Report Overview

3D Printed Footwear Market Highlights

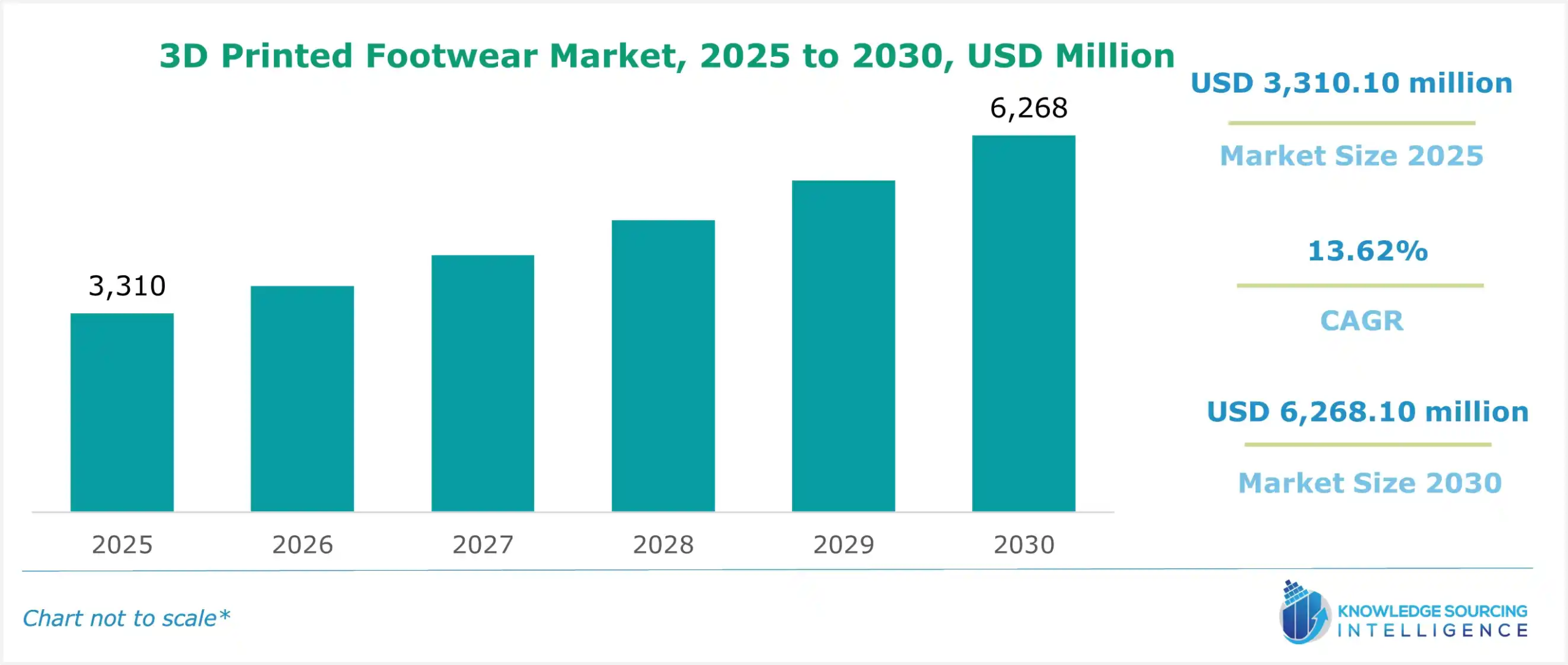

The 3D printed footwear market is expected to grow at a CAGR of 13.62%, reaching a market size of US$6,268.102 million in 2030 from US$3,310.100 million in 2025.

A 3D printed footwear is a type of footwear produced using 3D printing technologies. Where the manufacturer uses additive manufacturing technology, which helps in creating customized and precise components. The 3D printed footwear offers multiple benefits over regular materials, as it reduces the wastage of material while manufacturing and also uses recyclable material.

