Report Overview

Thailand ALD Precursors Market Highlights

Thailand ALD Precursors Market Size:

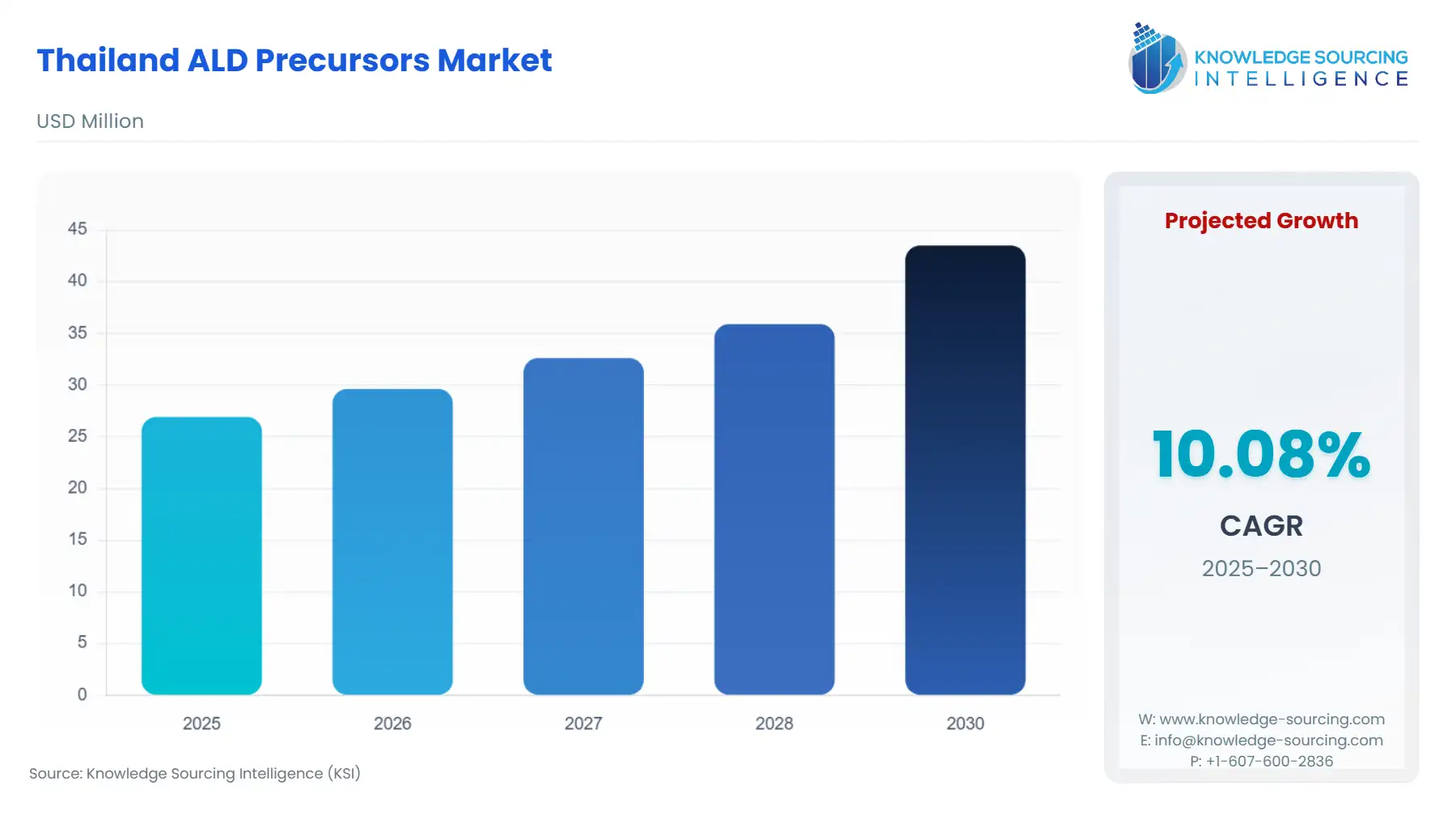

The Thailand ALD Precursors Market is anticipated to rise at a CAGR of 10.08%, reaching USD 43.511 million in 2030 from USD 26.918 million in 2025.

