Industrial Wireless Solution Market Report, Size, Share, Opportunities, and Trends By Solution Type, Enterprise Size, End-User Industry, and Geography - Forecasts From 2025 To 2030

Description

Industrial Wireless Solution Market Size:

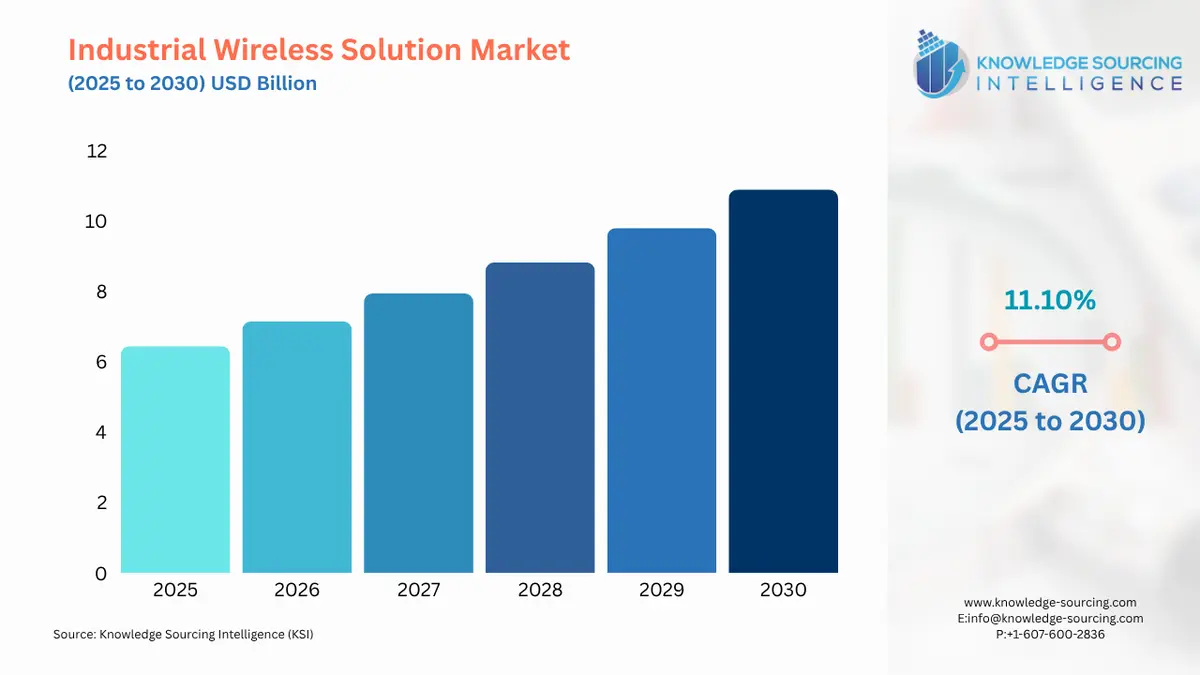

The Industrial Wireless Solution market is evaluated at US$6.435 billion in 2025 and is projected to grow at a CAGR of 11.10% to reach US$10.893 billion in 2030.

Industrial Wireless Solution Market Highlights

- 5G Connectivity: Enables high-speed, low-latency communication for smart factories and IoT applications.

- IoT Integration: Wireless solutions support real-time data exchange, driving Industry 4.0 and automation.

- Flexible Infrastructure: Reduces cabling costs, offering scalable connectivity for dynamic industrial environments.

- Predictive Maintenance: Wireless sensors enhance equipment monitoring, improving efficiency and reducing downtime.

To learn more about this report, request a free sample copy

Industrial Wireless Solution Market Introduction

The industrial wireless solution market is a critical enabler of modern industrial transformation, providing robust, flexible, and scalable connectivity solutions for industries such as manufacturing, automotive, energy, logistics, and aerospace. Industrial wireless solutions encompass technologies like wireless sensor networks, IoT platforms, 5G networks, and edge computing systems that facilitate real-time data transmission, monitoring, and control in industrial environments. These solutions reduce the reliance on costly and inflexible wired infrastructure, enabling seamless communication between machines, sensors, and systems to support Industry 4.0 initiatives like smart manufacturing, automation, and digital twins. As industries increasingly adopt digitalization to enhance efficiency, safety, and productivity, the demand for industrial wireless solutions is surging, driven by advancements in 5G, AI, and IoT.

