Report Overview

Advanced Materials Market - Highlights

Advanced Materials Market Size:

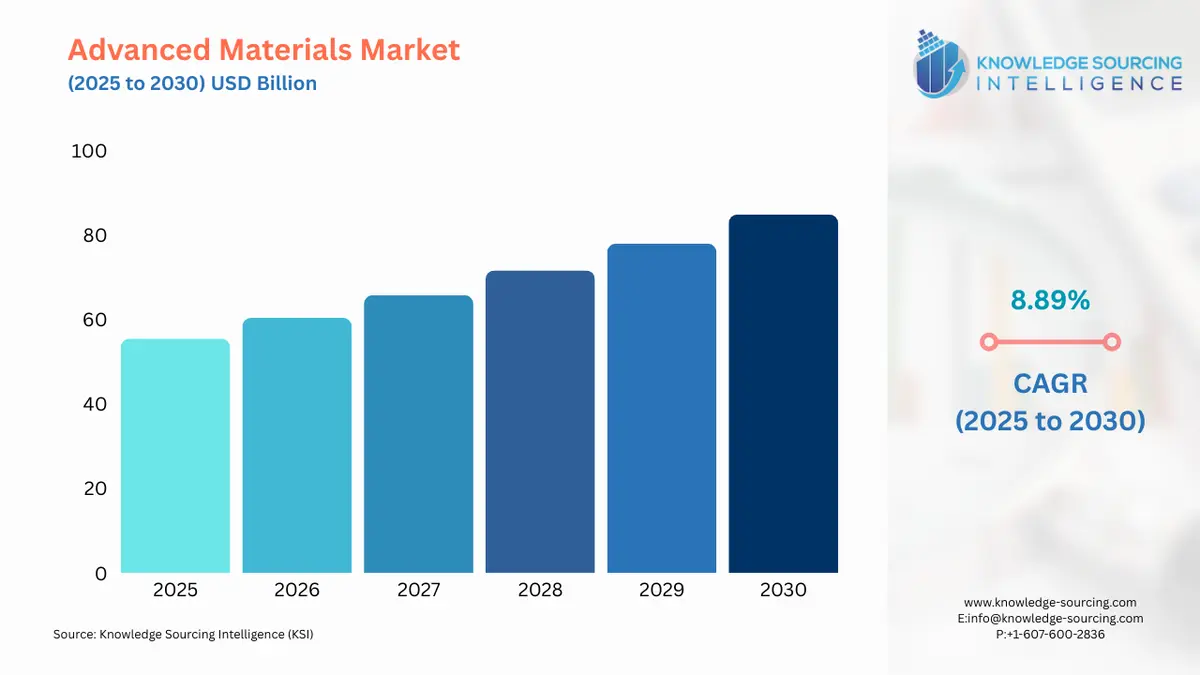

The Advanced Materials Market is expected to grow at a CAGR of 8.89%, reaching USD 84.876 billion in 2030 from USD 55.445 billion in 2025.

The advanced materials market serves as a foundational component for the modern industrial and technological landscape. These engineered substances, which often possess superior properties such as strength-to-weight ratio, heat resistance, and electrical conductivity, are displacing conventional materials across a wide array of applications. The market's evolution is not a result of a single factor but is instead a complex interplay of technological imperatives, regulatory pressures, and shifting end-user demands that collectively necessitate a new generation of materials to enable further innovation.

Advanced Materials Market Analysis

- Growth Drivers

The primary growth driver for the advanced materials market is the imperative for performance optimization in end-use industries. In the automotive sector, for example, the global shift toward electric vehicles (EVs) directly propels demand for lightweight composites and advanced polymers. These materials are critical for offsetting the weight of heavy battery packs, thereby increasing vehicle range and energy efficiency. The aerospace industry, driven by the continuous pursuit of fuel efficiency and payload capacity, demands carbon fiber composites and titanium alloys with high strength and low density. This expansion is a direct response to the operational economics of air travel, where reduced weight translates to significant fuel cost savings over the lifespan of an aircraft. The electronics industry's relentless drive for smaller, more powerful, and more energy-efficient devices creates a sustained demand for nanomaterials, such as silicon carbide and gallium nitride, for use in semiconductors. These materials enable higher power density and thermal conductivity, which are essential for the performance of modern electronic components.