The ALD precursors market in Thailand is experiencing robust growth, fueled by several industry-specific trends. This includes increasing demand for semiconductor components, technological advancements in deposition technologies, and government initiatives aimed at strengthening Thailand’s position as a leader in high-tech manufacturing. As the semiconductor sector remains the backbone of the market, applications across electronics, energy storage, and renewable energy continue to drive new requirements. However, challenges related to raw material sourcing and global supply chain complexities are influencing market dynamics.

Thailand ALD Precursors Market Analysis:

Growth Drivers:

Several key factors are driving the rapid growth of the ALD precursors market in Thailand.

- Semiconductor Industry Expansion: Thailand’s semiconductor manufacturing sector is experiencing rapid growth, spurred by increasing demand for advanced integrated circuits (ICs) and microchips. The country’s role as a significant player in Southeast Asia's electronics supply chain, coupled with the rise in demand for consumer electronics, telecommunications, and automotive components, is directly boosting the need for Atomic Layer Deposition (ALD) technology. As semiconductor manufacturers aim to meet the growing demand for smaller, more efficient devices, ALD becomes essential in creating the high-precision, thin films needed for next-generation chips. This has directly led to increased consumption of ALD precursors, particularly in high-k dielectric and barrier layer applications.

- Technological Advancements in ALD: Advancements in ALD technology, particularly Plasma-Enhanced ALD (PE-ALD) and Thermal ALD, are significantly enhancing the capability to deposit ultra-thin layers with precision. These technologies allow manufacturers to achieve the high-quality, conformal coatings necessary for critical applications in semiconductors, photovoltaics, and energy storage. The increasing adoption of these advanced techniques directly drives demand for specific ALD precursors that enable more efficient deposition processes and improved product performance. The ability to deposit at lower temperatures and higher throughput rates also positions these technologies as key enablers of continued market growth.

- Government Support and Infrastructure Development: The Thai government’s focus on advancing its electronics and semiconductor industries under initiatives such as the Thailand 4.0 policy is creating a conducive environment for ALD precursor demand. By promoting the development of high-tech industries and offering incentives for the adoption of advanced technologies, the government is directly supporting the local semiconductor and electronics manufacturing sectors. This, in turn, is driving the demand for ALD precursors as companies seek to stay competitive in the global market.

- Renewable Energy and Solar Power: With Thailand’s commitment to increasing its share of renewable energy sources, particularly solar power, the demand for ALD precursors is expected to rise. ALD is used in the deposition of thin films for photovoltaic (PV) cells and other energy storage components. The Thai government’s efforts to support the renewable energy sector, including solar power, creates opportunities for ALD precursor suppliers to expand their market footprint. The increasing adoption of ALD in energy storage systems, such as lithium-ion batteries, further supports the growth of this market segment.

Challenges and Opportunities:

Despite the significant growth prospects, the Thailand ALD precursors market faces several challenges.

- Raw Material Availability and Pricing: The supply of key ALD precursors, such as hafnium, titanium, and aluminum, is influenced by the global availability of raw materials, which can be subject to price volatility and supply chain disruptions. Thailand's reliance on imports for many of these materials creates vulnerabilities to global market fluctuations. In addition, geopolitical tensions and trade policies may further complicate the procurement of critical materials, potentially driving up costs and affecting production schedules.

- Price Sensitivity: Despite the growing demand for ALD precursors, manufacturers in Thailand face pressure to keep costs competitive, particularly in cost-sensitive applications like consumer electronics. The fluctuation of raw material prices, along with increased competition in the market, creates margin compression for manufacturers, limiting profitability.

However, the market also presents significant opportunities.

- Local Manufacturing Expansion: The continued development of local production capabilities for ALD precursors presents a significant opportunity. As local suppliers expand their production facilities to meet the growing demand from Thailand’s semiconductor and energy sectors, they can help mitigate risks associated with material shortages and pricing volatility. This will also support greater price stability in the ALD precursor market.

- Sustainable and Green Technologies: The global push toward sustainability presents a unique opportunity for ALD precursor suppliers to align their products with environmental goals. The need for ALD-based materials in renewable energy applications, such as photovoltaic panels and battery technologies, is expected to continue growing as Thailand pursues a greener energy future. This shift could lead to new product developments and innovation in ALD precursor formulations that align with environmental sustainability standards.

