Report Overview

4D Printing in Healthcare Highlights

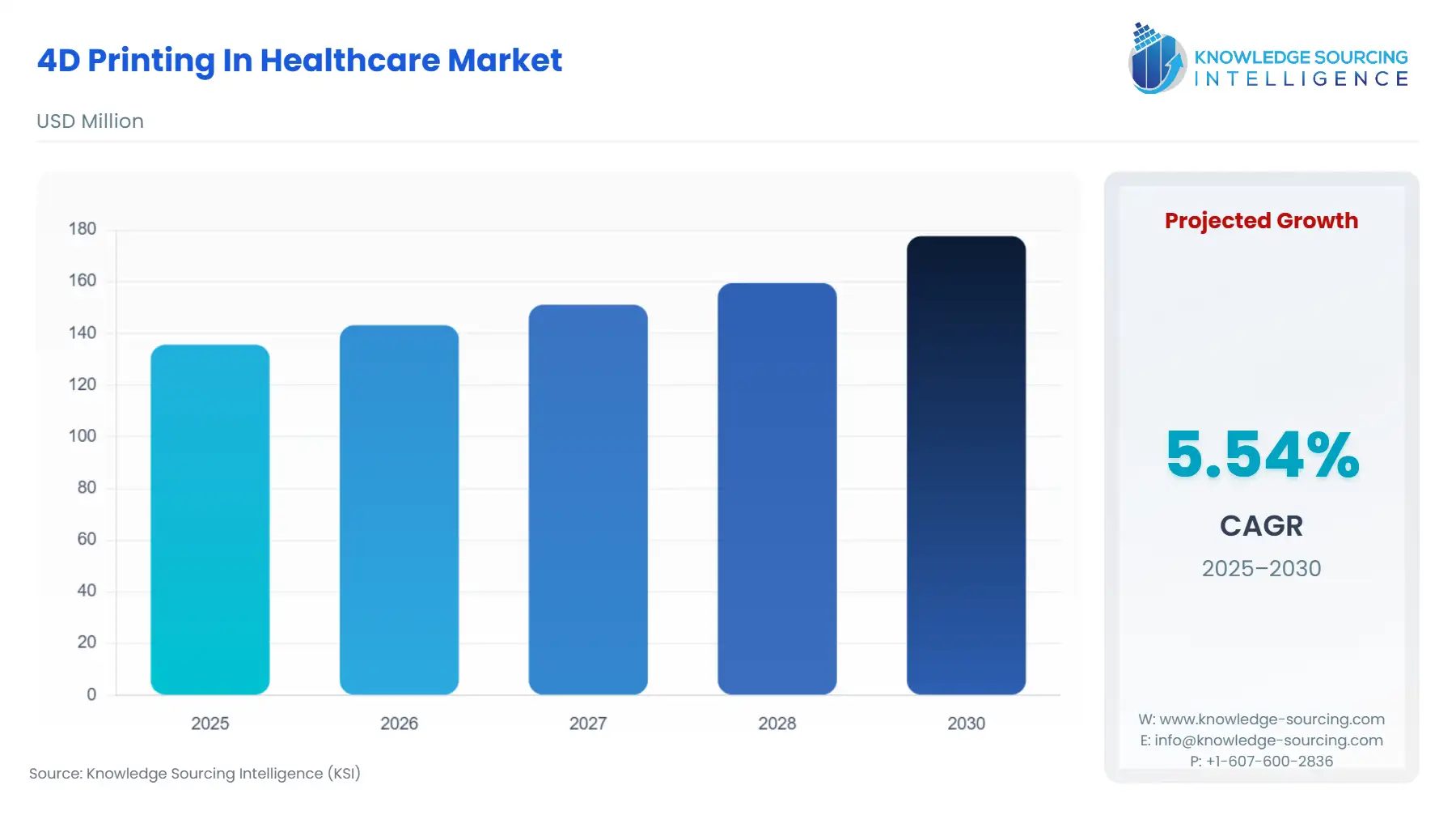

4D Printing In Healthcare Market Size:

4D Printing In Healthcare Market, sustaining a 5.37% CAGR, is projected to increase from USD 135.680 million in 2025 to USD 185.743 million in 2031.

4D Printing In Healthcare Market Trends:

4D printing has emerged as a revolutionary technology in the field of biomedical engineering, offering the potential for dynamic and stimuli-responsive structures applicable to tissue engineering, drug delivery, medical devices, and diagnostics. Unlike traditional 3D printing, 4D printing integrates smart materials that can change their shape, properties, or functionality over time in response to external stimuli. The "4D" term emphasizes the fourth dimension, time, highlighting the dynamic behaviour of these printed structures.

By incorporating stimuli-responsive materials like shape-memory polymers, hydrogels, and bio-inks, 4D printing enables the creation of dynamic structures capable of adapting to their environment, opening up new possibilities for biomedical applications. The use of 4D printing in healthcare facilitates the customization and personalization of medical products, drugs, and equipment, benefiting both healthcare providers and patients. Custom 4D-printed implants, fixtures, and surgical tools, for instance, have the potential to reduce surgery time and patient recovery periods while enhancing the overall success of surgeries or implants.

