Report Overview

Chemical Warehousing Market - Highlights

Chemical Warehousing Market Size:

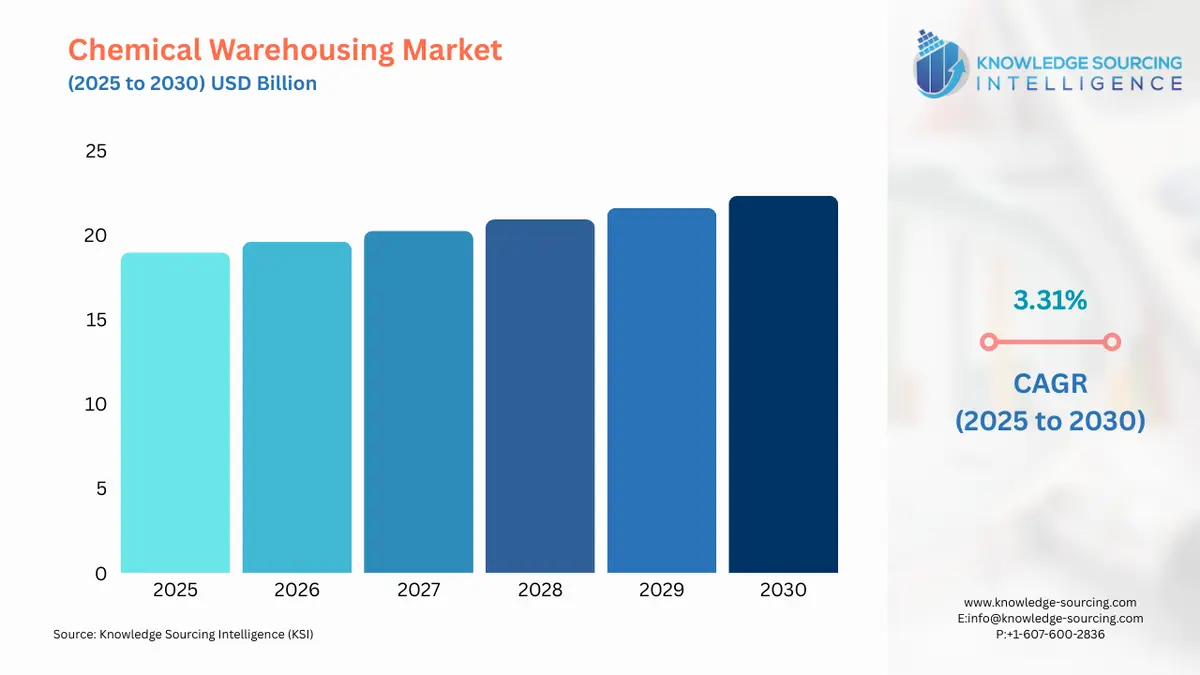

The chemical warehousing market is projected to witness a CAGR of 3.31% during the forecast period to reach a total market size of US$22.334 billion by 2030, up from US$18.974 billion in 2025.

Chemical Warehousing Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

:

Chemical warehousing is the technique or process of storing various types of chemicals safely and efficiently. This process helps enhance the storage and distribution of the chemicals. Specialty chemical storage has distinct requirements from regular warehouses. Liquids or gases that can catch fire are dangerous substances. Further, these specialty chemicals pose an emerging risk to well-being and safety since they are hazardous or combustible. In addition, due to their nature, these compounds must be stored securely in specialized chemical warehouse facilities.

Hazardous substance generation and transportation are expanding. Numerous businesses habitually contract hazardous warehousing and other services to third-party logistics because of safety and environmental issues with storage. Third-party logistics work has been established within the chemical division and has become crucial.

The increasing global trade in the chemical sector is among the key factors propelling the chemical warehousing market’s expansion worldwide. This market witnessed a major growth in trade in the chemicals sector, especially in international trade.

American Chemistry Council, Inc., in its report, stated that in the USA, the total chemical export of the nation in 2024 increased 2.1% over 2023. Similarly, the India Brand Equity Foundation, in its report, stated that between April and September of 2024, the export of inorganic and organic chemicals of the nation reached US$14.09 billion. Meanwhile, the import of organic chemicals was recorded at US$8.56 billion, and the import of inorganic chemicals was recorded at US$3.17 billion during the same timeline.

Some of the major market players are Odyssey Logistics & Technology, Univar Solution, BRENNTAG, Warehouse Specialists, Rinchem, Anchor 3PL, KEMITO, Commonwealth, Broekman Logistics, Affiliated Warehouse, ALFRED TALKE GmbH, and Deutsche Post DHL, among others.

