Report Overview

Aminoglycosides Market - Strategic Highlights

Aminoglycosides Market Size:

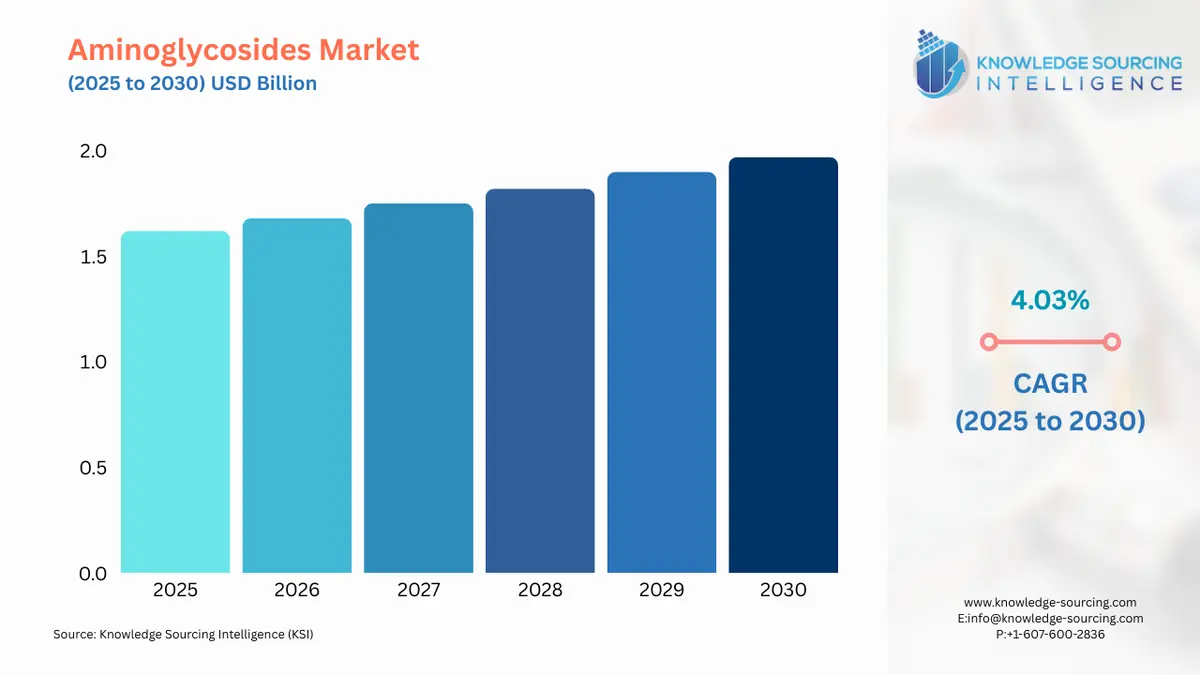

Aminoglycosides Market is expected to increase at a 3.91% CAGR, growing from USD 1.619 billion in 2025 to USD 2.038 billion in 2031.

Aminoglycosides Market Trends:

The projection period will see an increase in the demand for aminoglycosides due to the rise in gram-positive and gram-negative bacterial infections. These medications are used to treat different bacterial diseases in both humans and animals, which is expected to affect aminoglycosides market growth. These drugs have qualities including bactericidal, concentration-dependent killing action, and activity against staphylococci and certain mycobacteria. This class of medications used in treating medical conditions is a significant aspect that is anticipated to fuel aminoglycosides market expansion.

Aminoglycosides Market Segmentation Analysis:

Prospects for the aminoglycosides market to expand

The key drivers of the aminoglycosides industry development include the ageing population, rising antibiotic use, an increase in animal infectious illnesses, and an increase in the prevalence of bacterial infectious diseases. The use of aminoglycosides in treating a range of bacterial diseases in people and animals is growing due to its antibacterial action against staphylococci and other viruses, which is anticipated to fuel the aminoglycosides market growth. Since they work even when the bacterial inoculum is enormous, antibiotics are frequently utilised as a kind of defence against primary infections that are resistant to conventional antibacterials. Demand for aminoglycosides is also anticipated to increase as the TB epidemic spreads.

Rising incidences of animal disease outbreak

Rising animal disease outbreaks are a significant factor anticipated to fuel the aminoglycosides market in the future. Animal illness is a disturbance of an animal's natural state that interferes with or affects its vital processes. The most widely used aminoglycosides in veterinary medicine are gentamicin and amikacin. For instance, in July 2022, Wood Buffalo National Park, Canada's largest national park, reported and monitored an anthrax epidemic, a disease that affects people and other creatures. As a result, the aminoglycosides industry is anticipated to be driven by the increased number of animal illness outbreaks.

