Report Overview

US ALD Precursors Market Highlights

US ALD Precursors Market Size:

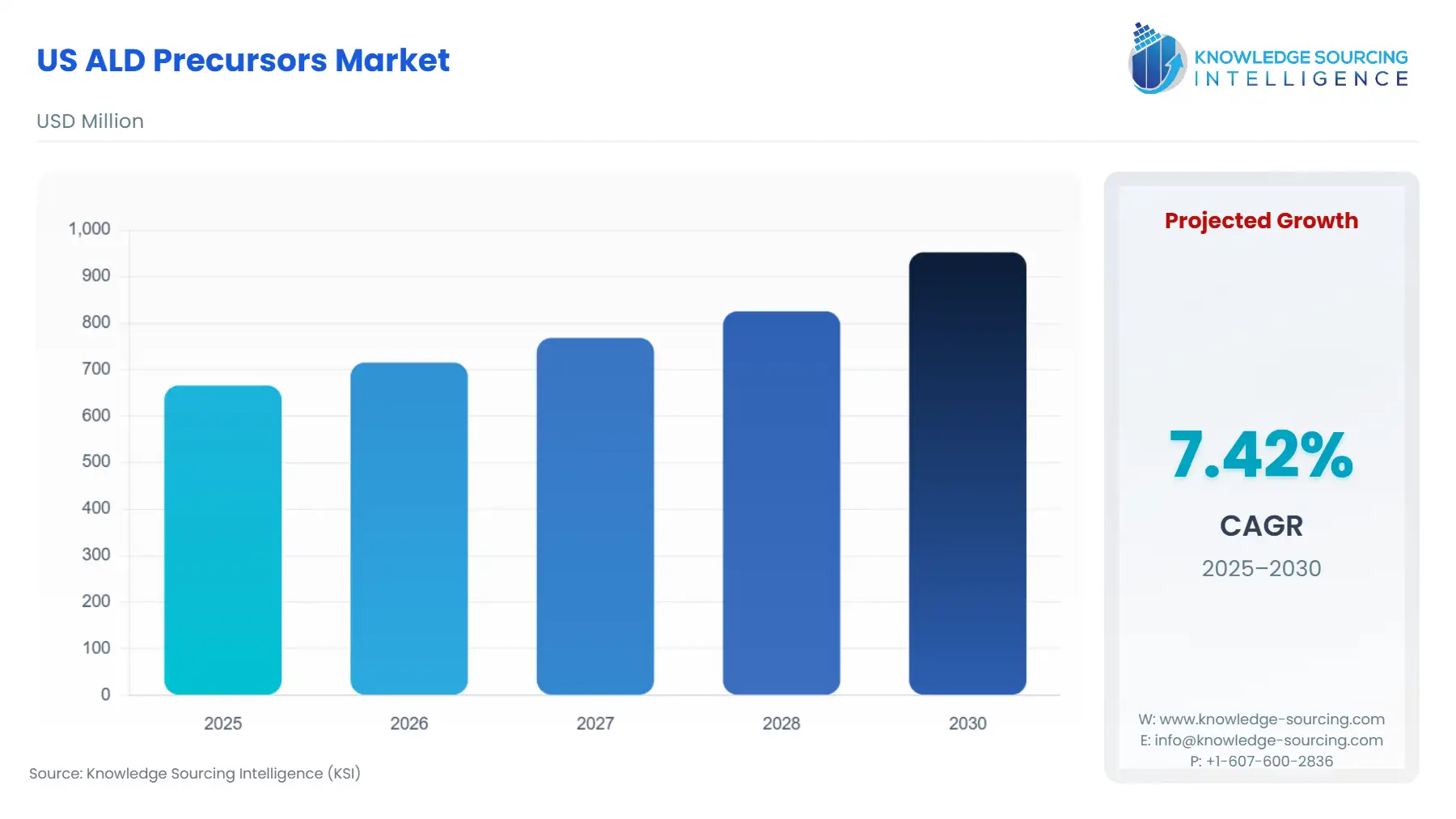

The US ALD Precursors Market is expected to grow at a CAGR of 7.42%, rising from USD 665.994 million in 2025 to USD 952.372 million by 2030.

The US market for Atomic Layer Deposition (ALD) precursors is inextricably linked to the trajectory of advanced microelectronics manufacturing. These chemical compounds, typically high-purity metal-organic, inorganic, or halide chemistries, are the fundamental building blocks for depositing ultra-thin, conformal films required for state-of-the-art semiconductor devices. The market's current momentum is driven by the industry's continuous push for device miniaturization and the subsequent shift from traditional deposition techniques to ALD, which provides the necessary atomic-scale control.

