Report Overview

Global Carbon Nanotube Market Highlights

Carbon Nanotube Market Size:

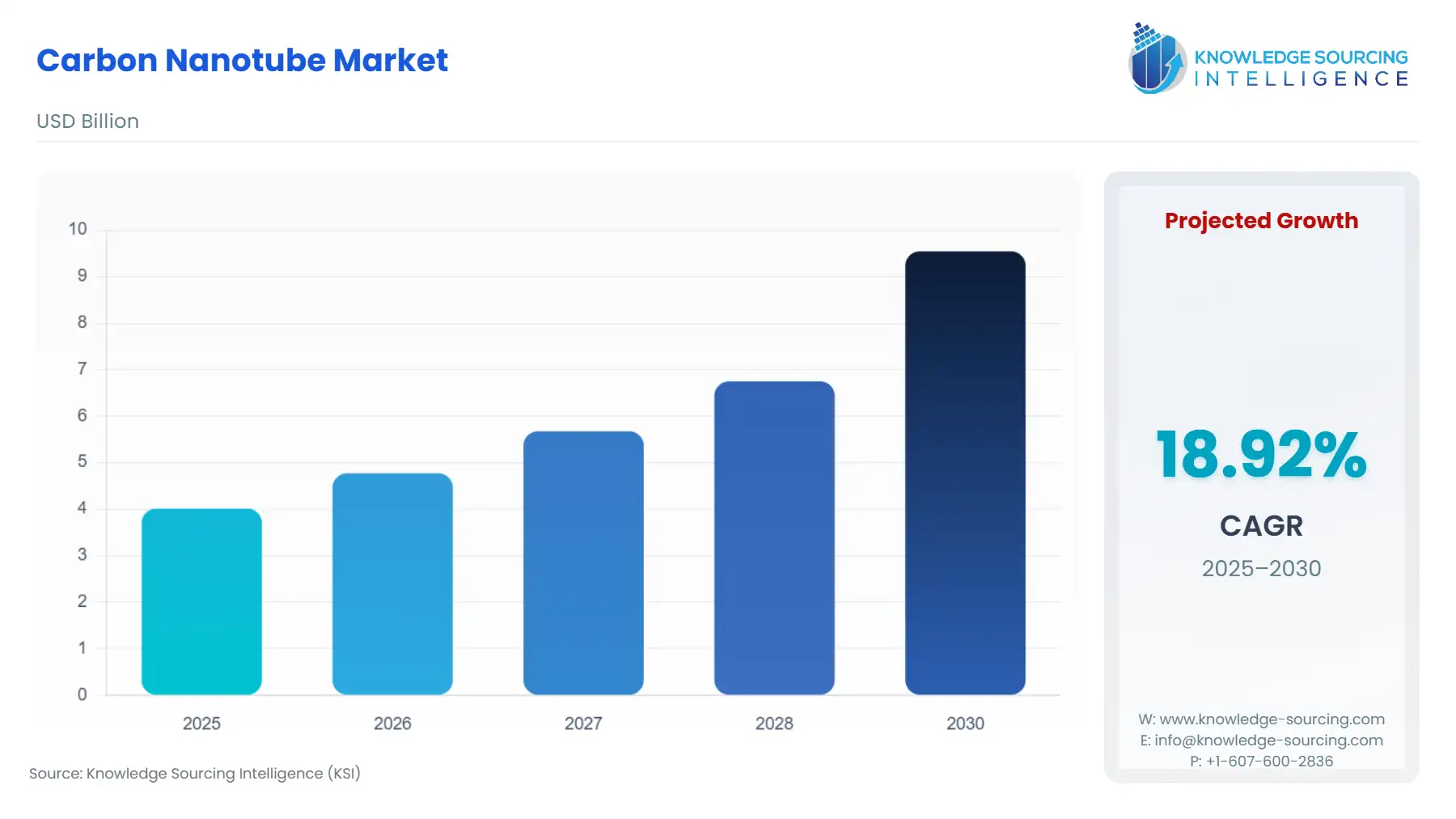

The Global Carbon Nanotube Market is expected to grow from USD 4.013 billion in 2025 to USD 9.545 billion in 2030, at a CAGR of 18.92%.

The global Carbon Nanotube (CNT) market forms a critical stratum within the advanced materials sector, fundamentally supporting the performance evolution of diverse high-technology industries. As an allotrope of carbon with exceptional electrical, thermal, and mechanical properties, the material's unique one-dimensional structure enables it to act as a superior conductive additive and mechanical reinforcement agent. The market environment is characterized by a high degree of technical complexity and significant capital expenditure for synthesis processes such as Chemical Vapor Deposition (CVD), yet the performance gains delivered across end-use sectors establish a compelling value proposition.