The rising production of footwear worldwide, followed by ongoing investments and strategic collaboration to bolster modern concepts in footwear manufacturing is among the major factors pushing the 3D printed footwear market forward. Hence, with the increasing production, companies and manufacturers will shift towards more sustainable and faster production techniques, increasing the demand for 3D-printed shoes.

What are the 3D Printed Footwear Market drivers?

- Rising footwear demand globally is expected to improve the market growth

Footwear forms one of the major accessories that defines a person’s lifestyle, and with the rapid urbanization followed by improvement in living standards the demand for varied footwear is witnessing a bolstering expansion especially in developed economies thereby leading to a positive growth in the overall sales.

For instance, World Footwear, in its report, stated that German footwear retail sales witnessed a growth of about 4% in 2023, accounting for about EUR 11.6 billion in total sales. Similarly, the association further stated that in 2023, the UK-based retailer Shoe Zone witnessed a growth of about 6.1% in its total revenue in 2023. The group's digital revenue reached EUR 35.6 million. The Italian-based footwear group, GeoX, also witnessed an increase of about 0.6% in its total sales in 2023. Such growing sales will create scope for new technologies in footwear production thereby improving overall demand for 3D printing.

- Favorable efforts to revolutionize footwear manufacturing are driving the market expansion

The rapid transition towards new innovations and technological concepts has established a framework for industrial sectors that would assist them in improving their productivity and meeting the customer the dynamic customer requirements. Likewise, footwear manufacturers namely Addidas, Nike and Hypsole are investing in such concepts. For instance, in August 2024, Hypsole showcased its 3D-printed cleat product “Tidal 3D Elite” featuring its Carbon Digital Light Synthesis™ technology. The footwear delivers high functionality, comfort and convenience to field athletes.

Likewise, in October 2023, Brooks Running formed a partnership with HP for the development of the latter’s new line of running shoes namely “Exhilarate-BlueLine’ which will feature footwear made using HP’s 3D printing solutions. The footwear would offer dynamic range thereby matching an athlete’s shoe size and offering him/her required cushioning along with each stride.

3D Printed Footwear Market Restraints:

- High complexities in designing and varied requirements to be met can hamper the market expansion

Unlike traditional manufacturing processes, 3D modeling involves layer-to-layer modelling and designing which requires a lot of time and skillset to optimize the product output. Moreover, the scope of 3D printed materials is somewhat limited and cannot be used in general performance footwear which further slows their market demand.

Likewise, 3D printing is a capital-intensive technique owing to which the initial cost required for starting footwear production via such an approach is very high, thereby various start-ups and small-scale footwear producers will opt out of adopting modern technological adoption.

Segment analysis of 3D Printed Footwear Market:

