Report Overview

US AI in Transportation Highlights

US AI in Transportation Market Size:

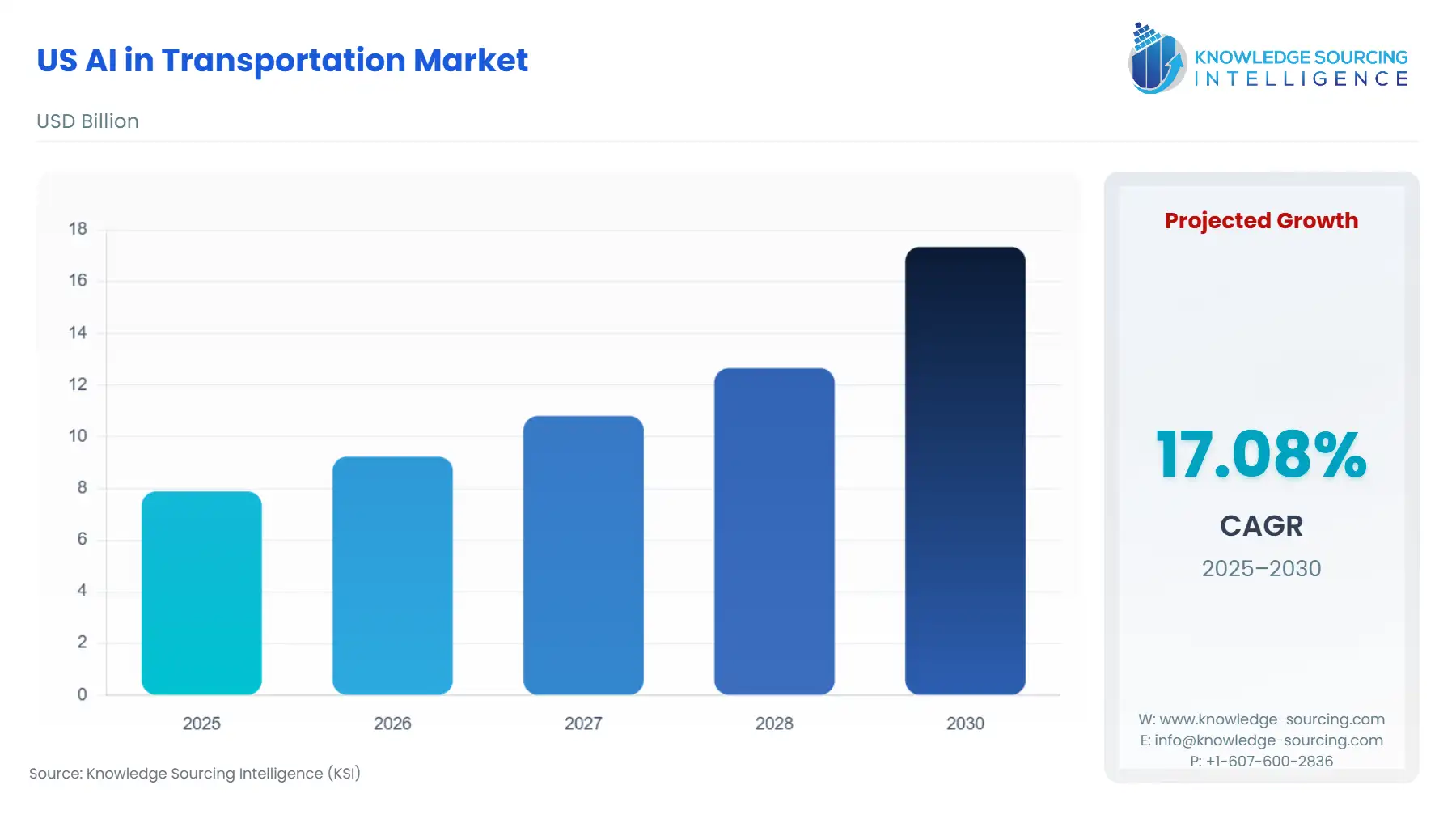

The US AI in Transportation Market is expected to grow at a CAGR of 17.08%, reaching USD 17.350 billion in 2030 from USD 7.886 billion in 2025.

The United States AI in Transportation market is fundamentally reshaped by an intersection of regulatory safety mandates, foundational technological maturation, and intense commercial pressure for operational efficiency. The market is defined by AI's transition from an exploratory technology to an embedded, mission-critical component across mobility and logistics segments. The proliferation of sensor data from vehicle fleets and smart infrastructure provides the indispensable feedstock for advanced machine learning models, creating a virtuous cycle that accelerates the development and deployment of increasingly sophisticated AI applications.