US ALD Precursors Market Analysis:

Growth Drivers

The foundational driver of precursor demand is the global shift to next-generation logic and memory devices. The transition from FinFET to Gate-All-Around (GAA) transistor architectures significantly increases the number of required ALD steps and the volume consumption of novel precursors, particularly for the multiple high-k, work-function, and barrier layers essential for these 2nm and below nodes. Additionally, the proliferation of data-intensive technologies such as Artificial Intelligence (AI) and 5G networks drives greater silicon complexity and capacity expansion in US fabrication facilities. This expansion is a direct growth catalyst, as new or upgraded fabrication facilities, often supported by government-backed incentives, require significant, long-term procurement of characterized, high-volume precursor chemistries.

Challenges and Opportunities

A primary challenge remains the inherently complex synthesis and purification of novel precursor chemistries; the need for ultra-high purity (often nine nines) to prevent device defects creates an entry barrier and adds to manufacturing costs. This purity imperative constrains the potential supplier base. However, this same constraint presents a significant opportunity: the demand for sustainable, less-hazardous ALD chemistries (Green Chemistry principles) for next-generation devices. Developing and scaling precursors that reduce waste or operate at lower temperatures and pressures not only addresses environmental regulations but also creates a differentiated product offering, driving demand away from legacy, high-toxicity compounds towards innovative, proprietary formulations.

Raw Material and Pricing Analysis

ALD precursors are a physical product, fundamentally derived from ultra-high-purity (UHP) raw materials, including specialty metals, halogens, and custom organic ligands. The pricing dynamic is dominated by two factors: the raw material cost and the intellectual property/purification cost. Key materials like Hafnium, Zirconium, Tantalum, and Ruthenium exhibit price volatility due to their specialized sourcing and refining, which directly impacts the precursor's final price. More critically, the proprietary, multi-step purification and synthesis processes required to achieve contamination-free, wafer-grade purity account for the majority of the cost, making the price inelastic to minor raw material fluctuations but highly sensitive to batch-to-batch consistency and certification requirements.

Supply Chain Analysis

The ALD precursor supply chain is highly specialized, characterized by concentrated production in a few global hubs—predominantly East Asia (South Korea, Japan) and Europe, with growing strategic investment in North America. Logistical complexity is substantial, driven by the specialized requirements for handling, shipping, and storing these materials, which are often pyrophoric, corrosive, or highly sensitive to air and moisture. The key dependency is on a limited number of specialized chemical synthesizers who can perform the necessary UHP purification. This concentrated, high-dependency structure amplifies the impact of any geopolitical or logistical disruption, creating a strong market pull within the US for regionalized precursor manufacturing and dual-sourcing strategies to safeguard domestic chip production.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | Export Administration Regulations (EAR) / Bureau of Industry and Security (BIS) | Controls on advanced computing and semiconductor manufacturing items, which can include highly specialized precursor chemistries, impose restrictions on export to specific foreign end-users. This regulation incentivizes domestic US production and R&D for advanced-node ALD precursors, aiming to bolster the internal supply chain and reduce reliance on foreign-manufactured inputs for critical US technologies. |

| United States | The Toxic Substances Control Act (TSCA) / Environmental Protection Agency (EPA) | TSCA regulates the introduction of new or significantly new chemical substances. The development of novel ALD precursors, particularly metal-organic compounds, requires rigorous review and registration before commercial production, creating a significant regulatory lead time but guaranteeing a standard for environmental and human safety, pushing developers toward inherently safer chemistries. |

| United States | U.S. CHIPS and Science Act of 2022 | Provides financial incentives and tax credits for the construction, expansion, or modernization of semiconductor manufacturing facilities in the US. This legislation directly drives and guarantees the long-term, high-volume demand for domestically supplied ALD precursors by increasing the total installed US wafer fab capacity, making localized precursor production economically viable and strategically necessary. |

US ALD Precursors Market Segment Analysis:

By Application: High-k Dielectric

The High-k Dielectric segment represents a foundational element of ALD precursor demand. As transistor dimensions scale down to the 7nm node and below, the physical limit of traditional silicon dioxide as a gate dielectric is surpassed, necessitating materials with a higher dielectric constant (high-k) to maintain electrical performance and prevent leakage. ALD precursors for materials such as Hafnium Oxide (HfO2) and Zirconium Oxide (ZrO2) are critical growth drivers. The transition to GAA structures requires the deposition of highly conformal, multi-layered films on complex 3D surfaces. This requires a new generation of high-k precursors offering superior thermal stability, higher vapor pressure, and minimal carbon incorporation to ensure perfect film uniformity and dielectric reliability, pushing demand toward proprietary metal-halide and metal-organic chemistries that can meet the stringent requirements of advanced logic manufacturing.