Chemical Warehousing Market Drivers:

- Increasing international trade will bolster the chemical warehousing market growth.

In recent years, there has been a sharp rise in the demand for chemicals worldwide, especially for chemicals and petrochemicals. This is generally due to the rising utilization of these substances in rising markets like China and India. To meet the developing demand from end-user businesses, nations must have adequate storage facilities to hold these chemical crude materials.

According to recent data by OEC, in 2022, the leading chemical item exporters were Germany ($249 billion), China ($248 billion), the United States ($237 billion), Ireland ($147 billion), and Switzerland ($134 billion). Additionally, for the imports in 2022, the biggest chemical products importers were the United States ($324 billion), Germany ($172 billion), China ($161 billion), Belgium ($104 billion), and the Netherlands ($92.6 billion).

Further, due to the significant presence of chemical producers and end-user industries, logistics, distribution, and warehousing services are needed due to the growing global trade in chemical goods, which is increasing the chemical warehousing market size.

- Using blockchain to enhance traceability in logistics is anticipated to propel the demand for chemical warehousing.

A blockchain contains records of events that cannot be changed or tampered with and is a sequential stream of information. A blockchain system is a series of records that have been cryptographically protected. All supply chain activities are made more efficient and cost-effective by implementing blockchain technology, which eliminates the requirement for a single source to keep records.

More transparency will be available in warehouse and storage operations thanks to the new blockchain technology. These elements will encourage the warehousing chemicals market expansion over the projected period.

- Rising technological advancements are expected to boost the market expansion.

The manufacturing of bio-based insecticides and fertilizers is projected to open up new market opportunities. In addition, several activities and technical developments in real-time temperature monitoring, autonomous handling, and inventory tracking promote market growth. However, the market will grow throughout the projected period due to a shift in consumer preferences toward processed foods brought on by rising disposable income, enhanced convenience, and rising living standards in emerging economies.

- Increasing chemical manufacturing will contribute to the market’s growth.

The chemical warehousing market size is expected to rise due to the rise in chemical manufacturing. A rise in the requirement for safe transportation and distribution services in regions results from expanding chemical production to provide different industries such as food production, pharmaceutical manufacturing, car manufacturing, and engineering. According to the American Chemistry Council, in the United States, the chemical volumes increased by around 3.2% in 2022, from 1.4% in 2021; however, the shipments jumped by nearly 8.2% in 2022.

With the rising production of chemicals worldwide, the demand for efficient and optimum storage solutions will witness major growth, enhancing the demand for chemical warehousing during the forecasted timeline. BASF, a global leader in the chemical sector, stated that in 2024, global chemical production witnessed a growth of 2.7% compared to 2023. In its report, the company further stated that China will grow at 4%, whereas the USA and EU are expected to grow at 1.1% and 0.8%, respectively.

The chemical production in India also witnessed major growth. The India Brand Equity Foundation stated that in July 2024, the total production of petrochemicals in the nation was recorded at 1,872.8 thousand MT, which increased to 1,889.7 thousand MT in August.

Chemical Warehousing Market Segmentation Analysis:

- High demand for chemical warehouses in agrochemical industries

The chemicals utilized in agriculture to bolster the expansion and well-being of living things may also be destructive to an individual's health and the environment. Dizziness, chemical burns, and other indications are conceivable in people after exposure to pesticides or fertilizers. Proper chemical storage for agricultural applications improves production beyond merely adhering to rules. The warehouses are made with the knowledge of skilled engineers to meet strict industry standards while maintaining the chemicals secure, safe, and still available when needed. For instance, U.S. Chemical Storage provides a range of hazardous materials storage to meet the demands of your business, with adaptable fire-rated or non-fire-rated buildings to house the chemicals needed for agricultural management.

The agrochemical warehouse industry represents a critical aspect of the agricultural supply chain as it offers tailor-made storage solutions for agrochemicals in fertilizers, insecticides, herbicides, and fungicides. Warehouse owners are best to facilitate the safe, proper, and compliant storage management of agrochemicals to meet the growing needs of modern agriculture. This led to a comprehensive growth in yet another agricultural sector that was ultimately failing to meet the global food requirements, along with emerging new requirements for state-of-the-art storage facilities that are known to have made huge improvements and investments in the industry.

The global agrochemical warehouse market is growing continuously with the rise in agrochemical outputs, stringent safety norms, and the need for proper supply chain management. New warehouses are being designed with advanced technology such as controlled-climate facilities, alarm systems for real-time monitoring, and automation for ensuring product integrity and efficient operation. It should be noted that such works are very critical in placing these assets under different weather conditions and within strict regulatory frameworks.