Industrial wireless solutions are pivotal in transforming traditional industrial operations by offering flexibility, scalability, and cost efficiency compared to wired systems. These solutions enable real-time monitoring, control, and data analytics, which are essential for optimizing manufacturing processes, improving asset management, and ensuring worker safety. For instance, wireless technologies like ZigBee and WirelessHART, based on the IEEE 802.15.4 standard, support low-power, reliable communication for industrial sensor networks, as noted in a 2023 MDPI study on wireless technologies for Industry 4.0. By eliminating the need for extensive cabling, wireless solutions reduce installation and maintenance costs while enabling connectivity in challenging environments, such as remote oil rigs or mobile robotics in factories. The ability to connect mobile assets, like autonomous guided vehicles (AGVs), and support applications like predictive maintenance and digital twins underscores their importance in achieving the goals of smart manufacturing and Industry 4.0.

The industrial wireless solution market serves a wide range of applications critical to industrial operations:

- Smart Manufacturing: Wireless solutions enable real-time monitoring and control of production lines, as seen in Siemens’ SCALANCE MUM856-1 5G router for industrial connectivity.

- Asset and Personnel Tracking: Wireless technologies like RFID and LoRaWAN support asset tracking and worker safety in logistics and mining. Caterpillar’s 2024 wireless tracking solutions enhance operational efficiency in heavy industries.

- Predictive Maintenance: IoT-enabled wireless sensors monitor equipment health, reducing downtime. General Electric’s Predix platform uses wireless connectivity for predictive analytics in industrial settings.

- Autonomous Vehicles and Robotics: Wireless networks support communication for AGVs and robots in factories. NVIDIA’s 2025 Jetson platform integrates wireless connectivity for robotics.

- Energy and Utilities: Wireless solutions enable remote monitoring of power grids and oilfields. Schneider Electric’s EcoStruxure platform leverages wireless IoT for energy management.

Industrial Wireless Solution Market Overview

The Industrial Wireless Solution market is expected to witness moderate growth over the forecast period, driven by various advantages it offers, such as easy maintenance, control, and monitoring. Owing to a significant return on investment and several other benefits, wireless sensor networks are rapidly replacing wired sensor networks across different industry sectors. The emerging trend of BYOD (Bring-Your-Own-Device) policy due to the rising number of smartphone users is one of the key drivers of the global industrial wireless solution market. The growing need for automation in both process and discrete industries, along with the falling prices of wireless sensors, is further augmenting the demand for industrial wireless solutions over the forecast period. A surge in demand for robotic automation across different industry sectors, such as mining and chemical, to maximize productivity, reduce human errors, and provide workers’ safety will propel the industrial wireless solution market growth.

The market is poised for significant growth in the coming years, primarily driven by the accelerating global Bring Your Own Device (BYOD) trend. This workplace revolution has gained substantial momentum in recent years as employee preferences shift toward using personal devices for professional purposes. The workforce demographic transformation, with tech-savvy new entrants preferring their own devices, has been a key growth driver. Industry data from Dell, a leading technology firm, reveals that 60% of surveyed professionals in 2023 were already using smartphones for work-related tasks. Complementing this analysis, the Global Industrial Wireless Solution Market Report delivers in-depth industry assessment, featuring executive-level strategic insights supported by robust data analytics and forward-looking projections. This regularly updated resource equips stakeholders with actionable intelligence on evolving market patterns, emerging opportunities, and competitive landscapes. The report thoroughly examines various industrial wireless solutions, including wireless sensors, routers, access points, and communication modules, while analyzing their geographic adoption patterns. Additionally, it incorporates critical evaluations of technological innovations, regulatory frameworks, and macroeconomic influences to provide comprehensive market understanding.

