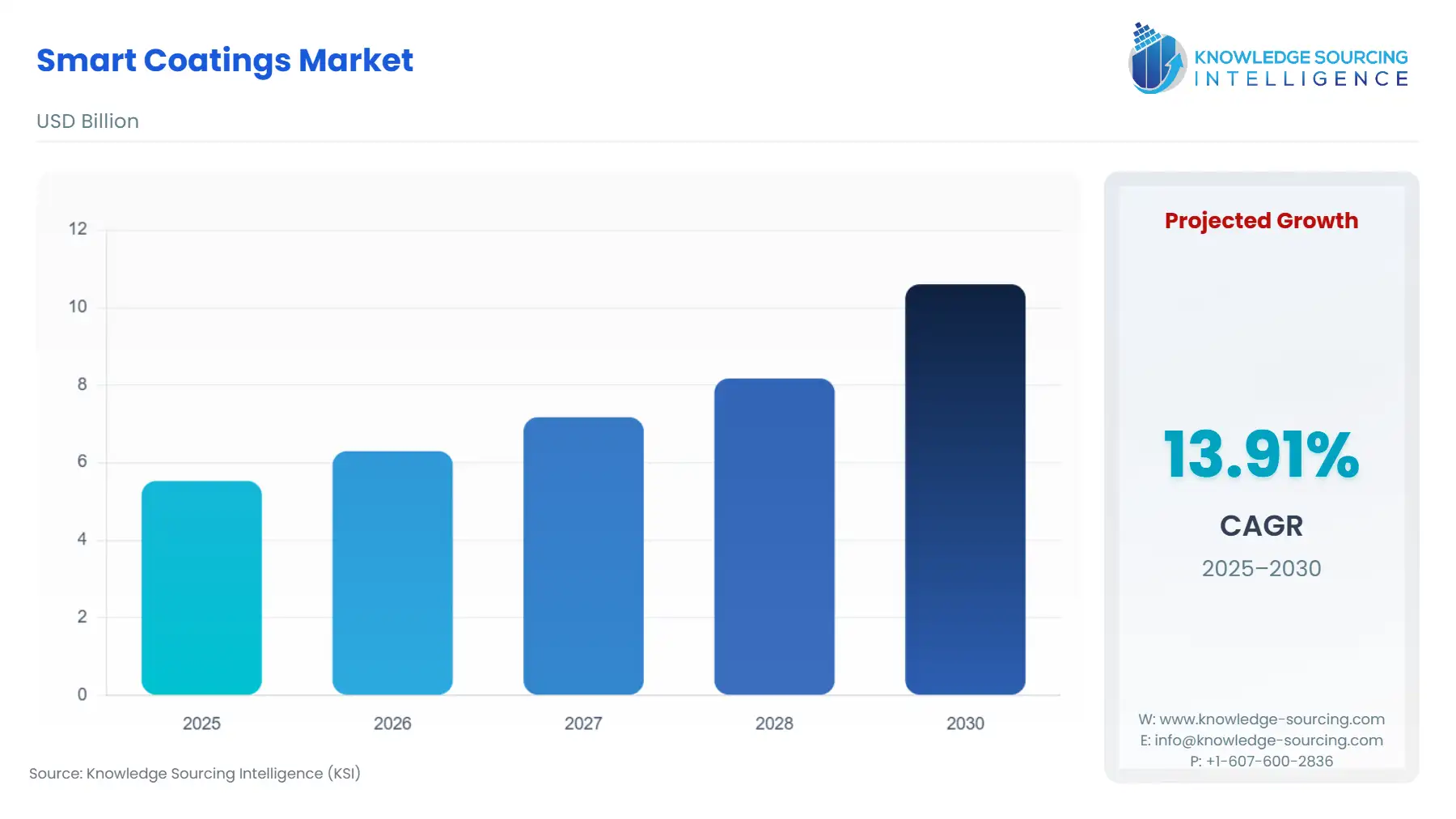

The smart coatings market will grow from US$5.528 billion in 2025 to US$10.604 billion in 2030 at a CAGR of 13.93%.

