Consumer Oxygen Equipment Market Size, Share, Opportunities, And Trends By Type (Oxygen Concentrators, Compressed Gas Systems, Liquid Oxygen Systems), By End-User (Hospitals & Clinics, Homecare), And By Geography - Forecasts From 2021 To 2026

- Published : Jul 2021

- Report Code : KSI061610680

- Pages : 109

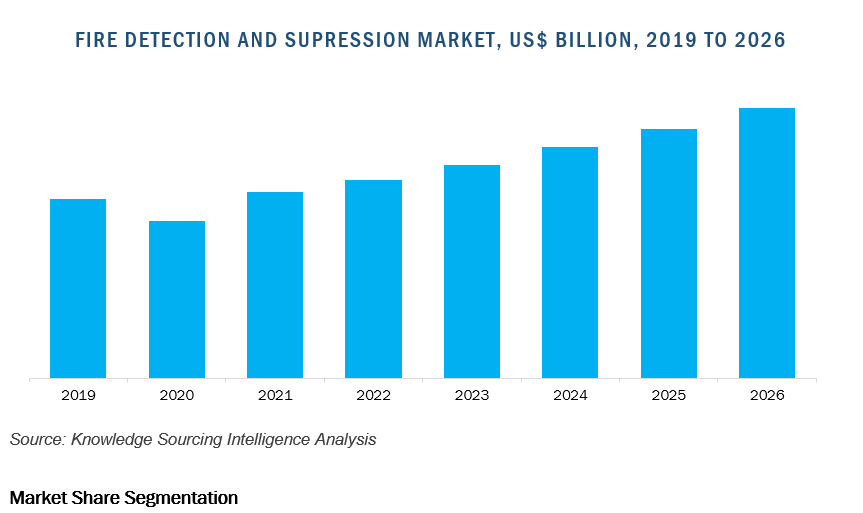

The global consumer oxygen equipment market is projected to grow at a CAGR of 8.04% during the forecast period to reach US$11.812 billion by 2026, from US$6.873 billion in 2019.

The prime reason driving the market growth during the forecasted period is the rising demand for oxygen for medication purposes. An increasing level of pollution coupled with an unfavourable environment has significantly increased instances of lung-related diseases and breathing disorders. Patients suffering from cancer, chronic obstructive pulmonary disease (COPS), or any other disorders find it difficult to breathe since their lungs are unable to extract enough oxygen from the air they breathe in. These patients then rely on oxygen equipment for aid. Further, technological innovation has resulted in the manufacturing of portable oxygen concentrators which are easier to carry, increasing the market scope significantly.

Rising cases of asthma and lung cancer have created a significant market demand for oxygen equipment for better aid and health.

Asthma and lung cancer patients are the prime users of consumer oxygen equipment. Rising instances of these chronic diseases are the prime reason driving the market demand for oxygen equipment. Research by the World Health Organization (WHO) found that 2.2 million new lung cancer cases were discovered in 2020, the second-highest in the year. However, lung cancer was the leading reason for cancer-related deaths, taking 1.8 million lives. Increasing pollution coupled with rising consumption of tobacco is anticipated to increase the cases of cancer and other lung-linked chronic diseases in the coming years, requiring medical attention for prevention and treatment. Hence, the oxygen equipment market will observe significant market growth during the forecasted period.

The coronavirus is another breathe-linked disease that has severely affected the global economy. The outbreak of the virus has boosted the demand for oxygen equipment at an exponential rate. Coronavirus affects the respiratory functions of the body, making it difficult for the infected patients to breathe and hence causing death. The outbreak of the virus has accelerated the oxygen demand and linked equipment at an exponential level. Particularly during the second wave of the virus which caused more deaths due to a higher name of per day cases and oxygen-linked shortage. The limited supply of oxygen and/ or supporting equipment increased the number of preventable fatalities. Hence, to ensure sufficient oxygen and equipment supply, WHO, partnered and distributed over 30,000 concentrators and more than 40,000 oximeters and patient monitors, especially in 37 countries classified as “fragile”.

Oxygen Concentrators in a homebound medication system saw a skyrocketing market size amid the pandemic which is anticipated to resume to normal rates during the forecasted period.

Oxygen concentrators are commonly used oxygen equipment by patients in a homebound medication environment. Portal oxygen concentrators are anticipated to dominate the market during the forecasted period. Owing to their portability, ease of carry, and low cost these concentrators are widely adaptable. Further, rising favourability for home medication since it costs less than in-hospital treatment, has significantly inclined the market trends towards concentrators.

During the peak of the virus, hospitals globally observed a boom in the number of patients rushing for treatment and other facilities. However, limitations of beds and other equipment constrained proper treatment. Hence, infected people with the least severity were advised to adopt homebound medication through oxygen concentrators which significantly increased the market scope. Further, skyrocketing cases and limited resources increased the demand for oxygen concentrators in the retail division. However, financial constraints and loss of income amid lockdown and increasing unemployment hindered the market. As support, several international organizations and companies tied up to provide the demand shortage. Hindustan Unilever, for instance, partnered with Portea Medical to supply 4,000 oxygen concentrators in India, to fight against the devastating second wave.