- Challenges and Opportunities

The market faces significant challenges, primarily rooted in the high cost and complexity of material development and manufacturing. The high cost of raw materials, such as carbon fiber precursors and rare earth elements, acts as a significant barrier to widespread adoption, particularly for smaller manufacturers. This directly constrains demand in cost-sensitive applications. Furthermore, the development cycle for new advanced materials is often long and capital-intensive, which presents a challenge in bringing new products to market swiftly. However, these challenges also create opportunities. The need for cost-effective alternatives provides a clear market opportunity for companies to invest in scalable manufacturing processes and develop more efficient material synthesis methods. Additionally, the increasing focus on sustainability presents a major opportunity. As industries face pressure to reduce their environmental impact, there is a burgeoning demand for advanced materials derived from recycled or bio-based sources, which creates a new avenue for innovation and market expansion.

- Raw Material and Pricing Analysis

The advanced materials market is fundamentally tied to the supply and pricing dynamics of key raw materials. For many advanced composites, such as carbon fiber-reinforced plastics, the precursor material, polyacrylonitrile (PAN), is a critical cost driver. The supply chain for PAN is concentrated, and any disruption or price fluctuation in its production directly impacts the final cost of carbon fiber, which in turn influences the economic viability of its use in applications like wind turbine blades or automotive chassis. Similarly, the pricing of rare earth elements, essential for certain advanced ceramics and magnets, is subject to geopolitical factors and concentrated mining operations. The high-purity silicon required for semiconductor fabrication is also a key input with its own pricing volatility, which influences the cost of advanced semiconductor materials like silicon carbide. This concentration of supply and high-cost structure of raw materials creates a significant market risk and directly influence the demand elasticity for the end products.

- Supply Chain Analysis

The global supply chain for advanced materials is characterized by a high degree of specialization and geographical concentration. Production hubs for specific materials are often located near key raw material sources or in regions with established manufacturing infrastructure. For example, a significant portion of the world's rare earth elements are mined and processed in a limited number of countries, creating a dependency for manufacturers of advanced magnets and electronics. The logistical complexities are substantial, given the often-hazardous nature and specialized handling requirements of raw materials and finished products. The supply chain also involves a multi-tiered structure, with upstream raw material providers, midstream processors and compounders, and downstream manufacturers of finished components. This intricate web of dependencies means that disruptions at any point, from mining to processing to shipping, can have cascading effects on the global market, impacting availability and pricing.

- Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union | European Green Deal / EU Commission | The directive's focus on circularity and a carbon-neutral economy directly increases demand for bio-based and recyclable advanced materials. It creates a regulatory imperative for industries to transition away from traditional materials and towards sustainable alternatives. |

| United States | Environmental Protection Agency (EPA) / Toxic Substances Control Act (TSCA) | EPA's regulations on the manufacturing and use of specific chemical substances and nanomaterials necessitate extensive testing and compliance, which can increase the cost and time to market for new materials, thus affecting their commercial viability and adoption rate. |

| Japan | Ministry of Economy, Trade and Industry (METI) | METI's promotion of lightweight materials in the automotive and aerospace sectors, often through research and development grants and collaborative projects, directly stimulates demand for advanced composites and high-strength alloys to meet national industrial goals. |

Advanced Materials Market Segmentation Analysis:

- By End-User: Automotive

The automotive end-user segment is a critical catalyst for the advanced materials market, with demand primarily driven by two strategic objectives: lightweighting and electrification. The average weight of a modern vehicle is a direct determinant of its fuel efficiency and, in the case of electric vehicles, its range. Consequently, automakers are increasingly substituting traditional steel components with lighter, high-strength advanced materials. The adoption of carbon fiber composites in structural components, such as body panels and chassis, directly reduces the overall vehicle mass. This reduction is an essential demand driver, as it allows for the use of smaller batteries in EVs to achieve the same range, which in turn lowers production costs and vehicle weight. Similarly, the demand for advanced polymers and lightweight aluminum alloys is accelerating in powertrain components and interior structures. This demand is not merely a preference but a necessity dictated by stringent regulatory standards for fuel economy and emissions.