Smart coatings are regarded as coatings that are equipped efficiently with the ability to sense their environment while responding to encountered stimuli. These coatings are intricately designed to possess a level of intelligence that allows them to detect various extreme factors such as moisture levels, changes in temperature, or even the presence of contaminants. The major factor driving this market is their superior properties over traditional coatings, followed by the rising demand for smart coatings in other end-user industries, especially the construction and automotive industries. Furthermore, various advancements in research and development have further driven market growth. For instance, steel faces many persistent challenges, such as corrosion, and to address this issue, a few advancements in smart coatings emerged, which offered innovative solutions like anti-microbial technologies and self-healing. It is also said that smart coatings extend the lifespan of steel structures and enhance their performance, sustainability, and safety.

Smart Coatings Market Drivers:

- Increasing demand from Building and Construction Industry

Smart coatings are efficiently used in glass walls in buildings for easier maintenance, especially for high-rise commercial and office buildings. In the construction industry, smart coatings play an imperative role as they offer two areas of value for investors and building owners. It provides enhanced protection from degradation action and external forces such as corrosion, general damage, microbial incursion, icing, and soiling. Secondly, smart coatings possess a range of active properties essential in boosting effectiveness, such as hydrophobicity, and constituting certain capabilities for self-healing with liquid-infused formulas.

With the growth in the construction and building industry, the demand for smart coatings is expected to grow. For instance, according to TST Europe, in the United States, the construction industry stands at an imperative place, encompassing over 745,000 companies that will provide employment opportunities to 7.8 million people annually. Additionally, the total construction spending in 2023 reached $1.98 trillion, which was also a 7.4% increase from the previous year. This amount of construction spending, which will increase yearly, will directly impact the smart coatings market growth in the United States.

Smart Coatings Market Geographical Outlook:

- The United States will dominate the smart coatings market during the forecast period.

The region of North America is expected to grow mainly because of its growing automotive and construction industry, where smart coatings play an efficient role. Smart coatings in the automotive industry are imperative as they help protect the surface from corrosion and scratches.

Smart coatings are referred to as self-healing smart coatings, which are equipped with the feature of self-cleaning coatings that can repel dirt, while adaptive coatings can change color or transparency. These coatings play an important role because they also help increase the service life of the components, which is imperative for the automotive industry.

These properties and uses of smart coatings in the automotive industry make them directly correlated to each other. With the growing automotive industry, the smart coatings market growth is expected. According to the International Trade Administration, the United States automotive industry is the world’s second-largest vehicle production and sales market. In 2020, United States vehicle sales were recorded at 14.5 million units. Moreover, according to the study conducted by the HIS Markit and released by the Motor & Equipment Manufacturers Association in 2021, a total of 4.8 million U.S. direct, indirect, and induced jobs were generated. Thus, an increase in the automotive industry is expected to drive demand for the smart coatings market.

Smart Coatings Market Challenges:

- High price is considered one of the restraining factors for the smart coatings market globally. As the growth in competitors increases, prices will increase, affecting the quality of smart coatings and further acting as a restraining factor for the smart coatings market.

The smart coatings market by application is segmented into construction, military, healthcare, automotive, aerospace, and consumer electronics.

Smart coatings are broadly applied in construction, automotive, and healthcare, where the chances of corrosion are high. With the growing economies of Asia and Africa, the demand for smart coatings in aerospace, consumer electronics, and military is growing, thus causing the demand for smart coatings.

Smart Coatings Market Key Developments:

Smart Coatings Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Smart Coatings Market Size in 2025 | US$5.528 billion |

| Smart Coatings Market Size in 2030 | US$10.604 billion |

| Growth Rate | CAGR of 13.93% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Smart Coatings Market |

|

| Customization Scope | Free report customization with purchase |

The smart coatings market is segmented and analyzed as follows:

- By Sensing Type

- Ionic strength

- pH

- Temperature pressure

- Surface tension

- Magnetic field

- Mechanical forces

- By Application

- Construction

- Military

- Healthcare

- Automotive

- Aerospace

- Consumer electronics

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America