Further, various governments worldwide have adopted policies that require proper storage of agrochemicals to prevent environmental pollution and protect public health. Regulatory bodies have developed detailed requirements for the design of storage facilities and their operations, concentrating on adequate ventilation, spill catchment, and fire safety.

For instance, the US Department of Agriculture (USDA), whose study developed pesticide storage and security manuals meant for the agriculture sector. Moreover, India's agrochemical sector generated a trade surplus of INR 289.08 billion (US$3.46 billion) in FY 2022-23 as exports increased. Indian firms provide competitively priced generic agrochemicals, gaining global attention and increasing export quantities. The nation is an appealing place for agrochemical manufacturers due to the low cost and high quality of its products.

Furthermore, Tropical Agrosystem (India), a market leader in the Indian agricultural sector, announced its latest farming solutions for the 2024 Kharif cropping season. With a steadfast commitment to addressing agriculture’s dynamic problems, the agrochemical company has expanded its product line with 16 new items across the spectrum of farming methods, from seed treatment to post-harvest care. Additionally, Best Agrolife (BAL), one of India's major makers of specialty and patented agrochemicals, announced the debut of an under-patent formulation called 'Nemagen' in July 2024. The company received the 9(3) Formulation Indigenous Manufacture (FIM) registration for the product.

- The chemical industry is expected to grow significantly

The demand for chemical warehousing has increased due to the rising need for chemicals over the last few years. This growth is attributed to the global chemical market’s expansion, increased international trade, and the need to ensure effective and safe storage for all those chemicals. Since this sector carries more weight, financially and otherwise, and is among major sectors such as agriculture, pharmaceuticals, automotive, and consumer goods, chemical storage and handling have now emerged as essential components in the supply chain. These warehouses are specifically designed to store hazardous and nonhazardous materials in compliance with strict safety rules and environmental norms.

Further, the increase in global chemical production and advances in material handling technologies have spurred the demand for specialized warehousing facilities. There has been a whole festival change in how chemicals are stored in line with the ongoing changes revolutionizing supply chain logistics. This includes such novelties as automation and sustainable solutions, plus smart technology integration. These are bound to enhance farm operation efficiency as well as safety. Moreover, coupled with increasing chemical trade, government-backed programs to construct high-quality storage facilities enhance the safety and sustainability focus in the economic sector.

The use of blockchain improves traceability and uplifts efficiency in chemical logistics. Blockchain technology is very helpful as it can safely and transparently track them across the supply chain, ensuring error elimination and improved compliance. In 2024, the government introduced laws and programs aimed at enhancing operational efficiencies of increasing safety and environmental protection in chemical storage facilities.

The Toxic Substances Control Act (TSCA) amendment amended the new chemicals' procedural requirements of TSCA to comply with Frank R. Lautenberg Chemical for the 21st Century Act. These amendments will enhance the efficiency of the EPA review process and ensure higher-quality material in new chemical notices, ultimately enriching their risk assessments and promoting the overall review process for new chemicals.

Moreover, in August 2024, Olaf Scholz, Chancellor of Germany, made a call to handle per- and polyfluoroalkyl substances with pragmatism that are sometimes called “forever chemical”. This means harmonizing environmental interests with industrial progress by influencing legislation at the EU level. Additionally, in October 2024, the London Metal Exchange (LME) announced a plan to expand its apparent network of stores, and Hong Kong might be added to it by the end of the year. This strategic pioneering step is designed to maximize market access to mainland China, the world's largest metals consumer, and will also change the global chemical warehousing trend.

Chemical Warehousing Market Geographical Outlook:

- Asia Pacific is projected to dominate the Chemical warehousing market.

During the projected period, the Asia Pacific region is anticipated to lead the Chemical warehousing market. The entire region of Southeast Asia is the Asia Pacific's center for emerging economies.

Additionally, India leads the world in both chemical imports and exports, ranking eighth in imports and fourteenth in exports. Although China is its largest single market, the chemical industry will continue to grow globally.

The construction of a strong warehouse infrastructure in developing nations, which is constantly prioritized, is anticipated to fuel the growth of the chemical logistics sector. For instance, in August 2022, Rhenus Warehousing Solutions India opened an economical chemical warehouse near New Delhi, reacting to the increasing requirement in the chemical and dangerous substances industry, taking after its expansion procedure by building up a multi-user facility in Gurgaon.