- By Application: Electronics

The electronics application segment presents a sustained and high-growth demand vector for advanced materials. The continuous miniaturization of electronic devices, coupled with the need for enhanced thermal management and power efficiency, mandates the use of materials with specific properties. Demand for advanced ceramics, for instance, is rising due to their application as substrates and insulators in printed circuit boards (PCBs) and semiconductors, where they provide superior thermal and electrical insulation. Similarly, the proliferation of Internet of Things (IoT) devices and high-speed computing has created a strong demand for materials with advanced thermal properties, such as silicon carbide and gallium nitride, to dissipate heat more efficiently in power electronics. These materials are instrumental in enabling the performance of high-frequency components and power converters, directly enabling the development of smaller and more powerful electronic devices.

Advanced Materials Market Geographical Outlook:

- US Market Analysis

The US advanced materials market is a robust ecosystem driven by a confluence of strong defense, aerospace, and technology sectors. The market’s growth is propelled by a continuous flow of public and private investment into R&D. The Department of Defense and NASA, for instance, are significant drivers of demand for advanced composites and high-performance ceramics for use in aircraft, satellite systems, and military equipment. This expansion is performance-centric, prioritizing materials with superior durability and strength in extreme conditions. The presence of Silicon Valley and a dense network of technology companies also fuels demand for semiconductor materials and functional coatings. Government initiatives and a high level of R&D expenditure by companies like DuPont and 3M contribute to the market's leadership in material innovation and commercialization. - Brazil Market Analysis

Brazil's advanced materials market is an emerging landscape, with demand primarily influenced by the nation's key industries. The agricultural sector, a cornerstone of the Brazilian economy, is a growing source of demand for biomaterials and composites used in machinery and infrastructure. The automotive industry, with a significant domestic manufacturing base, is increasingly adopting advanced polymers and lightweight metals to improve fuel efficiency and meet local market needs for more economical vehicles. However, the market's growth is tempered by economic volatility and a relatively less developed R&D infrastructure compared to other major global players. The demand for advanced materials is therefore more focused on cost-effective, proven technologies rather than cutting-edge innovations. - German Market Analysis

Germany’s advanced materials market is a mature and sophisticated ecosystem, deeply integrated with its world-renowned automotive and manufacturing industries. The country’s market is heavily influenced by the "Industry 4.0" initiative, which emphasizes smart manufacturing and automation. This drives the demand for advanced polymers and composites in precision engineering and robotics, where lightweighting and durability are critical for operational efficiency. The German government's strong emphasis on environmental regulations and electric mobility also propels demand for innovative battery materials and lightweight structural components in the automotive sector. The market is characterized by a strong presence of major chemical and engineering companies, a robust R&D landscape, and a focus on high-quality, high-performance materials. - Saudi Arabia Market Analysis

The advanced materials market in Saudi Arabia is intricately linked to its national economic diversification strategy, "Saudi Vision 2030." Demand for advanced materials is being stimulated by large-scale infrastructure projects and the development of new industrial sectors, including defense, aerospace, and renewable energy. The construction of new smart cities and industrial zones is driving the need for advanced composites, smart coatings, and materials with enhanced durability and sustainability. Furthermore, the country's solar and wind energy projects are creating new demand for materials used in photovoltaic cells and wind turbine blades. The market’s growth is fueled by significant government investment and a strategic shift away from an oil-dependent economy. - China Market Analysis

China’s advanced materials market is defined by its massive scale, rapid industrialization, and strong government support. This growth is a direct result of the nation's "Made in China 2025" plan, which prioritizes domestic self-sufficiency in high-tech manufacturing. This policy creates a powerful demand signal for advanced materials across a wide spectrum of industries, including aerospace, electric vehicles, and electronics. The country is a leading consumer of advanced composites and rare earth elements, driven by its expansive manufacturing base and ambition to lead in next-generation technologies. The market is also a significant hub for manufacturing and R&D, with a focus on scaling production and developing cost-competitive materials for both domestic consumption and export.