Some of the major players covered in this report include Cisco Systems Inc., Siemens AG, Honeywell International Inc., Rockwell Automation, Emerson Electric Company, ABB Ltd., Moxa Inc., Belden Inc., Phoenix Contact GmbH & Co. KG, Yokogawa Electric Corporation, Advantech Co., Ltd., and HMS Networks, among others.

Industrial Wireless Solution Market Drivers

- 5G Network Rollout

The global deployment of 5G networks is a primary driver of the industrial wireless solution market, offering high-speed, low-latency, and high-capacity connectivity essential for advanced industrial applications. Unlike previous generations, 5G supports massive machine-type communications (mMTC) and ultra-reliable low-latency communications (URLLC), making it ideal for real-time control in smart factories, autonomous vehicles, and remote operations. For instance, Nokia’s AirScale portfolio, expanded in May 2025, provides private 5G networks tailored for industrial settings, enabling seamless connectivity for IoT devices and robotics. This rollout facilitates applications like real-time monitoring of production lines and remote maintenance, reducing downtime and enhancing efficiency. Ericsson’s 2025 partnership with Telstra to deploy industrial-grade 5G networks further demonstrates 5G’s role in enabling scalable, high-performance wireless solutions for manufacturing and logistics. The ability of 5G to handle large-scale IoT deployments and support mission-critical applications is accelerating its adoption, positioning it as a cornerstone of industrial wireless growth.

- Industry 4.0 and IoT Adoption

The rise of Industry 4.0 and the widespread adoption of the Internet of Things (IoT) are driving demand for industrial wireless solutions, as they enable interconnected, data-driven ecosystems in smart factories and industrial operations. Industry 4.0 emphasizes automation, real-time data analytics, and machine-to-machine (M2M) communication, all of which rely on robust wireless networks to connect sensors, actuators, and control systems. Qualcomm’s 2025 5G IoT solutions, for example, support industrial automation by providing reliable connectivity for IoT devices in manufacturing environments. Similarly, Siemens’ SCALANCE MUM856-1 5G router, launched in 2024, facilitates IoT integration in smart factories, enabling real-time data exchange for predictive maintenance and process optimization. The integration of IoT with wireless networks allows industries to monitor equipment health, optimize supply chains, and enhance operational efficiency, as seen in General Electric’s Predix platform, which leverages wireless connectivity for industrial IoT analytics. This convergence of Industry 4.0 and IoT is fueling the demand for wireless solutions that can handle high data volumes and ensure seamless connectivity across complex industrial environments.

- Automation and Digital Twins

The growing emphasis on automation and digital twins is a significant driver, as these technologies rely on wireless solutions to enable real-time data collection, analysis, and control. Automation systems, such as autonomous guided vehicles (AGVs) and robotic arms, require low-latency wireless networks to coordinate movements and ensure operational efficiency. Digital twins—virtual replicas of physical assets—depend on continuous data streams from wireless sensors to monitor and optimize performance. NVIDIA’s 2025 Jetson platform integrates wireless connectivity to support real-time communication for industrial robotics and digital twins, enhancing automation in manufacturing. Similarly, Rockwell Automation’s 2025 FactoryTalk innovations leverage wireless networks to enable digital twin applications, improving predictive maintenance and operational insights in smart factories. The ability to wirelessly connect distributed assets and feed data into digital twins allows industries to simulate processes, predict failures, and optimize resource allocation, driving efficiency and reducing costs. This trend is particularly evident in automotive and aerospace, where wireless-enabled automation enhances production precision and scalability.

Industrial Wireless Solution Market Restraints

- Security Concerns

Security concerns pose a significant restraint on the industrial wireless solution market, as wireless networks are inherently more vulnerable to cyberattacks compared to wired systems. Industrial environments, with their reliance on IoT devices and real-time data, are prime targets for threats like data breaches, ransomware, and unauthorized access. The integration of wireless solutions in critical applications, such as power grid management or autonomous vehicle control, amplifies the need for robust security measures. Arm’s TrustZone technology, updated in 2024, addresses these concerns by providing hardware-based security for IoT devices, ensuring secure data transmission in industrial wireless networks. However, implementing advanced encryption and authentication protocols increases system complexity and costs, as noted in a 2023 IEEE study on industrial wireless security challenges. The lack of standardized security frameworks across wireless protocols like ZigBee and WirelessHART further complicates efforts to safeguard industrial networks, limiting adoption in highly regulated industries like energy and defense.

