Report Overview

Spain ALD Precursors Market Highlights

Spain ALD Precursors Market Size:

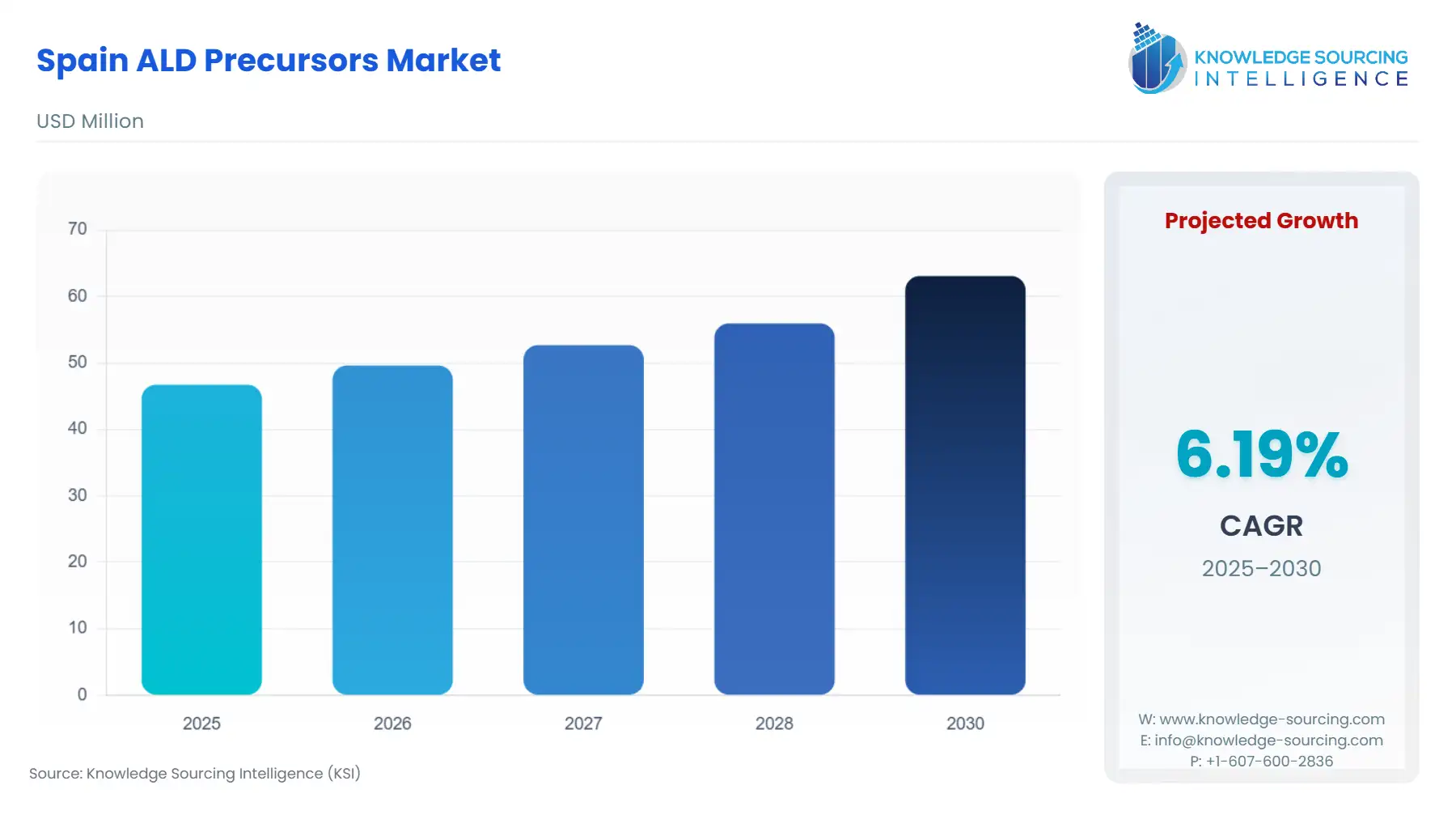

The Spain ALD Precursors Market is expected to grow at a CAGR of 6.19%, rising from USD 46.741 million in 2025 to USD 63.101 million by 2030.

The market for Atomic Layer Deposition (ALD) precursors in Spain is transitioning from a nascent, R&D-focused environment to one characterized by significant industrial investment, spurred primarily by the national strategic imperative to secure the semiconductor supply chain. ALD precursors—highly specialized chemical compounds such as metal-organics and halides—are foundational materials essential for depositing ultra-thin, highly uniform films critical to advanced microelectronics, photovoltaic cells, and energy storage devices.