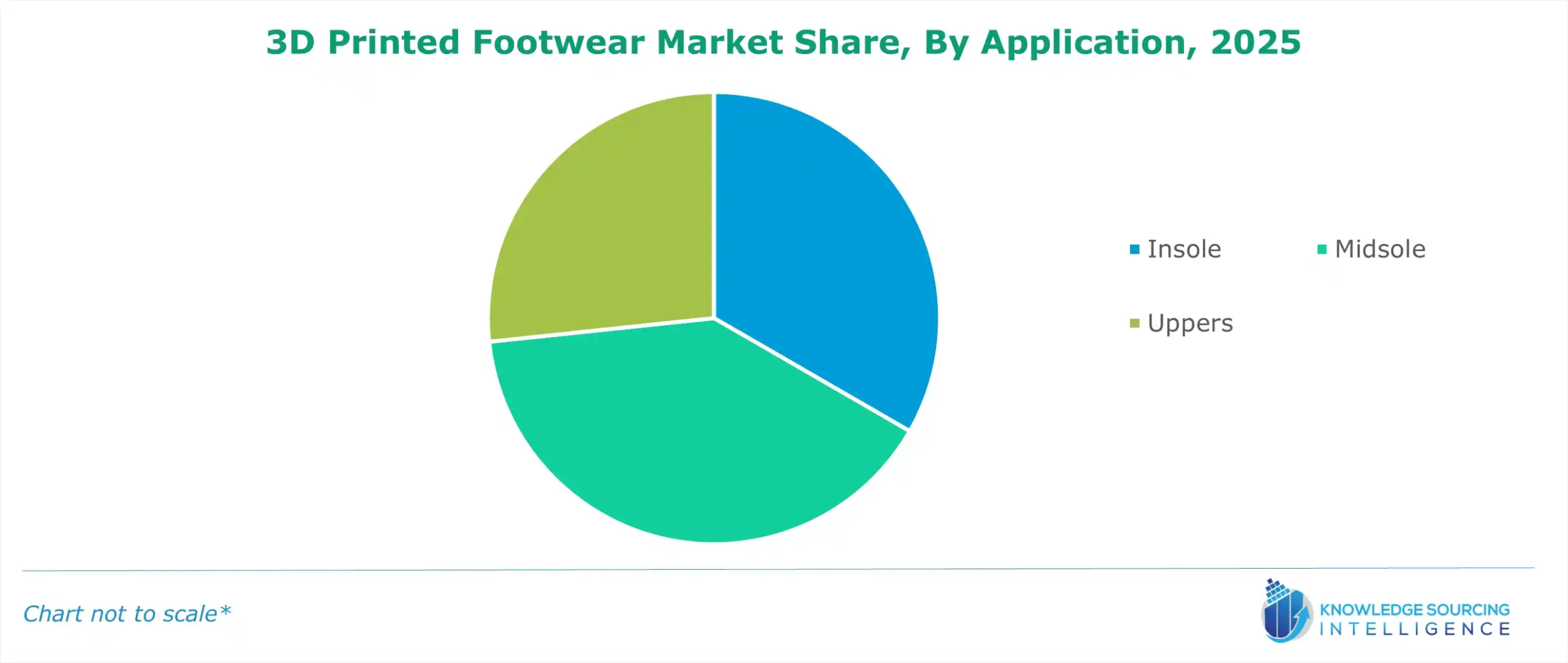

- The insole segment based on application will account for a considerable market share.

By application, the insole is expected to constitute for a remarkable market share during the given timeframe fueled by the growing demand for footwear offering comfort aspects in different physical activities. Moreover, footwear insoles assist in alleviating pain in joint muscles thereby improving the comfort while standing or walking.

Owing to their such high-performance features, the demand for modular designed insoles is expected to show positive growth, additionally the growing old age population will further drive the segment growth since older generation majorly requires footwear with extra-padding insoles for reducing their knee and joint pain.

What are the key geographical trends shaping the 3D Printed Footwear Market:

- North America will continue to be the dominant market shareholder of 3D printed footwear during the forecast period