- Signal Reliability Challenges

Signal reliability remains a critical restraint, as industrial environments often feature harsh conditions like electromagnetic interference, physical obstructions, and extreme temperatures that can degrade wireless performance. Factories with metal structures or remote sites like oilfields pose challenges for maintaining consistent signal quality, impacting real-time applications like robotics and remote monitoring. Honeywell’s 2025 wireless solutions, such as the SmartLine Wireless Transmitters, focus on improving signal stability in harsh environments through adaptive frequency hopping and redundancy. However, achieving reliable connectivity in complex industrial settings requires significant investment in infrastructure, such as additional access points or repeaters, which can increase costs. A 2023 MDPI study highlights that signal interference in industrial wireless networks remains a barrier to widespread adoption, particularly for mission-critical applications requiring ultra-low latency. These reliability challenges can delay deployment and limit the scalability of wireless solutions in demanding industrial contexts.

Industrial Wireless Solution Market Segmentation Analysis

- By Type, Wireless Sensors are growing considerably in the market

Wireless sensors dominate the industrial wireless solution market due to their critical role in collecting real-time data from industrial environments, enabling monitoring, control, and optimization of processes. These sensors, often based on standards like WirelessHART or ZigBee, measure parameters such as temperature, pressure, vibration, and humidity, transmitting data wirelessly to central systems for analysis. Their compact design, low power consumption, and ability to operate in harsh environments make them indispensable for smart factories, energy management, and predictive maintenance.

Wireless sensors are integral to applications like equipment monitoring, environmental sensing, and worker safety in industries such as manufacturing, oil and gas, and utilities. They enable predictive maintenance by detecting anomalies in machinery, reducing downtime and maintenance costs. For example, Honeywell’s SmartLine Wireless Transmitters, updated in 2025, monitor industrial processes in real time, ensuring operational efficiency in chemical plants and refineries. In energy management, wireless sensors integrated into Schneider Electric’s EcoStruxure platform monitor power consumption and environmental conditions, optimizing energy efficiency in industrial facilities. Their ability to operate without extensive cabling reduces installation costs and enables deployment in remote or hazardous areas, such as offshore oil rigs or mining sites. The scalability of wireless sensor networks supports large-scale IoT deployments, making them a cornerstone of Industry 4.0 initiatives.

- By Technology, WiFi is predicted to dominate the industry

WiFi, based on the IEEE 802.11 standard, is the leading technology in the industrial wireless solution market due to its high data rates, widespread availability, and compatibility with existing infrastructure. WiFi supports robust, high-bandwidth communication, making it ideal for data-intensive applications like video surveillance, real-time analytics, and machine-to-machine (M2M) communication in industrial settings. Its ability to integrate with IoT platforms and 5G networks further enhances its dominance.

WiFi is widely used in smart factories, warehouses, and logistics for applications requiring high-speed data transfer, such as real-time monitoring of production lines and video-based quality control. Cisco’s industrial WiFi solutions, part of its 2024 Catalyst IW9167 Series, provide reliable connectivity for industrial IoT and automation, supporting seamless data exchange in manufacturing environments. In logistics, WiFi enables real-time tracking of assets and vehicles, as seen in Caterpillar’s 2024 wireless solutions for mining operations. WiFi’s compatibility with existing enterprise networks and its ability to handle large data volumes make it a preferred choice for industries transitioning to digital operations. The adoption of WiFi 6 and 6E, with improved speed and capacity, further enhances its suitability for industrial applications, as noted in a 2023 IEEE study on WiFi advancements for Industry 4.0.

- By Application, the Real-Time Monitoring segment is expected to grow rapidly

Real-time monitoring is the most significant application in the industrial wireless solution market, driven by the need for continuous data collection and analysis to optimize industrial processes, ensure safety, and reduce downtime. This application leverages wireless sensors, routers, and networks to monitor equipment health, environmental conditions, and operational parameters, providing actionable insights for decision-making.