4D Printing In Healthcare Market Growth Drivers:

Increase in healthcare spending

Globally, the population is increasingly adopting changing lifestyles, and changing demographic trends, leading to growing spending on healthcare facilities. In 2021, for instance, health spending in the United States saw a 2.7% increase, reaching a substantial $4.3 trillion or $12,914 per capita. The country allocated $4,255.1 billion to healthcare during the same period. Notably, the surge in spending was significantly influenced by the government's efforts to mitigate the COVID-19 pandemic, through National Health Expenditures (NHE). In India, healthcare spending shown as a percentage of its GDP gradually increased from 2.84% in 2018 to 2.94% in 2019 and further to 2.96% in 2020. The realm of healthcare intersects closely with the burgeoning field of 4D printing, which plays a pivotal role in meeting the evolving demands of the biomedical engineering sector. This technology's potential applications in healthcare align with the sector's continual pursuit of advancements and solutions to address various medical challenges.

Growing geriatric population around the world

Over the years, there has been a significant shift in the global population age structure. From a mere 34 years in 1913, global life expectancy has surged to 72 years in 2022. Between 2000 and the projected year 2050, the global proportion of individuals aged 80 and above is expected to rise to nearly 5 percent. In the United States, the older population reached 55.8 million, constituting 16.8% of the total population in 2020. This marks a substantial increase from 4.9 million individuals (4.7% of the total U.S. population) in 1920. This demographic shift underscores a growing demand for healthcare services, prompting an increased need for innovative technologies within the healthcare sector.

4D Printing In Healthcare Market Challenges:

Need for more research and development

Several challenges persist in the realm of 4D printing within biomedical engineering. These include material constraints related to biocompatibility, mechanical properties, and degradation rates. Fabrication complexities arise from the integration of multiple materials, encompassing resolution, accuracy, and scalability issues. Additionally, navigating regulatory and ethical considerations concerning safety, efficacy, and intellectual property is paramount. Addressing these challenges is crucial for unlocking the full potential of 4D printing in the expansive field of biomedical engineering.

4D Printing In Healthcare Market Geographical Outlook:

North America is anticipated to hold a significant share of the 4D printing in the healthcare Market.

North American 4D printing is expected to command a notable share, influenced by multiple factors. Factors such as, in 2021, the United States allocated 17.8 percent of its gross domestic product (GDP) to healthcare, nearly twice the average of OECD countries. The U.S. spends three to four times more per capita on healthcare than South Korea, New Zealand, and Japan in terms of U.S. dollars. The high healthcare spending in the U.S. is influenced by lifestyle factors, particularly its elevated obesity rate, which is nearly double the OECD average at 42.8 percent. Obesity poses a significant risk for chronic conditions like diabetes, hypertension, cardiovascular diseases, and cancer among Americans. In 2020, a survey by the Commonwealth Fund of International Health revealed that three out of 10 U.S. adults have been diagnosed with two or more chronic conditions such as asthma, cancer, depression, diabetes, heart disease, or hypertension at some point in their lives. These health challenges underscore the close intersection between healthcare and the rapidly advancing field of 4D printing.

4D Printing In Healthcare Market Company Products:

NGB-R - The NGB-R bioprinting platform is a versatile, multimodal 4D system designed for live tissue and organ printing. Integrating laser-assisted, micro-valve, and extrusion bioprinting, it accommodates various biomaterials and hydrogels. Featuring an embedded microscope for real-time cell printing monitoring and a comprehensive software suite, NGB-R manages bioprinting protocols seamlessly, from biological CAD to data analysis.

(4D) printing (Sigma Aldrich)- The advent of four-dimensional (4D) printing is propelled by declining costs, enhanced software design, and a broader array of printable materials. 4D printing endows objects with the capability to alter their form or function over time, responding to stimuli like heat, water, current, or light. Their key distinction lies in the integration of smart design and responsive materials, inducing time-dependent deformations in printed objects.

(4D) printing (Wyss Institute) - The Wyss Institute offers licensing opportunities for its 4D Printing technology, featuring hydrogel composite architectures capable of shape transformation over time. Ideal for applications in smart textiles, soft electronics, medical devices, and tissue engineering, the technology aligns wood-derived cellulose fibrils using a proprietary mathematical model in the 4D printing process. This process encodes anisotropic swelling and stiffness properties along the printing path, allowing for programmable local swelling behaviors in water-immersed composites, resulting in intricate and predictable shape changes.

List of Top 4D Printing In Healthcare Companies:

Wyss Institute

Scintica

DSM

ARC India

Sigma Aldrich

4D Printing In Healthcare Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

4D Printing In Healthcare Market Size in 2025 | USD 135.680 million |

4D Printing In Healthcare Market Size in 2030 | USD 177.687 million |

Growth Rate | CAGR of 5.54% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the 4D Printing In Healthcare Market |

|

Customization Scope | Free report customization with purchase |

4D Printing in Healthcare Market Segmentation

By Component

Hardware

Software

Services

By Material

Thermo-Responsive Material

Photo-Responsive Material

Moisture Responsive Material

Others

By Technology

Fused Deposition Modelling

Stereo Lithography

Selective Laser Sintering

Others

By Application

Smart Implants & Prosthetics

Drug Delivery System

Surgical Guides & Models

Others

By End-User

Hospitals & Clinics

Research Institutes

Others

By Geography

Americas

United States

Others

Europe

Germany

France

United Kingdom

Others

Asia Pacific

China

Japan

South Korea

Others