Use of aminoglycosides in tuberculosis

The use of aminoglycosides for respiratory illnesses like tuberculosis accounts for the largest portion of income because TB is very common in underdeveloped countries. Additionally, the rise in cases of multi-drug resistant TB contributes to the expansion of the aminoglycosides market. For instance, according to the Centres for Disease Control and Prevention report from 2023, 8,300 cases of tuberculosis (TB) were recorded in the United States in 2022, translating to a rate of 2.5 cases per 100,000 persons. Compared to the 7,874 instances recorded in 2021, showing a little increase.

Gentamicin is anticipated to be used at a huge rate

Amikacin and gentamicin are most frequently used in veterinarian medicines. The indications for gentamicin include perinatal problems, sepsis, acute or chronic renal illness, complications during labour or delivery, diabetes, and UTI/pyelonephritis.

Many illnesses are treated with gentamicin as a first line of defence in both emerging and developed markets. Its use is particularly prevalent in underdeveloped countries because older gentamicin is an affordable and effective treatment for a variety of infectious illnesses. As a result, its demand is steadily increasing for a variety of disorders linked to bacterial infections, and several players use it in combinations fueling the aminoglycosides market growth.

Advancements in drug delivery systems

The effectiveness and safety profile of aminoglycosides is being improved by developing new drug delivery methods. The global aminoglycosides industry is predicted to be driven by the development of novel drug delivery systems, such as sustained-release formulations, liposomal formulations, and nanoparticle-based formulations, which will improve medication targeting, decrease dose frequency, and lower the risk of adverse effects.

According to a study on the antibacterial efficacies of nanostructured aminoglycosides that was published in the ACS Omega journal in 2022, using nanoscale drug delivery technology, such as nanoparticles, has the potential to decrease toxicity, enhance drug availability, and lower dosages.

Growing demand for aminoglycosides in veterinary medicine

Aminoglycosides are increasingly being used in veterinary care, providing aminoglycosides industry participants with profitable potential. Aminoglycosides are often used in cattle, companion animals, and aquaculture to treat bacterial infections. In the pig and poultry sectors, these aminoglycosides are provided in feed and water form.

For instance, the most prevalent causes of respiratory infections in poultry that require treatment with aminoglycosides are Mycoplasma and Escherichia coli. These factors are anticipated to propel the global aminoglycosides market for the foreseeable future.

Aminoglycosides Market Geographical Outlook:

Asia Pacific aminoglycosides market is projected to propel

Asia Pacific is anticipated to make up the majority of the share because of a greater prevalence of multi-drug-resistant TB, which necessitates second-line drugs for treatment. This is a result of the region's much higher availability of other aminoglycosides and its significantly larger percentage of kanamycin and capreomycin. The significant potential for aminoglycosides market share in this area during the projection period is also attributable to the existence of several market entities in economies like Japan, China, and India. Major kanamycin suppliers are situated in the same areas that supply kanamycin to GDF for the STOP TB programme, boosting aminoglycosides market growth.

Government regulations for aminoglycosides

Aminoglycoside production and distribution are governed by FDA regulations in the United States. These standards include criteria for efficacy, potency, purity, and safety.

Guidelines for the appropriate use of antibiotics, including aminoglycosides, have been released by the World Health Organisation. These recommendations encourage doctors to constantly monitor patient outcomes and to combine them with other antibiotics wherever possible.

Regulation (EU) No 536/2014, enacted by the European Commission, governs the marketing authorization procedures for medications containing aminoglycosides. Before these items may be certified for sale, the legislation lays forth certain requirements for their quality and safety.

Aminoglycosides Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Aminoglycosides Market Size in 2025 | USD 1.619 billion |

Aminoglycosides Market Size in 2030 | USD 1.973 billion |

Growth Rate | CAGR of 4.03% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Aminoglycosides Market |

|

Customization Scope | Free report customization with purchase |

Aminoglycosides Market Segmentation

By Product

Neomycin

Tobramycin

Gentamicin

Amikacin

Paromomycin

Others

By Route of Administration

Parenteral

Intra-mammary

Topical

Oral

By Application

Veterinary

Skin Infection

Respiratory Diseases

UTI and Pelvic Diseases

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others