Real-time monitoring is critical in industries like manufacturing, energy, and logistics, where it supports predictive maintenance, quality control, and safety compliance. For instance, General Electric’s Predix platform uses wireless connectivity for real-time monitoring of industrial assets, enabling predictive analytics to prevent equipment failures. In the energy sector, BP employs wireless monitoring systems to track offshore oil rig operations, ensuring safety and efficiency, as highlighted in their 2025 sustainability report. Real-time monitoring also supports worker safety by tracking environmental hazards, such as gas leaks or temperature extremes, using wireless sensors. The ability to transmit data instantly to centralized systems or digital twins enhances operational visibility and enables rapid response to anomalies, making it a cornerstone of smart industrial operations.

Industrial Wireless Solution Market Key Developments

- July 2025: Qualcomm Incorporated launched WiFi 7-enabled industrial wireless solutions, offering ultra-low latency and high throughput for smart factories and IoT applications. These solutions enhance real-time monitoring and automation, supporting high-bandwidth applications like digital twins and robotic control in manufacturing environments. This launch strengthens Qualcomm’s position in providing advanced connectivity for Industry 4.0.

- May 2025: Nokia Corporation expanded its AirScale portfolio with private 5G networks optimized for industrial applications, improving latency and scalability for real-time monitoring and automation. This development targets industries like manufacturing and logistics, enabling seamless connectivity for IoT devices and robotics in harsh environments.

- April 2024: Synaptics Incorporated introduced the Astra AI-native IoT platform, featuring wireless connectivity for industrial IoT applications. The platform supports edge AI and robust wireless communication, enabling real-time data processing for smart home, industrial, and enterprise use cases, with a focus on scalability and performance.

Industrial Wireless Solution Market Scope:

| Report Metric | Details |

|---|---|

| Industrial Wireless Solution Market Size in 2025 | USD 6.435 billion |

| Industrial Wireless Solution Market Size in 2030 | USD 10.893 billion |

| Growth Rate | 11.10% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | Billion |

| Segmentation | Type, Technology, Application, Geography |

| Geographical Segmentation | Americas, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Industrial Wireless Solution Market |

|

| Customization Scope | Free report customization with purchase |

Industrial Wireless Solution Market Segmentations:

Industrial Wireless Solution Market Segmentation by Type:

The Industrial Wireless Solution Market is analyzed by type into the following:

- Wireless Sensors

- Wireless Routers

- Wireless Access Points

- Communication Modules

Industrial Wireless Solution Market Segmentation by Technology:

- WiFi

- Bluetooth

- Zibgee

- Others

Industrial Wireless Solution Market Segmentation by Application:

The Industrial Wireless Solution Market is analyzed by application into the following:

- Real-Time Monitoring

- Asset Tracking

- Process Automation

- Data Communication

- Others

Industrial Wireless Solution Market Segmentation by End-User Industry:

The Industrial Wireless Solution Market is analyzed by end-user industry into the following:

- Manufacturing

- Oil & Gas

- Automotive

- Energy & Utilities

- Others

Industrial wireless solution Market Segmentation by geography:

The study also analysed the Industrial wireless solution market into the following regions, with country level forecasts and analysis as below:

- Americas (US)

- Europe, Middle East, and Africa (Germany, Netherlands, and Others)

- Asia Pacific (China, Japan, Taiwan, South Korea, and Others)

Frequently Asked Questions (FAQs)

The industrial wireless solution market is expected to reach a total market size of US$10.893 billion by 2030.

Industrial Wireless Solution Market is valued at US$6.435 billion in 2025.

The industrial wireless solution market is expected to grow at a CAGR of 11.10% during the forecast period.

Key drivers include rising automation, IoT adoption, demand for real-time data, industrial digitization, and enhanced network reliability.

The North American region is anticipated to hold a significant share of the industrial wireless solution market.