Raw Material and Pricing Analysis:

The pricing dynamics of key ALD precursor materials such as titanium tetrachloride, hafnium chloride, and trimethylaluminum are highly sensitive to fluctuations in global supply and demand. Thailand’s ALD precursor manufacturers depend heavily on imports from key global suppliers in regions such as the United States, Europe, and China. Volatility in raw material prices due to factors such as geopolitical instability, supply chain disruptions, or increasing global demand in industries like aerospace, automotive, and semiconductor fabrication can directly impact the costs of ALD precursors in Thailand.

The increasing scarcity of certain metals used in ALD precursor production also presents challenges for manufacturers. The limited supply of high-purity raw materials, combined with growing demand from industries such as electronics and energy storage, is likely to drive up costs and create potential supply chain bottlenecks.

Supply Chain Analysis:

The global supply chain for ALD precursors is complex and geographically dispersed. Thailand’s strategic location in Southeast Asia provides access to key global shipping routes, facilitating the transportation of raw materials and finished products. However, supply chain challenges, including transportation delays, inventory management, and geopolitical risks, continue to pose obstacles to the steady flow of materials.

Thailand is well-positioned to benefit from the global supply of ALD precursors, particularly from suppliers based in Europe and North America. However, reliance on imports means that any disruptions in these regions, such as trade conflicts or natural disasters, could significantly affect production timelines and material availability in Thailand.

Thailand ALD Precursors Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Thailand | Ministry of Industry | The Ministry of Industry's initiatives to boost Thailand’s semiconductor industry under Thailand 4.0 are driving demand for high-tech materials, including ALD precursors. This governmental push creates favorable market conditions for precursor manufacturers. |

| Thailand | Ministry of Energy | Thailand's renewable energy goals, as outlined in the Alternative Energy Development Plan (AEDP), are increasing demand for ALD precursors used in solar energy and energy storage applications. Government incentives are expected to boost investments in these areas. |

| Thailand | National Electronics and Computer Technology Center (NECTEC) | NECTEC’s role in advancing R&D for advanced materials, including ALD precursors, supports market growth by fostering innovation and creating demand for high-performance ALD materials in local industries. |

Thailand ALD Precursors Market Segment Analysis:

- By Application – High-k Dielectric: The High-k Dielectric application segment remains one of the largest growth drivers for ALD precursors in Thailand, primarily within the semiconductor manufacturing industry. High-k dielectric materials are essential for creating high-performance, energy-efficient semiconductor devices, particularly for advanced logic and memory chips. As semiconductor manufacturers strive to meet the demand for smaller, more efficient devices, the need for precise deposition of high-k dielectrics using ALD technology continues to grow. ALD precursors are particularly important in these applications due to their ability to provide conformal coatings at the atomic level. As Thailand positions itself as a regional hub for semiconductor manufacturing, the demand for high-k dielectrics will continue to drive significant consumption of ALD precursors.

- By End-User – Electronics & Semiconductors: The Electronics & Semiconductors sector is the largest end-user of ALD precursors in Thailand. The need for semiconductor devices, driven by the growing need for consumer electronics, telecommunications, and automotive applications, directly fuels the growth of the ALD precursor market. Thailand’s semiconductor industry is expanding due to both domestic and foreign investments, positioning it as a major player in the global electronics supply chain. The country’s adoption of advanced manufacturing technologies such as ALD allows manufacturers to meet the stringent performance and miniaturization requirements of modern electronic components, thereby sustaining the high demand for ALD precursors.

Thailand ALD Precursors Market Competitive Environment and Analysis:

The competitive landscape in Thailand’s ALD precursors market is defined by a combination of local and international players.

- Air Liquide Thailand: A major player in the ALD precursor space, Air Liquide offers a range of high-purity gases and materials used in semiconductor fabrication. Their continued investments in production capacity and R&D activities in Thailand ensure they maintain a competitive edge.

- Linde Thailand: With a strong footprint in Southeast Asia, Linde’s advanced ALD precursor offerings are integral to the semiconductor and electronics industries in Thailand. The company is focused on providing customized solutions to meet the specific needs of its clients in these sectors.

- Merck KGaA Thailand: A leading provider of high-performance materials, including ALD precursors, Merck KGaA’s strong market position in Thailand is supported by their continuous innovation and commitment to sustainability, particularly in energy storage and semiconductor applications.

Thailand ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 26.918 million |

| Total Market Size in 2031 | USD 43.511 million |

| Growth Rate | 10.08% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

Thailand ALD Precursors Market Segmentation:

- BY APPLICATION

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- BY TECHNOLOGY

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- BY END-USER

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others