Global Carbon Nanotube Market Analysis

Growth Drivers

The confluence of global technological imperatives drives significant, direct demand for the Global Carbon Nanotube Market. The most powerful current catalyst is the exponential growth of the Energy & Storage sector, specifically the Electric Vehicle (EV) and battery technology segment. Manufacturers of lithium-ion batteries face an urgent need to increase energy density and lifespan while reducing weight to meet stringent range and performance expectations for next-generation EVs. CNTs directly address this demand by functioning as highly efficient conductive additives within battery cathodes and anodes. Their exceptional electrical conductivity and large surface area create an interconnected conductive network that facilitates faster electron transport and buffers the structural volume changes of silicon-based anodes, a technology critical for achieving higher energy density. This performance enhancement is not merely incremental; it is essential to the commercial viability of high-performance battery packs, directly elevating the procurement demand for both Single-Walled (SWCNT) and Multi-Walled Carbon Nanotubes (MWCNT).

A second core driver is the miniaturization and functional enhancement of components within the Electronics & Semiconductors industry. As consumer electronics and advanced computing systems demand smaller form factors with greater processing power, the need for materials offering superior thermal management and electrical conductivity intensifies. SWCNTs and high-purity MWCNTs are increasingly replacing conventional conductive materials like Indium Tin Oxide (ITO) in flexible displays, transparent conductive films, and advanced integrated circuits. For flexible and foldable displays, SWCNTs provide superior mechanical flexibility and conductivity without compromising transparency, a combination of properties that glass-based ITO cannot replicate. The drive toward 5G technology and sophisticated radar systems also propels demand, as CNTs offer lightweight and efficient solutions for electromagnetic shielding and high-performance antennas, proving indispensable for the next wave of high-frequency communication devices.

Furthermore, the demand for lightweight, high-strength composite materials in the aerospace, automotive, and construction sectors creates a sustained pull for CNTs. Regulatory frameworks, particularly in the automotive industry, impose progressively stricter fuel efficiency and emissions standards, necessitating material solutions that significantly reduce vehicle weight without sacrificing structural integrity. When incorporated into polymers and epoxy systems, CNTs act as powerful reinforcing agents, imparting superior mechanical strength and toughness at minimal loading percentages. This enables manufacturers to produce lighter components, which in turn directly increases demand for CNTs as an essential constituent material for advanced structural composites and performance coatings. The pursuit of weight reduction across defense and civil aerospace platforms similarly mandates the adoption of these high-performance carbon structures.

Challenges and Opportunities

The primary challenge constraining the market is the prohibitive cost of high-purity CNT production, particularly for SWCNTs. Synthesis and purification processes, such as chemical vapor deposition (CVD), are energy-intensive and require expensive metal catalysts (e.g., cobalt or nickel), resulting in higher material costs that limit adoption in price-sensitive, high-volume applications like standard composites. This cost structure hinders demand aggregation outside of performance-critical sectors. A significant opportunity, however, lies in the expansion of industrial-scale functionalization techniques. Developing cost-effective methods for mass-producing high-quality CNT dispersions, which are easier to incorporate into polymers and liquids, will unlock substantial new demand in functional coatings, 3D printing inks, and anti-static materials, particularly in the large-volume chemicals and polymers segment. Addressing dispersion issues is the critical technical hurdle to mass-market penetration.

Raw Material and Pricing Analysis

The production of carbon nanotubes relies on key raw materials: a carbon feedstock, typically hydrocarbon gases like methane, ethylene, or acetylene, and specialized metal catalysts, most commonly iron, nickel, or cobalt. Pricing is highly sensitive to the stability and purity of the metal catalysts, which constitute a major portion of the raw material cost, especially for high-purity SWCNT synthesis. The pricing dynamics are further complicated by the small batch sizes and high processing requirements necessary to achieve the requisite structural integrity and low defect rate, contributing to the premium over bulk carbon materials. A stable supply of the hydrocarbon precursors is generally ensured by the large-scale petrochemical industry, but the proprietary nature and specific requirements of the high-purity metal catalysts introduce a supply chain vulnerability, dictating production stability and final material pricing.