Table Of Contents

1. EXECUTIVE SUMMARY

2. MARKET SNAPSHOT

2.1. Market Overview

2.2. Market Definition

2.3. Scope of the Study

2.4. Market Segmentation

3. BUSINESS LANDSCAPE

3.1. Market Drivers

3.2. Market Restraints

3.3. Market Opportunities

3.4. Porter’s Five Forces Analysis

3.5. Industry Value Chain Analysis

3.6. Policies and Regulations

3.7. Strategic Recommendations

4. TECHNOLOGICAL OUTLOOK

5. INDUSTRIAL WIRELESS SOLUTION MARKET BY TYPE

5.1. Introduction

5.2. Wireless Sensors

5.3. Wireless Routers

5.4. Wireless Access Points

5.5. Communication Modules

6. INDUSTRIAL WIRELESS SOLUTION MARKET BY TECHNOLOGY

6.1. Introduction

6.2. WiFi

6.3. Bluetooth

6.4. Zibgee

6.5. Others

7. INDUSTRIAL WIRELESS SOLUTION MARKET BY APPLICATION

7.1. Introduction

7.2. Real-Time Monitoring

7.3. Asset Tracking

7.4. Process Automation

7.5. Data Communication

7.6. Others

8. INDUSTRIAL WIRELESS SOLUTION MARKET BY END-USERS

8.1. Introduction

8.2. Manufacturing

8.3. Oil & Gas

8.4. Automotive

8.5. Energy & Utilities

8.6. Others

9. INDUSTRIAL WIRELESS SOLUTION MARKET BY GEOGRAPHY

9.1. Introduction

9.2. Americas

9.2.1. United States

9.3. Europe, the Middle East, and Africa

9.3.1. Germany

9.3.2. Nehtherlands

9.3.3. Others

9.4. Asia Pacific

9.4.1. China

9.4.2. Japan

9.4.3. Taiwan

9.4.4. South Korea

9.4.5. Others

10. COMPETITIVE ENVIRONMENT AND ANALYSIS

10.1. Major Players and Strategy Analysis

10.2. Market Share Analysis

10.3. Mergers, Acquisitions, Agreements, and Collaborations

10.4. Competitive Dashboard

11. COMPANY PROFILES

11.1. Qualcomm Incorporated

11.2. Nokia Corporation

11.3. Siemens AG

11.4. Cisco Systems, Inc.

11.5. Honeywell International Inc.

11.6. Emerson Electric Co.

11.7. Rockwell Automation, Inc.

11.8. Synaptics Incorporated

11.9. Texas Instruments Incorporated

11.10. NXP Semiconductors N.V.

11.11. Advantech Co., Ltd.

11.12. Belden Inc.

11.13. Phoenix Contact GmbH & Co. KG

11.14. Yokogawa Electric Corporation

11.15. ABB Ltd.

12. APPENDIX

12.1. Currency

12.2. Assumptions

12.3. Base and Forecast Years Timeline

12.4. Key benefits for the stakeholders

12.5. Research Methodology

12.6. Abbreviations

LIST OF FIGURES

LIST OF TABLES

Companies Profiled

Qualcomm Incorporated

Nokia Corporation

Siemens AG

Cisco Systems, Inc.

Honeywell International Inc.

Emerson Electric Co.

Rockwell Automation, Inc.

Synaptics Incorporated

Texas Instruments Incorporated

NXP Semiconductors N.V.

Advantech Co., Ltd.

Belden Inc.

Phoenix Contact GmbH & Co. KG

Yokogawa Electric Corporation

ABB Ltd.

Related Reports

| Report Name | Published Month | Download Sample |

|---|---|---|

| Wireless Connectivity Market Report: Size, Trends, Forecast 2030 | March 2025 | |

| Wireless Gigabit Market Insights: Share, Trends, Forecast 2030 | January 2026 | |

| China Wireless Connectivity Market Size: Report, 2023 - 2028 | June 2023 | |

| Network as a Service (NaaS) Market Size, Share & Forecast 2030 | May 2025 | |

| 5G Fixed Wireless Access Market: Size, Trends, Forecast 2030 | July 2025 |