- The US market is also experiencing notable expansion

The U.S. chemical industry is responsible for more than a quarter of the U.S. GDP. It supports the production of commercial and household goods. It employs 554,000 skilled professionals for good-paying Jobs. According to the American Chemistry Council, it is a $633 billion industry and supports 18% of manufacturing construction spending.

Chemical warehousing operates in manufacturing plants, where raw materials are converted into intermediate and end products. Further, in transportation systems carrying to/from manufacturing plants, warehouses, and end users. Besides, various warehousing facilities provide downsized repackaging and bulk storage. It is estimated that chemical distributors in the US deliver more than 31 million tons of chemical products every 6 seconds.

Chemical warehousing in the USA is a highly regulated sector with a substantial investment in the physical storage environment and rigorous adherence to protocols and practices. States with the greatest concentration of chemical facilities are California, Texas, Ohio, Illinois, and Pennsylvania. In February 2024, Rinchem opened its newest custom-built hazmat warehouse in Surprise, Arizona. This facility has 123,516 square feet and 16,000 pallet positions, allowing Rinchem to strategically support the booming semiconductor industry in the Phoenix Metro Area. A dedicated gas pad with 48 storage bays enhances the safety and segregation of high-purity chemicals and gases.

America is the leading producer and exporter of major chemicals globally. According to the World Integrated Trade Solution (WITS), the United States exported 1,291,940 Kg of calcium, 1,536,470 Kg of iodine, and 27,728 Kg of boron (tellurium). The United States is the third largest exporter of boron (tellurium) in 2023, second for calcium, and fifth for iodine. This growing demand for chemicals worldwide will likely increase the investment in warehouses in the United States.

Chemical Warehousing Market Recent Developments:

- December 2024 - Odyssey Logistics, a global leader in chemical logistics, acquired OctoChem Inc., a chemical sample solution provider.

- December 2024 - IEL Limited, or Indian Extraction Limited. a leader in the chemical, dye, and pigment market, acquired land in Lucknow, India, marking its entry into the warehousing sector.

- February 2024- Rinchem opened a massive custom-built hazmat (chemical) warehouse in Surprise, Arizona, spanning 123,516 square feet and offering 16,000 pallet positions to support the booming semiconductor industry in the Phoenix Metro Area.

- October 2022- A brand-new chemical warehouse for Rinchem in Malaysia is almost finished and expected to be operational in Q2 of 2023. This will be Rinchem's first warehouse in Malaysia, even though the company currently operates two other warehouses in the Asia Pacific region (in Taiwan and South Korea). The 45,000 square foot dangerous products warehouse will have 3100 pallet spots for storage. The warehouses of Rinchem are specifically designed to accommodate several temperature zones and adequate classification of different hazard classifications.

- January 2022- Leschaco unveiled a new 120.000 ft, two-story chemical and dangerous commodities facility in Port Klang, Malaysia. Up to 13,000 chemical items and hazardous materials pallets can be properly housed in this new facility.

List of Top Chemical Warehousing Companies:

- Univar Solution, a leading player in chemical & plastic warehousing solutions, provides a wide range of supply chain services such as inventory management. The company provides all formulation needs to fulfill all types of varied requirements.

- BRENNTAG is a leading chemical company with an established presence operating through its different chemical warehouses. For instance, in 2023, the company announced its new warehouse facility in Moerdijk, the Netherlands. The new warehouse has a tripled storage capacity for various industrial ingredients and chemicals.

Chemical Warehousing Market Scope:

| Report Metric | Details |

| Chemical Warehousing Market Size in 2025 | US$18.974 billion |

| Chemical Warehousing Market Size in 2030 | US$22.334 billion |

| Growth Rate | CAGR of 3.31% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Chemical Warehousing Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation

- BY TYPE

- General Warehouse

- Specialty Chemicals Warehouse

- BY CHEMICAL TYPE

- Synthetic Rubber

- Petrochemicals

- Agrochemicals

- Consumer Chemicals

- Construction Chemicals

- Polymer and Plastic

- Textile Chemicals

- Others

- BY INDUSTRY

- Pharmaceutical Industry

- Pesticide Industry

- Chemical Industry

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Chemical Warehousing Market Size:

- Chemical Warehousing Market Highlights:

- Chemical Warehousing Market Overview:

- Chemical Warehousing Market Drivers:

- Chemical Warehousing Market Segmentation Analysis:

- Chemical Warehousing Market Geographical Outlook:

- Chemical Warehousing Market Recent Developments:

- List of Top Chemical Warehousing Companies:

- Chemical Warehousing Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 16, 2025