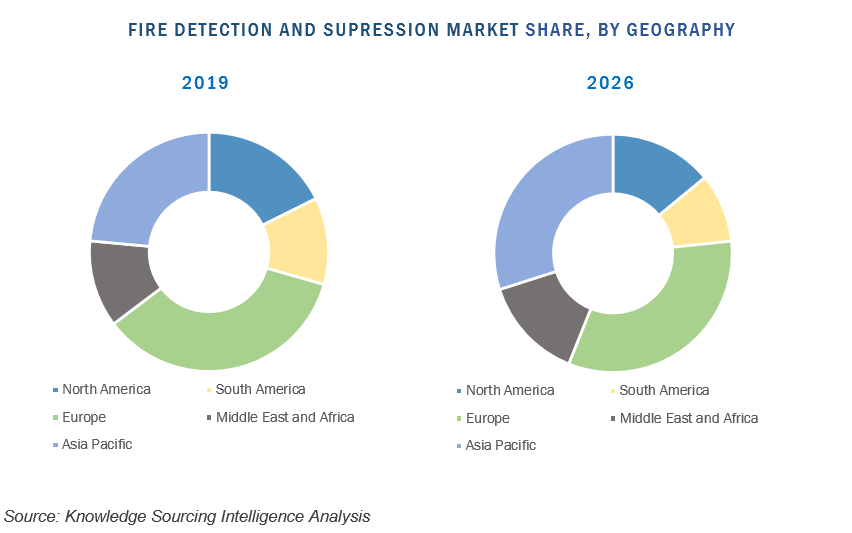

Demand for oxygen equipment boomed in the Asia Pacific region amid the outbreak of the virus. However, the North American consumer oxygen market will have a significant market share during the forecasted period.

Based on geography, the global consumer oxygen equipment market is segmented into North America, South America, Europe, the Middle East, and Africa, and the Asia Pacific region. The North American region is projected to hold a significant share of the consumer oxygen equipment industry. the rising instances of lung-related chronic diseases along with better healthcare infrastructure and resources support the market growth during the forecasted period. In the US, lung cancer is the third largest disease-causing cancer-linked death. In 2020, 235,760 new cases were recorded in the country while the diseases caused 131,880 deaths. Rising cases of lung cancer along with other chronic diseases such as asthma and obesity have increased the demand for oxygen equipment in the region.

The Asia Pacific region, however, is projected to show robust demand amid pandemics. A surge in cases of patients was observed, particularly in the second wave of the virus, across the region, especially in India, Singapore, Thailand, and others. The severity of this wave caused a hike in demand for oxygen equipment in the region. The prediction of a third wave has increased the concerns of healthcare authorities and increased the demand for oxygen equipment to reduce COVID-19-linked fatalities and deaths.

Key Market Segments

- By Type

- Oxygen Concentrators

- Compressed Gas Systems

- Liquid Oxygen Systems

- By End-User

- Hospitals & Clinics

- Homecare

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others

- North America

Frequently Asked Questions (FAQs)

1. Introduction

1.1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Research Data

2.2. Assumptions

3. Executive Summary

3.1. Research Highlights

4. Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Powers of Buyers

4.3.3. Threat of Substitutes

4.3.4. The threat of New Entrants

4.3.5. Competitive Rivalry in Industry

4.4. Industry Value Chain Analysis

5. Global Consumer Oxygen Equipment Market, by Type

5.1. Introduction

5.2. Oxygen Concentrators

5.3. Compressed Gas Systems

5.4. Liquid Oxygen Systems

6. Global Consumer Oxygen Equipment Market, by End Users

6.1. Introduction

6.2. Hospitals & Clinics

6.3. Homecare

7. Global Consumer Oxygen Equipment Market, by Geography

7.1. Introduction

7.2. North America

7.2.1. United States

7.2.2. Canada

7.2.3. Mexico

7.3. South America

7.3.1. Brazil

7.3.2. Argentina

7.3.3. Others

7.4. Europe

7.4.1. Germany

7.4.2. France

7.4.3. United Kingdom

7.4.4. Spain

7.4.5. Others

7.5. The Middle East and Africa

7.5.1. Saudi Arabia

7.5.2. UAE

7.5.3. Israel

7.5.4. Others

7.6. Asia Pacific

7.6.1. China

7.6.2. India

7.6.3. South Korea

7.6.4. Taiwan

7.6.5. Thailand

7.6.6. Indonesia

7.6.7. Japan

7.6.8. Others

8. Competitive Environment and Analysis

8.1. Major Players and Strategy Analysis

8.2. Emerging Players and Market Lucrative

8.3. Mergers, Acquisition, Agreements, and Collaborations

8.4. Vendor Competitiveness Matrix

9. Company Profiles

9.1. Precision Medical Inc.

9.2. Boost Oxygen LLC

9.3. Nidek Medical Products Inc.

9.4. Philips Healthcare

9.5. Drive DeVilbiss international

9.6. Invacare Corporation

9.7. Chart industries

9.8. Inogen Inc

9.9. Summit Oxygen international

9.10. Oxygen Plus Inc.

9.11. Foshan Shunde bond Electronics Co.

9.12. ABC Healthcare

Precision Medical Inc.

Boost Oxygen LLC

Nidek Medical Products Inc.

Philips Healthcare

Drive DeVilbiss international

Invacare Corporation

Chart industries

Summit Oxygen international

Oxygen Plus Inc.

Foshan Shunde bond Electronics Co.

ABC Healthcare

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| Oxygen Concentrators Market Size: Industry Report, 2022-2027 | Jul 2023 | |

| Food Sterilization Equipment Market Size: Report, 2023-2028 | Oct 2023 | |

| Sterilization Equipment Market Size: Industry Report, 2021-2026 | Dec 2021 | |

| Rehabilitation Equipment Market Size & Share: Report, 2021 - 2026 | Oct 2021 | |

| Angiography Equipment Market Size & Share: Report, 2024-2029 | Apr 2024 |