Supply Chain Analysis

The global CNT supply chain is structured as a vertical integration model, moving from catalyst and gas feedstock suppliers to CNT synthesizers, then to specialized compounders that create the final dispersions and masterbatches, and finally to end-user manufacturers (e.g., battery, automotive, and aerospace). Key production hubs are heavily concentrated in Asia-Pacific, specifically China, South Korea, and Japan, due to significant capital investment in advanced manufacturing infrastructure and governmental support for nanotechnology. Logistical complexity centers not on bulk transport, but on the safe handling and preservation of the CNTs' state—specifically, ensuring stable dispersion to maintain performance. Tariffs and trade friction between major economic blocks, particularly the US and China, introduce an overhead cost and logistical impediment, forcing manufacturers to establish parallel regional supply chains or absorb higher import duties, which ultimately impacts the cost-competitiveness of CNT-enhanced components.

Carbon Nanotube Market Government Regulations

Stringent regulatory frameworks, primarily concerning health and environmental impact, govern the manufacturing and use of carbon nanotubes globally. These regulations impose a compliance burden that directly affects production costs and, consequently, market accessibility.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | REACH Regulation (EC 1907/2006) | Mandates strict registration for "nanoforms" of CNTs. Manufacturers must provide comprehensive toxicological and safety profiles, directly increasing R&D and compliance costs, but creating a high standard that builds user confidence and long-term demand stability. |

United States | Toxic Substances Control Act (TSCA) / EPA | Requires Pre-Manufacture Notice (PMN) for new nanomaterials. This forces manufacturers to secure regulatory approval before commencing production, extending lead times and placing a strong emphasis on early-stage safety data collection. |

China | National Standards (e.g., GB/T 30544.1) | Focuses on testing and safety standards for specific applications like biomedical devices containing nanomaterials. This facilitates the standardization of CNT products within key domestic sectors, stimulating localized, high-volume adoption in protected markets. |

Global Carbon Nanotube Market Segment Analysis

By Product Type: Single-Walled Carbon Nanotubes (SWCNTs)

The demand for Single-Walled Carbon Nanotubes (SWCNTs) is exclusively driven by the most demanding, performance-intensive applications where cost is a secondary consideration to supreme electrical and mechanical properties. SWCNTs possess an exceptional length-to-diameter ratio and superior electron mobility, making them ideal for transparent, flexible, and high-performance electronics. The most significant driver is the integration of SWCNTs into next-generation memory and display technologies, such as flexible organic light-emitting diodes (OLEDs) and high-speed transistors, where they replace less efficient or less flexible materials. Their use as a sophisticated conductive additive in high-energy density batteries for aerospace and high-performance electric vehicles also propels demand, as they facilitate a more effective conductive pathway at extremely low loading weights compared to other carbon allotropes, making them an indispensable material for ultra-high-end applications.

By Application: Chemicals & Polymers

The Chemicals & Polymers application segment experiences demand growth driven by the need for multi-functional composite materials across various industrial sectors. Multi-Walled Carbon Nanotubes (MWCNTs) are the primary product in this segment, as their lower production cost and robust mechanical properties offer a favorable performance-to-price ratio for large-volume industrial applications. The key demand driver is the requirement for electrostatic discharge (ESD) and electromagnetic interference (EMI) shielding capabilities in plastics and coatings, particularly for sensitive electronic casings and automotive components. By incorporating a small percentage of MWCNTs, polymer manufacturers can transform standard insulators into electrically conductive materials, thereby complying with stringent safety and performance standards in automotive and industrial environments. Additionally, the demand for reinforced polymers in infrastructure and industrial equipment, where MWCNTs improve mechanical stiffness, impact resistance, and durability, further sustains the segment's consumption.

Global Carbon Nanotube Market Geographical Analysis

US Market Analysis (North America)

The US market for carbon nanotubes is driven by robust, federally supported Research & Development (R&D) infrastructure and high-value defense procurement. Government funding and initiatives focused on advanced materials and nanotechnology directly support the commercialization of novel CNT applications, particularly in lightweight aerospace composites and advanced electronic warfare systems. The market demand is heavily skewed towards high-specification materials, where premium pricing is justified by performance in critical applications. The stringent "Buy American" procurement mandates, coupled with a focus on domestic innovation, propel localized demand for high-purity CNTs from established US-based manufacturers and their subsidiaries. The US market is characterized by a strong adoption curve in electric vehicle battery R&D, driven by incentives to onshore the entire EV supply chain.

Brazil Market Analysis (South America)

Demand in the Brazilian market is fundamentally linked to the expanding infrastructure and automotive manufacturing sectors. As a major regional manufacturing hub, the growth of vehicle production by global automotive companies creates a consistent, though price-sensitive, demand for MWCNT-enhanced polymer composites. These composites are primarily used for weight reduction and mechanical reinforcement in non-critical automotive components. The market also exhibits nascent demand from the construction sector, where CNTs are being explored to improve the structural integrity and durability of cementitious materials for large-scale public and private infrastructure projects, contingent on achieving favorable cost-efficiency metrics.