By End-User: Electronics & Semiconductors

The Electronics and Semiconductors segment overwhelmingly dictates the trajectory of the ALD precursors market. The necessity here is not merely linear growth but exponential growth linked to technological inflection points. The shift to 3D NAND flash memory, where ALD is essential for depositing multiple hundreds of layers to create the vertical memory stack, drives massive consumption of precursors for materials like Aluminum Oxide (Al2O3) and various barrier layers. Furthermore, the industry's strategic investment in next-generation packaging (e.g., 3D stacking and fan-out wafer-level packaging) relies on ALD for moisture barriers and ultra-thin encapsulation films. This relentless pursuit of higher transistor density, lower power consumption, and increased packaging complexity solidifies the semiconductor sector as the definitive, non-negotiable end-user driving both volume and innovation demand for ALD precursors.

US ALD Precursors Market Competitive Environment and Analysis:

The US ALD precursors market competition is an oligopoly dominated by a few multinational chemical and materials giants that command the intellectual property for high-purity, proprietary chemistries. The competitive edge is not based on price but on the security of supply, a global manufacturing footprint, and the co-development relationship with major semiconductor manufacturers (fabs and OEMs) to qualify new molecules for next-generation nodes. Barriers to entry are high, driven by the complex synthesis and purification requirements, lengthy qualification cycles, and the significant capital expenditure needed for specialty manufacturing infrastructure. Strategic positioning focuses on portfolio diversification across a full spectrum of ALD/CVD chemistries, not just single-metal precursors, and the establishment of regional production closer to US fabrication hubs.

Merck KGaA

Merck KGaA positions itself as a critical enabler of advanced semiconductor architectures through its Electronics business, particularly its Thin Films portfolio. The company's strategic focus is on solving complex integration challenges at sub-7nm nodes, including the transition to GAA. A key strategic positioning is its comprehensive offering, which includes not only ALD/CVD metals, dielectrics, and spin-on materials but also integrated Delivery Systems and Services (DS&S). Verifiable details from official publications confirm the company's product portfolio includes advanced ALD precursors for Molybdenum (Mo), Ruthenium (Ru), and Zirconium (Zr), which are vital for memory capacitor and advanced interconnect applications. The company leverages its proprietary Materials Intelligence™ Solutions and collaborative R&D programs to accelerate the development and qualification of customized molecules for its customers' roadmaps.

Air Liquide

Air Liquide's strategic positioning in the US ALD precursor market centers on its status as an integrated global supplier of industrial gases and advanced materials, prioritizing reliability and security of supply. The Electronics business line is focused on delivering very high purity gas and advanced materials for semiconductor production. The company’s competitive advantage stems from its global supply chain infrastructure, which includes on-site production capabilities and its expertise in specialty gas and chemical management. Official press releases highlight the company's emphasis on sustainability and innovation, particularly through materials designed to reduce the environmental impact of manufacturing. Air Liquide supplies a broad range of precursors and co-reactants required for high-volume ALD processes across memory and logic applications, emphasizing both its capacity and its commitment to environmentally conscious solutions.

Entegris

Entegris focuses its competitive strategy on contamination control, material science, and the delivery of ultra-high-purity materials, which are non-negotiable for ALD processes. The company’s positioning is unique due to its strong expertise in the entire solid precursor and delivery system ecosystem. Official publications verify that Entegris offers total solutions encompassing the synthesis, characterization, and advanced delivery of solid precursors, which are increasingly crucial for depositing metal materials like Hafnium Chloride (HfCl4) and Zirconium Chloride (ZrCl4) used in high-k applications. The company’s proprietary ProE-Vap® delivery system and Solid Source Delivery Cabinets (SSDC) are key products that provide the necessary vapor delivery rates and consistent flux for high-volume manufacturing, distinguishing them by solving the complex logistics of working with solid-source materials.

US ALD Precursors Market Recent Developments:

- August 2025: Entegris publicly announced plans for a significant capital investment of $700 million in the United States, which includes the establishment of a new technology center in Illinois. This is a crucial capacity addition development, demonstrating a concrete move to regionalize and reinforce the US supply chain for advanced materials, which directly supports the company's specialty materials business that includes ALD precursors and their delivery systems. The investment is strategically aimed at co-locating R&D and manufacturing near key North American semiconductor customers to accelerate speed-to-yield for next-generation devices.

US ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 665.994 million |

| Total Market Size in 2031 | USD 952.372 million |

| Growth Rate | 7.42% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

US ALD Precursors Market Segmentation:

- BY APPLICATION

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- BY TECHNOLOGY

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- BY END-USER

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others