The current market dynamics are defined by a singular, colossal public investment aimed at re-shoring fabrication capacity within the European Union, which positions Spain as a crucial future node for high-precision manufacturing. This structural pivot in the national industrial policy is accelerating demand for high-purity specialty chemicals that enable next-generation device architectures, fundamentally changing the risk-reward profile for global precursor manufacturers operating within the Iberian Peninsula.

Spain ALD Precursors Market Analysis:

Growth Drivers

The most powerful growth driver is the Spanish government’s PERTE Chip initiative, committing €12.25 billion to microelectronics and semiconductors until 2027. This investment directly creates an urgent, high-volume demand for ALD precursors by subsidizing the creation of advanced manufacturing and nano-fabrication facilities that necessitate ALD for high-k dielectrics, barrier layers, and advanced packaging. Furthermore, the robust growth in Spain's installed Solar Photovoltaic (PV) capacity—reaching over 9,300 MW DC in 2023—propels demand for ALD precursors crucial for thin-film surface passivation and encapsulation layers, which increase cell efficiency and long-term durability. This dual focus on high-tech fabrication and renewable energy provides a resilient, two-pronged catalyst for precursor consumption.

Challenges and Opportunities

A primary challenge remains the high operational complexity and cost associated with handling and maintaining the ultra-high purity required for ALD precursors, which deters smaller, domestic manufacturers from entering the market, thus increasing reliance on foreign supply chains. The opportunity lies in the shift toward "greener" precursor chemistries driven by the EU’s sustainability goals. This regulatory push, particularly under REACH, creates demand for novel, less hazardous precursors (e.g., water-soluble or lower-toxicity metal-organics) compatible with Plasma-Enhanced ALD (PEALD) and other low-temperature processes. Companies that successfully certify and scale non-hazardous, high-purity precursor production gain a significant competitive advantage in the European and Spanish markets.

Raw Material and Pricing Analysis

The ALD precursor market’s pricing structure is subject to volatile global supply chains for exotic and specialized raw materials, primarily high-purity metals (e.g., Hafnium, Tantalum, Tungsten) and complex organic ligands. The specialized nature of the final metal-organic and halide compounds means they command a significant price premium over bulk chemicals; academic sources cite specialty precursor costs exceeding $500 per liter. Price stability is therefore constrained by the global upstream market, especially given the concentration of refinement and production outside of Europe. The need for absolute purity, often 99.9999% (6N), necessitates extremely high manufacturing and quality control standards, which prevents price erosion and ensures that a substantial portion of the final product cost is tied to purification and high-containment packaging (bubblers).

Supply Chain Analysis

The global supply chain for ALD precursors is highly centralized and complex, characterized by extreme logistical complexities. Production is dominated by a few key hubs in Asia-Pacific and North America, necessitating long, intricate transport routes to reach end-users in Spain. The final products—volatile, often air-sensitive, pyrophoric, and highly toxic chemicals—demand specialized, temperature-controlled, high-containment packaging and transportation infrastructure. Spain's market is critically dependent on just-in-time delivery from distribution and purification facilities, often situated in major European industrial gas hubs (e.g., France, Germany), managed by key suppliers like Air Liquide and Linde. Any disruption in this global, specialized logistics chain immediately translates to fabrication downtime for Spanish R&D centers and future fabrication facilities.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union (EU) | REACH Regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals) | Mandates the registration and evaluation of all specialty chemicals, including ALD precursors, above one tonne per year. Increases compliance costs and time for market entry, thereby constraining the supply of non-compliant precursors and driving demand exclusively toward authorized, high-safety-standard chemical formulations. |

| Spain | PERTE Chip (€12.25 Billion Strategic Project) | The primary catalyst for new, domestic demand. Funds the establishment of fabrication facilities, directly translating to a guaranteed, long-term procurement need for a spectrum of precursors (e.g., HfCl4 for HfO2, TMA for Al2O3). |

| European Union (EU) | Restriction of Hazardous Substances (RoHS) Directive | While primarily focused on finished electronics, it indirectly mandates the reduction or elimination of certain heavy metals in the final device. This accelerates the R&D and eventual demand for newer, less-toxic ALD precursor chemistries that meet the evolving requirements for future EU-manufactured chips and devices. |

Spain ALD Precursors Market Segment Analysis:

By Application: High-k Dielectric

The need for ALD precursors in the High-k Dielectric segment in Spain is intrinsically linked to the national investment in advanced semiconductor manufacturing under the PERTE Chip. High-k materials, such as HFO2 (Hafnium Dioxide) deposited using precursors like HfCl4 or TEMA Hf, are non-negotiable for fabricating Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFETs) at sub-45 nm nodes. As the Spanish plan includes building manufacturing capacity for chips both above and below five nanometres, the demand shifts toward precursors that facilitate ultra-thin films with precise stoichiometry and minimal defects. This drives a premium on specific organometallic precursors, which allow for lower-temperature deposition compatible with complex 3D transistor architectures, pushing Spanish research facilities and new fabs toward procuring only the highest-purity, newest-generation precursors capable of maintaining process control.