Germany Market Analysis (Europe)

The German market, as the manufacturing powerhouse of Europe, demonstrates demand primarily rooted in the high-end automotive and specialized machinery sectors. Stringent European Union (EU) environmental regulations and the aggressive transition to electric mobility compel German OEMs to seek superior battery and lightweighting solutions. This translates to high demand for both SWCNTs and MWCNTs for conductive battery additives and advanced structural composites. Furthermore, the robust German chemical industry serves as a crucial intermediary, purchasing CNTs for dispersion and functionalization, which are then integrated into high-performance coatings, plastics, and engineering components for precision applications.

South Africa Market Analysis (Middle East & Africa)

The South African CNT market is an emerging segment, with demand currently concentrated in the mining, industrial coatings, and nascent renewable energy sectors. The extreme operating conditions in mining and resource extraction industries necessitate high-performance, durable anti-corrosion and wear-resistant coatings, driving a niche demand for MWCNT-enhanced products. The government's push for renewable energy projects, particularly solar and grid-scale storage, is a future growth catalyst, as CNTs are explored for improving the efficiency and lifespan of battery and supercapacitor technologies necessary for reliable power infrastructure.

China Market Analysis (Asia-Pacific)

China is the largest global consumer and producer of carbon nanotubes, with its market demand propelled by vast, integrated supply chains in electronics, electric vehicles, and battery manufacturing. The Chinese government’s strong commitment to becoming a global leader in nanotechnology, supported by massive state and private investment, underpins this demand. Domestic companies leverage cost advantages from large-scale production capacity, allowing CNTs to penetrate high-volume applications like consumer electronics and mass-market EV batteries.

Global Carbon Nanotube Market Competitive Environment and Analysis

The Global Carbon Nanotube market features a moderately concentrated structure, dominated by a few large chemical and materials companies that leverage proprietary synthesis and purification technologies to maintain a competitive edge. Differentiation is achieved through product purity, dispersibility, and the ability to scale production to industrial volumes. Key competitive factors include intellectual property ownership related to catalyst technology and the establishment of robust, geographically diversified production capacity to mitigate supply chain risks.

LG Chem (South Korea): LG Chem stands as a major force, primarily focusing on Multi-Walled Carbon Nanotubes (MWCNTs) with a strong strategic alignment to the rapidly growing Electric Vehicle (EV) battery sector. The company’s competitive advantage stems from its in-house expertise in large-scale chemical manufacturing and its direct integration with the domestic battery supply chain.

Cabot Corporation (US): Cabot Corporation, a global specialty chemicals and performance materials company, focuses on developing and commercializing highly engineered carbon materials, including MWCNTs. Their competitive approach integrates CNTs within a broader portfolio of conductive carbons and additives, targeting customers seeking comprehensive materials solutions.

Global Carbon Nanotube Market Key Development

May 2025: OCSiAl announced a collaboration with Taiwan-based Molicel to incorporate its single-wall CNT additives into Molicel’s ultra-high-power lithium-ion batteries. The integration of the CNTs is specifically targeted at enhancing the cell's energy density, thermal stability, and overall electrical conductivity.

May 2025: Zeon Corporation and Taiwan’s Sino Applied Technology (SiAT) announced a strategic partnership signed in Taoyuan, Taiwan, where Zeon will lead a $20 million Series C investment to help SiAT scale production of single-walled carbon nanotube (SWCNT) conductive paste for next-generation lithium batteries used in EVs and other high-demand applications.

December 2024: DENSO signed an MOU with Finnish company Canatu to accelerate practical applications of carbon-nanotube technology—combining Canatu’s high-purity CNT production and transparent conductive-film know-how with DENSO’s automotive and mass-production expertise to improve visibility for autonomous driving and advance carbon-neutral solutions.

Carbon Nanotube Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 4.013 billion |

| Total Market Size in 2030 | USD 9.545 billion |

| Forecast Unit | Billion |

| Growth Rate | 18.92% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Carbon Nanotube Market Segmentation:

By Product Type

Single-Walled Carbon Nanotubes

Multi-Walled Carbon Nanotubes

By Application

Electronics & Semiconductors

Energy & Storage

Chemicals & Polymers

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

Israel

UAE

Others

Asia Pacific

China

Japan

South Korea

India

Thailand

Taiwan

Indonesia

Others