US AI in Transportation Market Analysis:

Growth Drivers

- The non-negotiable societal and economic cost of human-driven transport errors acts as the primary catalyst, directly increasing demand for autonomous systems. The National Highway Traffic Safety Administration (NHTSA)'s emphasis on proven safety technologies creates a regulatory pull for AI-powered Advanced Driver-Assistance Systems (ADAS), such as automatic emergency braking and collision warning, which rely on computer vision and deep learning. Furthermore, the persistent pressure on commercial fleet operators to mitigate rising fuel costs and supply chain volatility drives explicit demand for AI-based route optimization and predictive analytics software, which directly improves asset utilization and operational efficiency. Technological advancements in edge computing and sensor technology, specifically high-resolution LiDAR and radar, also lower the deployment cost of sophisticated AI, accelerating demand adoption.

Challenges and Opportunities

- A primary challenge is the inconsistent and fragmented regulatory framework across various US states and municipalities for full-scale autonomous vehicle deployment, creating a complex operating environment that constrains investment and limits demand to localized service areas. A further obstacle is the public's reluctance regarding data privacy and the ethical 'explainability' of AI-driven decisions, which necessitates greater transparency and validation to increase consumer adoption and market expansion. Conversely, a significant opportunity lies in the intersection of AI with intelligent traffic management systems. By leveraging AI for real-time congestion prediction and dynamic signal control, cities can validate the technology's efficacy outside of passenger vehicles, creating a new, scalable demand stream for smart infrastructure AI software and driving the adoption of vehicle-to-everything (V2X) communication standards.

Supply Chain Analysis

The US AI in Transportation supply chain is highly complex, exhibiting critical dependencies on a global network dominated by specialized hardware and sophisticated software. Key production hubs for high-performance graphic processing units (GPUs) and specialized AI accelerators, essential for the compute-intensive perception and planning layers of autonomous driving, reside primarily in the Asia-Pacific region. This concentration creates inherent logistical complexities and supply chain vulnerability, as evidenced by recent global semiconductor shortages, which constrains the pace of AI hardware deployment in US vehicle manufacturing. The software component, encompassing operating systems, middleware, and proprietary deep learning models, is largely developed in US and European technology centers, but its performance remains dependent on the reliability and flow of sensor components—LiDAR, camera modules, and radar—which are sourced internationally.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | Department of Transportation (USDOT) / NHTSA | USDOT's non-prescriptive, voluntary guidelines for Automated Driving Systems (ADS) encourage innovation but also place the onus of safety validation on developers, increasing demand for rigorous, AI-driven simulation and testing platforms to meet safety expectations. |

| United States | Federal Motor Carrier Safety Administration (FMCSA) | Regulations governing commercial vehicle operation, including hours-of-service rules, directly stimulate demand for AI-powered safety monitoring systems to ensure compliance and for Level 4 autonomous trucking solutions to circumvent human driver constraints and improve operational time. |

| Various US States | State-level legislation on autonomous vehicle testing and deployment | Inconsistent state laws create operational friction, but states with clear regulatory pathways, like California and Arizona, become high-demand hubs for commercial deployment, channeling investment and service-demand to specific geographic areas. |

________________________________________________________________

US AI in Transportation Market Segment Analysis:

By Technology: Deep Learning

Deep Learning (DL) is the indispensable technological foundation for the most complex and mission-critical functions in AI-powered transportation, making it a segment of paramount demand. The primary growth driver is the absolute requirement for advanced perception capabilities in autonomous vehicles. DL models, specifically Convolutional Neural Networks (CNNs), process vast, unstructured data from sensors (cameras, LiDAR, radar) to perform real-time, high-fidelity object detection, classification, and tracking. The superior ability of DL to handle edge cases and non-standard driving scenarios—a crucial barrier to full autonomy—directly stimulates investment and demand for DL-optimized computing hardware and specialized algorithm development teams. Furthermore, the expansion of L2+ and L3 systems in passenger vehicles, driven by consumer expectations for advanced safety and convenience, accelerates DL demand by embedding this technology into a broader range of mass-market vehicles for tasks like predictive road surface analysis and complex maneuver planning.