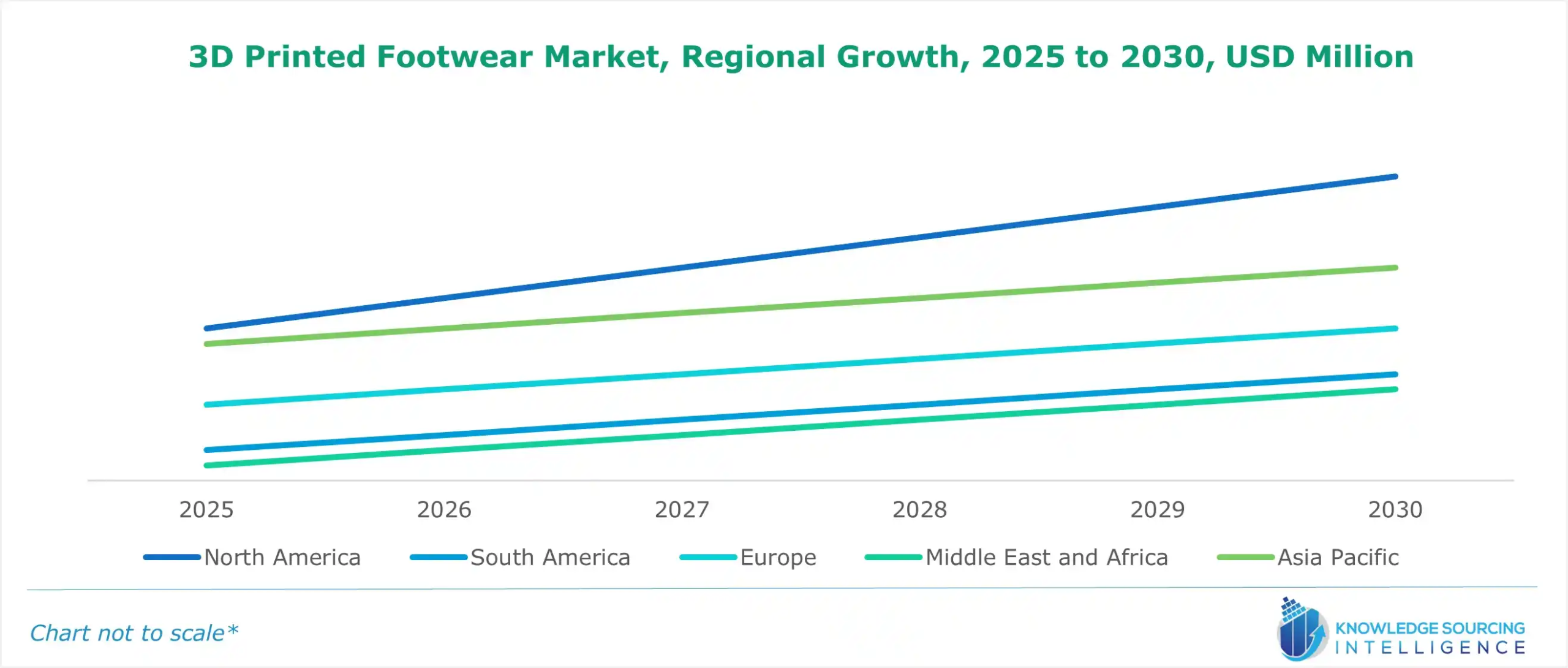

Geographically, the 3D printed software market has been segmented into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific.

During the forecast period, North America will be holding a considerable share of the market with major regional economies namely the United States showcasing a positive growth in new technological adoption inclusive of 3D printing in manufacturing lifestyle accessories. Furthermore, the growing research and development projects backed by both public and private funding further boost innovation in 3D printing technologies, leading to better printing results and products. The fashion and entertainment industries are also doing well and helping in the market growth as most of the celebrities and influencers are wearing 3D printed shoes and other items to express their style on social media.

Moreover, the increasing sports culture in the region followed by innovations in materials, design processes, and manufacturing techniques has further paved the way for regional market expansion. Additionally, strategic partnerships between technology experts and footwear brands are also shaping future market demand.

Recent development in the 3D Printed Footwear Market:

- In November 2024: Lubrizol formed a collaboration with Lore Cyle where the former’s Avid 3D printing will be used for the development of custom-fit components for the latter’s cycling shoes that would provide unparalleled support and comfort.

- In July 2024: Dassault Systèmes in collaboration with ASICS opened a studio in Paris that would provide on-demand sock liners. The studio would use ASCIS’s “3DEXPERIENCE” virtual-twin technology that would assist in on-demand manufacturing of show parts.

3D Printed Footwear Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| 3D Printed Footwear Market Size in 2025 | US$3,310.100 million |

| 3D Printed Footwear Market Size in 2030 | US$6,268.102 million |

| Growth Rate | CAGR of 13.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in 3D Printed Footwear Market |

|

| Customization Scope | Free report customization with purchase |

3D Printed Footwear Market is analyzed into the following segments:

- Polyurethane

- Thermoplastic Polyurethane (TPU)

- Insole

- Midsole

- Uppers

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others