By End-User: Electronics & Semiconductors

The Electronics and Semiconductors end-user segment is the definitive anchor for precursor demand in Spain, overriding all other applications in terms of purity and volume requirements. The government's strategic focus is on reinforcing scientific capacity for R&D on cutting-edge microprocessors, integrated photonics, and developing quantum chips. Each of these specialized fields relies heavily on ALD's unique ability to deposit highly conformal thin films over complex 3D structures. For instance, integrated photonics demands ALD for waveguiding layers and precise mirror coatings, while quantum chip fabrication requires exceptional material purity and uniform dielectric isolation layers. The PERTE Chip's goal to create "fabless companies, test pilot lines and semiconductor training networks" ensures a sustained, long-term demand curve for a diverse portfolio of precursors, transitioning from R&D-scale volumes to eventual manufacturing-scale consumption as facilities become operational.

Spain ALD Precursors Market Competitive Environment and Analysis:

The Spanish ALD Precursors Market is a function of the global specialty chemical and industrial gas sector, where high capital barriers and demanding purification requirements concentrate market power among a few multinational players. These companies leverage extensive logistical networks and proprietary purification technologies to meet the stringent requirements of the electronics and semiconductor sectors, which is the primary driver in the Spanish market. Competition centers on logistics efficiency, precursor purity, and regulatory compliance. Given the PERTE Chip's emphasis on domestic capacity, the competitive landscape will see a push for European-based or Europe-focused supply chain investments.

Air Liquide

Air Liquide, a world leader in gases, technologies, and services for industry and health, is strategically positioned to capture demand stemming from Spain's PERTE Chip. The company's competitive advantage is its integrated electronics division which supplies high-purity carrier gases, bulk specialty chemicals, and ALD precursors, ensuring a one-stop-shop for future Spanish fabs. Air Liquide announced an investment of more than €250 million in July 2025 to support the semiconductor industry in Europe, demonstrating a clear commitment to continental supply chain reinforcement. Furthermore, the company’s focus on decarbonization, evidenced by securing significant PPAs in Spain and elsewhere (February 2025), positions them favorably for meeting the sustainability criteria of government-backed projects.

Merck KGaA

Merck KGaA, through its Electronics business sector, is a critical global supplier of ALD precursors, operating under the EMD Performance Materials brand. The company’s strategy focuses on innovation in highly specialized, advanced material solutions, including precursors for High-k dielectrics and other next-generation logic and memory applications. Merck’s strength in the Spanish market derives from its deep portfolio of established precursor chemistries, often used in global research institutions, aligning well with the PERTE Chip's pillar of reinforcing scientific capacity and R&D. Their competitive approach centers on offering a wide range of cutting-edge materials that are essential for developing the integrated photonics and quantum chips targeted by the Spanish government’s investment.

Spain ALD Precursors Market Recent Developments:

- July 2025: Air Liquide announced a significant commitment to support the European semiconductor market with an investment of more than €250 million. This capacity addition is aimed at reinforcing the industrial gas and specialty materials supply chain across the continent, directly increasing the robust, reliable availability of gases and ALD precursors required by new and expanding fabrication facilities, including those planned under initiatives like the Spanish PERTE Chip.

- February 2025: Air Liquide announced that it signed record volumes of Power Purchase Agreements (PPAs) in 2024, securing over 2,500 GWh of low-carbon electricity across key countries, including Spain. This strategic move is instrumental in reducing the carbon footprint of its operations and allows the company to supply customers, particularly in the environmentally-conscious European electronics sector, with industrial gases and specialty chemicals—including ALD precursors—that have a lower carbon footprint.

Spain ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 46.741 million |

| Total Market Size in 2031 | USD 63.101 million |

| Growth Rate | 6.19% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

Spain ALD Precursors Market Segmentation:

- BY APPLICATION

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- BY TECHNOLOGY

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- BY END-USER

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others