By Application: Predictive Fleet Maintenance

Predictive Fleet Maintenance (PFM) represents a rapidly maturing application segment whose demand is fundamentally driven by the logistics industry’s relentless pursuit of maximized asset uptime and minimized total cost of ownership (TCO). PFM utilizes Machine Learning (ML) algorithms to analyze real-time telematics data, engine sensor outputs, and historical repair records to accurately forecast component failure probabilities. This capability shifts the operational model from reactive (repair after breakdown) or time-based (scheduled maintenance) to true condition-based maintenance. The direct, measurable benefit—reducing unplanned downtime, which can cost thousands of dollars per day for a single truck—creates a compelling ROI case that is a powerful growth catalyst for AI software subscriptions and the installation of necessary IoT sensor hardware across commercial fleets, including rail and long-haul trucking. The focus on sustainability also drives PFM demand, as optimized vehicle health contributes to better fuel efficiency and reduced emissions.

________________________________________________________________

US AI in Transportation Market Competitive Environment and Analysis:

The US AI in Transportation market features an intense competitive landscape characterized by major technological incumbents and a cohort of highly specialized, venture-backed autonomy companies. The competition is segmented: established automakers and tech giants dominate the sensor and software stack for Level 2/3 ADAS, while dedicated AV firms compete aggressively for market share in the commercialized Level 4/5 robotaxi and autonomous freight sectors. The primary competitive advantage is built on the accumulation of proprietary, real-world driving data and the proven safety record of the core AI driver, an asset that is difficult to replicate.

US AI in Transportation Market Company Profiles:

Waymo

Waymo, a subsidiary of Alphabet Inc., is strategically positioned as a pioneer and current market leader in commercialized, fully autonomous ride-hailing services. Its key product is the Waymo Driver, a unified hardware and software stack that enables Level 4 autonomy. The company's unique competitive edge is its extensive real-world experience, having accumulated over ten million rides served and billions of autonomous miles driven in controlled environments and public roads as of late 2025. This vast dataset reinforces its Deep Learning models, ensuring a high degree of confidence and safety critical for commercial scaling in markets like Phoenix, San Francisco, and Austin. The strategy is centered on scaling its Waymo One ride-hailing service and its Waymo Via logistics service.

Cruise

Cruise, majority-owned by General Motors, is positioned as a direct competitor to Waymo, focusing on fully autonomous Level 4 ride-hailing within dense urban cores. The company operates a purpose-built, all-electric fleet, primarily in San Francisco, with an operational model focused on providing a clean, shared mobility experience. Cruise leverages GM’s manufacturing scale for vehicle production and its proprietary Cruise Origin, a shuttle-like vehicle designed specifically for autonomous ride-sharing. Its strategy is to scale operations rapidly in complex urban environments, relying on significant funding rounds and strategic automotive partnerships to fuel its expansion and achieve widespread commercial viability.

Tesla

Tesla's strategy is unique, focusing on integrating AI-driven autonomy features into a mass-market consumer product, positioning its Full Self-Driving (FSD) capability as a core software product upgrade. FSD relies predominantly on a vision-centric system, using a vast fleet of production vehicles as a collective data-gathering network to train its Deep Learning models. Unlike its competitors, Tesla’s approach is predicated on continuously updating its software stack through over-the-air updates, a model that generates recurring revenue and allows for rapid feature iteration, fundamentally changing the competitive dynamic from a hardware-first to a software-first race.

________________________________________________________________

US AI in Transportation Market Recent Developments:

- May 2025: Waymo announced the opening of its dedicated autonomous vehicle factory in the Phoenix area. The facility is designed to support the integration of its upcoming sixth-generation self-driving technology into new vehicles, beginning with the all-electric Zeekr RT, and plans to add 2,000 more fully autonomous Jaguar I-Pace vehicles to its existing fleet. This capacity addition signifies a commitment to high-volume commercial scaling.

- June 2024: Waymo announced that it had removed the waitlist for its fully autonomous ride-hailing service in San Francisco, making the service available to anyone who downloads the app, 24 hours a day, seven days a week. This strategic move represents a transition from a limited trial to a fully commercialized, scalable mobility service in a major US metropolitan market.

________________________________________________________________

US AI in Transportation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 7.886 billion |

| Total Market Size in 2031 | USD 17.350 billion |

| Growth Rate | 17.08% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Deployment, Application |

| Companies |

|

US AI in Transportation Market Segmentation:

- BY TECHNOLOGY

- Deep Learning

- Natural learning process

- Machine Learning

- Others

- BY DEPLOYMENT

- On-Premise

- Cloud

- BY APPLICATION

- Route optimization

- Shipping volume prediction

- Predictive Fleet Maintenance

- Real-time Vehicle tracking

- Others