List of Top Advanced Materials Companies:

The competitive landscape of the advanced materials market is characterized by a mix of large, diversified chemical conglomerates and specialized technology companies. Competition is centered on innovation, production scale, and strategic partnerships with end-users to secure long-term supply agreements.

- 3M Company

3M's strategic positioning in the advanced materials market is defined by its broad portfolio of technologies and its deep integration into various end-user industries. The company's competitive advantage lies in its capacity for continuous innovation, with a focus on developing specialized materials that solve complex problems for its customers. A key part of its strategy involves creating high-performance materials that enhance products in segments such as electronics, healthcare, and automotive. For instance, 3M provides advanced adhesives and films that are critical for modern display technologies and electronic component manufacturing. The company's official newsroom details its focus on materials science as a core pillar of its business, reflecting its commitment to developing new materials to meet emerging industrial needs. - DuPont

DuPont’s competitive strategy in the advanced materials sector centers on its heritage as a science and technology company. The company focuses on high-performance polymers, composites, and specialty materials for demanding applications. Its portfolio of products is crucial for industries that require materials with superior properties in harsh environments. DuPont's official publications highlight its commitment to innovation in areas such as lightweighting for the automotive and aerospace industries and developing materials for consumer electronics. For example, DuPont's materials are integral to the production of durable and flexible electronic devices, which is a direct response to the demand for more robust consumer products. - Anglo American

Anglo American, a global mining and resources company, occupies a foundational role in the advanced materials market through its focus on critical minerals. While not a direct manufacturer of finished advanced materials, its strategic positioning is critical to the supply chain. The company's competitive advantage stems from its global footprint and its focus on key materials such as copper, platinum group metals, and iron ore, which are essential inputs for a variety of advanced material applications. The company's press releases detail its strategic moves to secure and expand its resource base, which directly influences the stability and availability of raw materials for the broader advanced materials market.

Advanced Materials Market Developments

- September 2025: Anglo American and Teck Resources Limited announced an agreement to merge, forming a new company, Anglo Teck. The new entity aims to become a global critical minerals champion, with a strong focus on copper. This merger, as detailed in the Anglo American press release, is projected to result in significant annual synergies and enhance the combined entity's portfolio of world-class copper assets, which will serve the growing demand for copper in electrification technologies.

- July 2025: Air Liquide announced an investment of more than 250 million euros to support the semiconductor industry in Europe. This investment includes the construction of a new molybdenum manufacturing plant in South Korea to support next-generation semiconductors. This move directly addresses the rising demand for high-purity materials required for the manufacturing of advanced semiconductor devices.

Advanced Materials Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Advanced Materials Market Size in 2025 | USD 55.445 billion |

| Advanced Materials Market Size in 2030 | USD 84.876 billion |

| Growth Rate | CAGR of 8.89% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Advanced Materials Market |

|

| Customization Scope | Free report customization with purchase |

Advanced Materials Market Segmentation

- By Material Type

- Polymers

- Metals & Alloys

- Composites

- Ceramics

- Others

- By Application

- Aerospace

- Automotive

- Electronics

- Medical

- Energy

- Others

- By End-User

- Aerospace & Defense

- Automotive & Transportation

- Electrical & Electronics

- Building & Construction

- Industrial

- Medical

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of Middle East & Africa

- North America

Our Best-Performing Industry Reports:

Navigation:

- Advanced Materials Market Size:

- Advanced Materials Market Key Highlights

- Advanced Materials Market Analysis

- Advanced Materials Market Segmentation Analysis:

- Advanced Materials Market Geographical Outlook:

- List of Top Advanced Materials Companies:

- Advanced Materials Market Developments

- Advanced Materials Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 17, 2025